Blog > Understanding No Fee Credit Card Processing: What Every Business Owner Should Know

Understanding No Fee Credit Card Processing: What Every Business Owner Should Know

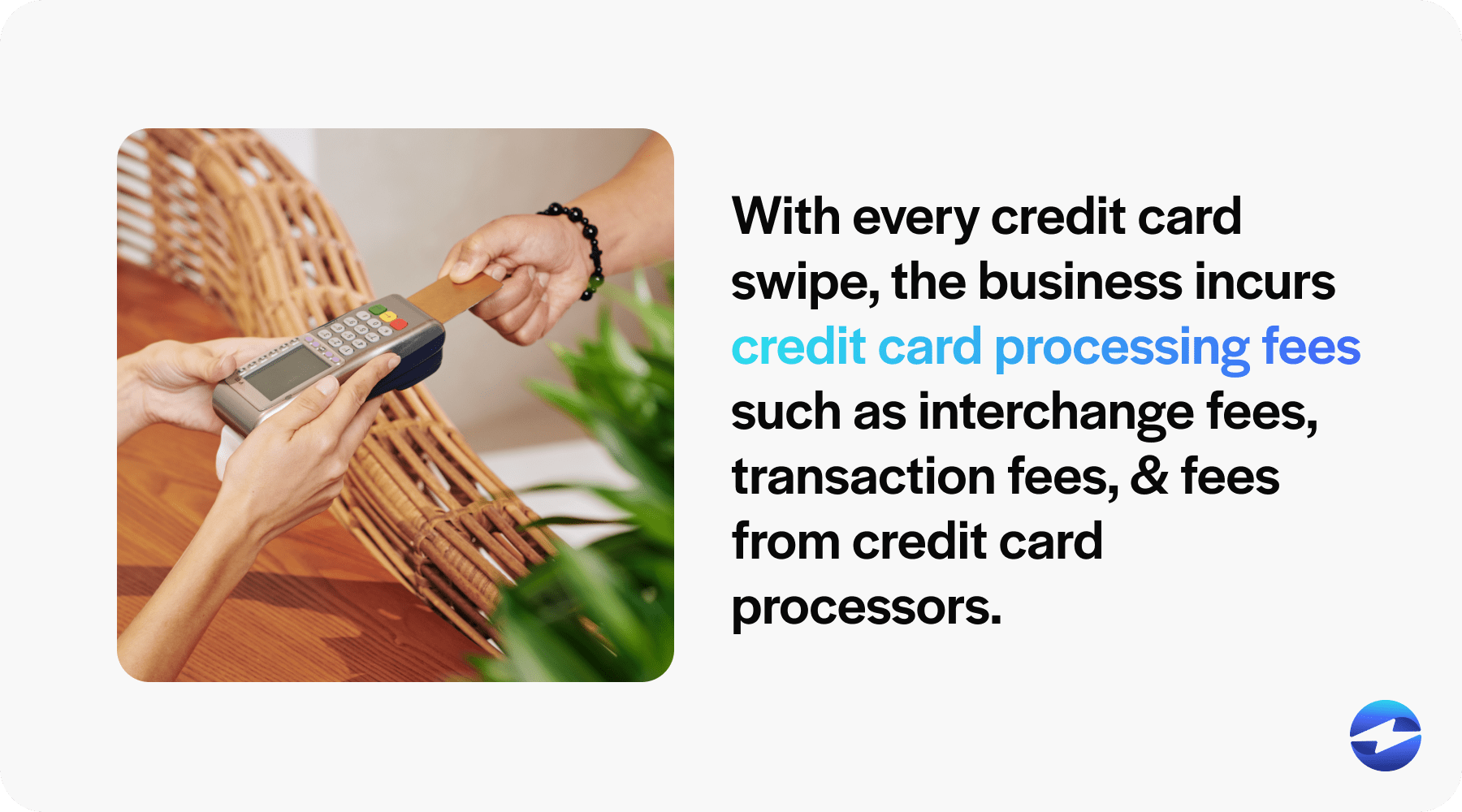

Credit card transactions are known to facilitate seamless and convenient payments for consumers, but they can come with many fees.

Thankfully, businesses can leverage no fee credit card processing to alleviate the burden of transaction costs.

What is no fee credit card processing?

No fee credit card processing, often called zero fee credit card processing, is a payment system that allows business owners to accept credit cards without the usual costs.

Every time a customer swipes or taps their card, the business typically incurs credit card processing fees. These can be a blend of interchange fees, transaction fees, and fees from credit card processors.

With no fee credit card processing, these expenses are offset differently than when billed to the merchant. Methods such as passing the cost to customers as a credit card surcharge or implementing a cash discount system are standard.

While free credit card processing for businesses may sound appealing, it’s imperative to ensure compliance with payment network rules and local laws and to evaluate how it may affect customer experience.

Understanding the facts about no fee credit card processing can empower business owners as they navigate cost-saving options.

How is zero fee credit card processing different from surcharging?

At first glance, zero fee credit card processing and surcharging may seem similar because both approaches aim to eliminate credit card payment processing fees. However, the critical difference lies in how these costs are managed.

The following sections will highlight the main differences of the two terms.

No fee credit card processing differences

No fee credit card processing allows businesses to accept credit cards without directly incurring traditional processing fees. It operates under different models, allowing merchants to sidestep these costs.

Some examples include:

- Implementing a service fee model where all customers are charged a fee, but credit card users need to be specifically targeted.

- Adopting a cash discount program where posted prices have the credit card processing fee built-in, and those paying by cash receive a discount.

This approach helps simplify merchants’ cost structures and can be advantageous if customers are comfortable with the pricing strategy.

Transparency is critical, as business owners must align their practices with payment network guidelines and consumer expectations.

Surcharging differences

On the other hand, surcharging takes a more direct approach. When customers pay with their credit cards, surcharging applies an additional fee that covers the specific cost associated with that transaction type.

Keep in mind:

- Surcharges must be disclosed to customers before payment.

- The surcharge cannot exceed the payment processing cost or legal limits set by state laws.

This practice can make customers more aware of the costs associated with credit cards and may influence their payment method. Conversely, it may discourage customers from using their cards, possibly impacting overall sales.

Both no fee credit card processing and surcharging alter how businesses handle the costs of accepting credit cards. Still, they do so in different ways, with varying impacts on customers’ perceptions and the merchant’s bottom line.

How does no fee credit card processing work?

While no fee credit card processing is relatively straightforward, there are a few steps to follow when conducting this type of payment processing.

Here’s how to implement no fee credit card processing in your infrastructure:

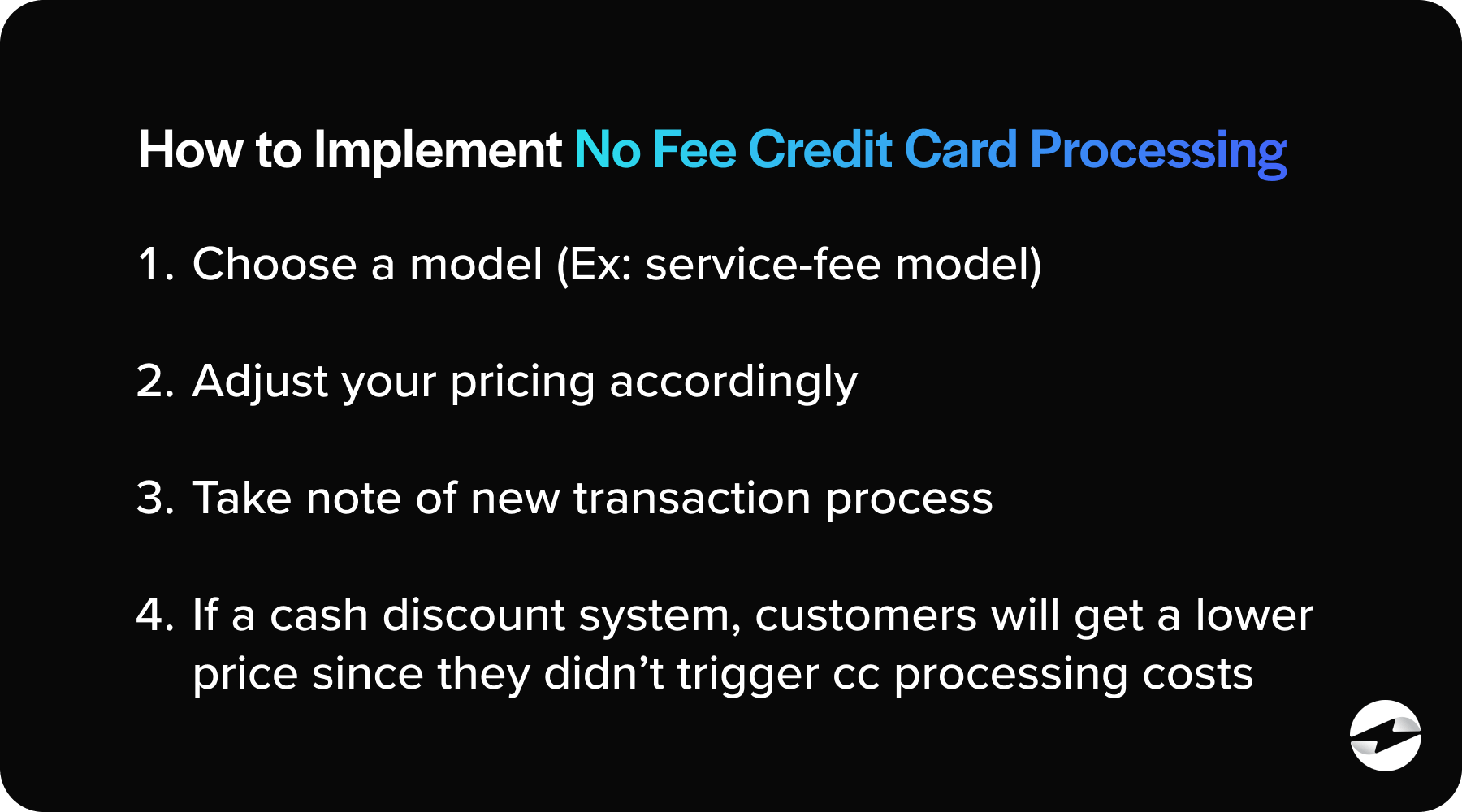

- Choosing a model: You must first select a no fee credit card processing model. This could be a service-fee model or a cash discount program.

- Pricing adjustment: Next, the business adjusts its pricing. This might mean slightly higher prices, with the processing costs factored in.

- Transaction process: When a customer purchases, the credit card payment is processed normally. However, under the no fee model, the merchant doesn’t pay a separate fee to the credit card processing company.

- Final step: If it’s a cash discount system, customers who pay with cash get a lower, adjusted price since they don’t trigger any credit card processing costs.

This structured system enables the business owner to offer the convenience of credit card payments without shouldering the extra costs traditionally associated with these transactions.

Are there any fees associated with no fee credit card processing?

Surprisingly, the concept of free credit card processing comes with an asterisk. While merchants don’t directly pay traditional processing fees, the expenses don’t just vanish.

Here are some of the fees you may see:

- Incorporated costs: The fees are generally incorporated into the price of goods and services. This means that customers are covering the costs with their purchases.

- Service fees: Under the service fee model, there’s an additional fee, but it’s billed universally, not just to credit card users.

- Compliance costs: Following regulations and guidelines can involve compliance and administrative costs when setting up and maintaining a zero fee credit card processing system.

So, while there are fees in no fee credit card processing, they’re allocated differently than typical credit card transactions. It’s a bit of a shell game with costs — they don’t disappear, but they’ve shifted away from the merchant and are integrated into the business operations.

There are some other limitations to no fee credit card processing.

Limitations around no fee credit card processing

Businesses should be aware of several limitations of no fee credit card processing that can affect their operations.

Some of these limitations include:

Some of these limitations include:

- Local legislation: Not all regions allow no fee models, such as cash discount programs or service fees.

- Consumer perception: Integrating higher costs into prices may not sit well with some customers. Some may feel they’re overpaying, which could impact customer loyalty and damage a business’s reputation.

- Competitive disadvantage: If competing businesses continue to absorb credit card fees, it may put the use of no fee credit card processing at a disadvantage pricewise.

- Complex pricing: Adjusting pricing to accommodate card processing fees requires careful calculation to avoid undercharging or overcharging for goods or services.

- Administrative burden: Setting up and maintaining a no fee system involves extra administrative work, including staying updated with compliance requirements and ensuring accurate pricing.

While no fee credit card processing has some drawbacks, one of the biggest limitations is its legalities.

Legalities of zero fee credit card processing

Zero fee credit card processing sits in a legal gray area, sometimes sparking controversy and legal challenges.

Stringent regulations govern the addition of service fees or offering cash discounts. These rules vary by state and country, and failing to comply can result in hefty fines.

Remaining within the confines of the law while offering free credit card processing requires diligence and sometimes extra resources.

How to find the perfect no fee credit card processing service

Discovering the ideal no fee credit card processing provider is akin to finding a hidden gem for your business. It’s about striking a balance between cost-efficiency and reliable service.

With plenty of options in the market, the search can seem daunting. However, you can be well-equipped to make an informed decision by focusing on critical components such as security level, compatibility with your Point of Sale (POS) system, and pricing.

Level of security

When considering a no fee credit card processing solution, it’s imperative to assess the security protocols they have in place.

Secure data handling, encryption standards, and protection against credit card fraud are non-negotiable. Look for PCI DSS-compliant services, as this is the industry standard for credit card security.

A leak or breach could be catastrophic, not just financially but also for your reputation. Ensure the processor you’re eyeing has robust measures to safeguard your customers’ sensitive information.

POS system requirements

A POS system is the heartbeat of your transactions. Any zero fee credit card processing service you’re considering must be compatible with your existing POS setup. This ensures seamless integration, enabling you to manage sales, inventory, and customer data easily.

Incompatibilities can lead to additional costs or operational headaches. Check whether the no fee credit card processing service can smoothly fit into your business’s workflow without extensive modifications or upgrades to your current system.

Pricing and credit card processing fees

When looking for a no fee credit card processing service, understanding the pricing structure and processing fees is paramount.

Here are some key considerations to guide your search:

- Zero transaction fees: A genuine no fee credit card processing service should eliminate transaction fees entirely. Ensure the provider explicitly states this policy and excludes any hidden charges per transaction.

- Interchange-plus pricing: Finding providers that offer interchange-plus pricing is optimal, as interchange fees set by card networks are separated from the processor’s markup. This transparent approach allows you to see the exact cost of each transaction, facilitating better cost management.

- Flat monthly fee: Some no fee credit card processing services may charge a flat monthly fee instead of transaction-based fees. Evaluate whether this model aligns with your business’s transaction volume and budgetary constraints.

Whatever the pricing structure the payment processor uses, some businesses work best with the no fee credit card processing service.

Which type of businesses work best with no fee credit card processing services?

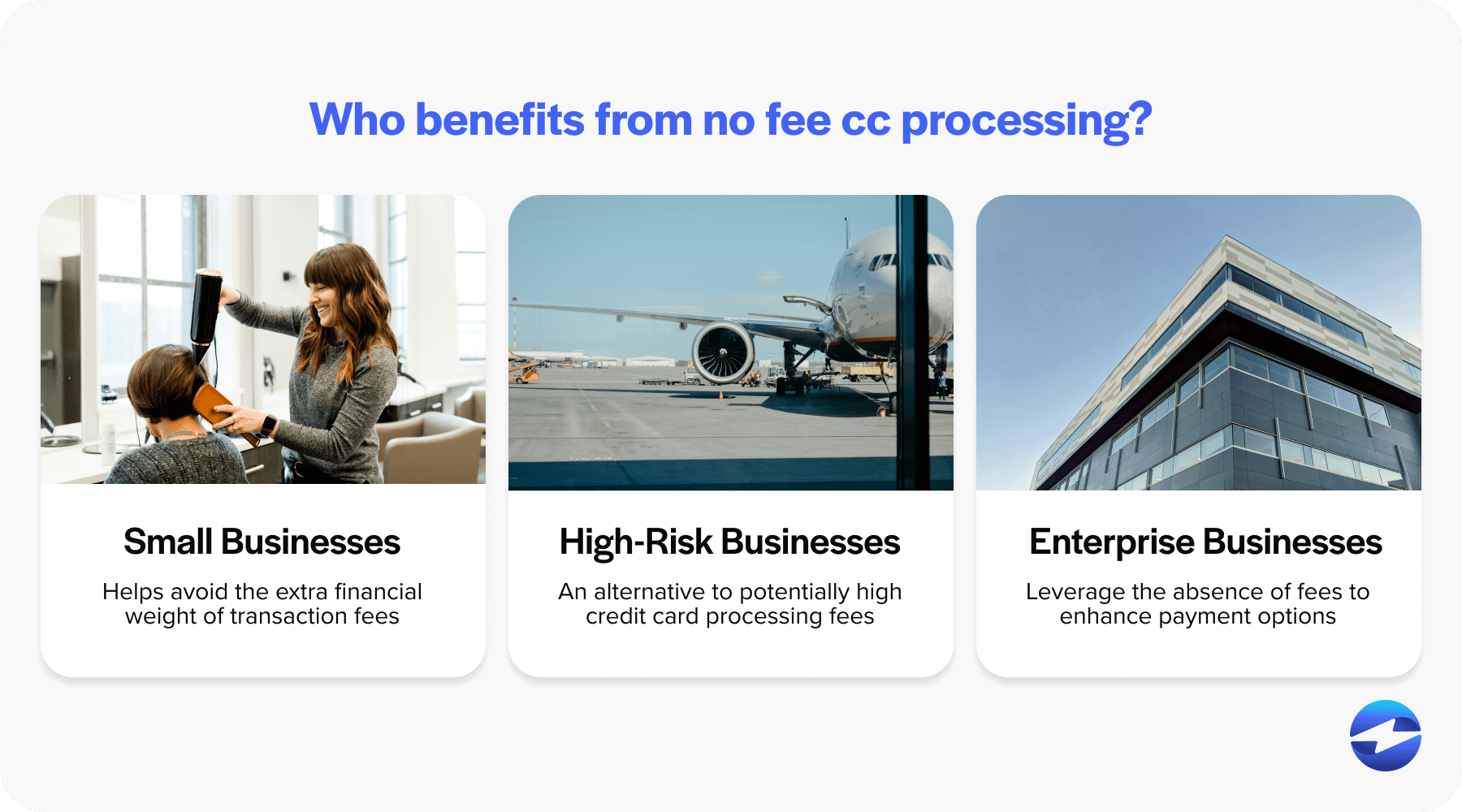

While no fee credit card processing services seem like a financial burden to some, they’re particularly appealing and beneficial for certain businesses.

These services are tailored to cater to unique business needs, whether a small local storefront, a high-risk company, or a large enterprise managing large transaction volumes. The value they offer comes from their ability to help businesses reduce overhead while providing convenience and efficiency in payment processing.

The following sections dive into the business types that often benefit from adopting zero fee credit card processing solutions.

Small businesses

Controlling overhead is not just a preference for small businesses – it’s essential for survival and growth.

Free credit card processing allows small businesses to avoid the extra weight of transaction fees, which can be burdensome for companies operating on thin margins.

Adopting a no fee credit card processing service aligns perfectly with the budget-conscious mindset of small business owners. It enables them to offer the convenience of credit card payments without eroding their profits.

High-risk businesses

Businesses categorized as high-risk, such as industries subject to high chargeback rates or irregular large transactions, often face elevated credit card processing fees from traditional merchant accounts.

No fee credit card processing can be a game changer for these businesses. It permits them to sidestep the hefty costs usually associated with high-risk transactions and frees up capital, reducing the financial strain and allowing for more predictable budgeting.

Enterprise-level businesses

At the enterprise level, transaction volumes can be enormous, making even small per-transaction fees add up to significant amounts over time. Therefore, zero fee credit card processing can equate to substantial savings for these businesses.

Additionally, these larger companies can leverage the absence of fees to enhance their payment options, improving the customer experience and helping them manage costs efficiently.

6 additional methods to reduce your credit card processing fees

Business owners have several strategies beyond free credit card processing or zero fee credit card processing options.

Here are six other methods that can help minimize these costs:

- Negotiate with providers: Talk to your payment processor to negotiate lower rates, especially if your transaction volumes have significantly increased and costs are out of control.

- Use ACH payments: Encourage customers to use direct bank transfers or Automated Clearing House (ACH) payments, which typically accrue lower fees than credit cards.

- Set a minimum purchase amount: Implement a minimum payment requirement for credit card usage to ensure small purchases don’t eat into profits with high percentage-based fees.

- Batch processing: Process transactions in batches to avoid per-transaction fees and to qualify for lower bulk processing rates.

- Use an integrated system: Integrating accounting, inventory, and payment systems may offer discounted processing rates and reduce errors that can inadvertently increase costs.

- Educate yourself on fees: Understanding interchange fees, transaction fees, and any additional costs can help you identify unnecessary charges and dispute them with your financial institution or credit card processor.

By employing these strategies, businesses can effectively manage and often decrease the amount their spending on credit card processing and retain more of their hard-earned revenue.

Seamless solutions to empower your business with no-fee credit card processing

Navigating the world of credit card processing can be complex, particularly when looking for cost-saving options such as free or zero fee credit card processing.

Thankfully, all-in-one providers like EBizCharge offer a solution to make credit card processing a simple and cost-effective process for your business. They have 100+ integrations with top ERP, eCommerce, and CRM platforms and offer many payment options.

FAQs

FAQs

Summary

- What is no fee credit card processing?

- How is zero fee credit card processing different from surcharging?

- How does no fee credit card processing work?

- Limitations around no fee credit card processing

- Legalities of zero fee credit card processing

- How to find the perfect no fee credit card processing service

- Which type of businesses work best with no fee credit card processing services?

- 6 additional methods to reduce your credit card processing fees

- Seamless solutions to empower your business with no-fee credit card processing

- FAQs