Blog > What is Accounts Receivable Management?

What is Accounts Receivable Management?

Accounts receivable management plays a pivotal role in businesses’ financial health and operational efficiency across industries.

As businesses extend credit to clients, managing accounts receivable becomes essential for maintaining liquidity, ensuring timely payments, and fostering healthy cash flow.

What is accounts receivable?

Accounts receivable (AR) refers to the money owed to a business by its customers or clients for goods and services on credit.

AR represents the short-term credit extended to customers, typically in the form of invoices or bills, with the expectation of receiving payment later according to agreed-upon terms.

How can businesses manage accounts receivable?

Managing receivables involves implementing strategies to ensure the timely collection of customer payments.

One key aspect of receivables management is establishing clear credit terms and policies to define when payments are due and the consequences of late payments.

Businesses should also regularly monitor AR to identify overdue invoices, allowing for prompt follow-up actions such as reminders or collection efforts.

What are the benefits of an efficient AR management system?

Effective AR management is crucial to collecting timely payments and improving cash flow, which can result in liquidity for daily operations and investment opportunities.

AR management also helps minimize the risk of bad debt by implementing timely invoicing and diligent follow-up procedures, safeguarding profitability and financial stability. As a pivotal component of any successful business, it’s important to find ways to improve AR processes as much as possible.

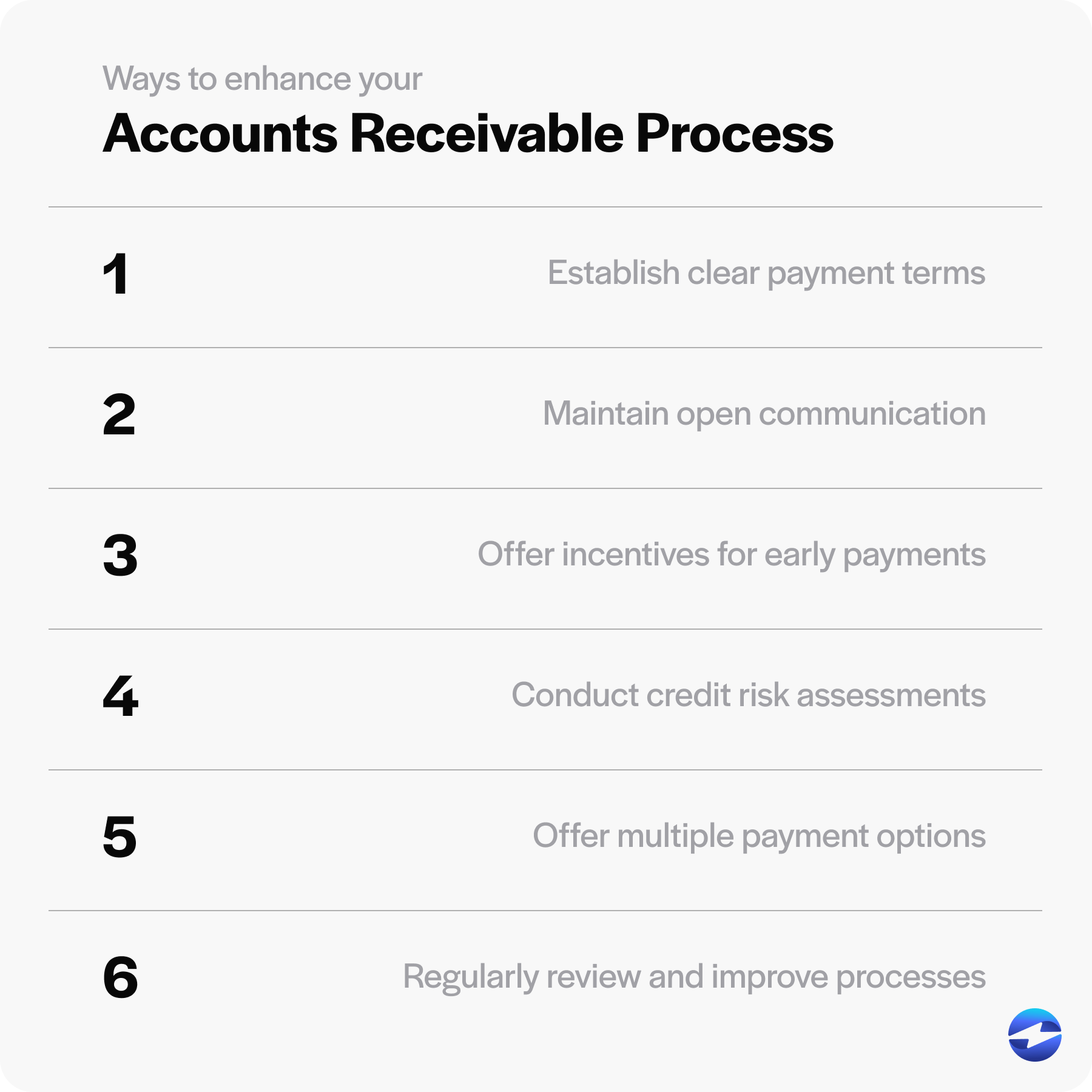

6 ways to enhance your accounts receivable process

Enhancing your AR process is crucial for maintaining healthy cash flow and optimizing financial performance. By implementing these best practices, you can ensure smoother operations and better financial outcomes for your business.

Here are seven best practices to ensure your AR processes are running smoothly:

- Establish clear payment terms: Clear payment terms can improve AR by providing clarity and accountability for your business and its customers. These terms outline when payments are due, what payment methods are accepted, and any consequences for late payments. By setting clear expectations upfront, customers are more likely to understand their obligations and adhere to payment deadlines, reducing the likelihood of disputes or misunderstandings regarding payment terms.

- Maintain open communication: Open communication allows for a clear and transparent exchange of information regarding billing terms, payment deadlines, and any outstanding invoices between your business and its customers.

- Offer incentives for early payments: By providing discounts, rebates, or other benefits for payments made before their due date, businesses encourage clients to prioritize their payments, thus accelerating the cash flow cycle. This helps to reduce the average collection period and minimize the risk of late or delinquent payments.

- Conduct credit risk assessments: Credit risk assessments involve analyzing factors such as the client’s financial stability, payment history, and credit score. Thoroughly evaluating the creditworthiness of potential clients will allow your company to identify and mitigate the risk of non-payment or late payment.

- Offer multiple payment options: By accommodating various payment preferences, businesses remove payment barriers, make it more convenient for clients to fulfill their obligations, and offer more flexibility to increase the likelihood of clients settling their invoices.

- Regularly review and improve processes: Regularly reviewing and improving AR processes allows your business to adapt to changing circumstances, identify inefficiencies, and optimize operations. You can also identify areas where invoicing, payment collection, or follow-up procedures may be lacking or outdated.

Now that you know the best practices for managing accounts receivable, you can learn how to measure AR performance.

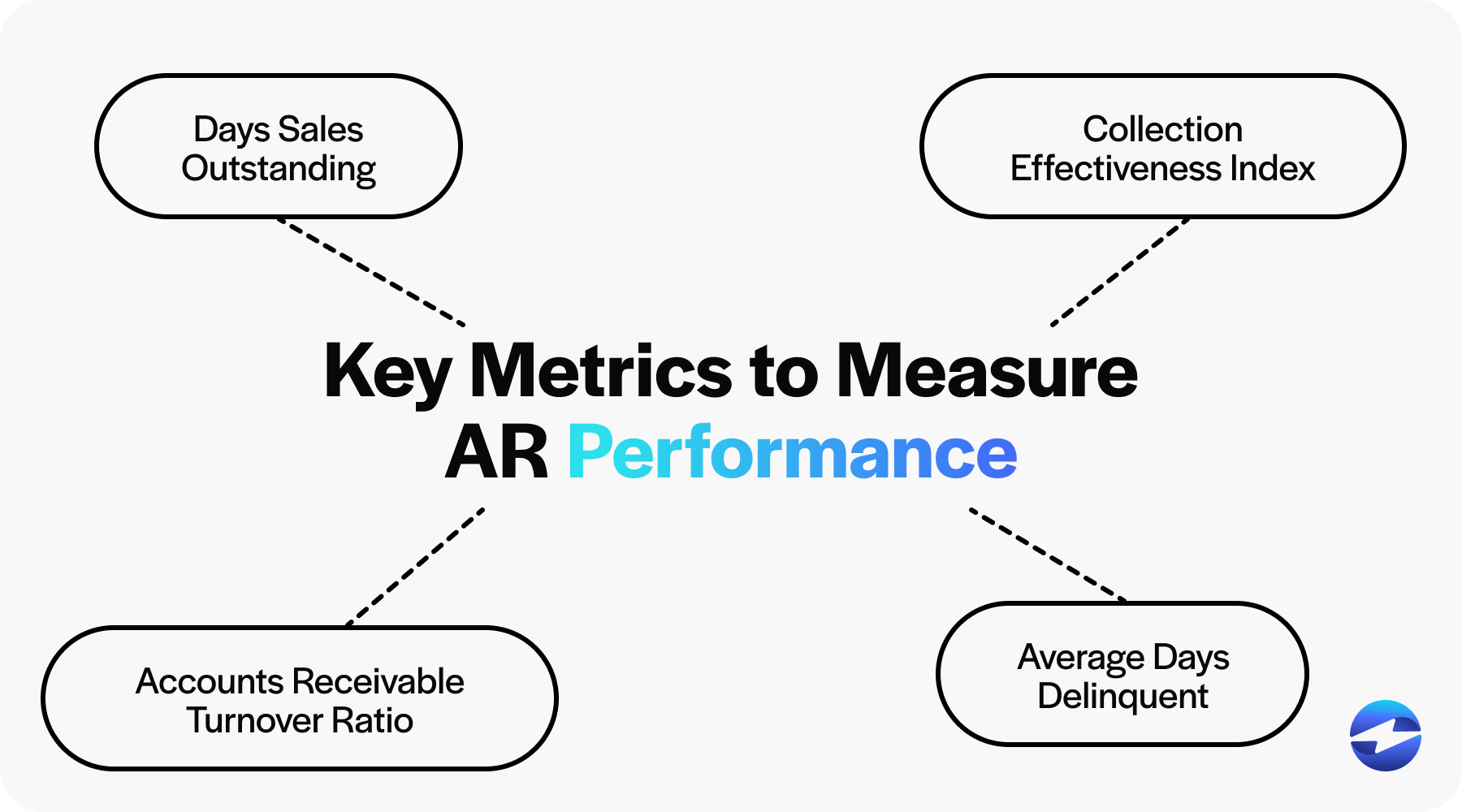

How to measure accounts receivable performance

AR performance can be measured using several key metrics, including Days Sales Outstanding, Collection Effectiveness Index, Average Days Delinquent, and Accounts Receivable Turnover Ratio.

Days sales outstanding

Days Sales Outstanding (DSO) is a key metric used to measure AR performance by indicating the average number of days it takes for a business to collect payment after a sale is made.

A lower DSO typically signifies that a company collects payments more quickly, generally indicating healthier cash flow and more efficient AR management. A higher DSO suggests payments are taking longer to collect, which can indicate potential issues such as ineffective credit policies, slow payment processing, or difficulties with collection efforts.

Monitoring DSO over time and comparing it against industry benchmarks or historical data will allow businesses to assess their AR process’s effectiveness, identify areas for improvement, and take proactive measures to expedite payments and optimize cash flow.

Overall, DSO provides valuable insights into the efficiency and effectiveness of your receivables management.

Collection effectiveness index

Collection effectiveness index (CEI) measures a company’s success in collecting outstanding receivables within a certain period, typically a month.

CEI is calculated by comparing the amount of cash collected during the period to the total amount of outstanding receivables at the beginning of the period, minus any new sales made during that period.

A higher CEI indicates that a business effectively collects outstanding payments, which reflects positively on its cash flow and revenue. Conversely, a lower CEI suggests inefficiencies in the

collections process, indicating potential problems with credit policies, billing procedures, or customer payment behaviors.

Average days delinquent

Average Days Delinquent (ADD) measures AR performance by providing insights into the average time it takes for customers to pay their outstanding balances beyond the due date.

A lower ADD indicates customers are paying promptly, which reflects an efficient AR process and healthy financial operations. A higher ADD suggests customers are taking longer to pay, indicating potential cash flow issues or payment collection discrepancies.

Tracking ADD over time allows businesses to monitor trends, identify problem areas, and implement strategies to improve collections and reduce delinquency.

Accounts receivable turnover ratio

Accounts receivable turnover ratio (ARTR) measures AR management’s effectiveness by calculating how often a company’s AR is collected and replaced within a specific period, usually a year.

A higher ARTR indicates that a company collects its outstanding receivables more quickly, which is generally a positive sign of efficient AR management. This ARTR suggests a company effectively converts its credit sales into cash, thereby improving cash flow, slower collections, potential credit policy issues, or difficulties collecting customer payments.

Now that you understand how to measure AR performance, you should be aware of some common problems to look out for.

5 common problems in accounts receivable

Familiarizing yourself with common problems will allow you to stay prepared for any complications that may arise in your AR processes.

Here are five of the most common problems to look out for:

- Late payments: Late payments can disrupt cash flow, affecting your ability to meet obligations such as paying suppliers, employees, or creditors on time. This can lead to additional borrowing costs or missed investment or growth opportunities. Late payments increase the risk of bad debts, as outstanding invoices become more challenging to collect the longer they remain unpaid. They can also strain relationships with customers, potentially damaging trust and loyalty.

- Manual processes and paperwork: Manual processes are inherently slower and prone to more errors than automated systems. This can lead to delays in invoicing, payment posting, and reconciliation.

- No ERP integration: Not having an Enterprise Resource Planning (ERP) system integration limits visibility into the entire order-to-cash process, making it challenging to track invoice status, monitor cash flow, and forecast future receivables accurately. This can impede strategic planning and hinder the ability to optimize working capital and financial performance.

- Fraud and security risks: AR involves processing sensitive financial information, including customer payment details and transaction data. This makes them a prime target for cybercriminals seeking to steal sensitive information for fraudulent purposes, such as identity theft or unauthorized transactions.

- Compliance issues: Businesses must navigate complex regulations and standards governing financial transactions and data protection. Failure to comply with these requirements can lead to penalties, fines, legal liabilities, reputational damage, and disruption of business operations. These regulations include the Payment Card Industry Data Security Standard (PCI DSS) and the Generally Accepted Accounting Principles (GAAP).

Businesses can also implement best practices when managing accounts receivable to better address concerns and problem areas in AR.

Accounts receivable management best practices

Now that you know the AR issues that can arise, your business can implement best practices to combat and avoid them altogether.

To help you get started, here are eight best practices you can implement to improve your AR management:

- Resolve disputes quickly: Address any billing disputes or discrepancies promptly by working closely with customers to resolve issues amicably, which can ensure timely invoice settlement and fewer payment delays.

- Accelerate invoice delivery: Sending invoices to customers at an accelerated pace can expedite the payment cycle, ensuring customers receive bills quickly. This helps minimize the time between delivering goods or services and receiving payments, thus improving cash flow and liquidity for the business.

- Follow up on overdue payments: Implement a systematic approach to follow up on overdue payments. Send reminders, make phone calls, or use automated emails to prompt customers to pay outstanding invoices.

- Offer customer credit terms: Extending credit to customers can help businesses attract and retain customers by offering flexible payment options. By allowing customers to buy now and pay later, you can cater to varying financial situations and preferences.

- Maintain accurate records: Keep detailed records of all AR transactions, including invoices, payments, and customer communications. Maintaining accurate records by using an AR ledger or business software will help your business track payment statuses and resolve disputes more efficiently.

- Train staff on AR operations: Ensure all staff members involved in AR operations have received thorough training on company policies and procedures related to invoicing, collections, and customer service protocols.

- Use AR collection email templates: Using AR collection templates for your customers can save your staff time and effort by eliminating the need to craft individual messages for each customer invoice. These templates provide standardized messaging for various invoicing and collection stages to ensure consistency and accuracy in customer communication.

- Embrace automation: Automation enhances efficiency by streamlining repetitive tasks such as invoice generation, payment reminders, and data entry, thus saving valuable time and reducing manual processes. It also ensures more AR accuracy by minimizing or eliminating human errors involving data entry, calculation, and reconciliation, thus improving financial accuracy.

Since the benefits of AR automation can’t be overstated, businesses can incorporate trustworthy payment processors equipped with reliable software to optimize their customer payments.

Automating accounts receivable with EBizCharge

Thanks to its robust payment software and unmatched collection tools, EBizCharge allows businesses to automate their AR, improve efficiency, reduce administrative overhead, and accelerate cash flow and revenue.

EBizCharge’s automated invoicing capabilities enable businesses to generate and send invoices automatically based on predefined schedules or triggers, such as the completion of a sale or delivery of goods and services. This reduces the need for manual intervention and ensures timely invoice delivery to customers.

EBizCharge provides online payment portals where customers can securely view and pay their invoices electronically, eliminating the need for paper checks and manual payment processing. It also offers recurring billing options, so businesses can set up automatic payments for regular or subscription-based services, further streamlining the AR process.

Finally, EBizCharge integrates seamlessly with over 100 top accounting, ERP, CRM, and eCommerce software systems, ensuring all payment data is automatically synced and reconciled, minimizing errors and discrepancies in AR management

Summary

- What is accounts receivable?

- How can businesses manage accounts receivable?

- 6 ways to enhance your accounts receivable process

- How to measure accounts receivable performance

- 5 common problems in accounts receivable

- Accounts receivable management best practices

- Automating accounts receivable with EBizCharge

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.