Blog > Understanding Payment Processing Costs in Acumatica and How You Can Save

Understanding Payment Processing Costs in Acumatica and How You Can Save

As companies transition to online payment platforms, the complexities of payment processing costs can often lead to unexpected expenses that eat into margins.

With numerous fees associated with each transaction, businesses must navigate a tangled web of charges that can vary by industry and business model. Understanding these costs empowers businesses to make smarter financial decisions.

When using popular business systems like Acumatica that provide the flexibility to manage finances, integrating a cost-effective payment solution is essential to ensure minimal costs while delivering seamless transactions.

Thankfully, this article will explore the various payment processing costs associated with Acumatica as well as actionable strategies for businesses to reduce these expenses.

Understanding payment processing costs in Acumatica

Acumatica is cloud-based enterprise resource planning (ERP) software designed to help businesses manage their finances, operations, and customer relationships in a unified system.

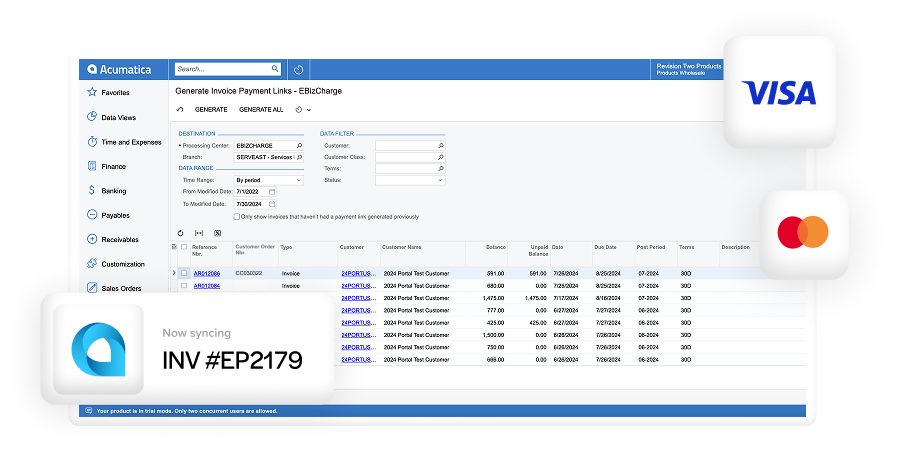

Acumatica allows businesses to accept and process credit cards, debit cards, Automated Clearing House (ACH) payments/eChecks, and other transactions seamlessly by integrating with payment gateways. This functionality helps companies manage sales, invoices, and financial transactions efficiently while keeping payment data centralized within the ERP system.

With payment processing in Acumatica, businesses can automate transaction entries, reconcile payments faster, and reduce manual errors.

Payment processing can also include recurring payments, customer payment portals, and fraud prevention tools to enhance security and streamline financial operations in Acumatica.

By integrating a payment processor, companies can improve cash flow, reduce administrative burdens, and gain better visibility into payment activities.

That said, the ability to process payments isn’t free, and most payment processing solutions come with multiple fees.

5 standard payment processing fees you may encounter when processing payments in Acumatica

Understanding payment processing fees in Acumatica is vital since these fees can add up and affect your company’s bottom line. Therefore, knowing various fee types will help businesses plan better and find ways to reduce their costs.

Here are five common payment processing fees to be aware of:

- Credit card processing fees: Credit card processing fees are the fees merchants pay to accept credit card payments from customers. These fees typically include interchange fees, which go to the card-issuing bank, assessment fees charged by the card networks, and payment processor fees for handling the transaction. The total cost varies based on factors like the type of card used, the transaction method, and the merchant’s industry.

- ACH processing fees: ACH processing fees are the costs associated with transferring funds electronically through the ACH network. These fees are typically lower than credit card processing fees and are charged by payment processors or banks for facilitating direct bank-to-bank transfers. ACH fees can be structured as a flat fee per transaction or a percentage of the transaction amount, depending on the provider. Factors like transaction volume, payment speed, and the type of ACH transfer can also influence the overall cost. Since ACH payments eliminate the need for credit card networks, they offer a cost-effective and secure alternative for businesses handling recurring payments, payroll, or large transactions.

- Gateway fees: Gateway fees are the fees merchants pay to use a payment gateway, which acts as a bridge between their website or point-of-sale (POS) system and the payment processor. These fees cover the cost of securely transmitting payment data, encrypting sensitive data, and authorizing transactions in real-time.

- Monthly subscription or software fees: Monthly subscription or software fees are recurring costs businesses pay to use an integrated payment processing solution or any third-party payment gateways in Acumatica. These fees may include charges for access to financial management tools, cloud hosting, and support services in Acumatica, as well as fees from payment processors for maintaining a merchant account and facilitating transactions. Some Acumatica payment gateways charge separate monthly fees for their services, which vary based on transaction volume, security features, and additional tools.

- Chargeback and dispute fees: Chargeback and dispute fees are costs merchants incur when a customer disputes a transaction and requests a refund through their credit card issuer. When a chargeback occurs, the payment processor temporarily withdraws the transaction amount from the merchant’s account while investigating the claim. If the dispute is resolved in favor of the customer, the merchant may lose the sale and be charged an additional fee, which covers administrative costs related to handling the dispute. These fees can add up quickly, especially if a business experiences frequent chargebacks.

It’s important to note that the cost of these fees can fluctuate based on several factors.

4 factors affecting payment processing costs

Acumatica processing costs can depend on various components of your operations, whether the payment software you use or the number of payments you receive.

By identifying these key factors, merchants can make informed decisions to optimize their payment processing strategy and potentially reduce costs.

Four common factors that can contribute to higher processing costs include your choice of payment gateway, industry, customer payment methods, and transaction volumes.

Choice of payment gateway

The payment gateway you choose can significantly impact costs, as different gateways can enforce various fees and pricing structures.

Some payment gateway providers may charge a flat rate, while others charge per transaction. Be on the lookout for providers that impose additional costs, such as setup, chargeback, or international transaction fees, which can add up over time.

Merchants should also consider gateways’ supported payment methods and compliance with security standards like Payment Card Industry Data Security Standards (PCI-DSS) since reliable security infrastructures and cost-friendly options can mitigate extra costs.

Finding a cost-effective gateway that aligns with your business needs in Acumatica without breaking the bank is essential. Thorough research will help your business garner these cost savings.

Business industry and merchant category code (MCC)

Your business industry and accompanying merchant category codes (MCCs) can also affect Acumatica processing costs.

Credit card companies assign MCCs to businesses to categorize their industry type using a numerical sorting format. This is because specific industries can lead to higher fees while others qualify for lower interchange rates due to lower risk of fraud or regulatory considerations.

If your business falls into an industry with preferential pricing, you can leverage this information when negotiating with payment processors to secure more favorable transaction fees.

Customer payment methods

The payment methods your customers use can determine the processing costs your business accrues. This is because credit cards, debit cards, and digital wallets have different fees.

Credit card payments, especially those involving premium or rewards cards, tend to carry higher interchange fees than debit cards, which typically have lower costs due to their reduced risk of chargebacks.

On the other hand, ACH transfers are direct bank payments that typically incur lower processing fees, making them a more cost-effective option for businesses handling large transactions.

Encouraging customers to use lower-cost payment methods, such as debit cards or ACH transfers, through incentives or discounts can help reduce expenses while maintaining efficient payment collections.

Transaction volume and average ticket size

The number and size of your transactions can influence the processing costs your business must pay.

High-volume businesses may qualify for lower rates since payment processors typically offer volume-based pricing. This means if your company processes a large number of transactions or high total sales amounts, you may be able to negotiate lower interchange and transaction fees.

That said, some payment processors charge a percentage-based fee, meaning higher transaction amounts result in larger fees, even if the percentage remains the same. Therefore, the cost-effectiveness of your company’s supported payment methods becomes crucial.

Businesses with larger ticket sizes may benefit from interchange-plus pricing, where interchange fees are fixed and not solely based on the transaction amount.

On the other hand, flat-fee pricing models charge a set fee per transaction, which may be less cost-effective for smaller purchases but more favorable for high-ticket transactions.

Businesses that handle large transactions should carefully assess their pricing model to ensure they aren’t overpaying on fees, as even small percentage differences can lead to significant cost savings over time.

Now that you know the factors that can determine processing fees, your company can better prepare and make more strategic decisions to optimize its cost savings.

6 ways Acumatica users can save money on payment processing

Understanding payment processing costs is essential to save money when accepting and processing customer transactions in Acumatica.

Since payment processing can be a significant expense, merchants should take the necessary steps to lower these costs.

Here are six ways Acumatica users can reduce their overall processing costs and fees:

- Select a reliable payment processor: Finding the right payment processor can make a big difference. Looking for payment processing solutions that offer free installation, support, fraud protection, chargeback management, and reporting tools at no extra cost can allow your business to avoid additional expenses while improving security and efficiency. Overall, a processor that offers competitive rates and a seamless payment integration into the Acumatica software is key.

- Negotiate lower rates: Negotiating rates with your payment processor can help save money. Don’t be afraid to ask for a better deal. Many processors are willing to negotiate, especially if your monthly volume is high.

- Encourage lower-cost payment methods: Encouraging customers to use lower-cost payment methods can reduce fees. For example, ACH transfers often cost less than credit card payments. Offering small incentives for using these methods can lead to savings.

- Optimize payment processing workflows in Acumatica: Streamlining workflows in Acumatica can reduce errors and save money. Automating tasks and using built-in tools can cut down on extra processing costs. Keep your system updated and make sure to use all the offered features.

- Implement a cash discount or surcharge program: You can incentivize your customers to pay with cash by offering discounts. Alternatively, charging a small fee for credit card transactions can pass these fees entirely to your customers to offset processing costs and encourage cost-effective payment methods.

- Monitor and audit processing fees regularly: Regularly review your processing fees to ensure they remain competitive. Auditing can help identify any unexpected charges or rate increases. By keeping a close eye, merchants can address issues and maintain low costs.

While all these strategies can help Acumatica users effectively reduce expenses and improve profitability, finding a reliable and transparent payment processing solution is key.

When choosing a payment processor, looking for a trusted solution that offers seamless integration and comprehensive tools and features to streamline payment operations is essential.

How EBizCharge’s Acumatica-Certified application enhances payment collections and costs in Acumatica

EBizCharge offers a powerful payment integration for Acumatica users to cut payment processing costs and enhance and accelerate their customer payments inside this system.

By integrating EBizCharge with Acumatica, merchants can benefit from lower transaction fees and enhanced payment data security, making the payment process more efficient and cost-effective.

EBizCharge provides several complimentary tools and features to streamline payment operations, such as real-time payment processing to speed up transactions and maintain steady cash flow, PCI compliance to ensure all payments meet industry security standards and sensitive data is protected, custom reporting tools for accessing detailed insights and making informed business decisions, and a customer payment portal that allows clients to pay invoices easily online.

EBizCharge also offers free installation and setup, ongoing customer support, and surcharging options, all of which help reduce unnecessary expenses and pass payment processing costs to customers.

EBizCharge also provides customized pricing options tailored to the unique needs of each business, ensuring the most cost-effective payment processing solution.

By leveraging the robust functionality, features, and cost savings of EBizCharge, Acumatica users can simplify customer payments, enhance financial management, and improve operational efficiency while reducing payment processing costs.