Blog > What are Accounts Payable vs. Accounts Receivable?

What are Accounts Payable vs. Accounts Receivable?

Accounts Payable and Accounts Receivable are essential accounting concepts for managing a business’s financial operations.

This article will provide a comprehensive overview of AP and AR, how they work, their benefits and differences, and more.

What is Accounts Payable?

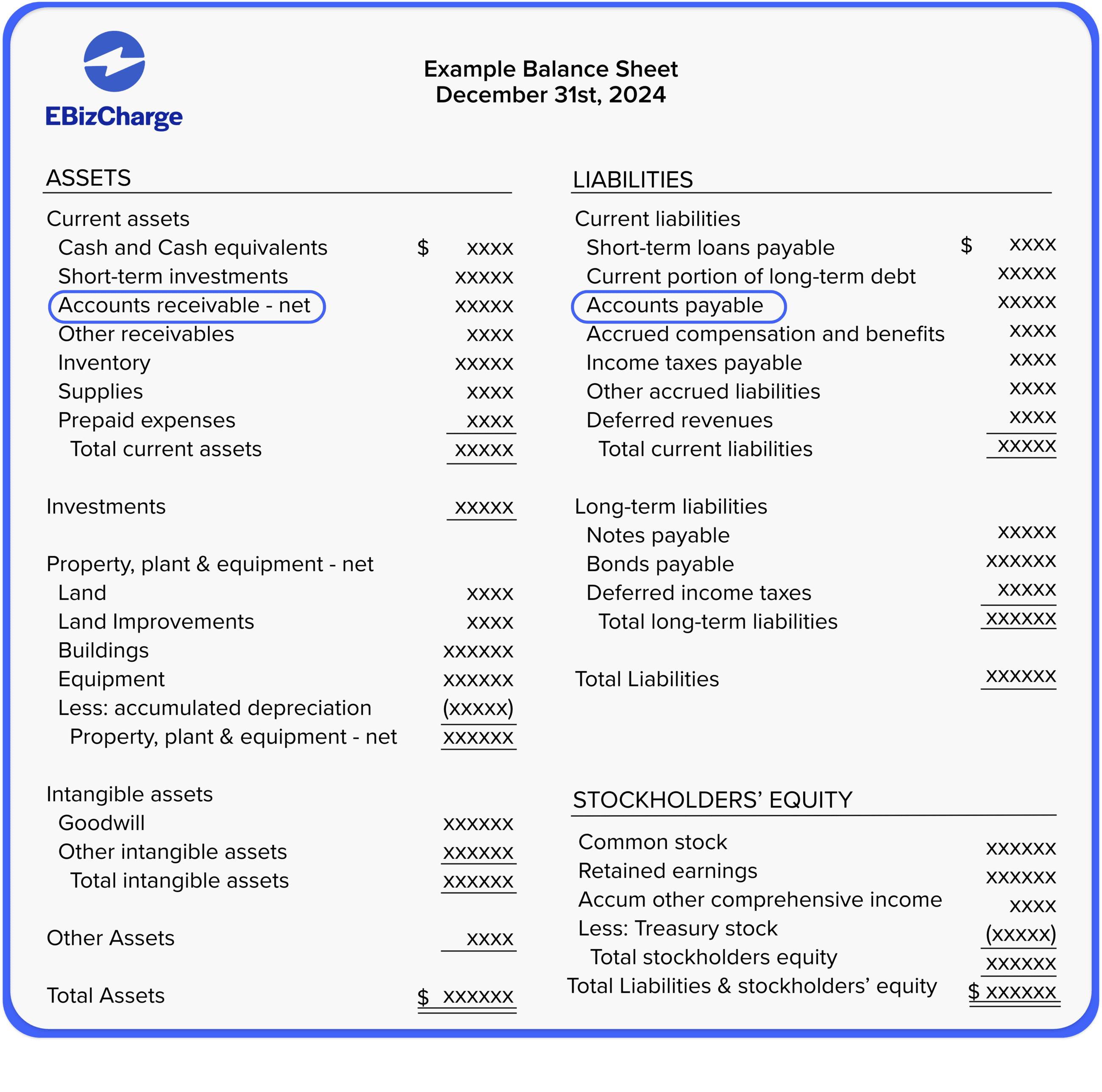

Accounts Payable (AP) refers to the money a business owes to its suppliers or vendors. It records the goods and services a business has received from its suppliers but has yet to pay. AP is typically recorded as a liability in a company’s balance sheet until paid.

AP works by invoicing a business for the goods or services received. This company then has a specified amount of time — usually 30-60 days — to pay the invoice. Once the payment is made, the AP account is updated, and the liability is reduced.

Using AP has several benefits, including better cash flow management, reduced risk of late payments, and improved vendor relationships. It also provides a clear record of all the business’s liabilities, which is useful when preparing financial statements.

What is Accounts Receivable?

The money the business owes its customers is known as Accounts Receivable (AR). Another name for accounts receivable is trade receivables, which can be used interchangeably. Both refer to the outstanding amounts a company expects to collect from its customers for goods or services provided on credit. AR is recorded as an asset in a company’s balance sheet until it’s collected.

AR works by invoicing customers for the goods and services provided. The business then waits for payment from the customer, which can be made through a check or electronic payment. Once the payment is received, the cash application process updates the AR account, and the asset is reduced.

Using AR has several benefits, including improved cash flow management, reduced risk of bad debts, and improved customer relationships. It also provides a clear record of all the business’s assets which is useful when preparing financial statements.

What do AP and AR have in common?

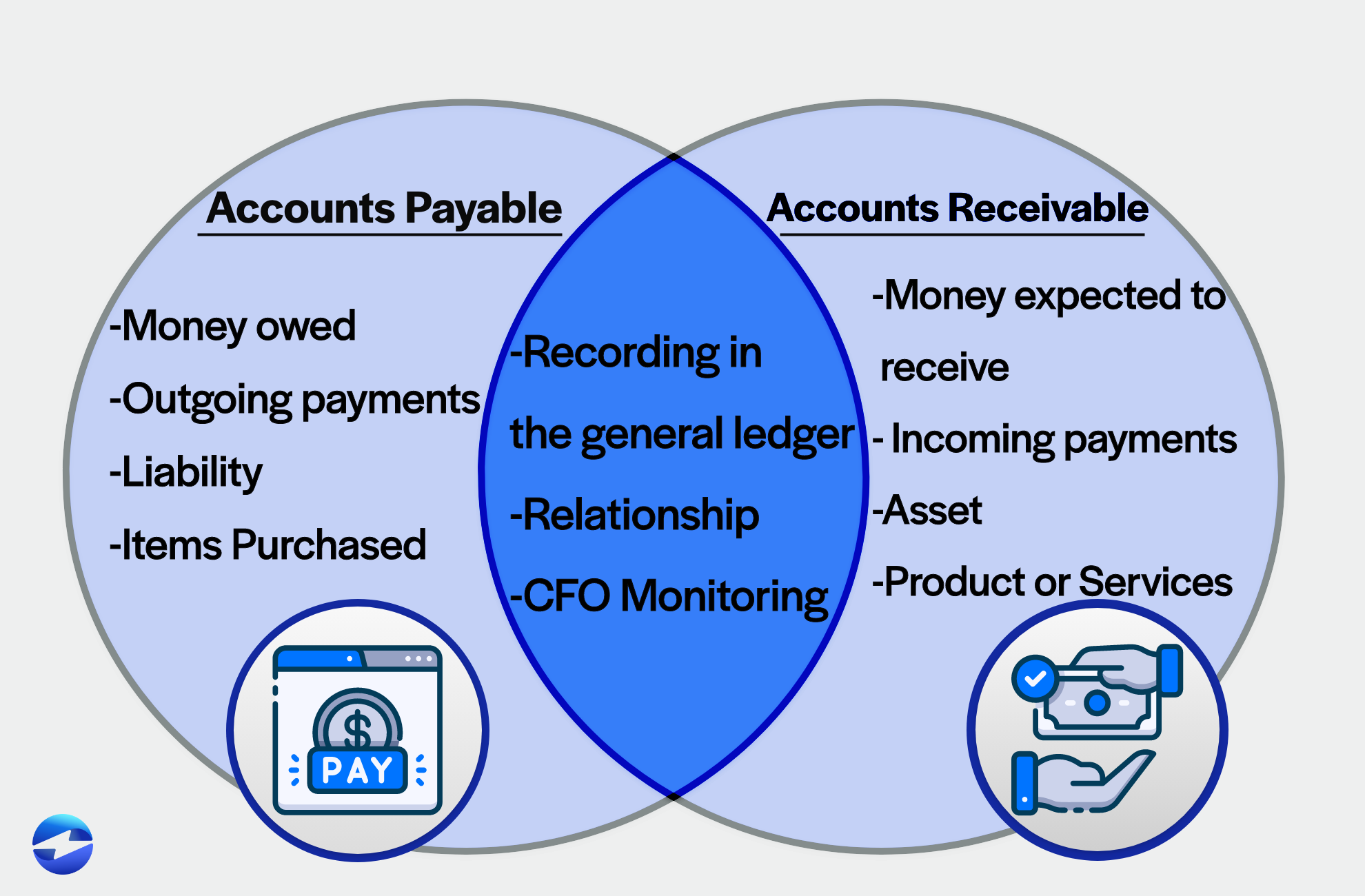

Accounts payable and accounts receivable are essential aspects of a company’s financial health and share several similarities.

Here are three key commonalities between AP and AR:

Recording in the general ledger:

- AP and AR are both recorded in a company’s general ledger and are important for managing cash flow.

Relationship with each other:

- AP and AR are closely related and are monitored together to understand a company’s financial standing better.

Monitoring by CFOs:

- AP and AR are closely monitored by Chief Financial Officers (CFOs). The CFO should ensure AP and AR teams have the right tools, skills, and capacity to scale with the business.

Despite these similarities, AP and AR also have several significant differences.

Accounts payable compared to accounts receivable

While there are some similarities, you may wonder what the difference between accounts payable and accounts receivable is.

AP and AR are similar in that they relate to money a business owes or is owed but differ in terms of who the money is owed to or by.

AP focuses on the money a company owes to its suppliers, and it’s used to manage outgoing payments and is recorded as a liability. Whereas AR focuses on the money a company owes its customers, and it’s used to manage incoming payments and is recorded as an asset.

AR plays a crucial role in maintaining the financial stability of a business. Auditors typically evaluate AR by looking at accounts past due beyond 120 days. At that point, the company may need to adjust expectations, remove the amount from AR, and charge it as an expense if the client can’t or won’t pay.

The auditing process involves testing AP and evaluating AR. Auditors look for quantity errors in AP during the auditing process and evaluate accounts past due in AR. If accounts are past due, the company may need to adjust expectations, remove the amount from AR, and charge it as an expense. The auditing process is crucial for evaluating the efficiency of AR and AP safeguards.

There are several practices to keep in mind to manage AP and AR effectively. These include regularly reconciling accounts, using technology to automate the accounts receivable processes, and implementing a system for managing and tracking invoices. Improving these processes can help your business better manage its finances, reduce the risk of errors, and make better decisions about its cash flow.

Understanding AR and AP

Understanding how AR and AP systems work is crucial for managing financial operations and making more informed decisions about your business’s finances and overall performance. By implementing best practices for managing AP and AR, a company can ensure that its finances are managed effectively and efficiently.

Businesses can also partner with reliable payment service providers like EBizCharge to automate invoice collections for a more enhanced payment experience.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.