Blog > How To Find the Best Payment Gateway for Your Business in 2026

How To Find the Best Payment Gateway for Your Business in 2026

Finding the right payment gateway for your business in 2026 is a critical step toward ensuring seamless online transactions, boosting customer satisfaction, and securing your revenue streams.

With the rapid evolution of eCommerce and digital payment trends, businesses must navigate an ever-growing array of gateway providers, features, and pricing models to select the option that best fits their needs.

This article will break down the essentials of payment gateways, highlight key factors to consider, and explore emerging trends, empowering you to make an informed decision that supports your business goals.

What is a payment gateway?

A payment gateway is a technology that facilitates the transfer of payment information between a customer and a merchant’s bank during an online or in-store transaction.

When a customer initiates a payment, the gateway securely transmits the information to the payment processor and the issuing bank for authorization. Once approved, the payment gateway sends a confirmation back to the merchant and the customer, completing the transaction.

Payment gateways are essential for eCommerce and other card-not-present (CNP) scenarios since they enable businesses to accept various payment methods – credit and debit cards, Automated Clearing House (ACH) payments, and digital wallets – while ensuring compliance with industry security standards like Payment Card Industry Data Security Standards (PCI DSS).

Overall, the payment gateway acts as a secure bridge that encrypts sensitive data, such as credit card details, to ensure the transaction is processed safely and efficiently.

Key characteristics of a payment gateway

Understanding the key characteristics of a payment gateway can help your business ensure secure and smooth online transactions, combat fraud, and improve customer satisfaction.

- Data encryption is crucial for a payment gateway since it converts sensitive information, like credit card details, into a secure format to prevent unauthorized access during online payments. Strong encryption builds trust with customers and reduces the risk of data breaches.

- Fraud detection and prevention are critical features of a payment gateway. Sophisticated algorithms monitor transactions for suspicious activity. Immediate alerts can help stop fraudulent transactions before they harm your business. Effective fraud prevention boosts customer trust and loyalty.

- Seamless gateway integrations with other business tools, such as shopping carts and accounting software, can reduce manual work and streamline operations, saving time and resources. Integrations ensure all payment details are accurately reflected in your systems.

- Real-time payment processing is a key characteristic of an efficient payment gateway. Instant transaction confirmation improves the shopping experience and cash flow by enabling businesses to access funds more quickly. This feature is crucial for maintaining operational efficiency in a competitive market.

Now that you understand the key characteristics of a payment gateway, you should familiarize yourself with the different types of payment gateways.

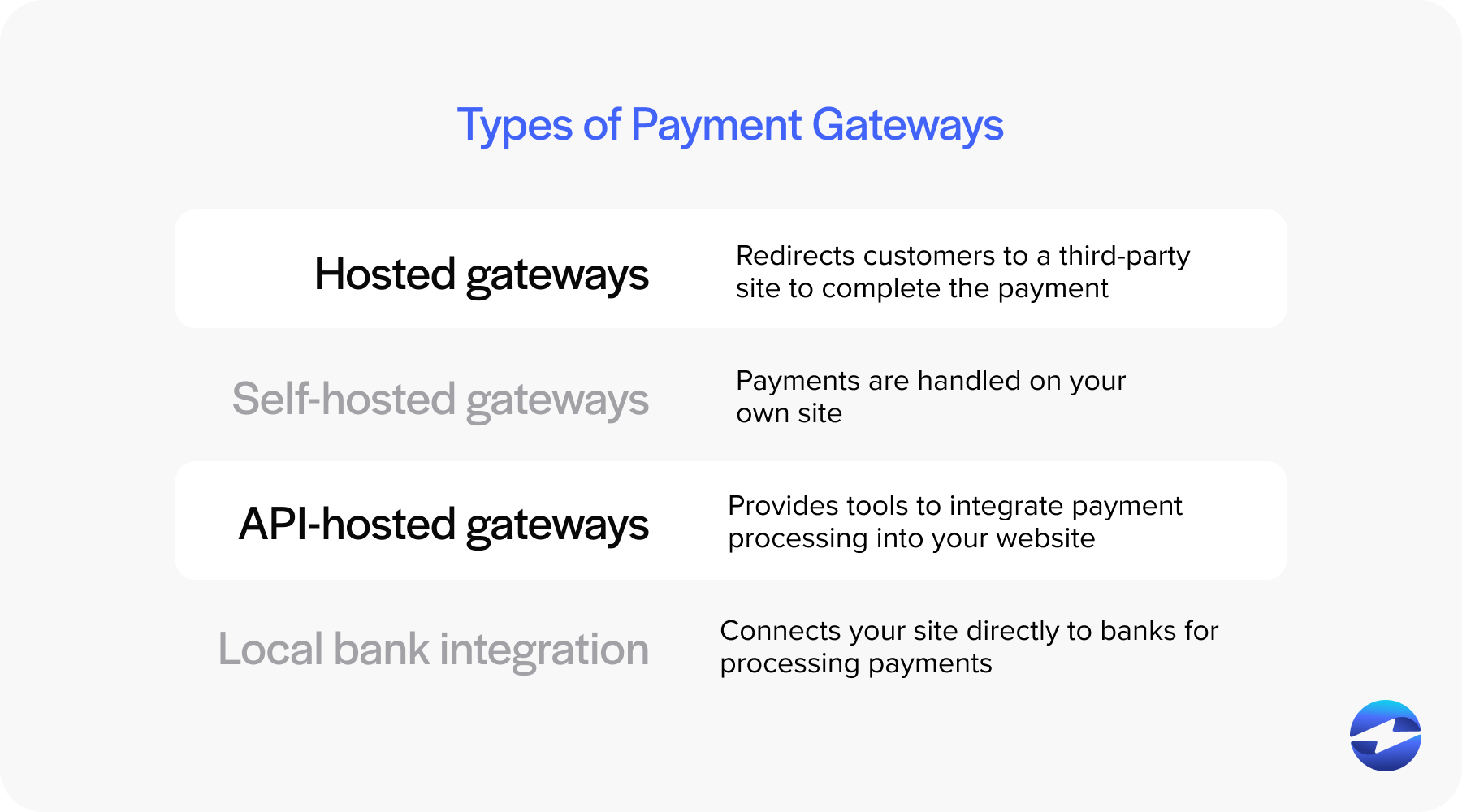

What are the main types of payment gateways?

Since different gateways suit different needs, transaction volumes, and budgets, it’s essential to understand the various types of payment gateways to choose the option that encourages the most efficient online transactions for your business and its customers.

Four types of payment gateways include hosted gateways, self-hosted gateways, API-hosted gateways, and local bank integrations. The following sections will explain how each works.

Hosted gateways

A hosted payment gateway redirects customers to a third-party site to complete the payment. These gateways handle all payment details, providing a secure system that minimizes the risk of data breaches.

The hosted gateway setup is simple, with no need for extensive technical skills. However, redirection can sometimes affect user experience and conversion rates.

Self-hosted gateways

Self-hosted payment gateways let you handle payments on your own site. Customers enter their credit card payment and other payment details without leaving your page. This method offers a seamless user experience.

Self-hosted gateways give businesses complete control, so you can customize this process to suit your brand. However, it’s your responsibility to enforce robust security to protect these payments. Additionally, the setup and maintenance may be more complex.

API-hosted gateways

API-hosted gateways provide tools to integrate payment processing into your website or app for greater flexibility and customization. It supports various payment methods, such as credit cards, debit cards, mobile payments, and digital wallets.

Businesses can tweak the payment flow of API-hosted gateways to suit their needs. However, it requires technical expertise and can involve higher setup fees.

Local bank integration

Local bank integration connects your site directly to banks for processing payments, which typically suits businesses targeting local customers who prefer bank transfers. It also supports international payments and transactions.

These gateways are often secure and have lower transaction fees. However, integration can be complex and may limit your range of payment methods.

It’s also important to remember that not all payment gateways are created equal. Before choosing a payment gateway, you should evaluate each option using a set of criteria.

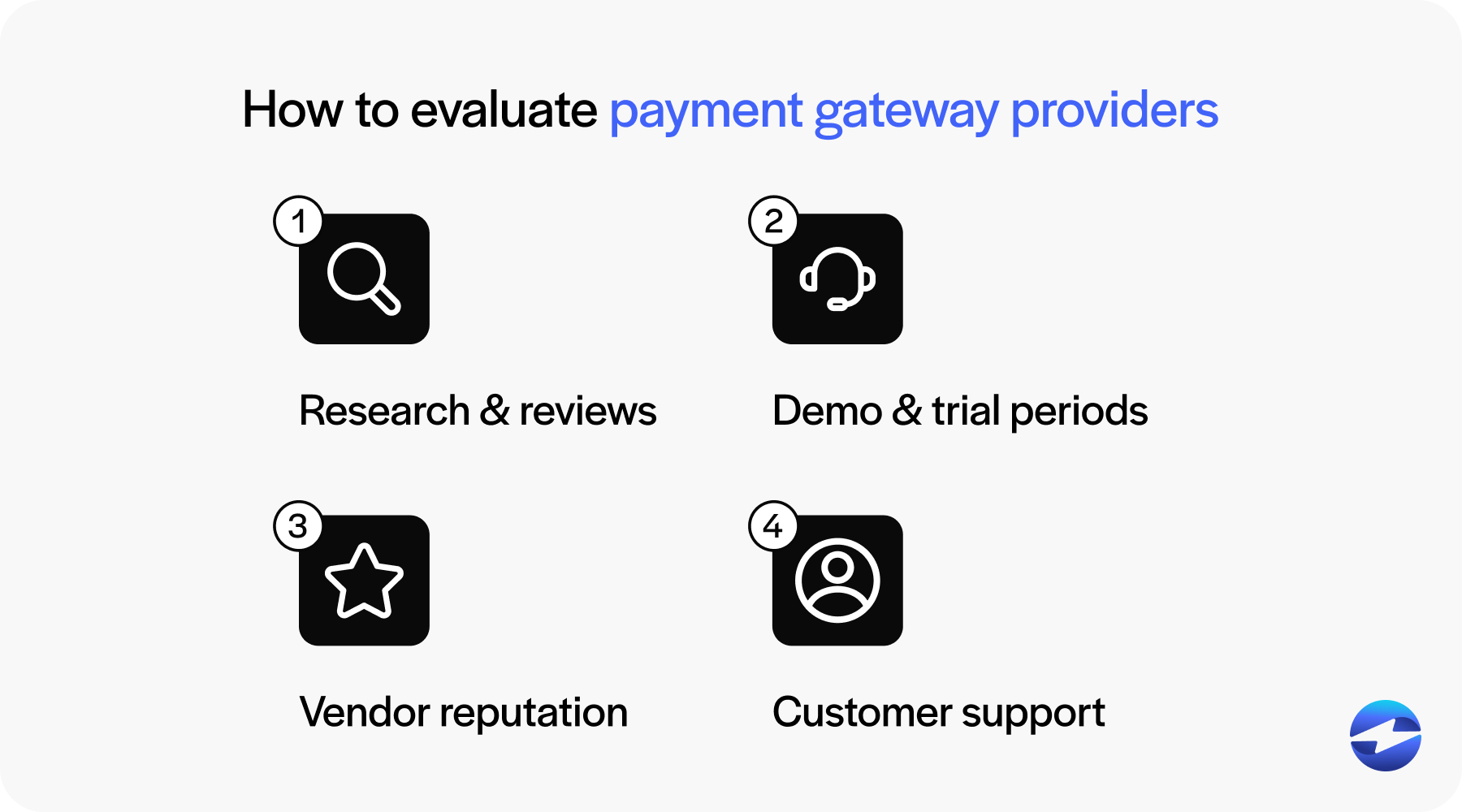

How to evaluate payment gateway providers

Choosing the right gateway is critical to enhancing online payments, customer satisfaction, and revenue.

Evaluating payment gateway providers to understand key features, transaction fees, and user experiences will help you solidify more efficient online transactions and well-managed cash flow.

To properly evaluate payment gateway providers, merchants should conduct thorough research, participate in demos and trials, assess vendor reputation, and review customer support options for each.

Research and reviews

Merchants should research various payment gateway providers to find cost-effective and highly-rated providers that support numerous payment methods (credit and debit cards and digital wallets) and offer robust functionality and security.

Businesses handling sensitive customer data must ensure their payment provider meets PCI DSS compliance standards. For healthcare organizations, using a HIPAA-compliant payment processor is essential to securely manage patient payment data while adhering to federal privacy laws.

Reading reviews can provide insights into the user experience and customer satisfaction. Reviews often highlight important aspects such as processing fees, conversion rates, and the ease of integrating the gateway with existing business software.

Demo and trial periods

Demos and trial periods are valuable tools in evaluating payment gateways. Providers often offer these to showcase their services without commitment.

During this time, you can assess the gateway’s features, user interface, and security measures. A trial period helps you gauge how well the gateway supports mobile payments and international transactions, which are vital for many online businesses.

Vendor reputation

Vendor reputation is a key factor when choosing a payment gateway, as reputable providers typically have a history of reliable service and secure payment gateways.

A strong reputation signifies trustworthiness, essential for handling sensitive payment details and ensuring secure online transactions.

Customer support

Customer support is critical when evaluating payment gateway providers since having reliable support can be an asset when installing this software, avoiding additional fees, and resolving technical issues.

When assessing customer support, response times and availability are key. For larger businesses or global enterprises, you may want to evaluate if the provider can handle high transaction volumes and international payments.

Quality customer support can be pivotal in enhancing your operational efficiency, quick conflict resolution, more cash flow, and better conversion.

Once you’ve evaluated your options, you should research emerging trends in the payment space to ensure your payment gateway meets consumer demands.

Emerging payment gateway trends in 2026

Familiarizing yourself with and adapting to emerging payment gateway trends is critical for your business’s success in 2026.

By staying ahead of any payment trends, merchants can better manage online payments and customer interactions and choose the best payment gateway that fits their needs.

To help with this, here are four payment gateway-related trends to look out for in 2026:

- AI-powered fraud detection: Protecting your business from fraud is more important than ever in 2026. Thus, AI-powered fraud detection is on the rise. AI systems can quickly analyze patterns and detect suspicious activities to reduce fraud and protect customer payment data. Businesses using these systems may enhance consumer trust and deliver a more secure payment experience.

- Cryptocurrency and blockchain-based gateways: More businesses are adopting cryptocurrency and blockchain-based gateway technologies, as they can provide secure payment processes, lower transaction fees, modern payment methods, and more transparency and speed regarding international payments. Adopting these gateways can also attract tech-savvy audiences and provide various payment options.

- Real-time payments and instant fund transfers: With the need for real-time payments growing and many customers now expecting instant fund transfers when shopping online, payment gateways that support real-time processing may be in high demand in 2026. Merchants that offer quick transfers can improve cash flow, user experience, and accounting processes. Choosing a gateway that provides these payments can also increase conversion rates.

- Contactless payments: Since contactless payments can enhance the customer experience, more businesses are integrating these payments with platforms like Apple Pay or Google Wallet. This trend increases speed during checkout and offers a seamless shopping experience. Focusing on these options can lead to more customer loyalty and higher revenue.

By proactively adopting innovations such as AI-driven fraud detection, blockchain technologies, real-time payment capabilities, and contactless payment options, businesses can enhance security, improve efficiency, and deliver a superior customer experience.

In addition to keeping up with emerging trends, it’s also important to consider key factors like cost structures and integration capabilities when choosing your payment gateway.

7 factors to consider when choosing a payment gateway

There are several essential factors to consider when selecting a payment gateway, as they can drastically impact the efficiency of your customer payments.

Here are seven factors to consider when choosing your payment gateway:

- Security features: Payment security is essential to protect your internal business infrastructure and sensitive customer payment data. Finding a gateway that provides robust fraud prevention tools, encryption, tokenization, full PCI Compliance, and advanced verification is important. By working with a secure gateway that enforces reliable security measures and features, you can avoid and mitigate fraud while enhancing customers’ confidence in their online transactions.

- Integration with existing systems: Finding a payment gateway that can seamlessly integrate with your other business systems can streamline your invoicing operations and customer payments and reduce human error. These integrations can include accounting, enterprise resource planning (ERP), customer relationship management (CRM), eCommerce platforms, and more. Finding a gateway compatible with your current setup can save your business time and costs.

- Support payment methods: A payment gateway must support many payment methods, such as credit and debit cards and digital wallets, to accommodate customer preferences and provide flexible payment options that increase sales.

- Ease of use: Working with a payment gateway that’s easy to set up and manage with a user-friendly interface will save your business time and money and help you avoid errors while improving the customer checkout experience.

- Transparent pricing structure: Understanding the pricing structure of each payment gateway is critical to ensure you find the most cost-efficient option with no hidden fees. Evaluate your contract to assess setup and transaction fees, and other monthly or annual charges. Finding a transparent provider that delivers a straightforward breakdown of its costs is preferred and can help you avoid hidden charges.

- Scalability: Finding a scalable payment gateway is vital to business growth and long-term success. These providers should be able to handle larger transactions, customer volumes, and payment amounts with little to no issues as you expand.

- Customer support: Reliable customer support will help merchants resolve issues quickly and efficiently by having immediate access to gateway experts when needed. Consider gateways known for excellent customer service to ensure any problems are promptly handled.

Reliable payment gateways are necessary to meet evolving business needs and growth initiatives, but it’s important to remember that gateways can come with challenges.

Common challenges when implementing a payment gateway

Implementing a payment gateway may involve several hurdles, so recognizing these challenges is critical in selecting the right payment service provider and minimizing costs.

Three common challenges of implementing a payment gateway include initial setup and technical requirements, required training, and compatibility with legacy systems.

Initial setup and technical requirements

The initial setup of a payment gateway can be difficult since it often involves integrating with online platforms and includes API configurations and security protocols.

Installation can be daunting for businesses without a tech-savvy team. Therefore, your company should address any technical issues early on and work with a processor that handles most of the setup for you.

Training staff to use new systems

Training staff to handle new systems is essential since employees must understand payment processing operations to manage customer payments properly.

Businesses should be familiar with their payment processor support and functionality, alternative payment methods (such as mobile options) they offer, and how to manage larger transaction volumes.

Without proper training and the support of a reliable payment service provider, the risk of errors can increase.

Ensuring compatibility with legacy systems

Many businesses use legacy systems, so ensuring your new payment gateway is compatible is vital since compatibility issues can disrupt payment processing.

Businesses should consider a wide range of issues and choose payment providers wisely. Key features include adaptability with existing systems and ease of integration.

By addressing these challenges, businesses can ensure their payment gateway runs smoothly. For a comprehensive payment gateway, look to top-rated payment solutions like EBizCharge.

EBizCharge provides a powerful payment gateway to transform your transactions

The EBizCharge payment gateway simplifies the payment collection process by enabling businesses to manage online payments efficiently and securely.

EBizCharge supports various payment options, including credit and debit cards, ACH, mobile payments, and more, offering more flexibility and a better shopping experience. Its robust payment integrations with accounting/ERP, CRM, and eCommerce systems ensure a smooth and user-friendly payment process.

In addition to its versatility, EBizCharge is fully PCI-compliant and offers advanced security features, such as tokenization, encryption, fraud prevention modules, and 3D Secure, to protect sensitive payment data and avoid fraud or data breaches. Moreover, EBizCharge provides 24/7 customer support to quickly address any issues or questions, helping you minimize downtime and keep transactions running smoothly.

With customizable settings and intuitive dashboards, businesses can easily track payments, generate reports, and manage transactions in real-time. These features make EBizCharge an invaluable tool for merchants seeking a reliable, secure, and efficient payment solution.

Businesses can leverage the powerful EBizCharge payment gateway to transform their customer payments and invoicing process, generating more long-lasting revenue and success.

FAQs regarding payment gateways

FAQs regarding payment gateways

Summary

- What is a payment gateway?

- What are the main types of payment gateways?

- How to evaluate payment gateway providers

- Emerging payment gateway trends in 2026

- 7 factors to consider when choosing a payment gateway

- Common challenges when implementing a payment gateway

- EBizCharge provides a powerful payment gateway to transform your transactions

- FAQs regarding payment gateways