Blog > HIPAA-Compliant Payments: Everything You Need to Know

HIPAA-Compliant Payments: Everything You Need to Know

Upon your first visit to any medical facility, you’ll need to input sensitive payment information. From names and addresses to medical insurance and social security, this information must be handled with the utmost care to ensure privacy and security.

Since this data requires more protection, strict standards and regulations were created to safeguard it from outside parties.

What is HIPAA?

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a federal law that protects the privacy and security of individuals’ health information.

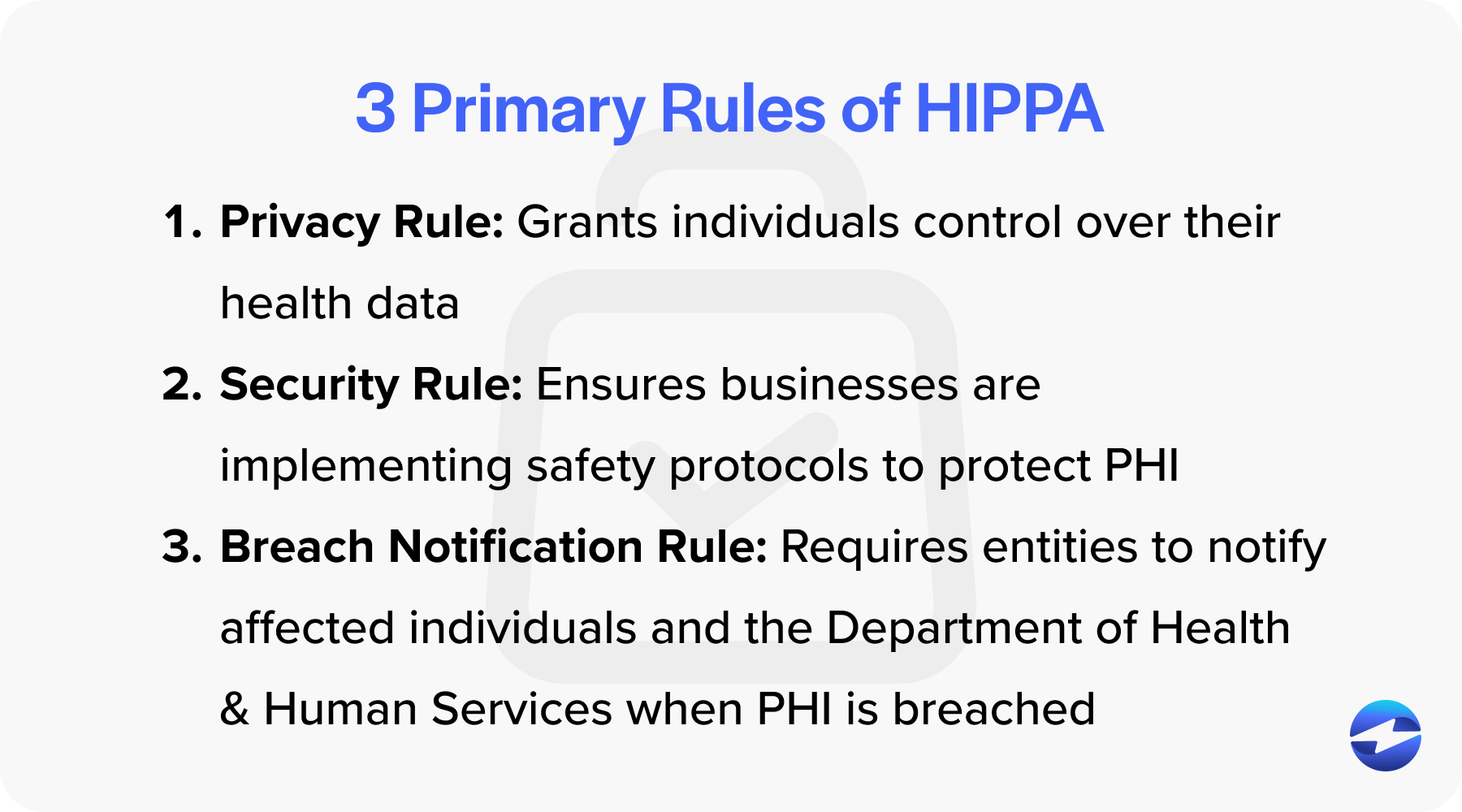

HIPAA incorporates three primary rules:

- The privacy rule grants individuals control over their health data, including the right to access, request corrections, and control disclosures of their protected health information (PHI). Covered entities must adhere to these regulations, ensuring the confidentiality and privacy of patients’ medical records while permitting necessary disclosures for treatment, payment, and healthcare operations.

- The security rule mandates covered entities and business associates to implement administrative, physical, and technical safeguards to protect the confidentiality, integrity, and availability of e-PHI.

- The breach notification rule requires entities to notify affected individuals and the Department of Health and Human Services (HSS) following a breach of unsecured PHI. It mandates prompt disclosure of breaches to affected parties, enabling them to take necessary steps to mitigate potential harm, such as identity theft or fraud.

HIPAA establishes national standards for protecting PHI and ensures that this information is only accessed and disclosed when necessary and with the individual’s consent.

Now that you understand what HIPPA entails, you can explore what information is included in PHI.

What is PHI?

PHI, or protected health information, refers to any information about a person’s health status, healthcare provision, or payment for healthcare that can be linked to that individual.

PHI consists of 18 sensitive data identifiers, including names, addresses, relevant dates, phone numbers, Social Security numbers, and more. PHI can include medical records, lab records, lab results, health insurance information, and other data used to identify a patient.

Unauthorized access to this sensitive information can lead to privacy breaches, identity theft, and medical fraud. Therefore, healthcare organizations and professionals are obligated to safeguard PHI using HIPAA-compliant payment methods that incorporate secure storage, transmission, and disposal practices.

What are HIPAA-compliant payment methods?

HIPAA-compliant payment methods refer to payment processing systems and practices that adhere to the security and privacy requirements outlined in HIPAA. These methods ensure the protection of patients’ PHI when processing payments for healthcare services.

Therefore, any payment method that adheres to HIPAA guidelines, including the privacy, security, and breach notification rules, is considered HIPAA-compliant.

Secure online portals provided by healthcare organizations are an example of a HIPAA-compliant payment method where patients can make payments for medical services. These portals employ encryption and other security measures to protect sensitive patient information, ensuring compliance with HIPAA regulations when handling PHI.

How to start accepting HIPAA-compliant payments

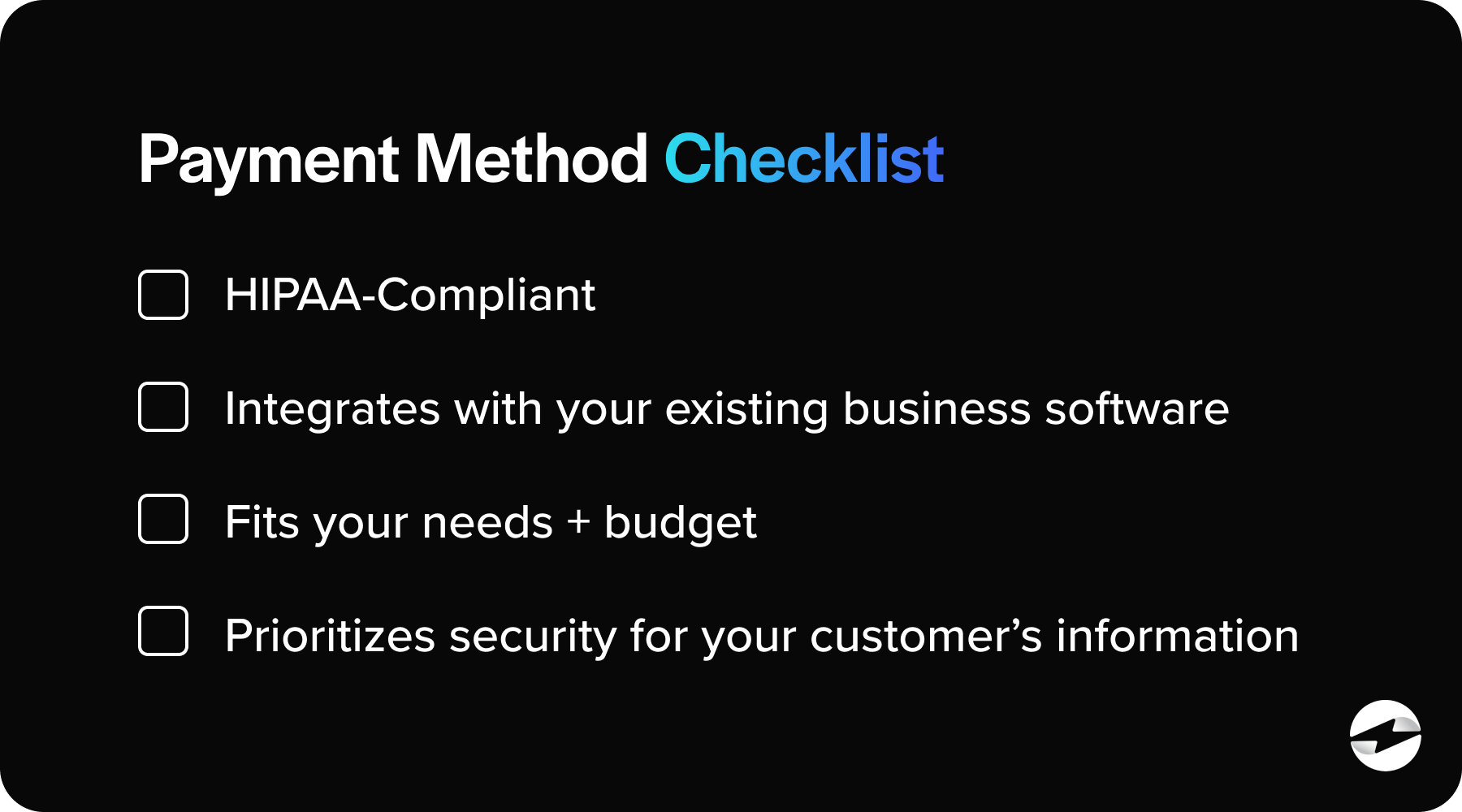

The simplest way to begin accepting HIPAA-compliant payments is to research and identify payment providers that use HIPAA-compliant payment software. Evaluate their features, services, and pricing to choose the best fit for your needs and budget.

Once you’ve selected a reliable payment processor, you can sign up for an account and set up your payment processing settings. The best providers will also offer integrated payment options into your existing systems, such as your HIPAA-compliant billing software or patient portal.

Not all businesses will require HIPAA-compliant payment methods, but for those that do, it’s imperative to use reliable payment software.

Businesses that require HIPAA-compliance

HIPAA compliance is primarily required for businesses and organizations that handle sensitive health data. Some examples include:

- Healthcare providers (hospitals, clinics, doctors’ offices, etc.)

- Health plan providers (insurance companies, Medicaid, and other government healthcare programs)

- Healthcare clearinghouses

- Business associates (billing companies, IT providers, etc.)

- Pharmacies

- Healthcare IT providers

- Medical laboratories

- Medical equipment suppliers

- Telemedic providers

- Medical research organizations

- Employer-sponsored health programs

These are just a few of the businesses that require HIPAA compliance and HIPAA-compliant billing software. One HIPAA-compliant payment software that simplifies receiving payments is EBizCharge, a top-rated payment processing solution that streamlines accounts receivables.

Facilitating HIPAA-compliant payments with EBizCharge

EBizCharge offers a seamless integration process, allowing businesses to incorporate HIPAA-compliant payment options into their existing business software effortlessly.

With its secure processing solutions, EBizCharge encrypts transactions and implements robust security measures, safeguarding patients’ confidentiality and health data for each transaction.

Additionally, EBizCharge provides comprehensive support and guidance, enabling healthcare entities to navigate HIPAA regulations and maintain compliance.

Is you business PCI compliant? Take this 1-min quiz to find out.

Is you business PCI compliant? Take this 1-min quiz to find out.