Blog > How to Calculate Days Sales Outstanding (DSO)

How to Calculate Days Sales Outstanding (DSO)

Days sales outstanding is a crucial metric that merchants can use to judge their financial health to understand how long it takes to get paid, make strategic changes to payment policies, and free up cash flow.

This article provides a clear definition of days sales outstanding, DSO calculation steps, and tips to improve DSO for your company to help you understand this metric.

What is Days Sales Outstanding (DSO)?

DSO meaning days sales outstanding, is a way to measure your business’s time to collect payments. If you run a cash-only company, you won’t calculate DSO since payments are immediate.

If you accept credit payments or send client invoices, you should know your company’s DSO. In a world where 49% of US businesses’ invoices are overdue, learning how much time it takes to deliver a product or service and get paid is essential.

The importance of DSO

DSO is vital to optimize your cash flow and better manage your finances for long-term growth and profitability.

The formula for days sales outstanding allows businesses to:

- Understand how long it takes to get paid

- Judge your financial health

- Better manage debt

If your DSO is too high, your cash flow suffers. Credit sales promise future payment, and you won’t have the cash to invest in other areas of your operations. You’ll also discover if your customers are happy or not.

For example, if your DSO is increasing, it may indicate that your customers are not satisfied.

Learning how to calculate days sales outstanding will allow you to monitor your financial health better and make strategic decisions to improve it.

How to calculate the days sales outstanding formula

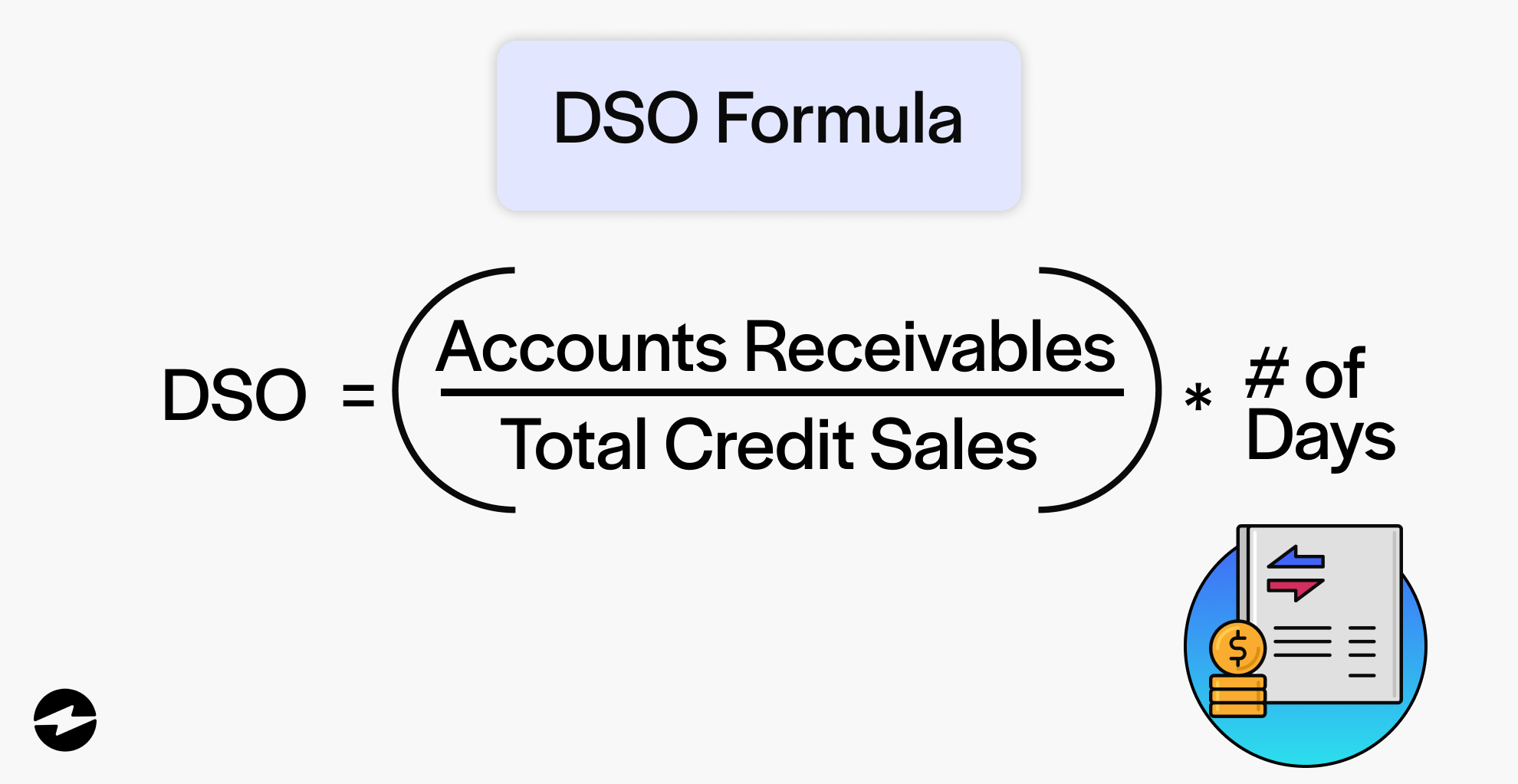

The DSO calculation formula requires you to know or define the following:

- Accounts receivable (AR): AR is the money outstanding to your company for services or goods that customers have received.

- Total credit sales: Total credit sales is the total value of all credit sales outstanding. A credit sale is a sale made via credit instead of cash.

- Cash sale: A cash sale is a sale where the person’s debt is satisfied at the time of purchase. While actual cash can be exchanged, cash equivalents can also satisfy the debt. Cash equivalents include debit cards, checks, and credit cards.

With this information, you can use the DSO formula to understand your company’s financial health:

- DSO = (Accounts receivable/Total Credit Sales) x Number of Days

Example of how to calculate DSO

An example of the days of sales outstanding formula will first begin with outlining your figures:

- AR = $22,500

- Total Credit Sales = $45,000

- Number of Days = 30

Based on these figures, our DSO calculation will be ($22,500 / $45,000) x 30 = 15. Therefore, it takes about 15 days for sales to be converted into cash. A DSO of 15 days is phenomenal compared to the top 1,000 US companies’ average of 40.6 days.

4 ways to improve DSO for your company

Knowing how to calculate DSO is the first step to improving it, but there are other strategies to help you improve this number.

Here are four ways you can improve DSO for your company:

- Give customers an incentive to pay early

- Send invoices ASAP

- Set up a collection process

- Cut problematic customers

1. Give Customers an Incentive to Pay Early

One way to simultaneously improve your cash flow and DSO is to incentivize your customers to pay early.

For example, offer a 2% discount for making payment within 10 days. Other incentives include gift cards, merchandise, and discounts on future orders.

It’s important to ensure these incentives are mentioned on the invoice to entice customers to take advantage of them.

2. Send invoices ASAP

Sending invoices in a timely manner is essential to promote on-time or early payments. Businesses can automate invoices to this process for more streamlined payment collections.

To help with this, you can include incentives with your invoices and auto reminders to improve collection times.

3. Set up a collection process

Setting up an efficient collection process is a last-step measure to ensure you collect on missed or late payments.

Companies can create a customer support team that calls customers to collect these payments or work with a third party that handles overdue invoice collection.

4. Cut problematic customers

If specific customers are considered problematic because they continue to fail to pay on time, you may need to cut ties.

Dissolving a customer relationship may be challenging, especially if you’ve worked with them for a long time. In this case, you can discuss these invoice issues with them before taking these measures.

When you take steps to improve DSO, you should also look for ways to enhance your cash flow.

Enhancing your company’s cash flow

A healthy flow of funds will keep your business in operation and help you avoid becoming one of the 82% of small businesses that fail due to poor cash flow.

Improving your company’s DSO can help increase your cash flow. Your business can also take steps to enhance its cash flow, such as reviewing accounts payable terms and reducing unnecessary spending.

Review accounts payable terms

Encouraging customers to make payments early can increase your cash flow, but consider taking the opposite approach with your accounts payables.

Rather than sending payment as soon as the bill arrives, wait until the deadline. Delaying payment can help prevent cash flow shortages. Some vendors may also be willing to negotiate longer payment terms in exchange for your business.

Reduce unnecessary spending

Reducing unnecessary spending can boost your cash flow immediately. Review each expense carefully and consider whether it’s an absolute necessity.

Cutting back on costs will free up more cash and help prevent future shortages.