Blog > Unlocking the Power of Payment APIs: A Guide for Merchants

Unlocking the Power of Payment APIs: A Guide for Merchants

With the rise of online shopping, APIs have become essential in providing a seamless and secure transaction experience. These revolutionary tools have transformed the payment industry by allowing merchants to process transactions quickly and safely while providing customers with a hassle-free payment experience.

However, with convenience comes the need for security and reliability. This is where payment APIs shine since they ensure transactions are processed safely and efficiently by providing multiple layers of protection and encryption.

Whether you’re a small business owner or a seasoned entrepreneur, selecting a suitable payment API can significantly impact your business.

What are payment APIs?

Payment APIs act as intermediaries between customers and online businesses, simplifying the payment process, ensuring security, and allowing companies to focus on core operations.

Application programming interfaces (APIs) are a set of protocols that provide a secure connection and line of communication between a merchant’s website or application and a payment processor. Payment APIs offer a simple and convenient way to accept online payments without requiring merchants to store sensitive payment information on their servers.

The general understanding of a payment API is that it acts as an intermediary between customers and online businesses, but it’s essential to understand how this technology works on the backend.

How do payment APIs work?

To properly function, payment processing APIs must follow a more in-depth, technical process. Fortunately, we broke the operations behind payment APIs into six straightforward steps.

Here are the six operational steps involved in payment APIs:

- A customer initiates a payment on a merchant’s website or application.

- The payment API receives the payment request and begins the verification process. This involves checking for sufficient funds, verifying the card details, and ensuring the transaction complies with relevant regulations and guidelines.

- Once the payment API has verified the transaction, it sends a response back to the merchant’s website or application. This response includes details such as the transaction status, the amount processed, and relevant transaction IDs.

- Based on this response, the merchant’s website or application will either fulfill the order or display an error message to the customer if the transaction was declined or failed.

- If the payment is accepted, the payment API communicates with the payment processor to finalize the transaction and send the funds from the customer’s bank account to the merchant’s.

Once the transaction is complete, the payment API sends a final confirmation back to the merchant’s website or application, indicating that the payment has been successfully processed.

In addition to understanding the functionality behind payment APIs, you should be aware of the various types of APIs and how they differ.

Understanding the different types of APIs

Several payment APIs are on the market, each designed for various business models. Therefore, understanding the differences between these APIs will help merchants unlock the power of payment APIs and select the one that best meets their needs.

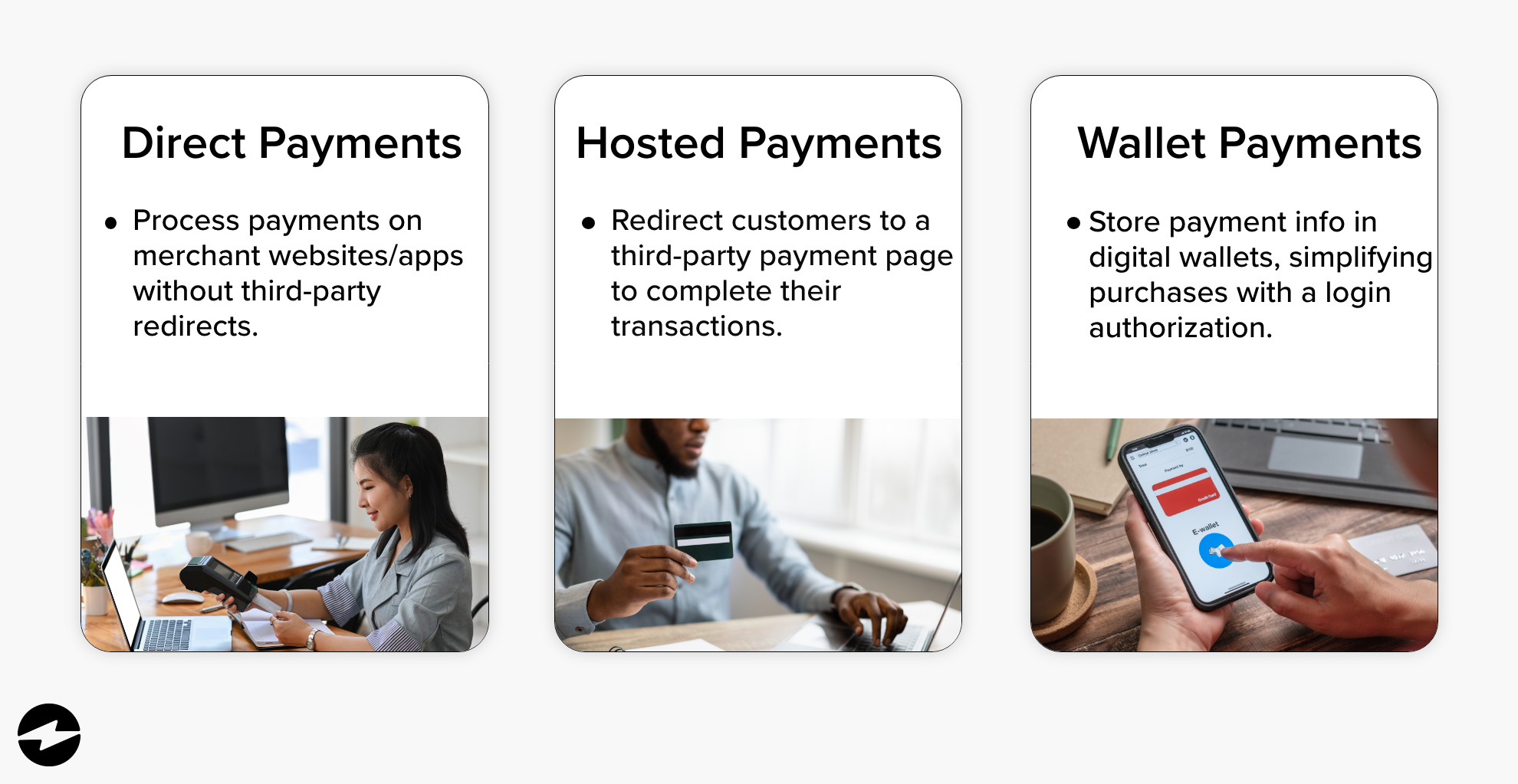

Payment APIs typically fall under three categories: direct payment, hosted payment, or wallet payment.

Direct payment APIs

Direct payment APIs are the most basic type of payment processing API. These APIs allow merchants to process payments on their website or application without directing customers to a third-party payment page.

Direct payment APIs provide merchants complete control over the payment process but require additional effort to comply with the Payment Card Industry Data Security Standard (PCI DSS).

Hosted payment APIs

Hosted payment APIs, also known as redirect payment APIs, redirect customers to a third-party payment page to complete their transactions.

These APIs provide a secure and easy-to-use payment experience for customers while reducing the burden of PCI compliance for merchants. Hosted payment APIs are popular for merchants who want a hassle-free payment processing experience.

Wallet payment APIs

Wallet payment APIs enable customers to store their payment information in a digital wallet, such as Apple Pay or Google Wallet. When customers make a purchase, they log in to their wallet and authorize the payment.

This type of payment API eliminates the need for customers to enter payment information for each transaction, making the payment process quick and convenient. Wallet payment APIs are particularly popular for mobile transactions, where entering payment information can be cumbersome.

Whether you utilize direct, hosted, or wallet payment APIs, many benefits are associated with using API for payments.

What are the benefits of using a payment API?

APIs revolutionize online transactions by providing merchants and customers with a seamless and streamlined payment experience.

Some of the main benefits of using a payment API include:

- Faster payment processing times: Payment APIs offer quicker payment processing times, so merchants can receive payments faster and improve their cash flow.

- Increased security and fraud prevention: Payment APIs eliminate the need for merchants to store sensitive payment information on their servers, reducing the risk of a security breach. APIs also include security measures like encryption and tokenization to ensure customer data is transmitted securely, making it much harder for hackers to steal payment information.

- Improved customer experience: Payment APIs save time and provide a hassle-free shopping experience by allowing customers to make payments in a few clicks without entering payment information for each purchase.

- Greater flexibility and customization options: Merchants can choose from various payment APIs that differ in features and capabilities for a more tailored payment process to meet their needs and preferences. For example, some payment APIs offer recurring billing options, while others support multiple currencies or payment methods.

Using a payment API that yields these benefits and fits your needs is critical, but businesses should also consider other factors like features, costs, and support when deciding.

5 factors to consider when selecting a payment API for your company

When searching for the perfect payment API, several factors must be considered when determining which software is best for your company.

Your company should evaluate these five areas when choosing a payment API:

- Features

- Costs

- Security

- Customer support

- Ease of use and integration

1. Features

Payment features may differ depending on the payment API you’re looking at. Your business should evaluate each API to find the one with the features that best meet your needs.

Some key features to look for include:

- Recurring billing: If you offer subscription-based services or products, you’ll need a payment API that supports recurring payments.

- Multiple currency options: If your business operates internationally, you’ll need to process payments in multiple currencies.

- Different payment methods: If you want to offer multiple payment methods, such as credit and debit cards, eChecks, or Apple Pay, you’ll need a payment API that supports these payment options.

These features are paramount to a company’s success in collecting payments, but it’s also crucial to look at the price of payment APIs.

2. Fees

Payment API providers charge fees for their services, which can vary widely depending on the provider and the services offered.

Some payment APIs charge a flat fee per transaction, while others charge a percentage of the transaction amount. It’s important to compare pricing structures and fee schedules to find an API that fits your budget.

3. Security

Security should be a top priority when selecting a payment API to protect your customers’ sensitive card data. Finding a PCI-compliant payment provider that offers advanced security tools and fraud prevention measures to process your payments securely is essential.

Luckily, most payment APIs use encryption and tokenization techniques to ensure customer data is transmitted securely, making it much harder for hackers to steal payment information.

4. Customer support

When it comes to payment processing, downtime can be costly. Businesses can avoid this downtime by looking for a payment API provider that offers 24/7 customer support to address any issues quickly.

Some payment APIs also provide dedicated account managers or technical support teams for a more efficient and prompt resolution process.

5. Ease of use and integration

When selecting an API, consider its ease of use and integration with your existing systems and platforms. A payment API that seamlessly integrates with your eCommerce platform or shopping cart can save you time and money in development costs.

Look for a payment gateway API that offers developer-friendly documentation, software development kits (SDKs), and plugins to simplify the integration process.

Now that you know to consider these five factors when selecting a payment API, your business can start researching the most popular providers to find the best fit.

4 payment APIs that can enhance your payment processing operations

Despite the many payment processor APIs on the market, several providers have gained prominence for their reliability, robust feature offerings, and advanced security measures.

Here are four leading payment APIs worth considering:

- EBizCharge

- Paypal

- Stripe

- Ayden

EBizCharge

EBizCharge is a comprehensive payment API that offers a wide range of features and customization options tailored to businesses’ unique needs.

EBizCharge’s features include a branded customer payment portal where businesses keep track of invoices and customers can make payments instantly, secure email payment links for customers to pay right from their inbox, and recurring billing to automate the accounts receivable process and help your business get paid on time.

On top of all the features EBizCharge provides, it also seamlessly integrates into 100+ accounting and ERP systems, eCommerce platforms, CRMs, etc. Integrating into major companies like QuickBooks and Salesforce allows you to send invoices to customers directly within this software to make payments more straightforward.

EBizCharge gives merchants all the tools to effortlessly process payments, manage invoices, access detailed reporting and analytics, and more. EBizCharge is also PCI-compliant and provides an API that prioritizes security with features like tokenization and encryption, off-site data storage, and more to protect sensitive payment data.

PayPal

PayPal offers a versatile payment API that enables businesses to accept payments from customers worldwide. With PayPal’s API, merchants can securely process transactions, set up subscriptions, implement mobile payments, and tap into a large user base.

PayPal’s reputation for reliability, global reach, and ease of integration has made it one of the most trusted payment APIs.

Stripe

Stripe is known for its developer-friendly payment API, providing comprehensive tools and features to facilitate online payments.

Stripe supports various payment methods, including credit cards, digital wallets, and local payment options, making it adaptable to a diverse customer base. Its robust security measures, customizable integration options, and developer-friendly documentation have made Stripe popular among businesses.

Adyen

Adyen offers a powerful payment API that caters to enterprise-level businesses with complex payment requirements. It provides a unified platform for accepting and managing payments across channels, countries, and currencies.

Adyen’s API supports various payment methods, offers advanced fraud detection capabilities, and provides detailed reporting and analytics to drive informed decision-making. Adyen focuses on companies working with large volumes of international transactions in multiple currencies, which may not be suitable for some businesses.

With numerous payment APIs to choose from, your businesses can rely on reputable providers like EBizCharge to take advantage of robust payment features and integrations that streamline the accounts receivable.

Optimize your online payments by taking advantage of a powerful payment API

Leveraging the power of payment APIs can help businesses accelerate their payment processing times, enhance security, provide more flexible payment options, and improve the overall customer experience.

With the help of this article, as well as understanding your business’s specific needs, you can achieve this by finding a reliable payment API that aligns with your requirements and optimizes your payment processing operations.

Summary

- What are payment APIs?

- How do payment APIs work?

- Understanding the different types of APIs

- What are the benefits of using a payment API?

- 5 factors to consider when selecting a payment API for your company

- 4 payment APIs that can enhance your payment processing operations

- Optimize your online payments by taking advantage of a powerful payment API