Compare / EBizCharge vs. QuickBooks Payments

Meet the #1 alternative

to QuickBooks Payments.

Meet the #1 alternative to QuickBooks Payments.

Meet the #1 alternative to QuickBooks Payments.

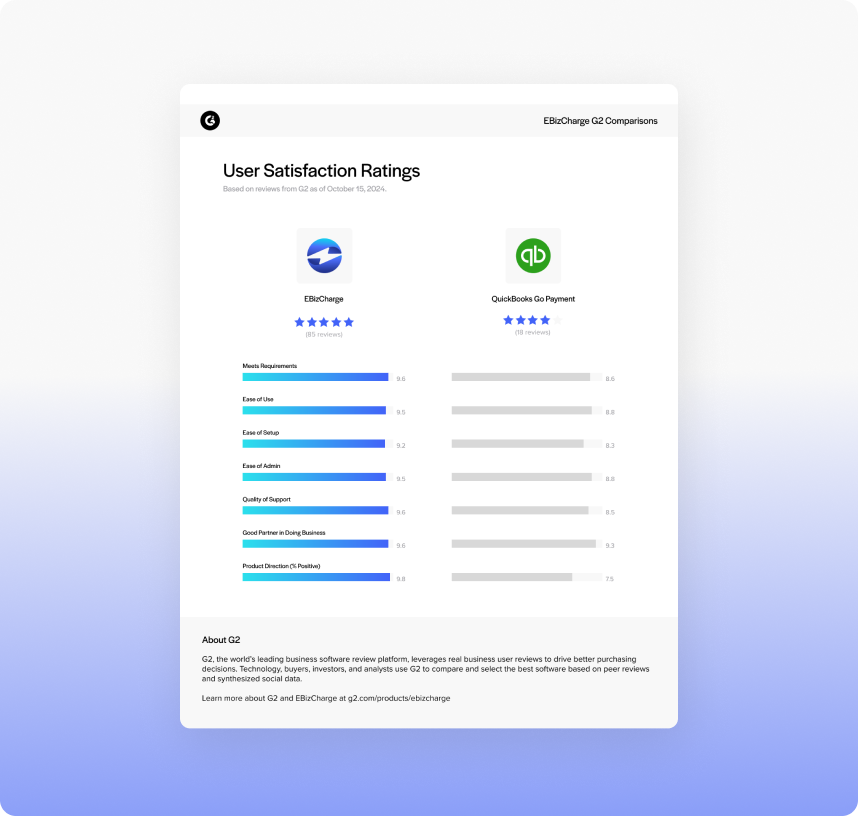

We guarantee cost savings compared to your current processing fees. Check out our satisfaction rating compared to QuickBooks Payments on G2Crowd.

We guarantee cost savings compared to your current processing fees. Check out our satisfaction rating compared to QuickBooks Payments on G2Crowd.

We guarantee cost savings compared to your current processing fees. Check out our satisfaction rating compared to QuickBooks Payments on G2Crowd.

EBizCharge utilizes tokenization and encryption to keep all your details 100% secure.

EBizCharge utilizes tokenization and encryption to keep all your details 100% secure.

Powering Payments for 400,000+ users

Works directly inside QuickBooks.

We integrate into your existing workflow.

Our features are created with you in mind.

Our features are created with you in mind.

Here are some of our favorite payment features that make customers love us.