Blog > Average Collection Period: Formula, Examples, Ways to Improve

Average Collection Period: Formula, Examples, Ways to Improve

Cash flow is the lifeblood of any successful business, with the timing of income being just as crucial as its amount. The average collection period, a critical financial metric, provides insight into the efficiency of a company’s credit and collections practices. By lowering your average collection period, your company will see significant improvements to your overall cash flow.

This article will dive into what the average collection period, its benefits to cash flow and other areas, and how to calculate the financial metric.

What is the average collection period?

The average collection period is a key financial metric that reflects the average number of days it takes for a business to collect payments from its customers after a credit sale has been made. This period is crucial for understanding how effectively a company manages its accounts receivable and, consequently, its cash flow. What does a high average collection period suggest?

A high average collection period might suggest that a company takes longer than desired to collect receivables. This extended period could point toward several underlying issues. For instance, it may indicate lax credit policies, where customers are not encouraged to pay on time. Alternatively, it could highlight inefficiencies in the company’s collection process or suggest that customers need help with financial difficulties that prevent them from paying on time. Regardless of the cause, a high average collection period can tie up capital in receivables, potentially leading to cash flow issues.

What does a low average collection period suggest?

Conversely, a low average collection period typically suggests that a company efficiently collects its receivable balances. This expediency means that customers are paying their dues quickly, which can be a sign of an adequate credit and collections policy and solid customer creditworthiness. It’s a sign that a company has a healthy cash flow, enabling it to reinvest in the business, settle its obligations on time, and maintain a buffer against financial uncertainties.

By keeping track of this period, businesses can make informed decisions regarding their credit terms and collection processes to ensure a healthy balance sheet and maintain a smooth cash flow cycle.

How to calculate the average collection period

The average collection period is often calculated in a sequence of steps that involve analyzing elements from a company’s financial statements. Here are the four steps required to calculate the average collection period:

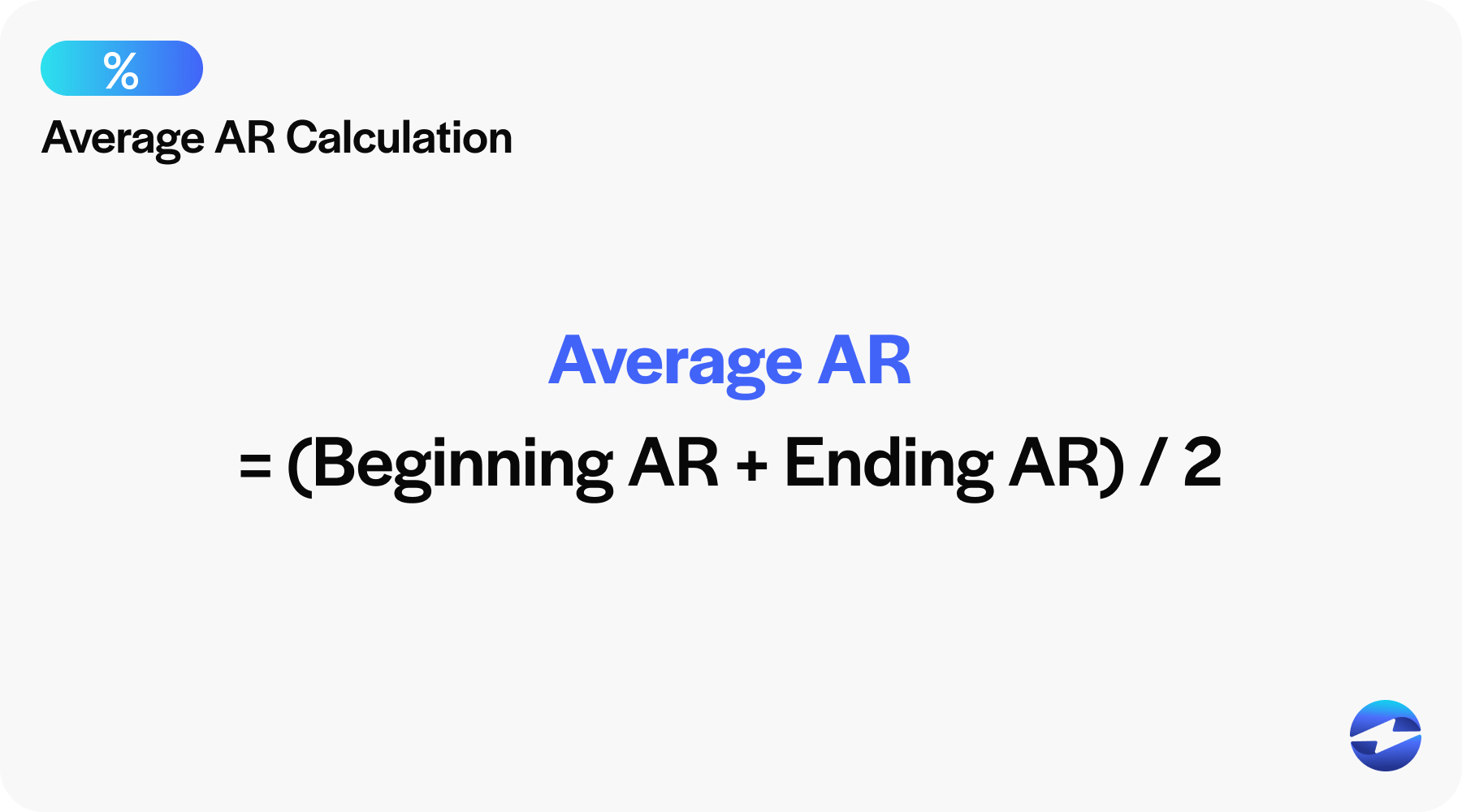

Step 1: Calculate average accounts receivable

Calculating average accounts receivable involves finding the mean amount of money owed to the company by its customers during a particular period. To do this, you add the accounts receivable at the beginning of the time frame to the accounts receivable at the end of the time frame and then divide by 2. The formula looks like this:

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

It’s essential that the selected time frame for the beginning and ending accounts receivable corresponds to the period for which you want to calculate the average collection period.

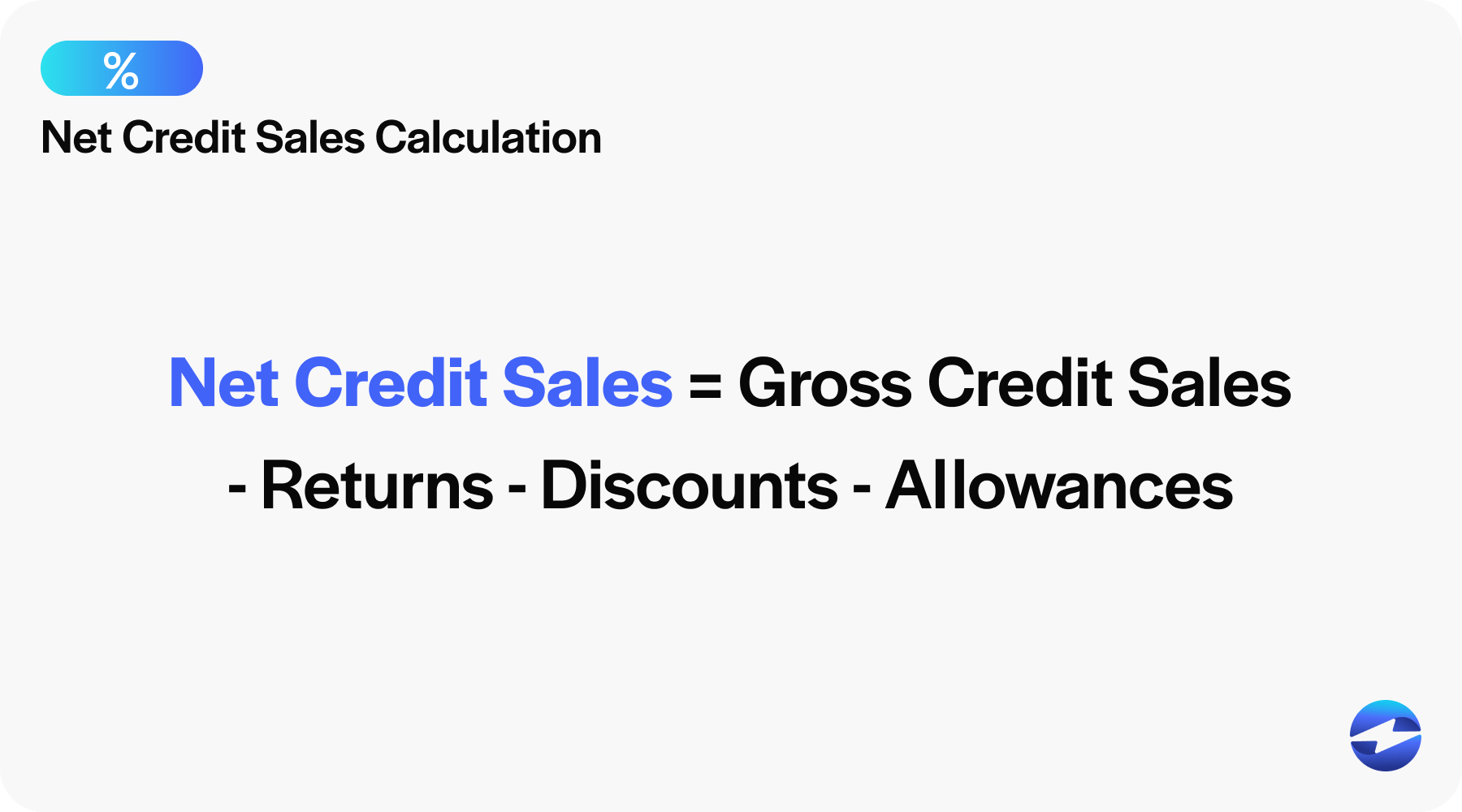

Step 2: Calculate net credit sales

The next step is determining the net credit sales, which represent the total sales made on credit minus any returns or allowances. This figure illustrates the actual credit sales that are expected to be collected. The formula is:

Net Credit Sales = Total Credit Sales – Sales Returns – Sales Allowances

This figure can be found on the income statement or calculated with detailed accounting records.

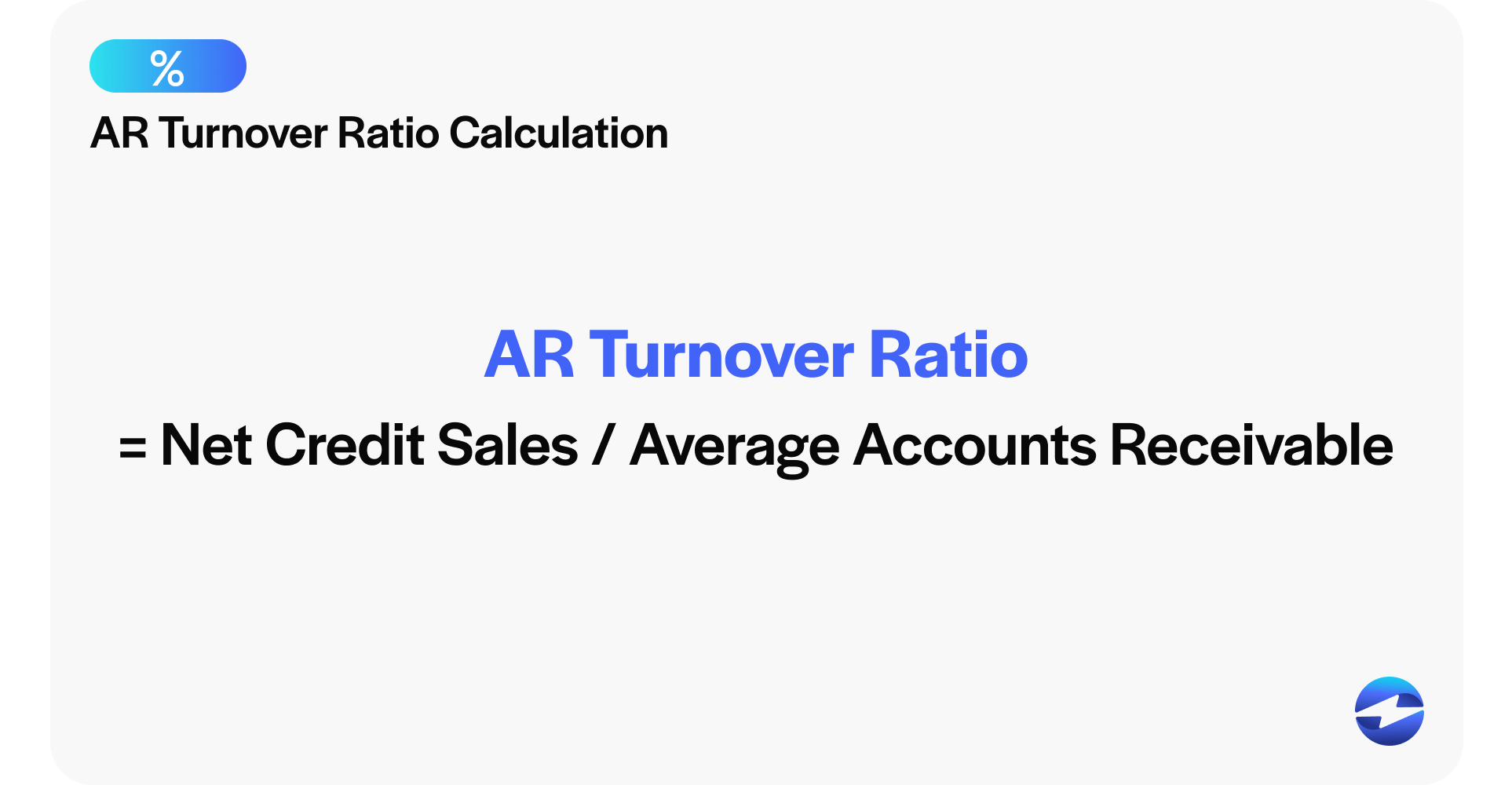

Step 3: Calculate the accounts receivable turnover ratio

The accounts receivable turnover ratio measures how often receivables are collected during a set period. To calculate it, divide the net credit sales by the average accounts receivable. This ratio indicates how effectively a company manages its credit sales and collections. The formula is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Step 4: Calculate the average collection period

Finally, the average collection period is calculated by taking the number of days in the period and dividing it by the accounts receivable turnover ratio. This calculation yields the average number of days it takes for a business to receive payment after a sale has been made on credit. The formula for the average collection period is:

Average Collection Period = (Number of Days in Period) / (Accounts Receivable Turnover Ratio)

Typically, the number of days set is 365 for an entire year, but it could be adjusted to a different time frame if needed. The resulting figure gives businesses an insight into the time necessary to convert credit sales into cash.

Average collection period in practice (example)

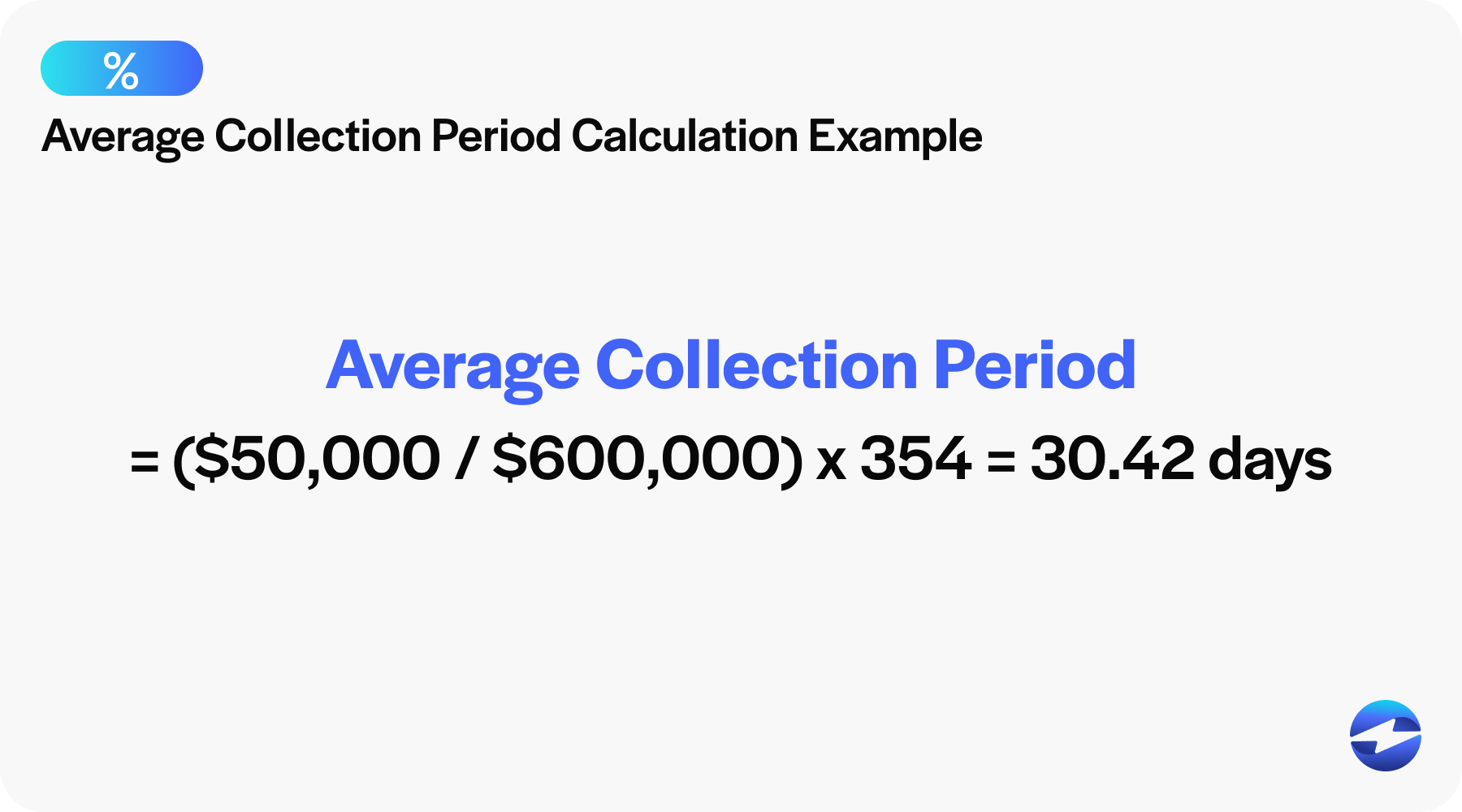

Let’s dive into a real-life example of how we can calculate the avergae collection period. Company A offers credit to its customers and wants to assess its collection efficiency. They examine their financials and find that their average receivables balance over a year is $50,000, and their annual credit sales are $600,000.

Using the average collection period formula: Average Collection Period = (Average Receivables / Credit Sales) x Number of Days in Period

They calculate their average collection period as follows:

Average Collection Period = ($50,000 / $600,000) x 365 = 30.42 days

This means it takes Company A, on average, about 30 days to collect payments on credit sales. As stated before, having a shorter collection period is generally better as it indicates faster cash flow. Having an average collection period of 30 days is just about average, so the company is barely getting paid on time.

Main benefits of reporting on the average collection period

Understanding the average collection period provides a company with several advantages.

- Cash Flow Insight: It offers critical insight into a company’s cash flow situation, revealing how quickly they can expect to convert receivables into cash.

- Credit Policy Assessment: It helps evaluate the effectiveness of a company’s credit policy. If the period is too long, it might be a sign that the company needs to reassess the terms it extends to customers.

- Financial Health Indicator: The duration of the collection period can indicate financial health. Shorter periods may suggest a robust collection process, while longer periods could indicate potential cash flow problems.

- Benchmarking Performance: Companies can use this metric to compare themselves against industry standards and competitors. By assessing their performance, businesses can strive for improvement and optimize collection methods accordingly.

By grasping this key financial concept, companies can develop strategies to minimize the collection period, which can strengthen their cash position and financial stability.

What is a good average collection period?

The concept of a “good” average collection period can vary significantly across different industries and companies. Generally, a good average collection period aligns with the credit terms a company extends to its customers.

What does an average collection period of 30 days indicate for a company?

If a business offers a 30-day credit term, an average collection period near or below 30 days is often seen as efficient. This timely turn-around keeps cash flows steady and can indicate a strong collection process.

It’s essential to consider the industry average and whether the nature of the business requires longer terms to remain competitive.

However, an average collection period that is significantly lower than industry norms could also point to overly strict credit terms, which might limit sales if customers look for suppliers with more lenient payment options.

Six methods on how to improve average collection period

Improving the average collection period can positively impact a company’s cash flow and overall financial health. Implementing efficient strategies may reduce the time it takes to convert credit sales into cash. Let’s explore six methods for streamlining the collection process:

Method 1. Automated Invoicing

Automating the invoicing process ensures that bills are sent to customers promptly and consistently, which can accelerate payments. Automation reduces the chance of human error and minimizes the need for manual follow-up. Invoices reach the customers faster, and the system can be set up to send reminders, decreasing the average collection period.

Method 2. Offer Incentives for Early Payment

Providing discounts or other incentives to customers who pay their invoices early effectively encourages quicker payments. These incentives are a win-win: customers save money, and businesses benefit from improved cash flows. Establish clear terms for these benefits to ensure customers know about the potential savings.

Method 3. Real-Time Communication with Customers

Establishing direct and real-time communication channels with customers can help immediately address any concerns or questions regarding their invoices. Swift communication can resolve issues that might otherwise delay payment, reinforcing the importance of punctual remittance.

Method 4. Detailed Reporting and Customer Management

Implementing detailed reporting mechanisms provides insight into payment patterns and identifies troubling trends with specific accounts. With effective customer relationship management, businesses can tailor their approach to each customer, including adjusting credit terms or follow-up procedures to ensure more timely collections.

Method 5. Establish Strong Client Relationships

Building a rapport with clients can lead to greater trust and cooperation. Clients with a strong relationship with a business are often more likely to make timely payments. Understanding clients’ payment cycles and preferences can also lead to more personalized and effective collection strategies.

Method 6. Utilize Collection Software and Tools

Incorporating specialized software and tools designed for collection purposes can significantly enhance the efficiency of the receivables process. This technology can automate many aspects of the collection, from tracking outstanding invoices to issuing payment reminders, and can provide valuable analytics to guide future credit and collections policies.

Utilizing the average collection period metric to skyrocket your cash flow

By mastering the average collection period formula, businesses can gain valuable insights, ensure healthier cash cycles, and contribute to the overall sustainability of their operations. Stay proactive, evaluate your credit sale terms and receivable balance regularly, and aim for processes that facilitate a timely collection to ensure financial stability and business growth.

FAQs

FAQs

Summary

- What is the average collection period?

- How to calculate the average collection period

- Main benefits of reporting on the average collection period

- What is a good average collection period?

- Six methods on how to improve average collection period

- Utilizing the average collection period metric to skyrocket your cash flow

- FAQs

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.