Blog > Maximizing Efficiency with Days Sales Outstanding (DSO): A Comprehensive Guide

Maximizing Efficiency with Days Sales Outstanding (DSO): A Comprehensive Guide

Since maximizing efficiency is vital for financial success nowadays, metrics like days sales outstanding (DSO) come in handy to help companies gauge their financial health.

Understanding and effectively managing DSO can significantly impact a company’s cash flow and overall financial stability.

This article will explore the intricacies of DSO, its importance, calculation methods, industry standards, contributing factors, and effective management techniques.

What is DSO?

Days sales outstanding (DSO) is a financial metric that measures the efficiency and effectiveness with which a company collects revenue from credit sales. It quantifies the average number of days a business takes to collect payment after a sale has been completed.

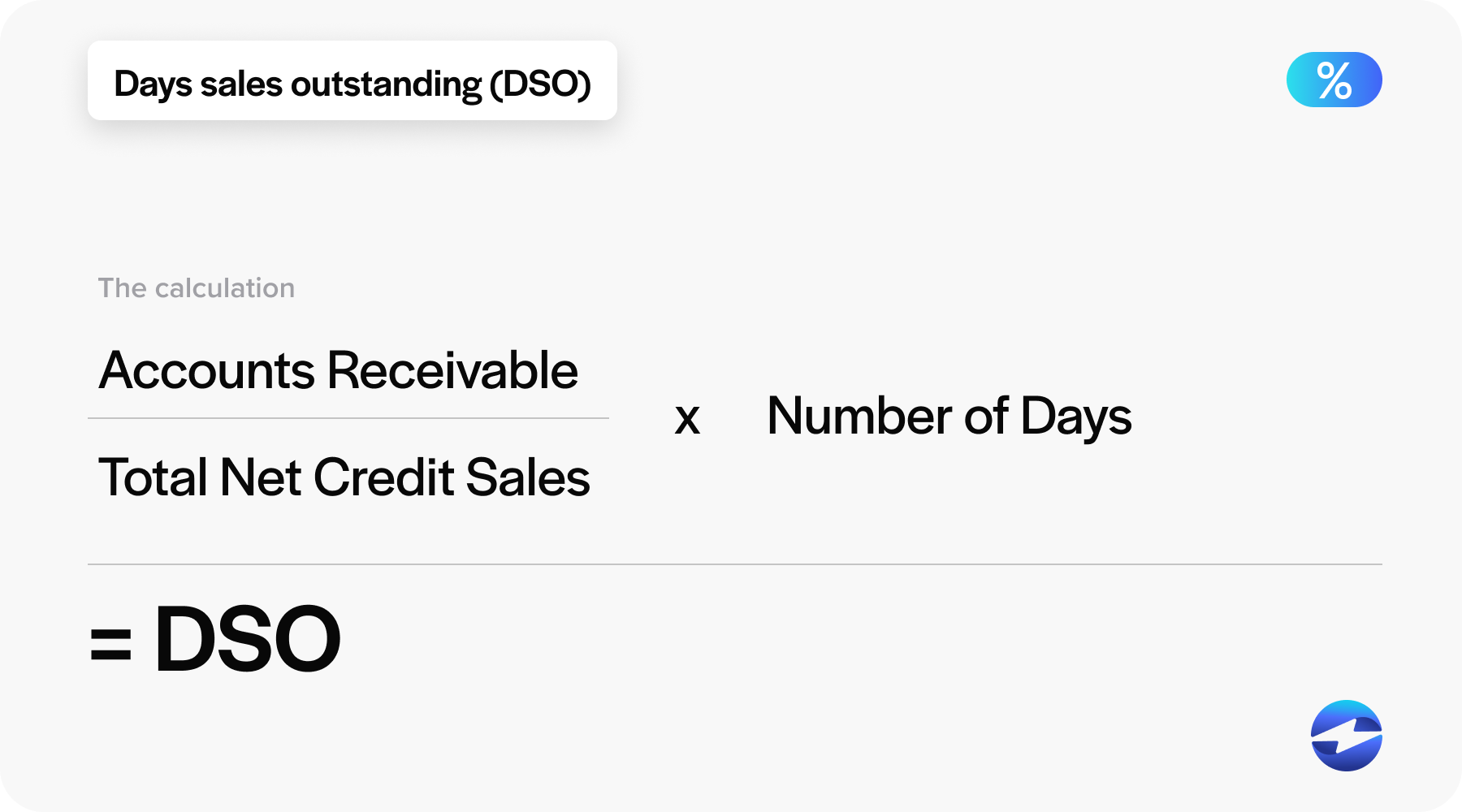

The DSO calculation formula involves dividing total accounts receivable (AR) during a specific period by the total net credit sales and multiplying the results by the number of days in the period.

A lower DSO indicates that a company can quickly convert sales into cash, signaling good receivable management and strong financial performance. Conversely, a higher DSO may suggest issues with cash flow management, collection efforts, or customer payment behaviors.

The significance of monitoring DSO

Managing DSO in a timely manner helps businesses maintain financial stability by ensuring that cash flows consistently.

DSO aids in preempting cash shortages and enables a company to meet its financial obligations, like paying suppliers or taking on new projects, without incurring debt.

Moreover, consistently monitoring DSO can highlight changing trends in customer payment behaviors, which can indicate potential bad debts. It can also inform the setting of payment terms and the development of collection strategies, improving overall financial performance.

Now that you understand the importance of monitoring DSO, you should familiarize yourself with the days sales outstanding formula needed to calculate it.

Methods for calculating DSO

Calculating DSO involves using the days sales outstanding formula, a straightforward yet essential equation that helps businesses understand the efficiency of their receivables collection process.

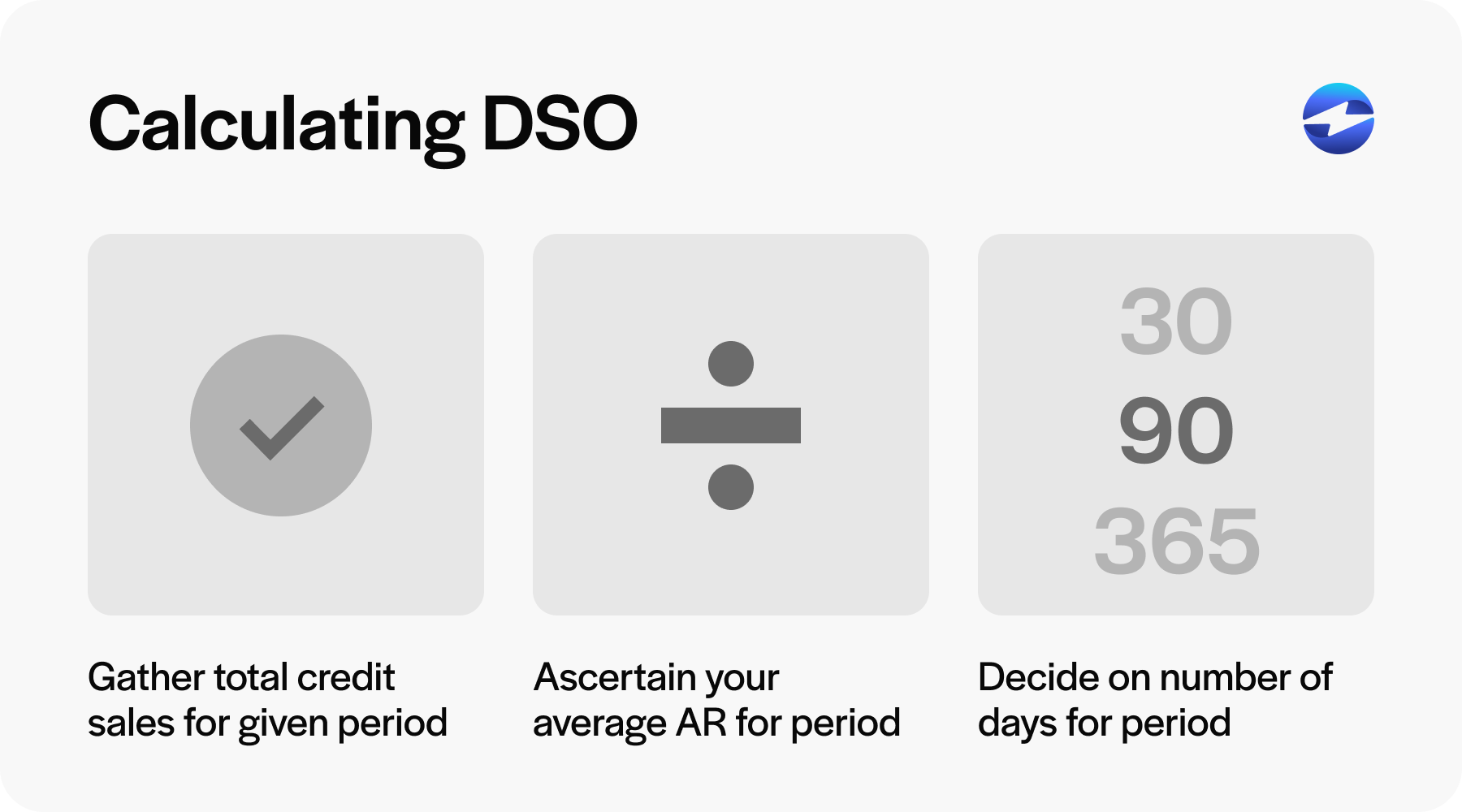

Here’s a practical step-by-step guide to calculate days sales outstanding:

- Gather your total credit sales for a given period (avoid using total sales to exclude cash sales).

- Ascertain your average AR for the same period. This involves adding the starting and ending AR and dividing it by two.

- Decide on the number of days in the period (usually 30, 90, 365).

Once you’ve collected this information, you can plug it into the DSO formula to compute the average number of days it takes a company to collect payment after a sale.

DSO = (Accounts Receivable/Total Net Credit Sales) x Number of Days

Businesses can also look to helpful tools to calculate days sales outstanding.

DSO calculation tools

Tools like the DSO calculator can simplify the process of measuring how quickly revenue is being converted into cash.

This specialized calculator facilitates the application of the DSO calculation formula by automating computations and offering instantaneous results. Such a tool often requires the user to input the average AR, total credit sale, and the time frame being analyzed.

Using a DSO calculator can reduce human error, allowing financial professionals to track their company’s performance more efficiently.

In larger companies with massive datasets, DSO calculators can integrate with their financial systems to process real-time figures, delivering updated metrics. Generating quick reports aids in internal analysis and presenting accurate data to stakeholders.

Now that you know how to calculate days sales outstanding and valuable tools to use, you can familiarize yourself with some best practices.

Best practices for calculating DSO

Following best practices for DSO calculation ensures the accuracy and consistency of financial metrics, which are critical for assessing a company’s liquidity and cash flow efficiency.

Here are a few best practices to keep in mind when calculating DSO:

- Regularly monitoring: Calculate DSO regularly, such as monthly, to track trends and address issues promptly.

- Segmentation: Analyze DSO for different customer segments or products to identify specific areas needing improvement.

- Improving collection processes: Implement efficient invoicing and follow-up procedures to reduce the time it takes to collect payments.

- Setting targets: Establish realistic DSO targets based on industry standards and business goals to drive performance.

Additionally, it’s important to use DSO alongside other metrics, such as the cash conversion cycle (CCC), to understand your financial position better. This ensures that you track the efficiency of receivables and how quickly your business can convert resources into cash, providing deeper insights into financial health and operational efficiency.

Now that you know some general best practices for calculating DSO, you should also understand what determines a good or poor DSO.

What is good DSO?

Understanding what constitutes a good DSO is essential for assessing a company’s receivables efficiency and financial standing.

A good DSO indicates that a company quickly converts its credit sales into cash, reflecting efficient cash flow management. While lower DSO values typically indicate a quicker collection process and robust cash flow management, they must be contextualized within industry norms and a company’s own credit policies.

While what constitutes a good DSO can differ by company, it generally means that a business appropriately manages its receivable processes, maintains consistent and on-time customer payments, and employs effective collection efforts that minimize bad debts and unpaid invoices.

Industry-specific DSO averages

DSO can vary significantly across different industries due to varying business models and credit practices. Therefore, comparing a company’s DSO to the average within its industry can provide meaningful context.

Below is a list outlining general industry-specific DSO averages to offer a comparative glance:

| Industry | Average DSO |

|---|---|

| Business services | 37 |

| Chemicals and allied products | 40 |

| Electronic and other electrical equipment & components | 43 |

| Fabricated metal products | 42 |

| Food and kindred products | 26 |

| Furniture and fixtures | 35 |

| Industrial and commercial machinery and computer equipment | 45 |

| Manufacturing: stone. Clay, glass, and concrete products | 45 |

| Miscellaneous manufacturing industries | 38 |

| Miscellaneous retail | 37 |

| Motor freight transportation | 55 |

| Paper and allied products | 42 |

| Petroleum refining and related industries | 30 |

| Primary metal industries | 32 |

| Printing, publishing, and allied industries | 43 |

| Transportation services | 52 |

| Wholesale trade – durable goods | 39 |

| Wholesale trade – nondurable goods | 32 |

Understanding industry averages can provide valuable insights into how your company’s receivables performance compares to others in the same sector. This knowledge helps in setting realistic goals, identifying areas for improvement, and ensuring your company maintains a competitive edge while managing its cash flow effectively.

6 factors that contribute to high DSO

High DSO can indicate several underlying issues within collection methods and financial operations.

Six factors that contribute to a higher DSO include:

- Inefficient receivable processes: Poorly managed invoicing systems and collection strategies can delay payment receipts.

- Flawed credit policies: Offering credit terms that are too lenient or not correctly aligned with industry standards can result in more extended collection periods.

- Customer payment behaviors: Customers with financial difficulties or those who tend to make late payments can adversely impact DSO.

- Bad debts: A high level of unpaid invoices results in a longer time to convert sales into cash.

- Inadequate communication: Insufficient communication with customers about payment terms and expectations can cause confusion and delays.

- Economic and industry factors: External factors such as economic downturns or industry-specific payment practices can affect the average DSO.

Addressing these factors through improved receivable management and communication can help reduce DSO, enhancing cash flow management and financial stability.

6 techniques to enhance DSO management

Managing and improving DSO is critical for enhancing a company’s cash flow and financial stability.

Here are six effective strategies for improving DSO:

- Invoice promptly and accurately: Ensuring invoices are sent immediately after delivering goods or services, with clear and correct details, reduces confusion and delays in payment.

- Clear payment terms: Establishing and communicating explicit credit terms and conditions helps set customer expectations and allows for consistent payment timelines.

- Customer credit checks: Assessing customers’ creditworthiness can preemptively address potential payment issues, adjusting terms as necessary for higher-risk clients.

- Efficient receivable processes: Streamlining AR processes via automation or dedicated software can accelerate collections and reduce human error.

- Regular communication: Maintaining open lines of communication with customers fosters stronger relationships and often leads to quicker payments.

- Early payment discounts and late payment penalties: Offering discounts for early payments incentivizes promptness, while penalties discourage delinquencies.

By implementing these strategies, businesses can effectively manage their DSO to maintain a healthy cash flow and financial stability.

Decrease your DSO with EBizCharge

Decreasing DSO is essential to improving payment collections.

Implementing powerful payment software like EBizCharge can significantly lower DSO by automating payment collections and AR operations.

EBizCharge accelerates payment cycles and improves cash flow by automating invoicing, offering multiple payment options, and integrating seamlessly with existing accounting systems. With its robust suite of payment solutions and collection tools, EBizCharge reduces the time spent on manual collections and strengthens financial stability, enabling better financial insight and resource allocation for future growth.