Blog > The Complete Guide to Sage Intacct Payment Processing & Integration

The Complete Guide to Sage Intacct Payment Processing & Integration

For many mid-sized and enterprise organizations, payment management has evolved into something far more complex than just moving money from customer to company. Between subscription models, international transactions, and compliance demands, manual billing systems no longer cut it. That’s where Sage Intacct integrations come in. Built as a modern financial management and ERP system, Sage Intacct helps businesses connect accounting, billing, and payment workflows into one streamlined system.

So, what is Sage Intacct? It’s essentially a cloud-based financial platform designed to manage core accounting, automate billing, and centralize financial data for smarter decision-making. When paired with the right payment processing setup, Sage Intacct becomes a central nervous system for your financial operations – keeping everything in sync and running smoothly.

This guide explores the essentials of Sage Intacct payment processing, including how integrations work, how credit card payments flow through the system, who the best integration partners are, and how companies – especially SaaS businesses – use Sage Intacct to simplify operations. It’ll also look at the Sage Intacct marketplace, pricing considerations, and where solutions like EBizCharge fit into the picture.

Understanding Sage Intacct Payment Processing

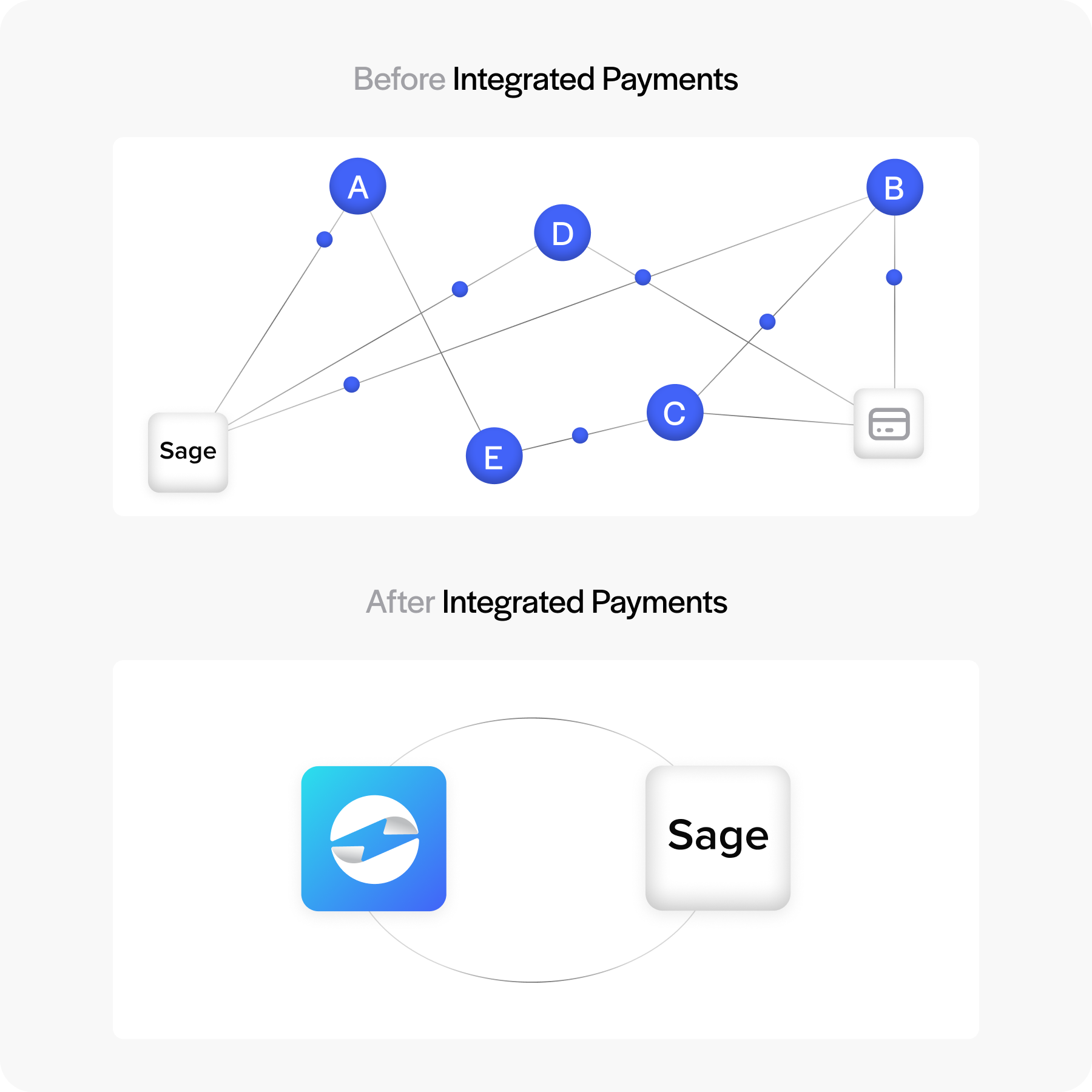

At its core, Sage Intacct payment processing connects the dots between customer payments and financial records. Instead of manually matching deposits or tracking invoices across multiple tools, payments can be accepted, recorded, and reconciled automatically within the Sage Intacct environment.

The process typically starts with a payment processor or payment gateway that handles transactions – whether that’s credit cards, ACH transfers, or digital wallets. Once the transaction clears, it flows directly into Sage Intacct, updating invoices and accounts in real time. This level of automation drastically reduces reconciliation errors and saves time for finance teams that otherwise spend hours verifying payment data.

One of the key benefits here is visibility. Sage Intacct users can see exactly when a payment posts, which account it affects, and how it ties into revenue recognition or reporting. This real-time insight allows businesses to spot issues early and make informed financial decisions without guesswork.

The Integration Process

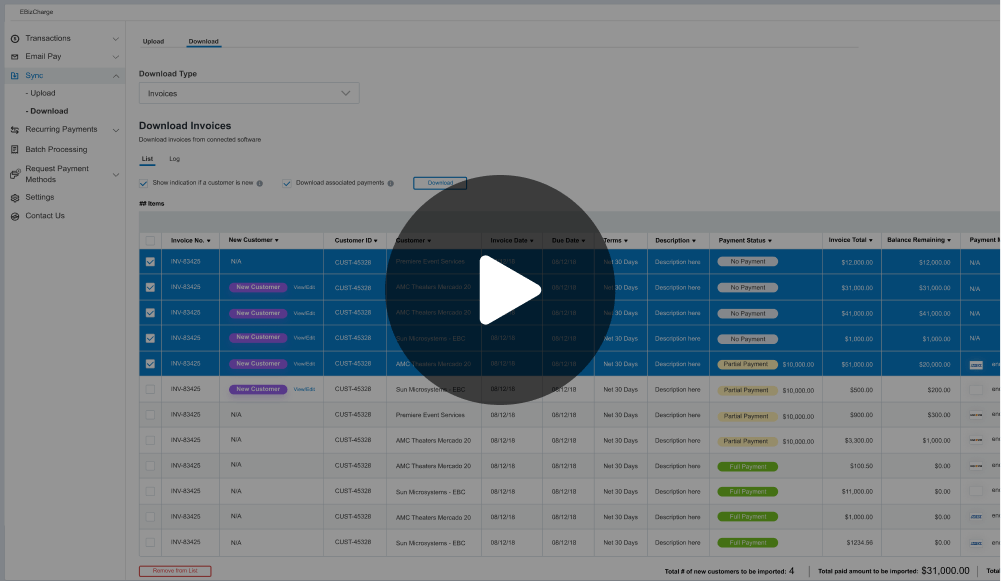

When setting up Sage Intacct integrations, businesses typically rely on application programming interfaces (APIs) and webhooks to connect third-party payment systems to Sage Intacct’s core financial modules. The Sage Intacct API is known for being open and flexible, allowing developers and IT teams to build custom integrations that fit unique workflows.

A standard integration setup involves linking a payment processor to Intacct through secure API credentials. Once connected, transactions are automatically synced across invoices, customer records, and the general ledger. Webhooks can be used to trigger specific events – like sending a receipt when a payment posts or updating a project record once funds are received.

Here’s a quick breakdown of what your integration process should look like:

- Define scope and goals: Identify which payment types, ledgers, and reports you’ll include. Clarify what success looks like – clean daily reconciliations and zero unmatched payments.

- Pick the right connector: Choose between a certified app in the Sage Intacct marketplace, a prebuilt connector from Sage Intacct integration partners, or a custom API build.

- Secure access: Generate limited-access tokens in the Sage Intacct API and your payment processor. Protect credentials and enable multi-factor authentication.

- Map and sync data: Match customers, invoices, and fees to the right accounts, then run a small test batch to confirm syncing accuracy.

- Test and automate: Use a sandbox to test full payment cycles, then schedule automatic syncs and alerts once data flows correctly.

- Go live: Launch gradually by departments or entity, monitor reconciliations daily, and document fixes for quick adjustments.

Of course, no integration is completely plug-and-play. There can be challenges, such as data mapping errors or syncing issues between systems. The best practice is to start small: integrate one function at a time, test transaction accuracy, and ensure error handling is in place. Working with experienced Sage Intacct integration partners like EBizCharge can make this process smoother by bringing prebuilt tools and proven methods to the table.

Credit Card Processing in Sage Intacct

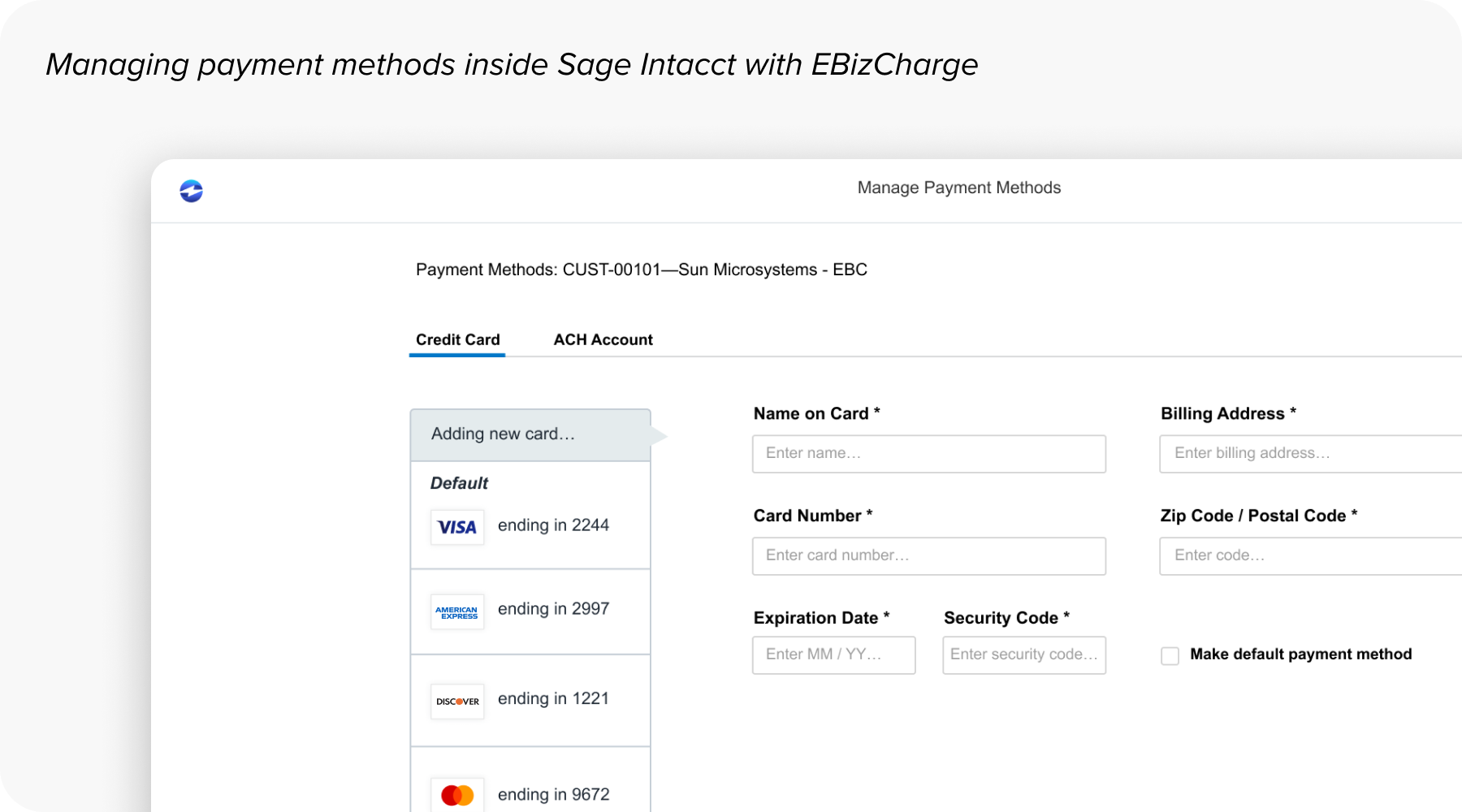

Handling credit card payments in Sage Intacct is straightforward once the integration is set up. The system supports various Sage payment solutions, including credit, debit, ACH, and digital wallet transactions. Once a customer pays, their information is securely processed through a PCI-compliant gateway, and the transaction is recorded in real time.

Tokenization and encryption keep sensitive data secure, ensuring that no raw card information ever touches your system. For businesses concerned about compliance or audits, this level of protection helps reduce PCI scope and liability.

From an operational standpoint, credit card transactions are automatically posted to invoices and reconciled with the bank feed. Finance teams no longer need to cross-check spreadsheets or manually update records. For many companies, this automation alone justifies the cost of Sage Intacct pricing, since the time saved often translates directly into lower labor costs and fewer errors.

Payment Solutions for SaaS Companies

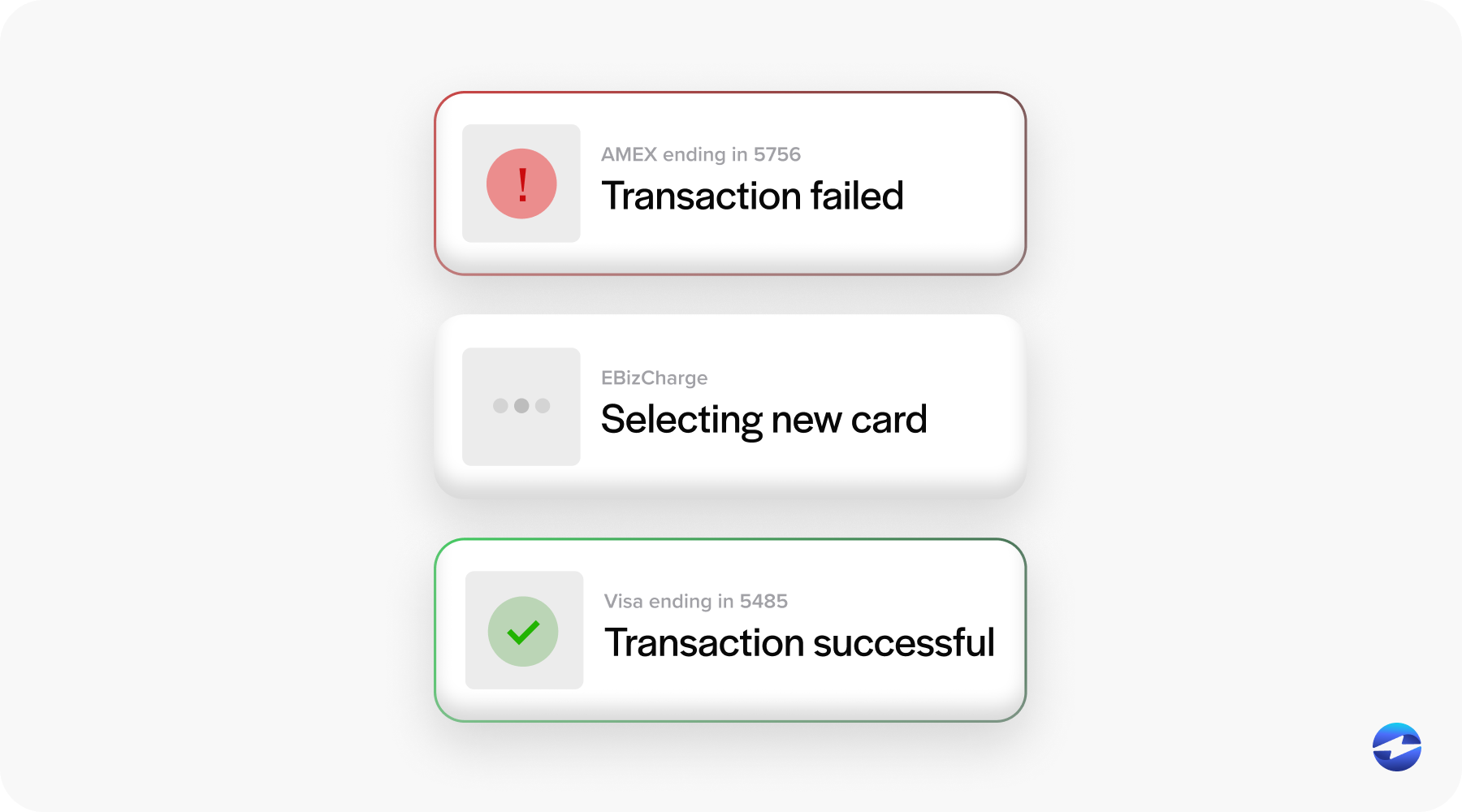

SaaS companies deal with billing and payments in a constant cycle – subscriptions, renewals, and usage-based charges that need precise automation to keep everything accurate. Without the right tools, even small errors can lead to missed revenue or inconsistent reporting. That’s where Sage payment solutions in Intacct make a difference.

With Sage Intacct integration, SaaS teams can easily manage recurring billing, automate renewals, and handle failed payments without leaving the platform. Built-in dunning workflows automatically retry failed transactions and alert customers when action is needed. The result is steadier cash flow and fewer interruptions for both the business and its customers.

Another major advantage for subscription-driven companies is real-time insight. Because payments and billing data live in one place, finance teams can quickly track monthly recurring revenue (MRR), churn, and other performance metrics. It’s also much simpler to align payments with deferred revenue schedules and stay compliant with ASC 606 – all without juggling multiple systems or spreadsheets.

Integration Partners

A strong ecosystem of Sage Intacct integration partners helps businesses connect payment workflows to their accounting systems. These partners specialize in building integrations that require minimal IT effort while ensuring security and reliability.

Certified partners from the Sage Intacct marketplace are often the safest choice because they’ve been vetted for performance and compliance. Working with these partners can save time on development and reduce the risk of integration errors. Many offer tailored features for different industries – for instance, EBizCharge focuses heavily on B2B and SaaS payment automation, while others may specialize in retail or service sectors.

The right partner can also help businesses customize workflows. For example, you can configure triggers for automated receipts, integrate customer portals for payment collection, or sync payment data with external analytics platforms.

Competitor Overview

In the ERP world, Sage Intacct competes with well-known systems like NetSuite, QuickBooks Enterprise, and Xero. Each has its strengths, but Intacct stands out for its open architecture and flexible Sage Intacct API, which make custom integrations easier to build and maintain. Sage Intacct integrations are typically more adaptable to complex business workflows without requiring heavy technical intervention.

For growing organizations, Sage Intacct also offers more scalability than QuickBooks. NetSuite is powerful, but it demands more developer involvement to tailor it to your needs. Xero, on the other hand, is user-friendly and affordable, but it lacks some of the advanced automation and reporting depth that Intacct delivers.

When considering Sage Intacct pricing, the platform may indeed carry a higher upfront cost. However, many users find that automation, accuracy, and reduced manual work lead to significant long-term savings. Across many Sage Intacct reviews, customers consistently highlight its strong reporting capabilities, reliable data integrity, and integration flexibility as key reasons they stick with it.

Industry-Specific Payment Scenarios

Sage Intacct isn’t a one-size-fits-all platform – it’s designed to adapt to the unique financial challenges of different industries. From managing complex construction projects to tracking nonprofit grants, the flexibility of Sage Intacct integration lets businesses shape their specific workflows. That versatility is a big reason many companies rely on Intacct as their financial backbone.

While SaaS companies often get most of the spotlight, Sage Intacct’s payment tools are built for a much wider range of industries:

- Construction payment processing: Handle progress billing, retainage tracking, and vendor payments right inside Sage Intacct.

- Professional services: Streamline client invoicing and track retainers for consulting, accounting, and legal work.

- Healthcare payment processing: Manage patient billing, claims reconciliation, and HIPPA-compliant payments with confidence.

- Nonprofit payment management: Simplify donation tracking, grant management, and fraud allocation while keeping reports audit-ready.

Every industry can benefit from Sage Intacct’s ability to connect payments directly with accounting and reporting data. When payment systems are integrated into day-to-day workflows, teams gain better visibility into cash flow, reduce repetitive administrative work, and free up time to focus on strategy and growth instead of manual processes.

Reducing Payment Processing Fees in Sage Intacct

One advantage that often gets overlooked with the right Sage Intacct integration is its potential to lower payment processing costs. By connecting directly through a trusted payment processor inside Sage Intacct, companies can skip unnecessary gateways or third-party services that tend to add hidden fees. Streamlined routing reduces interchange costs, and some processors use optimization tools that automatically qualify transactions for the lowest possible interchange rate.

Integrated systems also help avoid extra charges tied to manual reconciliation or delayed posting. When payments and records update automatically, there’s less need for batch processing or duplicate entries, both of which can inflate costs over time. As these savings add up, businesses see a clearer return on their investment. And thanks to the transparency of the Sage Intacct marketplace, teams can easily compare pricing, track fee reductions, and choose partners that best fit their transaction volume and industry focus.

Why EBizCharge is a Strong Fit for Sage Intacct

Among the available integration partners, EBizCharge stands out for its practical balance of simplicity, security, and real performance. It offers a seamless Sage Intacct integration that lets payments post instantly to invoices and accounts – no duplicate entries, no time-consuming reconciliations.

EBizCharge acts as both a payment processor and a Sage payment solution, managing transactions in real time while maintaining full PCI compliance. Its built-in safeguards – like tokenization and fraud prevention – protect customer data without adding extra steps for users. On top of that, businesses can customize secure payment portals that match their brand and simplify how customers pay.

For SaaS, B2B, and service-based organizations, EBizCharge’s automation tools – such as recurring billing, automatic payment posting, and integrated reporting – make it an easy yet powerful extension of Sage Intacct. Because it’s already listed in the Sage Intacct marketplace, setup is quick, and support teams familiar with Intacct can fine-tune the configuration to match specific business processes. It’s a solution built for teams that want a reliable payment experience inside Sage Intacct without adding complexity.

Strengthening Your Financial Foundation with the Right Sage Intacct Integration

When done right, Sage Intacct payment processing is more than just a back-office function – it’s a strategic advantage. With the help of robust Sage Intacct integrations, companies can streamline operations, improve data accuracy, and reduce manual work. Whether you’re in SaaS, construction, professional services, healthcare, or nonprofit management, integrating the right payment processor can make all the difference.

When comparing options, look at total cost, scalability, and partner ecosystem – not just licensing fees. Sage Intacct integration partners like EBizCharge can extend functionality, connect departments, and make daily operations more efficient. For organizations that rely on Sage Intacct, Sage 50, or Sage 100 to manage complex financial processes, the right integration doesn’t just improve payment workflows – it strengthens the entire business foundation.

- Understanding Sage Intacct Payment Processing

- The Integration Process

- Credit Card Processing in Sage Intacct

- Payment Solutions for SaaS Companies

- Integration Partners

- Competitor Overview

- Industry-Specific Payment Scenarios

- Reducing Payment Processing Fees in Sage Intacct

- Why EBizCharge is a Strong Fit for Sage Intacct

- Strengthening Your Financial Foundation with the Right Sage Intacct Integration