Blog > What is an eCheck? Learn How Electronic Payments Work

What is an eCheck? Learn How Electronic Payments Work

In the world of electronic payments, eChecks are like reliable workhorses of payment processing. Just as a traditional, paper-based check allows you to transfer funds from one account to another, an eCheck performs the same function in a digital format.

What is an eCheck?

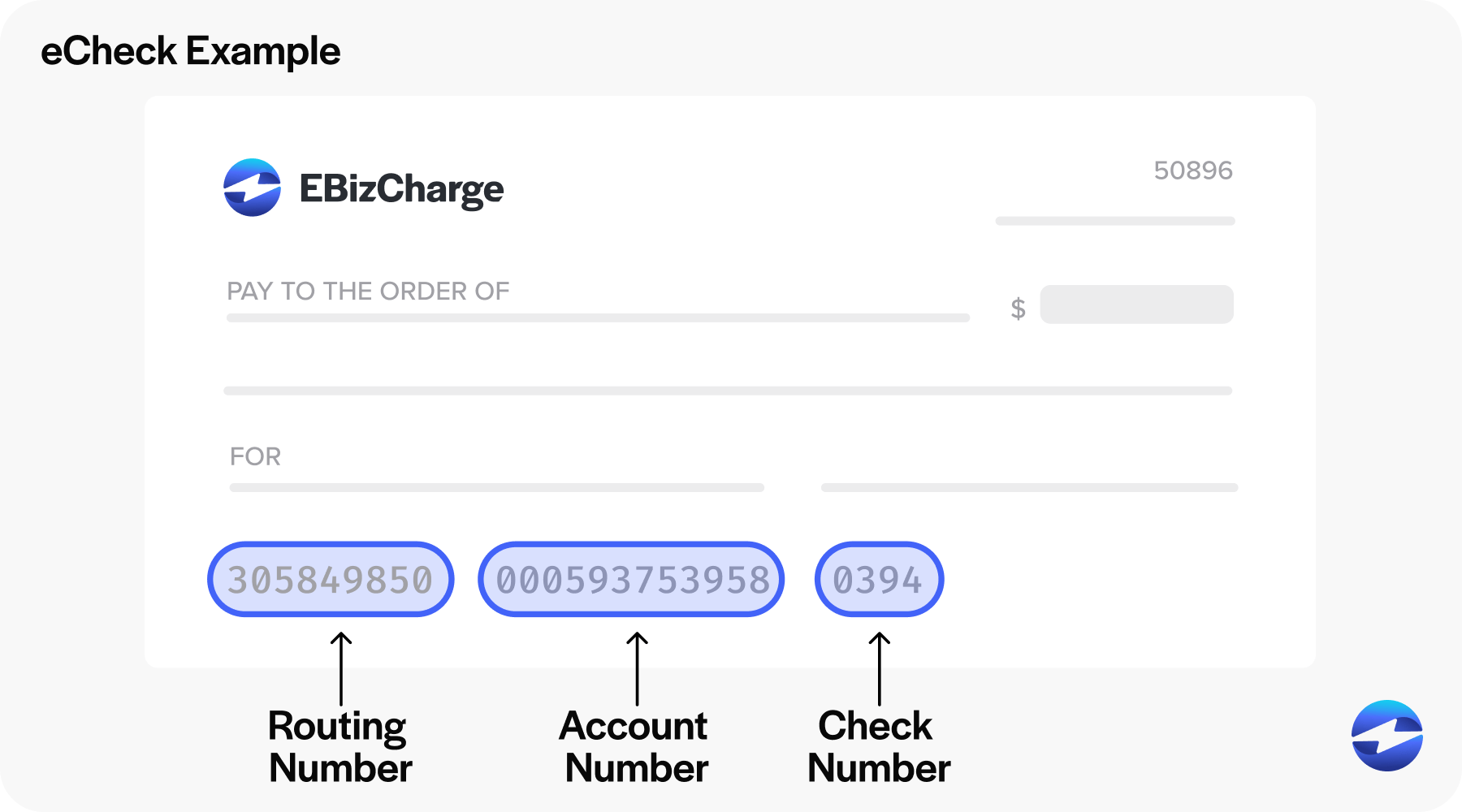

An electronic check or eCheck is a digital version of a traditional paper check that allows funds to be electronically withdrawn from the payer’s checking account, transferred over the Automated Clearing House (ACH) network, and deposited into the payee’s account.

EChecks are a convenient and secure way to make payments without needing physical paper checks. They offer the same level of protection as paper checks and are often used for recurring payments, such as utility bills, rent, and subscription services. eChecks are usually processed within a few business days, making them a reliable and efficient payment method.

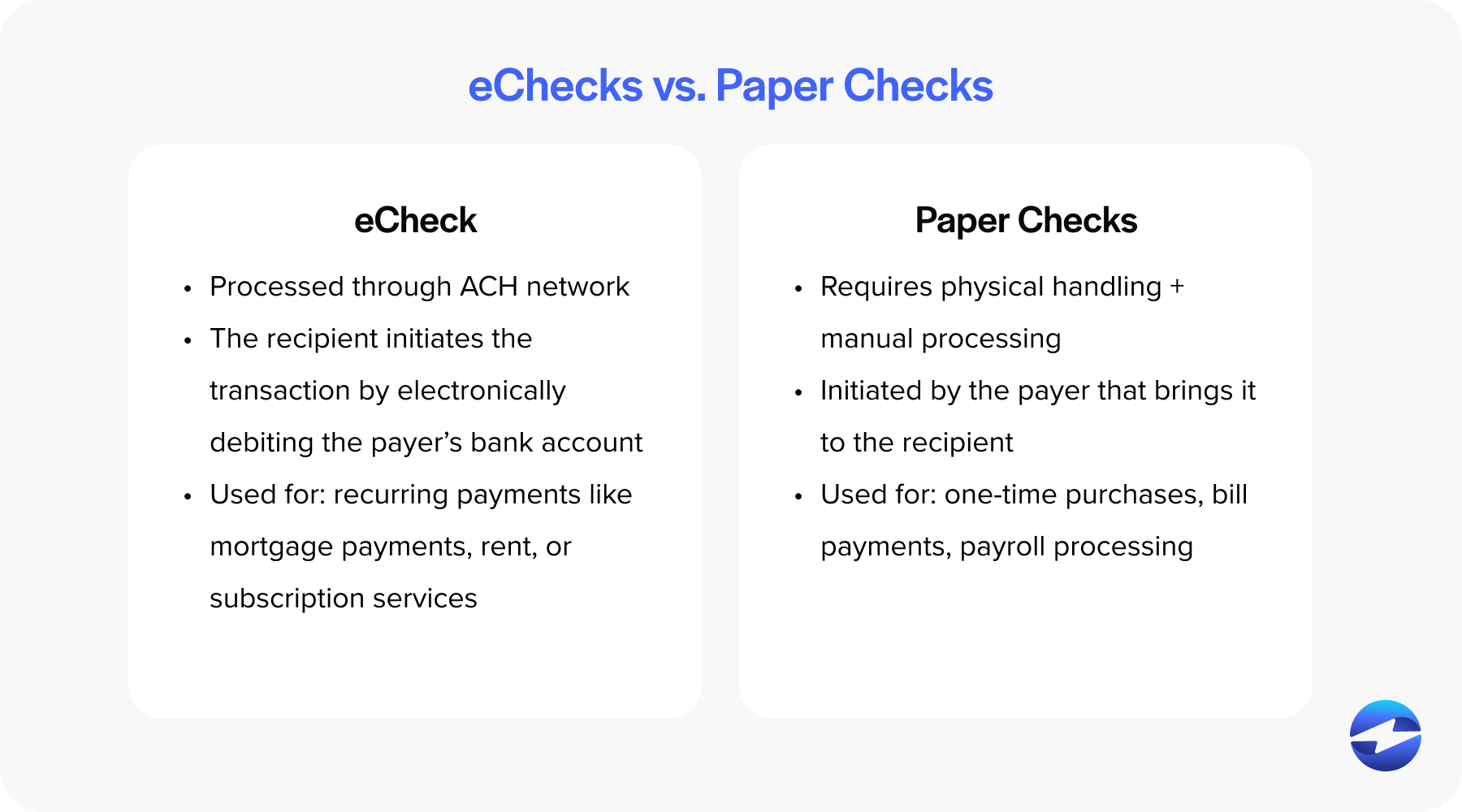

Despite the many similarities between traditional paper checks and eChecks, it’s important to know the differentiators between these two payment methods.

3 differentiators between eChecks and paper checks

While eChecks and paper checks are both effective payment methods, they differ in their use and the benefits they offer.

Three critical differences between eChecks and paper checks are the payment processing steps, payment initiators, and payment types and usages involved.

Payment processing steps

One of the most significant differentiating factors between paper checks and eChecks is the manner in which they’re processed.

Paper checks require physical handling and manual processing, including printing, signing, mailing, and depositing at a bank. This can be time-consuming and less secure.

On the other hand, eChecks are processed electronically through the ACH network, eliminating the need for physical transportation and reducing the risk of loss or theft.

Payment initiators

In addition to how these payments vary by processing steps, traditional paper checks and eChecks are initiated by different parties.

Paper checks are initiated by the payer, who writes and signs the check and then delivers it to the recipient for deposit. In contrast, eChecks work as pull payments where the recipient initiates the transaction by electronically debiting the payer’s bank account. This simplifies the process since the payer only needs to provide authorization and account details.

Payment types and usages

Since paper checks offer physical transactions and eChecks offer electronic transactions, the payment methods and usages involved vary.

Paper checks are commonly used for transactions, including one-time purchases, bill payments, and payroll processing. While eChecks are particularly popular for high-cost items and recurring payments, such as mortgage payments, rent, and subscription services.

Automated Clearing House (ACH) payments are another popular form of payment businesses use. Despite the similarities between ACH and eChecks, some distinctions are important to note.

eChecks payments vs ACH payments

Both eChecks and ACH payments are classified as electronic funds transfers (EFT) and involve electronic transactions, offering similar processing fees and speeds. The main difference between eChecks and ACH payments lies in the initiation process.

EChecks are initiated by the payer, while ACH payments are triggered by the payee with the payer’s authorization, and funds are deposited directly into the payee’s account. Despite their differences, payment methods offer a convenient and cost-effective way to transfer funds electronically, making them popular choices for businesses.

While many companies can benefit from eChecks, some may benefit more.

Which businesses benefit most from using eChecks?

EChecks can produce numerous benefits for businesses, making them a desirable payment option for specific industries.

Companies that handle a high volume of recurring payments, such as subscription-based services, utility companies, and insurance providers, can benefit from the lower processing costs and quicker turnaround time associated with digital checks.

Additionally, businesses that prioritize security and automated payment processing, such as financial institutions and healthcare providers, utilize eChecks to enhance their payment systems while ensuring the confidentiality of sensitive information.

The flexibility and versatility of eChecks also make them ideal for businesses with varying payment needs, such as retail, eCommerce, and B2B companies. They offer simple and convenient transactions that can automate payment processing, thanks to eCheck payment gateways integrating with a business’s existing accounting software, eCommerce platforms, or CRM systems.

How long does it take to process an eCheck?

When an eCheck payment is initiated, the transaction is sent through the ACH network for the bank transfer. Depending on the banks involved and their respective processing times, an eCheck can take three to five business days to process.

Once the eCheck reaches the recipient’s bank, a verification process is initiated to ensure the funds are available in the payer’s account. This verification process can also take a few days to complete. For one-time transactions, additional processing time may be involved as the merchant’s bank may perform security checks to verify the transaction’s legitimacy.

Overall, the processing time for an eCheck can vary but generally ranges from three to five business days for the ACH network transfer and additional time for verification and security checks. Businesses should consider this processing time when managing their cash flow and anticipating when funds will be available.

Despite eCheck payments clearing in a few days, a lot goes into how eChecks are processed.

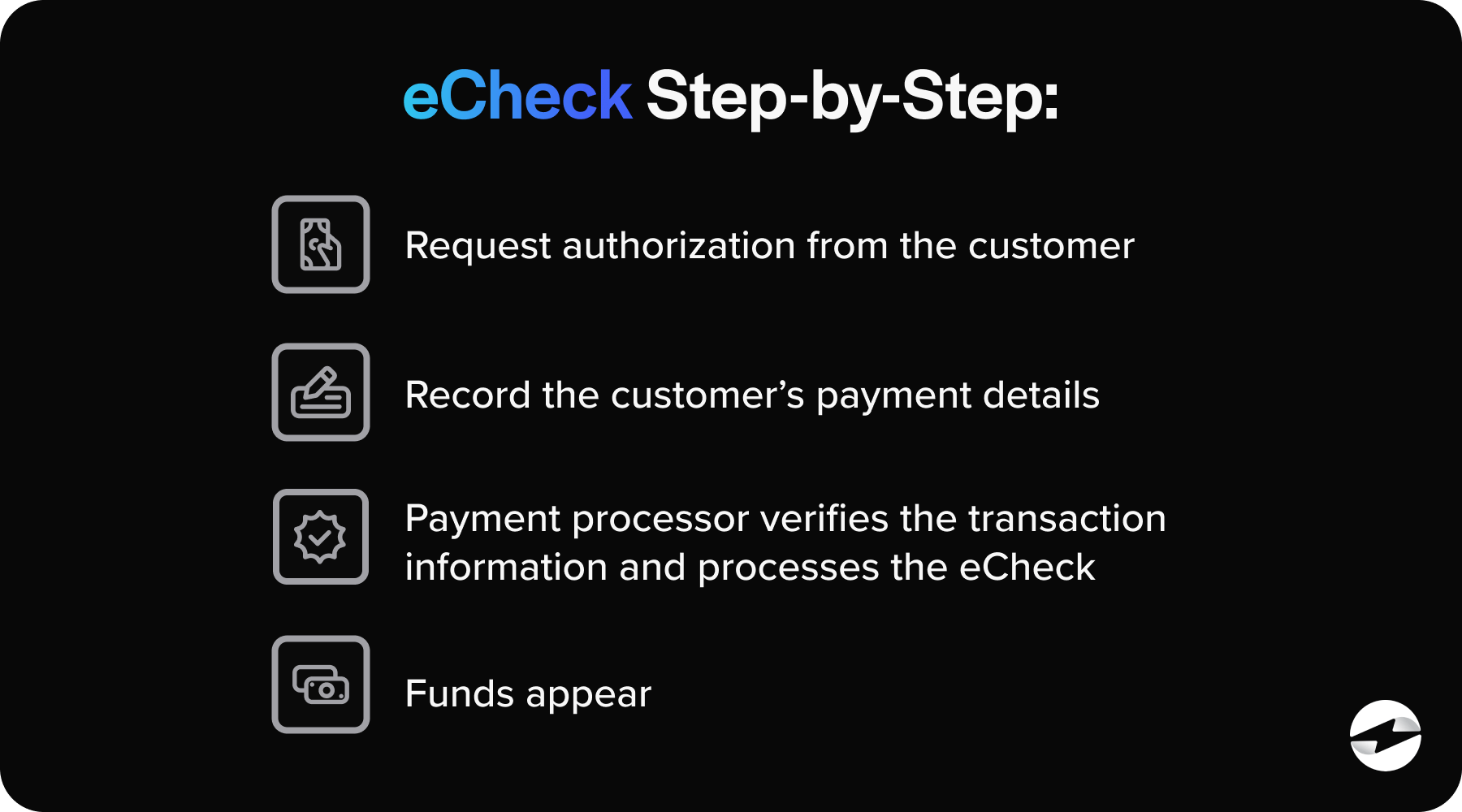

How does eCheck payment processing work?

Like other forms of payment, eCheck processing follows a clear, step-by-step process to make sure each transaction goes through securely and accurately.

So, how do eChecks work? Here are the four main steps involved:

- Request authorization from the customer

- Record the customer’s payment details

- Payment processor verifies the transaction information and processes the eCheck

- Funds appear in the business bank account

1. Request authorization from the customer

Before initiating a transaction, it’s crucial to request authorization from the customer. This involves obtaining permission to transfer the funds. Businesses can receive this permission via an online form, signed document, or a recorded phone call.

For online forms, a secure portal can capture the customer’s authorization electronically. This may involve the customer logging into their account and providing their electronic signature to approve the transaction. Alternatively, a signed document can be obtained after the customer provides a physical signature permitting the transfer. Another option is requesting authorization via a recorded phone call, where the customer clearly states their consent before processing the transaction.

Whichever method is used, the key is to ensure that the customer’s explicit permission is obtained before proceeding with the fund transfer to protect the customer and minimize the business’s risk.

2. Record the customer’s payment details

When recording a customer’s payment details, it’s essential to accurately input the customer’s name or company name, bank account number, bank routing information, and transaction amount to ensure the eCheck payment is processed correctly and efficiently.

3. Payment processor verifies the transaction information and processes the eCheck

When a customer submits payment information, the payment processor receives the payment details and begins the verification process.

The payment processor runs basic checks to ensure the transaction information looks legitimate before executing it. Once the payment is deemed legitimate, the payment request is sent via the ACH network, which debits the requested amount from the customer’s account.

This entire process involves the payment processor receiving and verifying the payment details and processing the transaction via the ACH network.

4. Funds appear in the business bank account

It’s essential to check your business bank account regularly to ensure you’re aware of incoming eCheck deposits.

eCheck deposits are processed through the ACH network, which operates in batches and typically takes two to three business days for funds to appear in the designated account.

Regularly monitoring your business checking account for incoming deposits and setting up alerts for notifications can help you stay informed about your cash flow and ensure you have access to the funds when needed.

Are eChecks safe to use?

EChecks are secure payment methods that protect sensitive financial information with security features such as encryption and a rigorous authorization process.

Compared to traditional paper checks, eChecks are more secure as they cannot be physically stolen or altered. In contrast to other electronic payment methods, eChecks also provide a higher level of security due to the ACH network’s strict regulations and encryption technology. This makes eChecks a reliable and safe choice for businesses and consumers alike.

In addition to eCheck security features, they offer many other benefits over traditional payments.

4 benefits of using an eCheck over traditional payments

The shift to electronic payment forms has revolutionized how businesses conduct transactions. With this shift, eChecks have noticed some added benefits over traditional payment methods.

The main benefits eChecks offer over traditional methods include cheaper processing, more security, faster processing times, and more convenience.

eChecks are cheaper to process than paper checks and credit cards

EChecks often provide a more cost-effective solution for processing payments than traditional paper checks and credit cards.

Using eChecks is typically cheaper than paper checks and credit cards due to several factors such as lower processing fees and enhanced security. On average, a single business check can range between $4 to $20, thanks to the physical check cost, shipping, and time spent by accounting staff costs. Credit card fees can range between 1.3% to 3.5% for each transaction, averaging around 2%. In contrast, an eCheck can cost as little as $0.10.

Given these benefits, eCheck payment processing is an attractive option for businesses who want a more efficient and affordable payment processing solution.

eChecks are more secure than paper checks and credit cards

EChecks offer more protection than paper checks and credit cards, thanks to several security features such as robust authentication processes, encryption tools, duplication detection, and digital signatures.

In terms of authentication, eChecks requires users to undergo a rigorous verification process, ensuring that the person initiating the payment is authorized. This helps prevent unauthorized transactions and fraudulent activity. ECheck payment processing also utilizes encryption to protect sensitive information, making it difficult for cybercriminals to intercept and misuse data.

Furthermore, eChecks have built-in duplication detection, which helps prevent the same check from being processed multiple times. This adds an extra layer of security and reduces the risk of financial loss due to duplicate payments. Additionally, eChecks uses digital signatures to authenticate and verify the sender’s identity, further enhancing security.

eChecks process faster than paper checks

Processing eChecks is faster than the manual processing of traditional paper checks, making them a more efficient payment option for businesses.

The average eCheck payment process involves several key steps. First, the customer initiates the eCheck payment by providing their bank account and routing numbers. This information is then securely processed through a payment gateway. The customer’s bank then authorizes the payment, and the funds are electronically transferred to the merchant’s account.

The quicker processing times associated with eChecks can be attributed to the lack of effort required from customers. Customers input their bank information online without having to write and mail a check. Since eChecks are paperless, they eliminate any delays associated with mail delivery, resulting in shorter overall payment times.

eChecks offer more convenience than paper checks

EChecks offer a convenient alternative to traditional paper checks by providing instant verification, advanced security features, and faster processing.

EChecks are more convenient than paper checks because they can be generated, sent, and processed electronically without the constraints of physical paper checks. Paper checks require manual processes and the need to have them physically on hand — taking time out of your month to complete these tasks and purchase checks through your bank.

EChecks also allows users to securely save payment details in a digital wallet, streamlining the payment process for future transactions and enhancing the customer experience.

In addition to these benefits, businesses can look to reliable eCheck payment processors to protect sensitive financial information from fraud or unauthorized access and optimize their overall process.

Finding a payment processor to help with your eCheck payments

While eChecks can provide cost savings, convenience, and improved customer satisfaction, businesses can fully leverage their benefits by working with a reliable payment processor.

Your company can partner with a reputable payment processor like EBizCharge to streamline eCheck payment processing, optimize financial operations, reduce transaction costs, and provide a seamless user experience.

EBizCharge is a well-respected payment solution that works with over 400,000 users to deliver secure and optimized payment processing for its customers. With robust payment collection features and eCheck processing, merchants can maximize their payment processing operations and eliminate the worry of missed payments.

Businesses can get even more out of eCheck processing by connecting it directly to their existing systems. A NetSuite payment gateway allows finance teams to accept and reconcile eCheck payments within their ERP, so every transaction is automatically posted without manual data entry. For mid-market organizations on Sage Intacct, payment processing for Sage Intacct offers the same seamless experience, syncing eCheck deposits to your accounting records in real time. Both options help businesses take full advantage of eCheck cost savings while keeping their financial data accurate and up to date.

Frequently Asked Questions

Frequently Asked Questions

- What is an eCheck?

- 3 differentiators between eChecks and paper checks

- eChecks payments vs ACH payments

- Which businesses benefit most from using eChecks?

- How long does it take to process an eCheck?

- How does eCheck payment processing work?

- Are eChecks safe to use?

- 4 benefits of using an eCheck over traditional payments

- Finding a payment processor to help with your eCheck payments

- Frequently Asked Questions