Blog > The Nine Pros and Cons of Using QuickBooks Payments in 2022

The Nine Pros and Cons of Using QuickBooks Payments in 2022

In the world of accounting software, QuickBooks leads the way being the number one accounting program in the United States. But, how does their built-in payment processing system, QuickBooks Payments, compare to the rest of the payment processing competition?

What is QuickBooks Payments?

QuickBooks Payments is a payment processing solution that is already integrated with QuickBooks making it easy for business owners to accept invoice payments without using a third-party payment processor. It is the most competitive and popular accounting software in the United States because of its intuitive interface and simplicity.

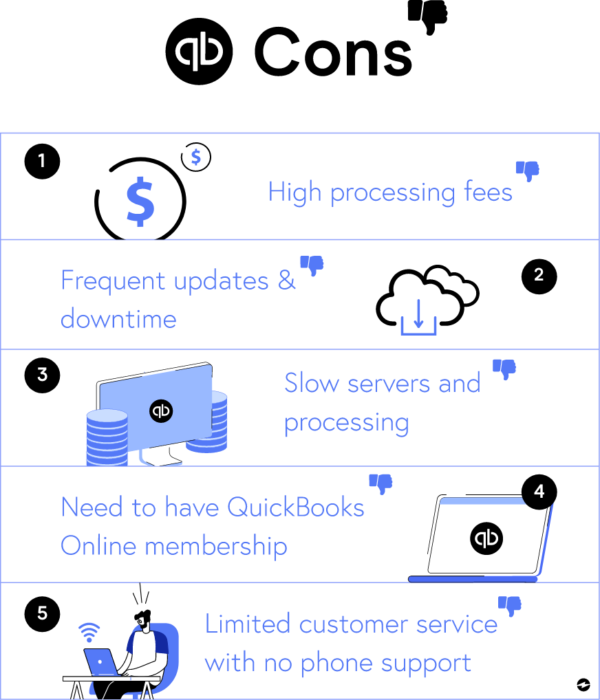

Cons of using QuickBooks Payment:

1. High Processing Fees

While it’s great that QuickBooks offers very transparent subscription and processing fees with no hidden fees, their fees are much higher than their competitors. Because of QuickBooks Payments convenience, customers have to pay the price for QuickBooks’ simplistic integrations.

Here are the fees associated with processing payments using QuickBooks Payments:

2.4% for swiped credit cards per transaction

2.9% for invoiced credit cards per transaction

3.4% for keyed credit cards per transaction

So, with convenience comes a price. There is an abundance of other payment processing solutions if these fees don’t seem worth it for your business.

2. Frequent Updates and Downtime

While frequent updates are generally a good thing when considering the level of security for accepting payments, many users agree that QuickBooks Payments has too many updates, which leads to a large amount of downtime.

As a business owner or accountant, your time is extremely valuable, so having to spend even a fraction of your time waiting for your software to update is quite frustrating and unproductive.

3. Slow Servers and Processing

As mentioned previously, QuickBooks is the most competitive and popular accounting software in the United States. With that said, thousands of individuals and companies are using QuickBooks Online fighting for bandwidth priority. This can cause the website to run slowly and have QuickBooks Payments process payments much slower than other payment processing companies.

Slow servers and processing could limit your ability to accept and process payments with QuickBooks. This could steer your customers away from paying online via QuickBooks Payments and possibly motivate them to take their business elsewhere.

4. Need to have a QuickBooks Online membership

According to Forbes, the only way you can utilize QuickBooks Payments as a payment processor is by subscribing to a QuickBooks Online membership.

This is especially limiting if, for instance, you would like to use another accounting software but utilize QuickBooks Payments as a sole payment processor. If you are using QuickBooks Payments, it’s assumed that you are using QuickBooks as your main accounting software.

There is an abundance of other payment processing that give you the capability to work with most accounting ERP software while also allowing you to integrate with other types of programs as well. These will be discussed later in this article.

5. Limited customer service with no phone support

Forbes and Nerdwallet agreed that one of the largest drawbacks of choosing to use QuickBooks Payments is their inconsistent customer support. While QuickBooks does offer a live chat, customers complain that their response time and helpfulness are very inconsistent. On top of that, QuickBooks Payments doesn’t offer any phone support, so if you’re running into issues, your only option is online chat support.

Pros of using QuickBooks Payments…

1. Convenience

Since QuickBooks is the most popular accounting software in the market today, utilizing the payment processing software that is already built into the program is incredibly convenient. QuickBooks Payments allows you to autonomously accept payments for invoices directly from your QuickBooks Online account.

The thought of using a third-party payment processor is intimidating to some small business owners, so QuickBooks Payments provides you with an all-in-one solution to make it easy for you. It simplifies the process of accepting payments by allowing you to create and send invoices in the same place.

Business owners who are new or value convenience would benefit from using QuickBooks Payments because of its all-in-one integration into QuickBooks Online.

2. Familiarity

Businesses aren’t interested in spending a lot of their valuable time devoted to learning new software. So, since a majority of businesses are already familiar with QuickBooks, QuickBooks Payments is intuitive and built into QuickBooks already so the learning curve is minimal.

This familiarity with QuickBooks makes it difficult for businesses to choose another payment processing company over QuickBooks Payments. Not only is it a difficult choice for the business itself, but also for the customers who are comfortable and familiar with QuickBooks.

If you’re used to QuickBooks and familiarity is something you value, then QuickBooks Payments is a great option for your company.

3. Transparent Pricing

While QuickBooks Payments does have relatively high processing costs, they are transparent about how much these costs are. Since there are no hidden fees, transparent pricing builds knowledge and reduces uncertainty between QuickBooks and their customers. Customers know what to expect when the prices are clearly highlighted.

Since businesses already need to be using QuickBooks Online in order to use QuickBooks Payments, the processing costs are added to the monthly QuickBooks Online subscription. The specific costs will be discussed later in this article since they are associated with the cons of using QuickBooks Payments.

4. Extensive Software Integration

QuickBooks Payments is one of the best payment processing tools for software integration. It has over 650 popular business applications that QuickBooks Payments can integrate with. While there are many other competitors of QuickBooks Payments that have an abundance of integrations, it seems they fall short to the sheer number of integrations that QuickBooks Payments has.

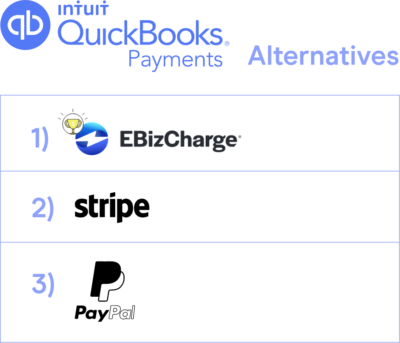

Alternatives to QuickBooks Payments…

QuickBooks Payments is clearly a convenient option for businesses and individuals already familiar with QuickBooks Online, but the cons outweigh the pros for using QuickBooks Payments as your payment processor. So what are some other options if the cons of QuickBooks Payments steer you away from using it?

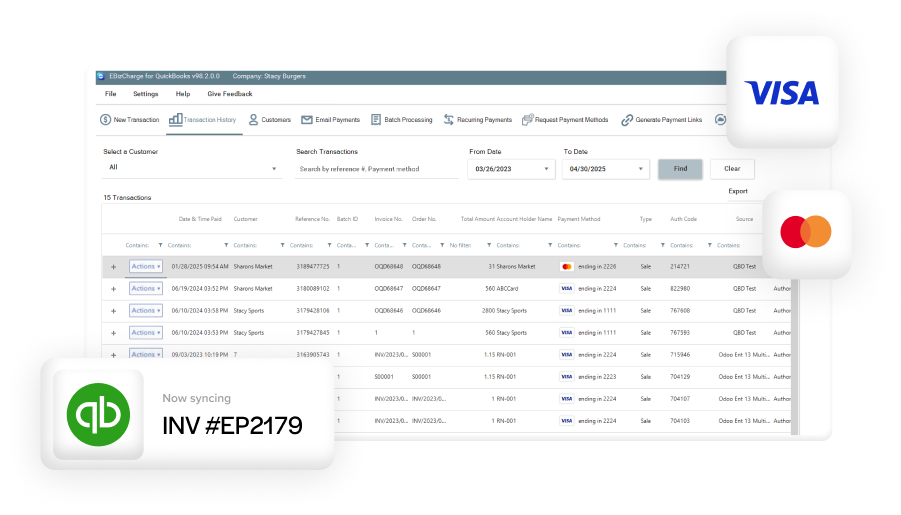

EBizCharge

EBizCharge is payment processing software that has many integrations into accounting ERP software, including QuickBooks Online & Desktop, Acumatica, NetSuite, Sage, and many other accounting, eCommerce, and CRM software. EBizCharge has many different payment methods allowing your customers to have the flexibility to pay off their invoices in a multitude of ways. With flexible costs and excellent customer service, EBizCharge is a great credit card processing alternative to QuickBooks Payments.

Stripe

Stripe is also a major contender in the payment processing world by specializing in allowing businesses to accept payments from mobile wallets and buy now, pay later services. Being such a popular option, Stripe supports payments in a variety of currencies worldwide. While Stripe mainly focuses on the eCommerce world for integration, they do have the capability to integrate with QuickBooks and other popular accounting software. Unfortunately, customers do often complain about Stripe’s poor customer service, so be wary when selecting Stripe as an alternative to QuickBooks Payments and other payment processors.

PayPal

PayPal is at the top of the digital payment processing environment. With roughly 360 million active users in over 200 countries, PayPal is the dominant payment processing company. Priding themselves on security, your company can feel secure accepting payments via PayPal. PayPal also has an abundance of integrations, including the most popular accounting and eCommerce software. One major downfall of using PayPal as your payment processor is that they have some of the highest transaction fees associated with accepting payments.

Is QuickBooks Payments the payment processor for you?

Taking into consideration the high processing fees and slow servers of QuickBooks Payments, you might be debating whether or not you should choose a different payment processor. Given the list of alternatives, it’s apparent that there are other excellent options out there, but it depends on what features you value the most for your business.

QuickBooks Payments is still an incredibly convenient and high-quality payment processor, but consider the alternatives before making a final decision on which payment processor you select.