Blog > What are ACH Payments? A Complete Guide

What are ACH Payments? A Complete Guide

The world of payment processing contains several areas of confusion for businesses and consumers. The Automated Clearing House (ACH) is one of the areas in which many people are unfamiliar and unaware of what occurs.

This article will clear up any confusion around an ACH online payment and provide you with the tools to understand if ACH payments are right for your business.

What is the Automated Clearing House (ACH) Network?

The Automated Clearing House (ACH) Network is an electronic payment system for processing direct deposit payments, online bill payments, and other transactions. The ACH Network is controlled by Nacha (National Automated Clearing House Association) which enforces requirements to ensure the network operates smoothly and safely.

The ACH facilitates the transfer of money between banks, allowing transactions to be settled in batches daily or weekly. The ACH Network operates as a centralized system in the U.S. that handles billions of transactions annually.

The following section will dive into the specifics of ACH payments and their major benefits and challenges.

What is an ACH payment?

ACH (Automated Clearing House) payments are electronic transactions that transfer funds from one bank account to another, offering an efficient alternative to traditional payment methods such as paper checks and wire transfers.

More specifically, ACH payments are a type of electronic funds transfer (EFT) between banks using the Automated Clearing House network.

ACH payments work by initiating an electronic transfer of funds from the payer’s bank account to the payee’s account. The process is similar to wire transfers but is much less expensive and initiated through online banking, bill payment services, or a payment processing partner.

Benefits of ACH payments

When determining which payment methods to use, businesses should consider the various benefits associated with ACH payments:

- Lower fees: ACH payments are less expensive than traditional payment methods, such as wire transfers and paper checks. This is because ACH payments are processed electronically, streamlining the payment process and reducing the need for manual labor.

- Increased security: ACH payments use a secure electronic network to process transactions to reduce the risk of fraud. Many ACH payments are processed using multi-factor authentication, adding an extra layer of security to the process.

- Improved payment speed and accuracy: ACH payments are processed much faster than paper checks and are typically more accurate since the information is entered directly into the system, reducing the risk of manual errors. This reduces the time it takes for a payee to receive their funds, as payments are transferred directly into their bank account.

- Increased customer convenience: ACH payments allow customers to make payments from the comfort of their own homes without having to write a check or visit a bank. This can be especially convenient for customers with busy schedules or who live in remote locations.

Whether you’re using consumer to business ACH or business to business ACH, the advantages of ACH may be enough to sway you into offering these payments. Still, it’s essential to weigh the cons before making your decision.

Challenges of ACH payments

Despite the many advantages associated with ACH payments, some challenges come along with these payments, such as technical difficulties, added manual tasks, and less flexibility.

Technical difficulties such as connectivity issues, software malfunctions, and data breaches are some of the main challenges of ACH payments. Therefore, ensuring the equipment and software used for these payments are secure and reliable is imperative.

ACH payments require customer information to be verified and transactions to be reconciled which can increase workloads and administrate tasks for your business. These tasks may require additional staffing and resources which can be costly.

Compared to credit and debit cards, ACH payments offer less flexibility since they take longer to clear and settle. This can limit the ability to access funds promptly which may concern some businesses.

Types of ACH payments

While most are familiar with the various types of ACH payments, businesses and consumers must understand each of these payments and what they fully entail.

ACH payments are broken down into five categories:

- Direct deposit: Direct deposit is a type of ACH payment used to transfer funds directly from an employer to an employee’s bank account. This is a convenient and secure way to receive regular payments — payroll, pension, etc.

- Automated bill payment: Automated bill payment is a type of ACH payment used to pay bills automatically from a bank account. This can save customers time and effort since they don’t have to write and mail a check to the biller.

- Electronic check conversion: Electronic check conversion is a type of ACH payment used to convert a paper check into an electronic payment. This can improve the speed and security of the payment process, and reduce the risk of check fraud.

- E-Invoicing: e-Invoicing is a type of ACH payment used to send and receive invoices electronically.

EChecks are another payment method many conside ACH payments since they’re digital versions of paper checks where funds are withdrawn from the payer’s bank account, transferred over the ACH network, and deposited into the payee’s account. However, eChecks differ from ACH because they’re typically one-time payments instead of recurring payments.

Now, let’s look at the actual process behind ACH electronic payments.

How to process ACH payments

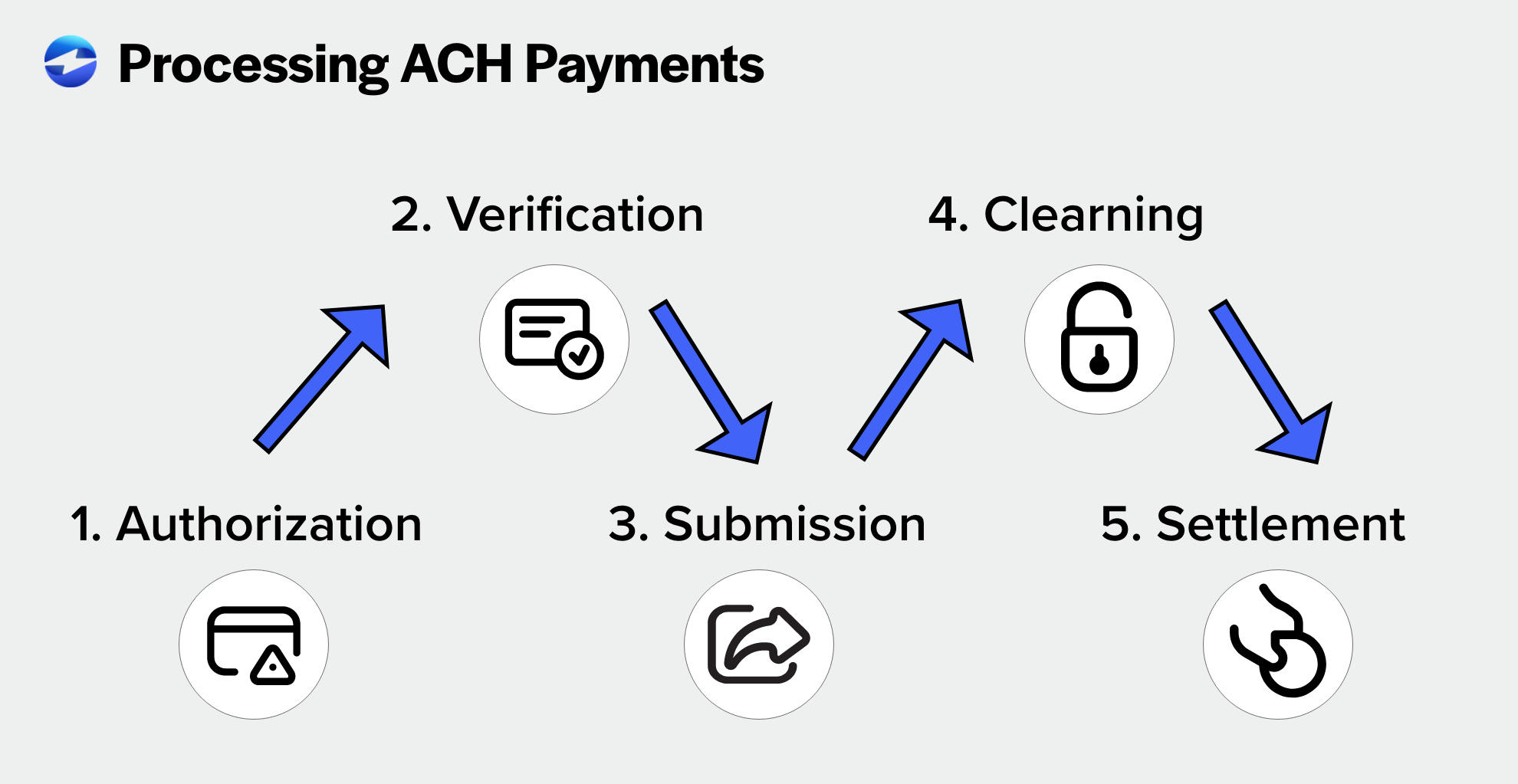

You may be wondering how does an ACH payment work? ACH payments can be processed using these five simple steps:

- Authorization: Obtain consent from the customer for the transaction, typically done through an ACH authorization form.

- Verification: Verify the customer’s account information to ensure accuracy.

- Submission: Submit the payment information to the originating bank or payment processor.

- Clearing: The payment information is sent to the ACH network and cleared through the Federal Reserve.

- Settlement: The transaction is settled and the funds are transferred from the originating bank to the recipient bank.

You’ll need a computer or mobile device, a secure internet connection, and software that supports ACH transactions to process ACH payments. If you plan to process electronic check conversions, you may also need specialized equipment such as a check scanner.

Can ACH payments be reversed?

Yes, ACH payments can be reversed, and this is typically done through a process known as an ACH reversal. When there’s an error or issue with a payment, the sending bank or financial institution can initiate an ACH reversal to undo the transaction. ACH payments can also be subject to returns, where the recipient’s bank rejects the incoming payment. Common reasons for ACH returns include insufficient funds, incorrect account information, or other issues related to the transaction. It’s important for both the sending and receiving parties to be aware of and adhere to the rules and guidelines set by the National Automated Clearing House Association (NACHA), which oversees the ACH network, to ensure that reversals and returns are handled properly and in compliance with established standards.

Incorporating ACH payments into your business

Overall, ACH payments can be a cost-effective and secure way for businesses and consumers to process transactions. Partnering with a payment processor can simplify this process and provide additional benefits such as lower fees, improved security, and increased customer convenience.

Using a payment processor like EBizCharge to accept ACH payments will allow your business to invest in secure, reliable software to handle technical tasks like customer data verification and submitting payments to the ACH network, while providing a seamless payment experience for your customers.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.