Blog > What is an ACH Authorization Form: How to Create One

What is an ACH Authorization Form: How to Create One

Before a business can debit and charge money from its clients’ checking accounts using the Automatic Clearing House (ACH) Network, it needs to gain authorization to do so. To receive this authorization, your client has to fill out an ACH authorization form.

This article will discuss the importance of using an ACH payment form, the elements that make up a typical form, and the steps to using one. We will also highlight common mistakes to avoid when using these forms to ensure a smooth and secure process.

What is an ACH form?

An ACH authorization form, also known as an ACH payment form, is an essential component of electronic transactions used to grant permission to a financial institution to debit or credit an individual or business account, allowing for the transfer of funds between bank accounts.

There are different types of forms designed for specific transaction needs. These include ACH credit authorization forms for depositing funds, ACH debit authorization forms for making payments, recurring ACH payment authorization forms for regular debits, and stop payment request forms for canceling scheduled transactions. Each type serves a specific purpose, ensuring efficient and secure electronic fund transfers through the ACH network.

What is ACH authorization?

ACH is an electronic payment system that facilitates the transfer of funds between bank accounts.

The process of ACH authorization goes as follows:

- The ACH electronic payment process begins with a request for payment.

- The requestor submits the necessary information, including the amount to be debited or credited, the account number, and the routing number of the financial institution.

- The financial institution processes the request and transfers the funds.

The entire process typically takes a few business days, as opposed to the several days or even weeks that traditional payment methods may take.

The benefits of using ACH forms include lower costs compared to other payment methods, improved accuracy and efficiency, and the ability to process payments quickly. ACH forms also ensure more secure transactions since they require the account holder’s signature to authorize the transfer of funds.

What Information is Needed for an ACH Payment?

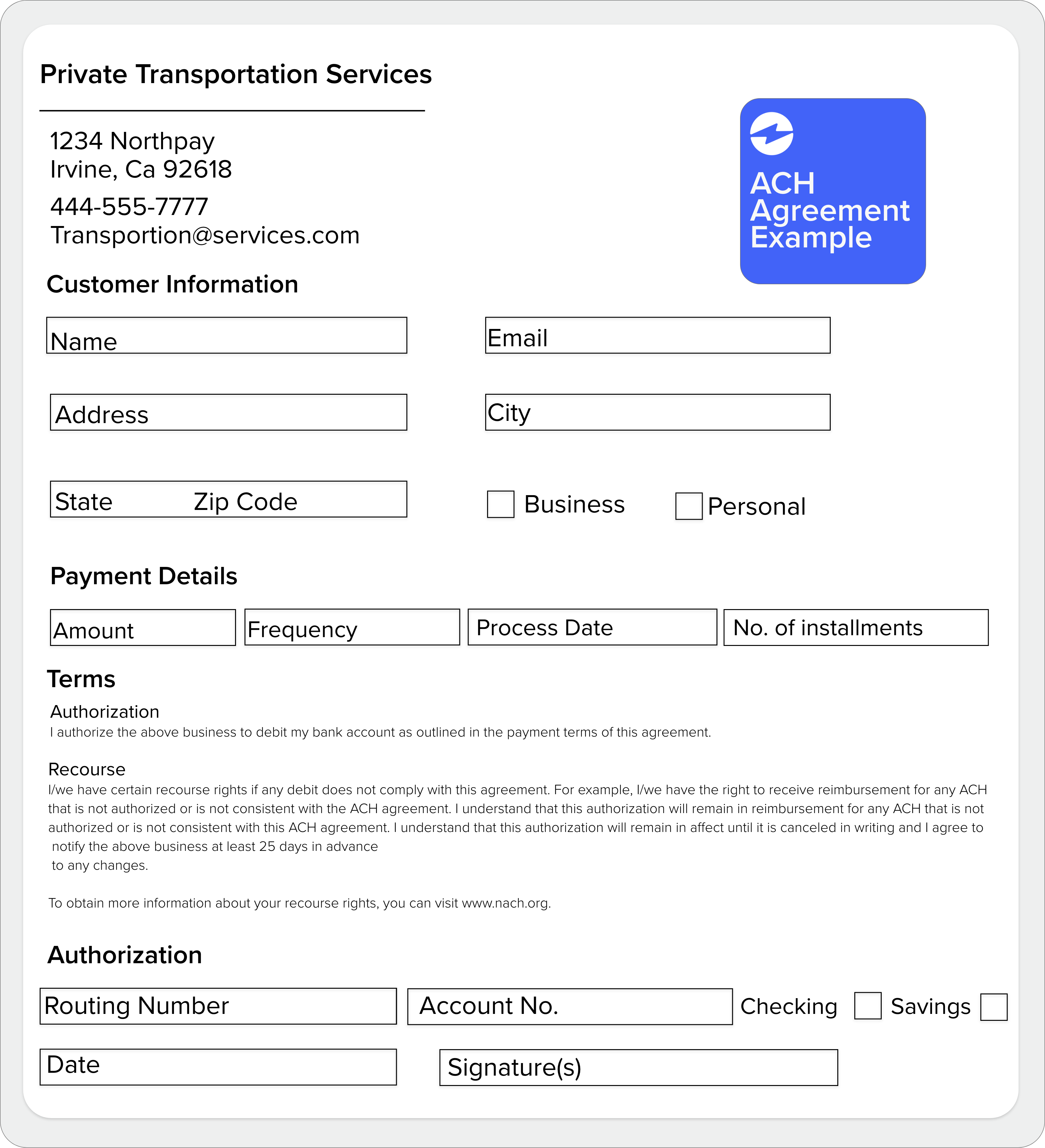

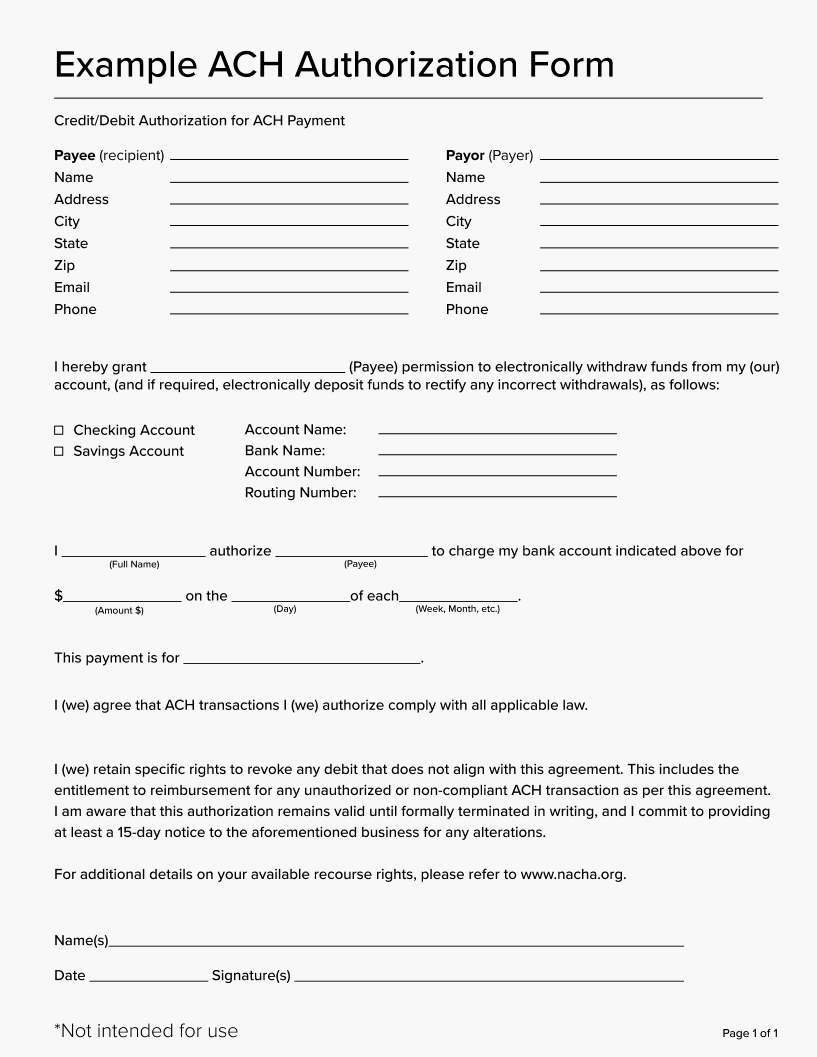

An ACH payment authorization form typically includes:

1. Account holder name and contact information:

This information is necessary for the financial institution to identify the account holder and contact them if necessary.

2. Bank routing number and account number:

These numbers are used to identify the financial institution and the specific account where the funds will be transferred.

3. Type of account (checking or savings):

This information is necessary to ensure the correct account is being used for the transaction.

4. Authorization for debit or credit transactions:

The account holder must specify whether they’re authorizing a debit or a credit transaction.

5. Frequency of transactions:

This information is used to determine the frequency of transactions and the amount being debited or credited each time.

6. Amount of transactions:

The account holder must specify the amount of each transaction.

7. Signature of the account holder:

The account holder’s signature is necessary to authorize the transfer of funds.

It’s essential to ensure you fill out the ACH information form with accurate and up-to-date details to avoid any misunderstandings or complications.

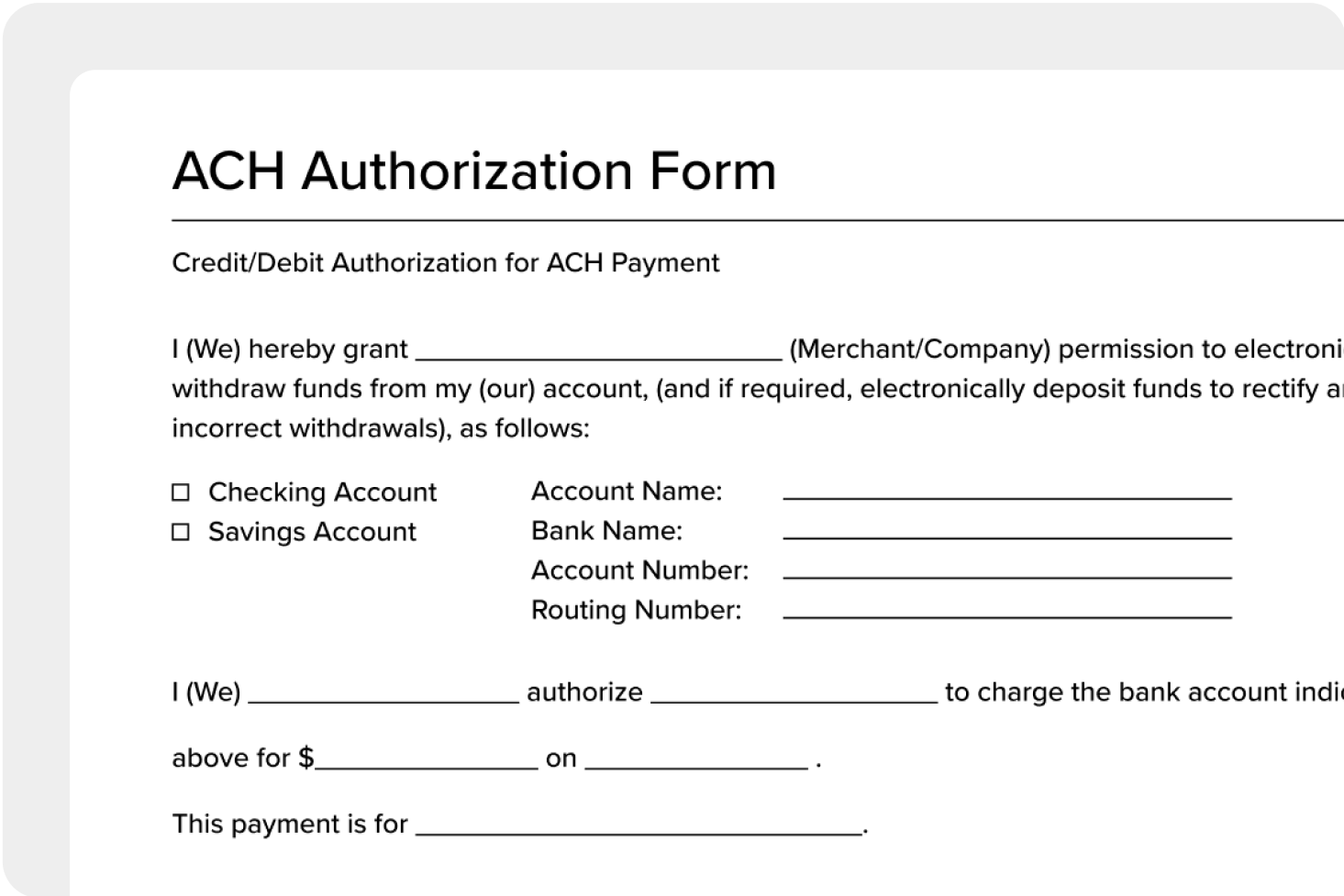

An example of an ACH authorization form can be found at many financial institutions or online.

Cancellation of an authorization

With ACH transactions, there are payor and payee protections and laws that must be followed, such as a cancellation period for ACH authorizations.

ACH authorization forms must include information on how ACH payments can be canceled. This can be done by either filling out a form, sending a request by mail, or by placing a phone call. Once the request for the ACH payment is submitted to be canceled, you’re required to cancel the payment.

How to use an ACH authorization form

The first step in using an ACH authorization form is to request this form from your bank or financial institution, or by downloading a template from the internet. It’s important to make sure the ACH bank form you use is up-to-date and compliant with regulations.

Once you’ve obtained a bank authorization form, the next step is to complete it. This involves filling in the required information — your name, bank account, authorization for the transfer of funds, etc. Ensure you input all the information accurately and the form is complete for a smooth transaction process, free of any mistakes.

After the form is complete, submit it for approval by sending the form to your bank or financial institution, either in person, by mail, or electronically.

It’s also important to keep a copy of the ACH agreement for record-keeping purposes. This will provide you with a record of the transaction and help to resolve any disputes or questions that may arise in the future.

Common mistakes to avoid when using an ACH authorization form

One of the most common mistakes made when using the ACH request form is misinterpreting the terms and conditions. It’s imperative that you read and understand the terms and conditions carefully before signing the form since they outline the details of the transaction, including the amount, frequency, and date of the transfer.

Another common mistake is providing incomplete or incorrect information on the ACH form. To avoid this, double-check all information to ensure it’s accurate and up-to-date. Incorrect information can lead to errors and delays in the transfer process.

Take advantage of the benefits of an ACH authorization form

ACH authorization forms play a critical role in the electronic payment process by providing a secure and efficient way to transfer funds.

In today’s technology-driven world, electronic transactions offer numerous benefits, including speed, cost savings, efficiency, and convenience. By using ACH authorization forms and following the steps outlined in this article, you can take advantage of these benefits to streamline your financial transactions.