Blog > SAP ECC Payment Integrations: 5 Critical Challenges and How to Solve Them

SAP ECC Payment Integrations: 5 Critical Challenges and How to Solve Them

If your business still runs on SAP ECC, you know how central it is to keeping daily operations moving. For many companies, ECC has been the backbone of enterprise resource planning for years. It’s stable, dependable, and packed with functionality. But as business models evolve and payment expectations shift, integrating modern payment processes into ECC can feel like trying to fit a square peg into a round hole.

That doesn’t mean it’s impossible—it just means businesses need to be prepared for challenges. SAP ECC integration can bring huge benefits, like faster cash flow, fewer reconciliation headaches, and a smoother customer experience. At the same time, if it’s not done thoughtfully, payments can turn into one of the most frustrating parts of your financial workflow.

This article walks through five of the biggest challenges companies face when dealing with SAP ECC payment integrations, and—more importantly—how to solve them. By the end, you’ll have a clearer picture of what’s holding many businesses back and how the right approach (and the right payment processing solution) can make all the difference.

Challenge 1: Complex System Architecture

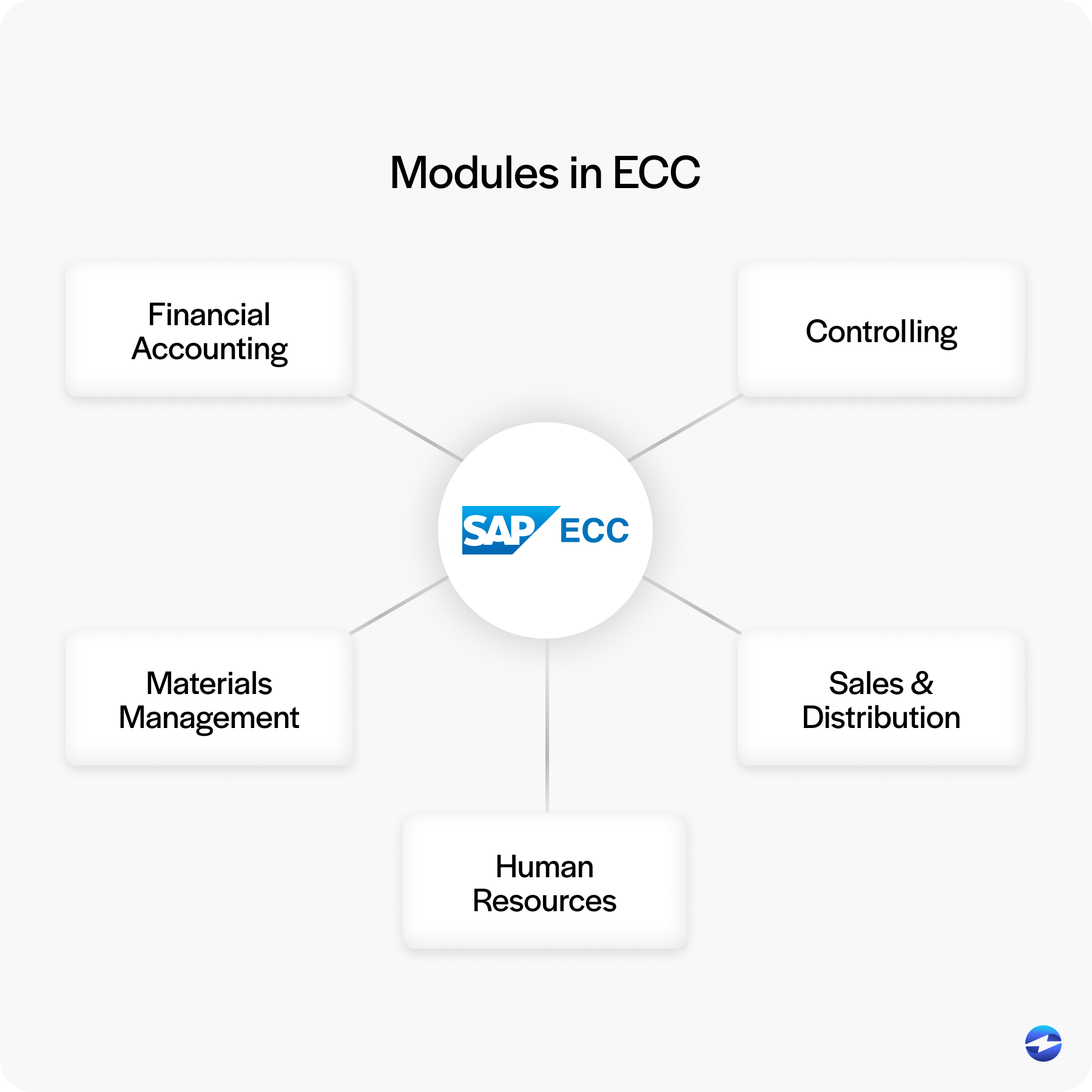

Anyone who has worked with ECC knows it’s not exactly a lightweight program. The SAP system is modular by design, which makes it powerful but also complicated when it comes to integration. Payments don’t just sit neatly in one place. They may touch the FI (Financial Accounting) module, flow through SD (Sales and Distribution), and even connect with MM (Materials Management). That overlap is part of ECC’s strength but also creates integration headaches.

The solution starts with clarity. Businesses need to map out how payments are supposed to move through their SAP ERP environment. Where does a customer’s payment land first? How should it post in accounts receivable? Does it need to update the general ledger automatically? Taking the time to outline these paths makes it easier to design an integration that works instead of patching things together on the fly.

Equally important is using proven tools designed for SAP ECC integration rather than trying to build everything from scratch. This not only reduces risk but ensures that the payment workflow fits naturally into ECC’s architecture instead of fighting against it.

Challenge 2: Limited Native Payment Options

When ECC was originally built, businesses weren’t juggling digital wallets, ACH transfers, or online credit card payments the way they are today. Out of the box, ECC isn’t set up to support many of the modern payment processing solutions customers expect. That leaves finance teams scrambling to add workarounds or patch together third-party tools.

Customers want flexibility. Some prefer to pay with a card. Others rely on ACH. More still want self-service portals where they can manage their invoices without calling in during office hours. Without integration, ECC can feel stuck in the past.

The fix is to extend ECC’s reach with a third-party payment processor that specializes in modern methods. These integrations allow companies to keep using ECC as their core SAP software while expanding the payment options available to customers. Instead of working around ECC’s limits, you’re upgrading its capabilities to match today’s standards.

Challenge 3: Security and Compliance

Processing payments isn’t just about moving money—it’s about keeping sensitive information safe. Businesses using ECC face the same PCI compliance requirements as anyone else, but integrating payments adds another layer of complexity. Handling cardholder data inside an older SAP system can feel risky if it’s not managed properly.

This is where built-in security measures like tokenization, encryption, and fraud monitoring come into play. Unfortunately, ECC doesn’t cover all of these on its own. The responsibility falls to the integration and the payment processor you choose.

The best way to address this is by selecting a payment processing solution that is already PCI compliant and adds those extra protections automatically. With the right integration, your SAP ERP environment can process payments securely without leaving your finance team worried about compliance gaps.

Challenge 4: Manual Processes and Reconciliation

Ask any finance team what slows them down, and chances are they’ll point to manual entry. Without proper SAP ECC integration, payments are often keyed in by hand, reconciled line by line, and double-checked against invoices. Not only is this time-consuming, but it also opens the door to errors. A mistyped amount or missed invoice can throw off your books and waste hours of cleanup.

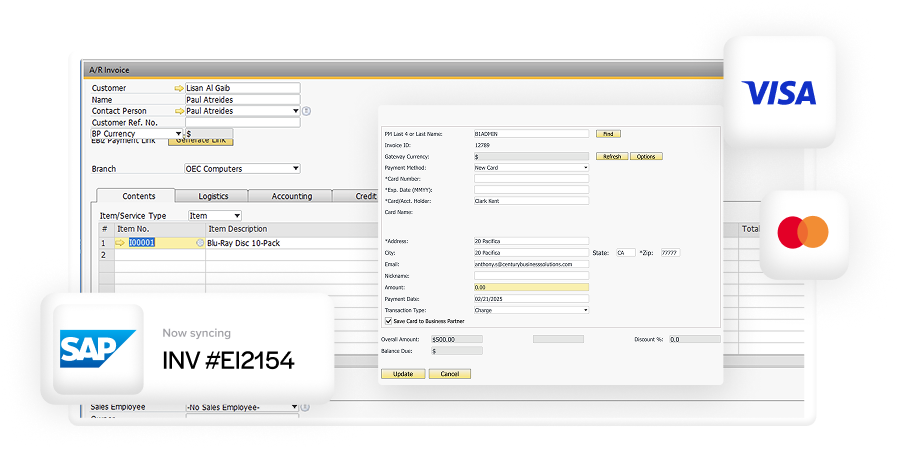

A well-designed integration with SAP billing software removes these manual steps. Payments are automatically posted into accounts receivable, invoices are matched in real time, and the general ledger reflects updates without delay. Finance teams no longer have to babysit the process; instead, they can spend their time analyzing trends and planning strategy.

This kind of automation doesn’t just save time—it reduces risk. When the SAP billing process runs smoothly with integrated payments, accuracy improves, and reporting becomes more reliable.

Challenge 5: Scalability and Performance

What works for a smaller business may not hold up once transaction volumes grow. Many companies running ECC today are processing thousands—or even millions—of payments each month. ECC itself can handle complex operations, but payment integrations that weren’t built to scale quickly become bottlenecks.

If every transaction has to be touched manually or goes through a slow posting process, growth creates exponential headaches. That’s not sustainable.

The solution is to look for integrations designed with scalability in mind. Some third-party payment processors—like EBizCharge—are built to scale as your volumes increase. That means whether you’re processing a handful of transactions a day or thousands, the system keeps pace. For businesses that want to stay competitive while still running ECC, scalability is non-negotiable.

Best Practices for Overcoming These Challenges

Knowing the challenges is one thing. Solving them consistently is another. Here are some practical steps that make any SAP ECC integration more successful:

- Start by cleaning up your data. Outdated or inconsistent records can cause major problems once payments start flowing automatically.

- Always test end-to-end. Run sample transactions to ensure postings hit accounts receivable and the general ledger as expected.

- Train your finance and IT teams. People need to understand how and why the integration works, not just how to click through screens.

- Keep monitoring performance. Use reporting tools to track how well the integration is working and adjust as your business evolves.

These steps might sound simple, but they go a long way toward ensuring your SAP ERP environment runs smoothly with integrated payments.

Why EBizCharge is a Strong Fit for SAP ECC

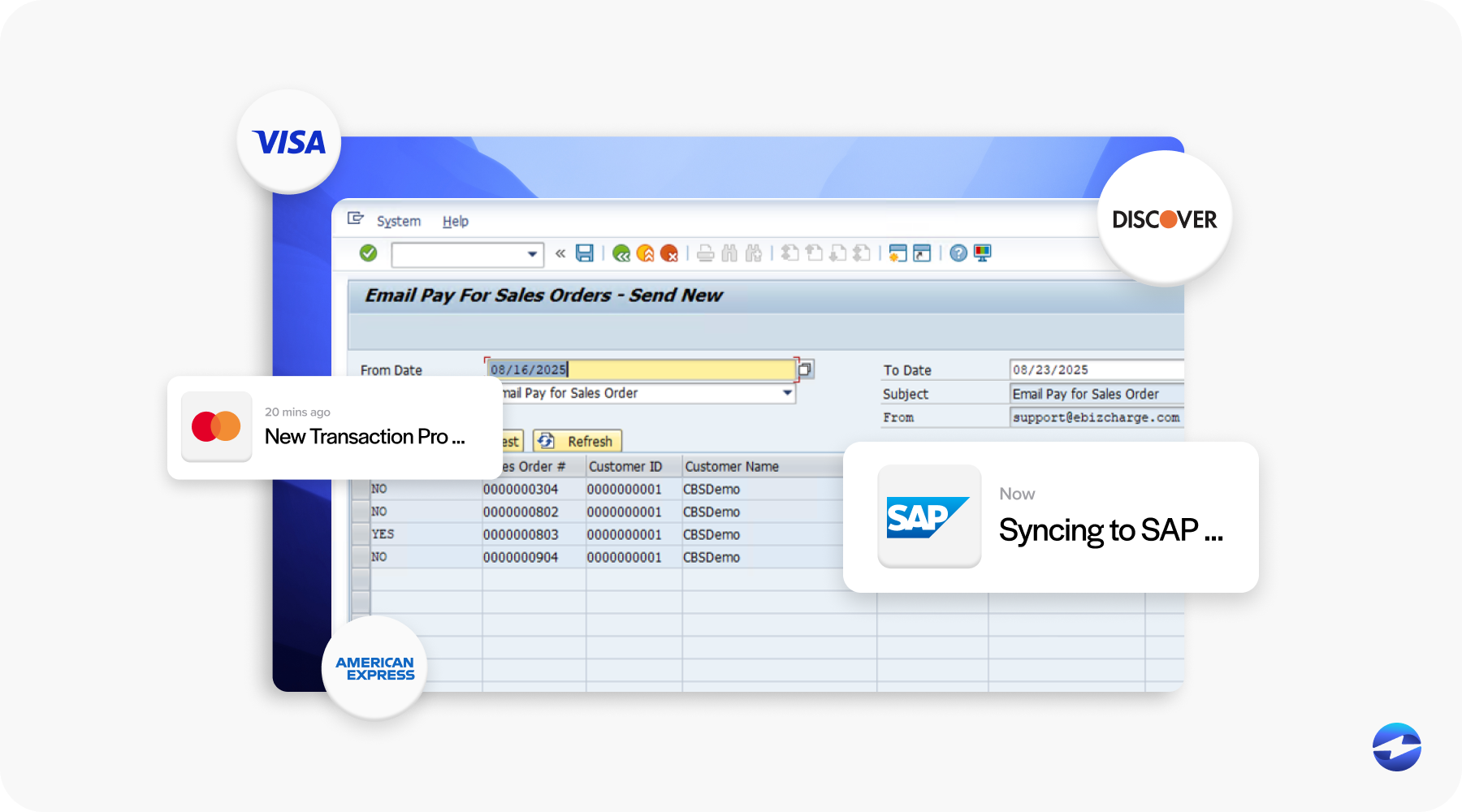

There’s no shortage of third-party payment processors out there, but not all of them are designed with ECC in mind. That’s where EBizCharge comes in. It integrates directly with the FI and SD modules, meaning payments are automatically posted where they need to go in accounts receivable and the general ledger. This drastically cuts down on manual work and improves accuracy.

On top of that, EBizCharge adds features ECC doesn’t offer on its own. Customers can pay invoices through secure online portals at their convenience. Finance teams get advanced reporting that makes it easier to track trends and forecast cash flow. Security is baked in with PCI-compliant safeguards, so sensitive data stays protected.

Perhaps most importantly, EBizCharge scales with you. As payment volumes grow, the integration grows alongside them, ensuring your SAP system remains reliable. For companies committed to ECC but ready to modernize their payments, EBizCharge is a practical, long-term solution.

Preparing SAP ECC for the Future of Payments

Integrating payments into SAP ECC isn’t always simple. The architecture is complex, native payment options are limited, and compliance requirements add extra pressure. Without proper integration, manual processes pile up and scalability suffers. But none of these challenges are impossible to overcome.

With thoughtful planning, the right payment processor, and integrations that align with your business needs, payment workflows inside ECC can be transformed from a burden into a strength. Whether it’s automation, security, or scalability, modern payment processing solutions like EBizCharge show that ECC doesn’t have to hold you back.

For businesses still relying on this tried-and-true SAP ERP platform, now is the time to rethink how payments fit into your strategy. Tackling these challenges head-on means not just keeping up with today’s expectations but preparing your SAP software environment for the future.