Blog > 7 Benefits of ACH Payments

7 Benefits of ACH Payments

Paper checks are a hassle for both businesses and their customers.

Among a number of inconveniences, customers may stress about remembering to pay their bill each month, while businesses are forced to spend time going to the bank to deposit the check. Fortunately, there’s a better way: ACH payments, also known as eChecks.

ACH payments are safer, more cost-effective, and more convenient than traditional paper checks. In this article, we’ll discuss seven key benefits of accepting ACH payments.

What is ACH?

What exactly is ACH? ACH stands for Automated Clearing House, which is an electronic network that allows people to directly transfer funds between two bank accounts.

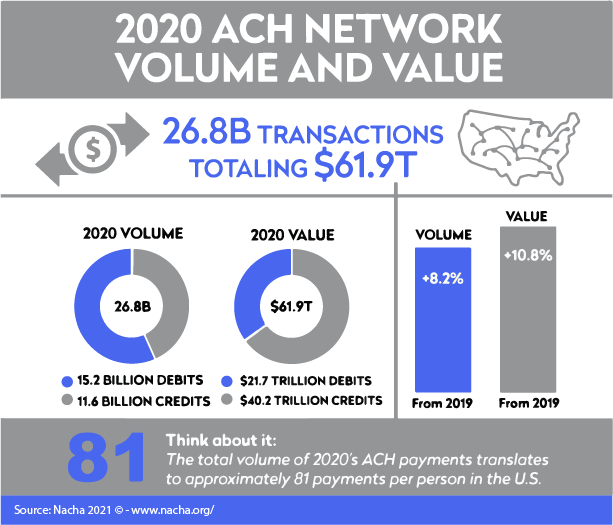

Since its founding in 1974, the National Automated Clearing House Association (NACHA) has seen tremendous growth. In 2020 alone, the volume of ACH payments processed reached 26.8 billion transactions, totaling $61.9 trillion in value.

One of the most common examples of ACH payments is a direct deposit program through your employer. Instead of receiving a paper paycheck, your employer transfers the funds directly into your own bank account. But ACH payments aren’t limited to employers and employees — B2B ACH payments can also take advantage of the seven benefits too.

Seven benefits of ACH payments

While there are a variety of advantages for businesses and customers that accept and use ACH payments, some of the most common benefits include:

1. Lower costs

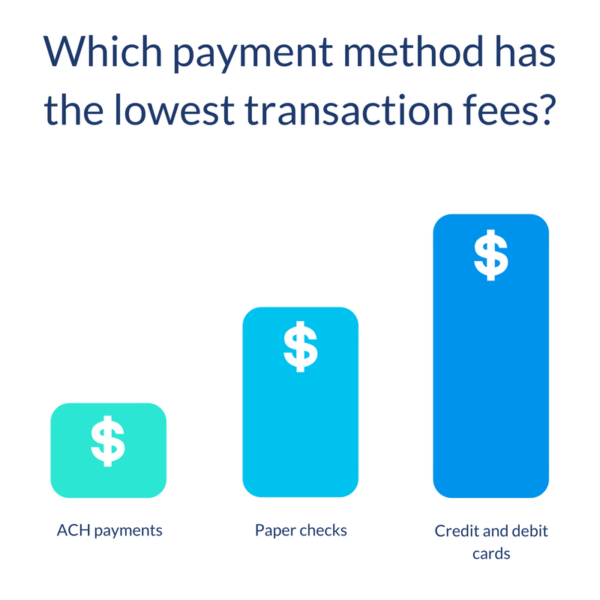

If your business accepts credit and debit card payments, then you’re already familiar with the processing fees that accompany these payment methods. But did you know that ACH payments can cost significantly less than credit cards?

When we compare the fees for processing paper checks, credit and debit cards, and ACH payments, credit and debit cards come in at the most expensive, since the fees are typically calculated as a percentage of the transaction. Paper checks have the lowest transaction cost but end up costing merchants more due to time and labor expenses. That leaves ACH payments as the least expensive payment method for merchants to accept. When all of your transactions are added up, this kind of cost reduction can have impressive effects on your processing fees.

2. Security

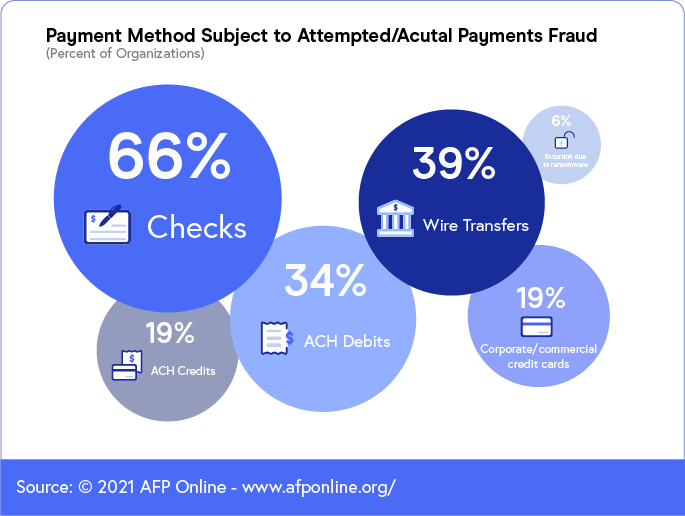

According to the AFP Payments Fraud and Control Survey, paper checks continue to be the payment method most subjected to fraud in 2021.

It’s no wonder that checks are the most vulnerable to fraud — when a customer writes a paper check and sends it through the mail, there are a number of ways that the check can be compromised or defrauded.

First, the check can be lost, either by the customer or the post office and may never arrive at the merchant’s office.

Second, the check is handled by several different entities along the way and is vulnerable to signature forgery or tampering. The full account and routing numbers and the check writer’s name, phone, and address are all plainly visible on the check, leaving the information susceptible to fraud.

And finally, when the check does arrive at the business, the use of paper records and invoices can increase the risk of both fraud and error.

With so many opportunities for fraud or error, it’s possible that customers may be reluctant or unwilling to pay via paper check. Fortunately, ACH payments are much more secure than paper checks.

ACH payments can’t be lost in the mail, cut out all intermediaries, and reduce the risk of fraud and tampering. By eliminating the security risks associated with paper checks and typically requiring explicit authorization through an ACH form, ACH payments significantly increase the likelihood that your customers will feel secure when conducting business with your company.

3. Convenience

ACH payments are convenient for both you and your customers.

Your customers won’t have to carry their checkbooks around or send checks in the mail, and they’ll have the flexibility of choosing to make a one-time payment or set up recurring billing (more on that later.) And you no longer have to deal with trips to the bank or paper invoices, checks, and records — a change that can save you costs on postage, ink, transportation, and labor.

With ACH payments, the funds are transferred electronically, saving you the hassle of dealing with a physical check.

4. Reduce human error and increase time savings

Since you don’t have to deal with a physical paper check, ACH payments can save you time and eliminate trips to the bank. This means your employees can spend their time on other, more productive tasks. You’ll also spend less time processing payments with ACH checks.

In addition, electronic ACH payments cut down on human errors and the ensuing time spent fixing them.

Human errors cost businesses both time and money. According to IBM Security’s 2020 Cost of a Data Breach Report, human errors account for 23% of data loss. The same report also estimated that data breaches caused by human errors cost businesses an average of $3.3 million per breach. With ACH checks, you eliminate the chance for human mistakes to occur.

5. Recurring billing

If your company operates on a subscription-based model, then ACH payments are a great option for both you and your customers.

Subscription-based businesses, or businesses that regularly bill their customers, face a number of challenges. Their payment processing costs can climb perilously high due to the number of recurring transactions they process each month. Furthermore, their customers may forget to pay their bills, resulting in unpaid invoices and cash flow issues.

ACH payments can address both of these problems.

ACH payments are one of the most cost-effective payment methods and can help merchants save on their processing fees. Cumulatively, these individual savings can have a significant effect on the merchant’s bottom line. With recurring billing, customers don’t have to remember to pay their bills — bills are paid on time and merchants don’t have to harass their customers for late payments. It’s a win-win.

6. Faster processing time

Unlike a paper check, which may have to go through the mail, an ACH payment is paid online, cutting down on processing time. ACH payments are also given preferred funding over paper checks, meaning that banks will usually process an ACH payment before a paper check. Both of these features ensure that you’ll get your funds faster than with a traditional check.

7. Customers prefer ACH

Finally, customers prefer ACH payments over paper checks.

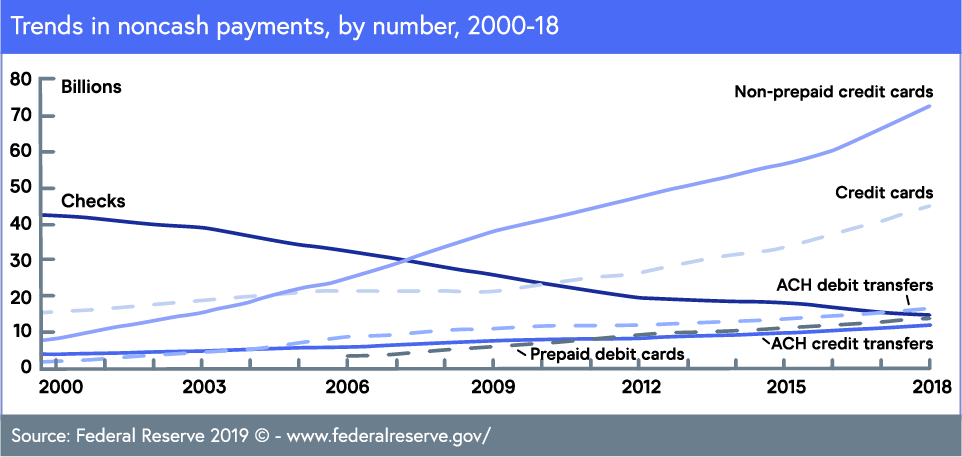

According to the 2019 Federal Reserve Payments Study, the use of checks declined from over 40 billion transactions in 2000 to less than 20 billion in 2018, whereas the number of ACH transactions grew at an annual rate of 6% from 2015 to 2018. ACH transactions show no sign of stopping with record growth in 2020 and 2 billion new payments added.

It’s understandable why customers would prefer ACH over traditional paper checks. The recurring billing feature of ACH payments takes the stress out of remembering to pay their bill each month. And since ACH payments are secure, customers may feel better about paying and be more likely to purchase from you if you allow them to use ACH payments.

When customers feel as though their payment options are secure and convenient, they’re more likely to open up their metaphorical wallets. The more payment options you offer, the more customers and revenue you’ll be able to attract.

ACH payments can optimize the transaction process for both merchants and customers

ACH payments offer opportunities for both merchants and customers to save time, secure their payments, and take advantage of the convenience of electronic payments. Hopefully, these seven benefits of ACH payments are enough to convince you to start accepting ACH payments — for the good of both you and your customers.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.

EBizCharge is the most robust ACH/eCheck solution on the market. Start collecting payments today.