Blog > Optimize Your Payment Process with Business to Business ACH

Optimize Your Payment Process with Business to Business ACH

To run a successful business, you will need to use a variety of products and services from other businesses to stay on track. This typically means you’re making weekly, monthly, or annual payments to ensure you have all the supplies, software and programs, and basic necessities to continue your operations.

Many businesses still use the outdated concept of paper checks to pay these bills. This process can be slow, time-consuming, expensive, and inconvenient. Luckily, business to business ACH payments have made it easier than ever to set up secure online payments that don’t need to be manually inputted every month.

What is business to business ACH?

Business to business ACH refers to electronic payments transferred between U.S. businesses using the Automated Clearing House Network, thus eliminating the need for paper checks and reducing other physical payments.

Business to business ACH payments can be simplified into two categories:

- ACH credits: funds are added to the bank account of the receiver (business receiving the payment).

- ACH debits: funds are deducted from the bank account of the originator (business making a payment).

ACH credits and ACH debits can be used for a variety of payment methods like direct deposits and monthly bills.

How does business to business ACH processing work?

To better understand how business to business ACH transactions works, this process can be broken down into four steps:

- Authorization: The originator fills out an online ACH agreement form on the receiver’s website that authorizes the funds to be pulled from their bank.

- Transaction initiation: The receiver sends the payment information to its bank or ACH provider — also known as the Originating Depository Financial Institution (ODFI).

- Payment request: The ODFI’s payment request is sent to the originator’s bank — also known as the Receiving Depository Financial Institution (RDFI).

- Payment processed: The RDFI confirms there are sufficient funds in the originator’s bank account to complete the payment and then processes the transaction.

To set up these transactions, there are just a few pieces of information needed.

How to set up business to business ACH payments

Business to business ACH can be implemented for a variety of different transactions like recurring billing, direct deposits, and eChecks. These payment methods make it easy for you to get paid and pay your bills on time.

Unlike other transactions, business to business ACH is not linked to a credit or debit card. Instead, funds are transferred between bank accounts which means the ACH network requires both the receiver and originator to provide their banking information — account and routing numbers — to set up these payments.

Once the receiving and originating businesses enter this information, it will be saved for all future B2B ACH payments. This eliminates the need for the originators to manually enter their banking information each time they need to make a payment.

Your business can save both time and money by implementing business to business ACH payments using a reliable ACH provider instead of your bank.

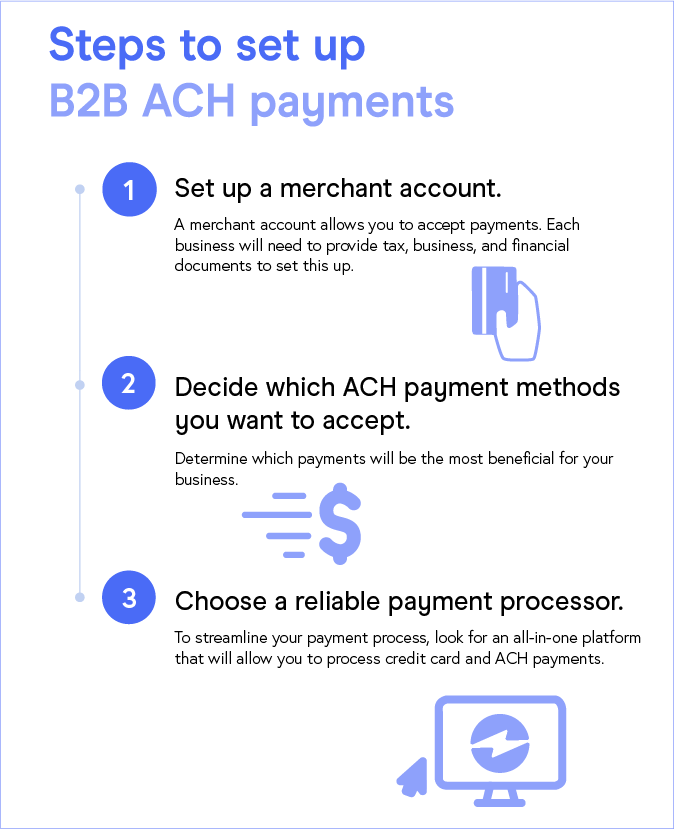

To set up B2B ACH payments, your business can follow these steps:

- Set up a merchant account. A merchant account allows you to accept payments. Each business will need to provide tax, business, and financial documents to set this up.

- Decide which ACH payment methods you want to accept. Determine which payments will be the most beneficial for your business.

- Choose a reliable payment processor. To streamline your payment process, look for an all-in-one platform that will allow you to process credit card and ACH payments.

By adding and automating business to business ACH payments, you will reap many benefits.

Benefits of business to business ACH payments

Business to business ACH payments can yield a variety of benefits for your business that will promote more growth, improve operations, and can result in long-term savings.

Some of the most notable business to business ACH benefits include:

- Streamlined operations; speed and efficiency

- Cost-effective; no processing fees and reduced costs

- Better security

- Easy to set up and use

- Better payment tracking and records management

1. Streamlined operations; speed and efficiency

Gone are the days of businesses going through the tedious process of writing and mailing paper checks, going to the bank, filling out paperwork, and waiting for their check to clear. Now, business to business ACH offers electronic, automated payments that can dramatically enhance and accelerate your operations.

Implementing B2B ACH debit payments streamlines your payment process by allowing funds to be automatically deducted or collected. ACH payments also offer faster processing times that range anywhere from 24 to 48 hours. However, more and more providers now offer same-day and next-day funding.

B2B ACH also eliminates the need to manually input information every time you need to make a payment, allowing you to put more focus on other important tasks.

2. Cost-effective; no processing fees and reduced costs

In addition to lower processing fees and bank charges, business to business ACH payments will eliminate or reduce the labor needed to perform manual tasks and material costs for paper checks.

Automated B2B ACH payments can also reduce late payments that can accrue additional charges and can increase early payments which may include extra discounts and savings. Both of these benefits can lead to increased cash flow for your business.

3. Better security

Business to business ACH payments offer more security by reducing the risk of human error or fraudulent activity that can occur when handling paper checks and other traditional payments.

For the best protection, make sure your payment provider is using strong security measures and fraud prevention tools. Going through a provider can also cut out any need for businesses to see each other’s banking information which will further improve security.

4. Easy to set up and use

Business ACH is known for its ease of use and fast setup process. Businesses are only required to provide their financial information to manually set up payments once. After this initial setup, corporate ACH payments can be automatically processed.

5. Better payment tracking and records management

Since business to business ACH payments are electronically processed, this data can be saved and tracked in real-time. Many payment providers will offer invoice tracking and digital reports for businesses to review at any time.

With better analytics and records management, your business can make more informed decisions regarding the payments it accepts.

Benefits of using credit cards instead of business to business ACH payments

While business to business ACH can be great to implement into your system, there are some disadvantages to using these payments instead of other methods like credit cards.

B2B ACH is limited to certain payment methods that typically include larger transactions or are set up on a recurring, long-term billing schedule, and are rarely used for one-off transactions. Credit cards, on the other hand, can be used for a variety of payments that include both large and small one-time transactions, recurring payments, and more.

Business to business ACH payments also take longer to process than credit cards because the ACH Network holds funds until they’re verified. Whereas, credit card payments usually allow funds to be immediately available to the receiver.

Some other benefits of accepting credit card payments include:

- More convenience and increased sales

- Improve cash flow

- Better guarantee of funds

1. More convenience and increased sales

Credit cards are one of the most widely used and trusted payment methods. Therefore, businesses that accept credit cards will provide their customers and other businesses with a reliable, convenient, and quick way to make or set up payments.

To further enhance convenience, businesses should also allow for a variety of well-known credit cards to be used like Visa, American Express, MasterCard, Discover, and more.

Along with the added convenience, credit cards can also help businesses boost revenue. Rather than being an ACH-only or cash-only operation, offering multiple credit cards options can expand your customer base, add to the legitimacy of your business, and garner more trust and willingness to purchase — all of which can increase your sales.

2. Improve cash flow

Since credit card payments allow for a more rapid release of funds into the receiver’s account, this can greatly improve your cash flow.

Businesses will be granted quicker access to the funds from these credit card transactions which can be used for other important projects or operations.

3. Better guarantee of funds

In addition to better cash flow, credit cards offer a better guarantee of funds than business to business ACH. Instead of waiting days to hear if an ACH payment was successful, credit card payments allow you to quickly or immediately confirm the card being used is valid and there are sufficient funds to complete the transaction.

Regardless of if your business prefers business to business ACH or credit cards, finding a provider that offers both of these payment methods can help you achieve long-term success.

EBizCharge can help streamline your B2B ACH and credit card payments

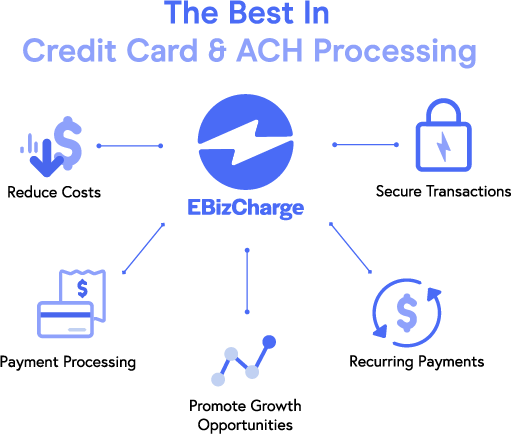

For the best business to business ACH and credit card processing, EBizCharge provides an all-in-one platform that will allow your business to streamline its payment processing, offer secure transactions, reduce costs, and promote more growth opportunities.

With EBizCharge, you can ditch traditional paper checks and the hassle that comes along with them, and implement eChecks for recurring payments, direct deposits, and more.

Summary

- What is business to business ACH?

- How does business to business ACH processing work?

- How to set up business to business ACH payments

- Benefits of business to business ACH payments

- Benefits of using credit cards instead of business to business ACH payments

- EBizCharge can help streamline your B2B ACH and credit card payments

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.