Blog > Why Small Businesses Should Choose Flat Fee Merchant Services

Why Small Businesses Should Choose Flat Fee Merchant Services

If your business is just diving into accepting credit card payments from customers, how do you know which merchant services provider to choose? There are several different pricing models for credit card processing—interchange plus, tiered, flat fee merchant services. Each has their own pros and cons, but the relative advantages and disadvantages are not easily apparent to those new to the scene. While not the best choice for every business, flat fee merchant services give merchants just starting out or with low monthly processing volumes a solid, easy-to-understand pricing model.

Credit card processing fees: the basics

To understand flat fee merchant services, you first have to understand how credit card processing fees work in general. On the most basic level, there are three main costs that make up credit card processing fees: interchange, assessment, and markup.

Credit card processing is inherently risky. There’s always a chance of fraud or debt, and at the end of the day, credit card brands like Visa, American Express, and MasterCard are on the hook. To cover any potential losses, these card brands charge interchange fees with every credit card transaction. These fees vary based on the risk level of the transaction. For example, a credit card transaction that happens face-to-face in a brick and mortar store is less likely to result in fraud, so it will probably have a lower interchange fee than a credit card transaction that happens online. Interchange fees also vary based on the type of credit card used. There are literally hundreds of interchange fees that can potentially change at any time based on industry standards and external events. Credit card processors have no control over these fees, and it requires a lot of due diligence on the merchant’s part to educate themselves, monitor interchange fees, and ensure they’re getting a good deal.

Assessment fees are also imposed by card brands. They’re usually a fixed percentage, and like interchange, they can’t be negotiated or changed.

Markup is charged by the credit card processor. It’s the only fee that the processor has control over, and if merchants want to negotiate lower credit card processing fees, this is the fee they should target.

So: interchange, assessment, and markup make up credit card processing fees. What does this mean for flat fee merchant services?

What are flat fee merchant services?

Flat fee merchant services give merchants a straightforward credit card processing experience that anyone can understand.

There are two main models for flat fee merchant services:

- Fees calculated as a percentage of the monthly processing volume (Ex: 2.5%)

- Fees calculated as a percentage of the monthly processing volume plus a pre-determined fixed rate (Ex: 2.5% + $0.25 per transaction)

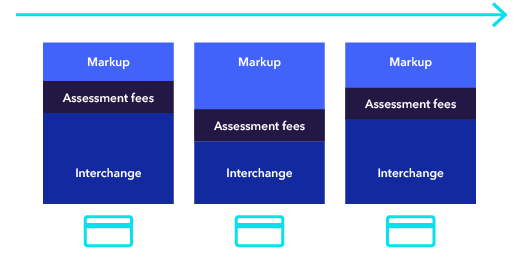

Basically, flat fee merchant services (also known as flat rate credit card processing) take into account the volatility of interchange fees and charge higher or lower markup on each transaction to reach a consistent, pre-determined rate. Every credit card transaction will have a different interchange rate and thus a different markup. Flat fee merchant services adjust the markup accordingly to ensure every transaction costs the same amount to process.

Flat fee merchant services vs. interchange plus pricing

The three most popular pricing models for credit card processing are:

- Flat fee

- Interchange plus

- Tiered

Tiered processing is one of the most expensive and least transparent pricing models. It’s not very popular among merchants or processors, so we won’t go into detail here.

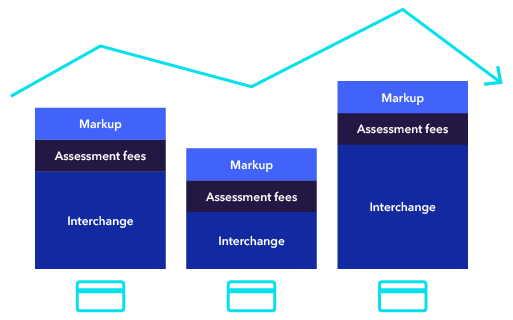

We discussed how the flat rate pricing model works to create a stable price for every credit card transaction. By contrast, with interchange plus pricing (also known as pass through or cost plus), every credit card transaction carries a different cost.

Again, every credit card transaction is made up of interchange fees, assessment fees, and markup. But instead of charging a variable markup, interchange plus charges a stable markup. Because of the inconsistency of interchange fees, this means every transaction will cost the merchant a different amount.

At a quick glance, here’s a comparison between flat fee merchant services and interchange plus pricing:

| Flat fee | Interchange plus |

| Stable costs | Variable costs |

| Don’t have to monitor fees or statements | Should monitor fees and statements |

| Know in advance what your bill will be | Won’t know what your bill will be |

4 advantages of flat fee merchant services

One of the most difficult things about credit card processing is how confusing it is. Merchants don’t always have the time, energy, or knowledge to pore over their merchant processing statement to ensure they’re getting a good deal. Most of the time, merchant statements are filled with long lists of obscure fees, costs, and percentages, and merchants struggle to untangle all the information.

That’s the main advantage of flat rate credit card processing: all that confusion and stress is taken away. Here are 4 more advantages of flat fee merchant services:

- There are no surprises—everything is very stable

- You don’t have to scrutinize your merchant statement and check every transaction to ensure you’re getting a good deal

- You know exactly what your credit card processing bill will be ahead of time

- The entire process is simple and easy to understand

However, despite the allure of an easy-to-understand pricing model, flat rate credit card processing isn’t the best choice for every business. Work with your credit card processors to ensure you fully understand your merchant processing statement and know if you’re getting a good deal or not.

Flat fee merchant services: a solid option for small businesses

When choosing a merchant processing provider for your business, you have to assess your business and decide which pricing model makes the most sense. For small businesses, flat fee merchant services can be a strong option and can help you get started with accepting credit card payments from your customers.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge