Blog > What is an ACH Return?

What is an ACH Return?

The automated clearing house, or ACH, is an electronic network that processes electronic transactions between financial institutions. These transactions are usually seen in the form of direct debits or credit card payments.

An ACH return (sometimes called an ACH reject or confused with an ACH reversal) is when a transaction cannot be processed in the automated clearing house. ACH transactions do not process in real-time similar to standard transactions. Because of this, they can be rejected or returned after the transactional process has already been deemed complete. The most common reasons for an ACH return include:

- Insufficient funds

- A stop payment

- Incorrect account information

- Bank account closed

The following sections will dive into greater detail of ACH returns and the many reasons why they may occur.

What are ACH payments?

ACH payments are a type of electronic payment between financial institutions. These transactions are completed in the ACH system which is a system that allows money to be transferred between bank accounts, rather than through credit card networks, wire transfers, cash, or paper checks. There are two main types of ACH payments: Direct deposits and direct payments

- ACH Direct deposits. An ACH direct deposit is any type of electronic payment made from a business or government entity to a consumer. Direct deposits are generally seen in the form of paychecks, tax refunds, or interest payments.

- ACH Direct payments. An ACH direct payment is any kind of electronic transfer from individuals or organizations to send money to each other. Examples of direct payments include applications like Venmo and Cash App which allow individuals to send money to each others’ bank accounts.

Understanding How ACH Returns Work

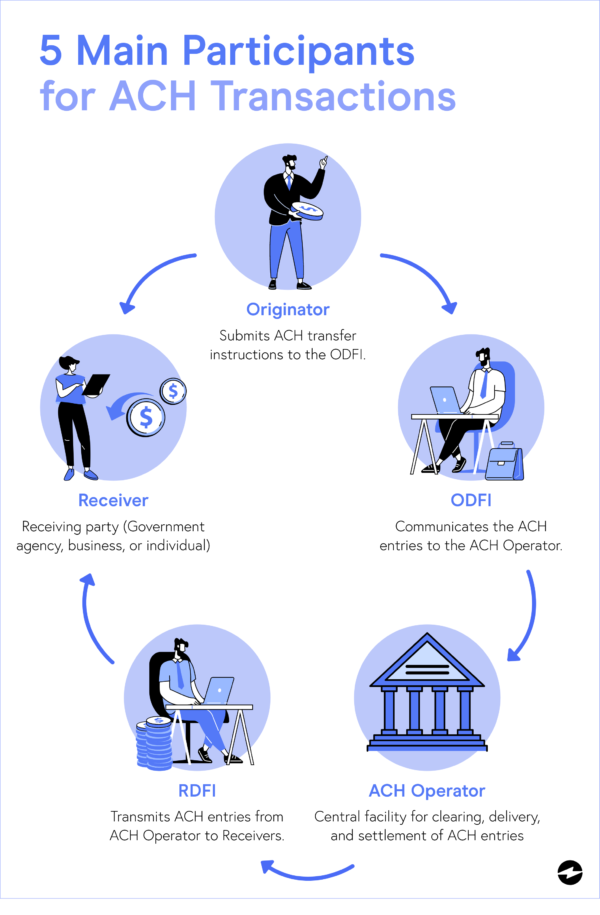

To understand how ACH returns work, you’ll need to understand the parties that are involved in ACH transactions. The five main participants for ACH transactions are:

- Originator – Submits ACH transfer instructions to the ODFI.

- Originating Depository Financial Institution (ODFI) – Receives the instructions from the Originator and communicates the specific ACH entries to the ACH Operator.

- ACH Operator – The ACH Operator is the central facility for the clearing, delivery, and settlement of ACH entries between the included financial institutions.

- Receiving Depository Financial Institution (RDFI) – The RDFI transmits ACH entries from ACH Operator and submits the entries to the Receivers.

- Receiver – The Receiver is the receiving party which can include a government agency, a business, or an individual.

An ACH return is a message that notifies the ODFI that the ACH Network wasn’t able to collect money from or deposit money into a Receiver’s bank account. The ACH return, generally, is sent by the RDFI, but the ODFI or ACH Operator may sometimes send an ACH return message in rare cases. All ACH returns have to be sent by one of the parties within the established time frame provided by the National Automated Clearing House Association (NACHA).

Why do ACH returns occur and should you worry about them?

As mentioned previously ACH returns, or ACH rejects, are initiated when the transaction cannot be processed in the ACH network. When the transaction cannot be processed, an ACH return code which explains the problem is generated, and the RDFI notifies the ODFI with a three-digit ACH return code. Looking at ACH return code associated with your case is the best way to understand how to resolve the issue. The next section will dive into the many different ACH return codes to help you understand ACH returns in more detail.

What are ACH return codes?

ACH returns are always accompanied by an ACH return code. These ACH return codes describe the reasons for the return and include an R followed by two numeric digits (e.g., R01, R10, R18). Here are some of the most common ACH return codes:

Common ACH Return Codes

| Reason for Return | Return Code | Description | Entry Type | Time Frame |

|---|---|---|---|---|

| Insufficient Funds | R01 | Available balance is not sufficient to cover the dollar value of the debit entry. | ALL | 2 Banking Days |

| Account Closed | R02 | Previously active account has been closed. | ALL | 2 Banking Days |

| No Account/Unable to Locate Account | R03 | Account number structure is valid, but doesn’t match individual identified in entry or is not an open account. | ALL | 2 Banking Days |

| Uncollected Funds | R09 | Sufficient balance exists, but value of uncollected items brings available balance below amount of debit entry. | ALL | 2 Banking Days |

| Corporate Customer Advises Not Authorized | R29 | Receiver has notified RDFI that corporate debit entry transmitted to a corporate account is not authorized. | ALL | 2 Banking Days |

What are SEC codes?

An SEC, or Standard Entry Class, code is a three-letter code that explains how an ACH payment was completed by the consumer or the business receiving the ACH payment. The ODFI is the institution that is responsible for including the proper SEC code in the ACH payment. The Originator, or the business using the ODFI for ACH, is also responsible for having the correct authorization from the Receiver.

NACHA allows a maximum amount of 13 SEC codes on ACH transactions. Here are some of the most common SEC codes:

Common SEC Codes

| SEC Code | Title | Transaction Type | Account Type | Agreement/Authorization |

|---|---|---|---|---|

| ACK | ACH Payment Acknowledgement | Non-Monetary (Acknowledges CCD Credit Entry) | N/A | N/A |

| ARC | Accounts Receivable Entry | Debit Single Entry | Consumer or Non-Consumer | Authorization: Written Notice |

| BOC | Back Office Conversion Entry | Debit Single Entry | Consumer or Non-Consumer | Authorization: Posted Notice and Written Notice |

| CTX | Corporate Trade Exchange | Credit or Debit Single Entry or Recurring Entry | Non-Consumer | Agreement: Originator or Receiver |

| POP | Point of Purchase Entry | Debit Single Entry | Consumer or Non-Consumer | Agreement: Posted Notice and in writing and signed, or similarly authenticated |

What happens when ACH payments get returned?

When an ACH payment gets returned, the ODFI receives an ACH return code which, as mentioned previously, contains an R followed by two numeric digits. Then, banking institutions need to work together with the customer or company to resolve the issue based on the reason code associated with the ACH return code.

While ACH returns are common and do occur, similar to credit card transactions getting declined, there are guidelines set by the NACHA that businesses must follow to solve the issue.

ACH return fees

Similar to transaction and surcharge processing fees, ACH returns come with additional fees as well. While these costs of ACH return fees differ depending on the specific ACH return code, they generally range from $2 – $5 and are often paid by the consumer.

Is it possible to dispute an ACH return?

ACH returns can be disputed if the ACH transaction meets a certain criteria. If there are grounds to be made about an ACH return dispute, the RDFI will request the ODFI to dishonor the return if the transaction included inaccurate information, was a duplicate entry, or did not fall under the time frame set by the NACHA.

Because ACH returns have a fast turnaround time (typically two banking days), ACH return disputes need to be resolved as quickly as possible. ACH returns that meet the above requirements must be sent in a time frame of five banking days from the date of the settlement.

ACH returns: The bottom line

ACH returns are a complicated but common occurrence in ACH transactions. So, understanding the many ACH return and SEC codes will give you the knowledge to react when an ACH return occurs.

Summary

- What are ACH payments?

- Understanding How ACH Returns Work

- Why do ACH returns occur and should you worry about them?

- What are ACH return codes?

- Common ACH Return Codes

- What are SEC codes?

- Common SEC Codes

- What happens when ACH payments get returned?

- ACH return fees

- Is it possible to dispute an ACH return?

- ACH returns: The bottom line

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.