Blog > Unlocking Cash Flow Efficiency: Mastering the Cash Conversion Cycle for Your Business

Unlocking Cash Flow Efficiency: Mastering the Cash Conversion Cycle for Your Business

In the intricate dance of business finances, understanding the efficiency of cash management is paramount. Enter the cash conversion cycle (CCC), a metric often overlooked, yet pivotal in gauging the health and efficacy of your financial operations. Understanding the cash conversion cycle and its importance can be the difference between thriving and barely surviving in today’s economic climate.

So, how can the cash conversion cycle become a pivotal tool in evaluating and improving your business’s performance? From monitoring cash flow metrics to streamlining inventory management, there are actionable tips and strategies to improve your CCC.

What is the cash conversion cycle?

It’s important to understand where your money is at any given time to maintain a smooth operation. This is where the cash conversion cycle comes into play. But what exactly is the CCC?

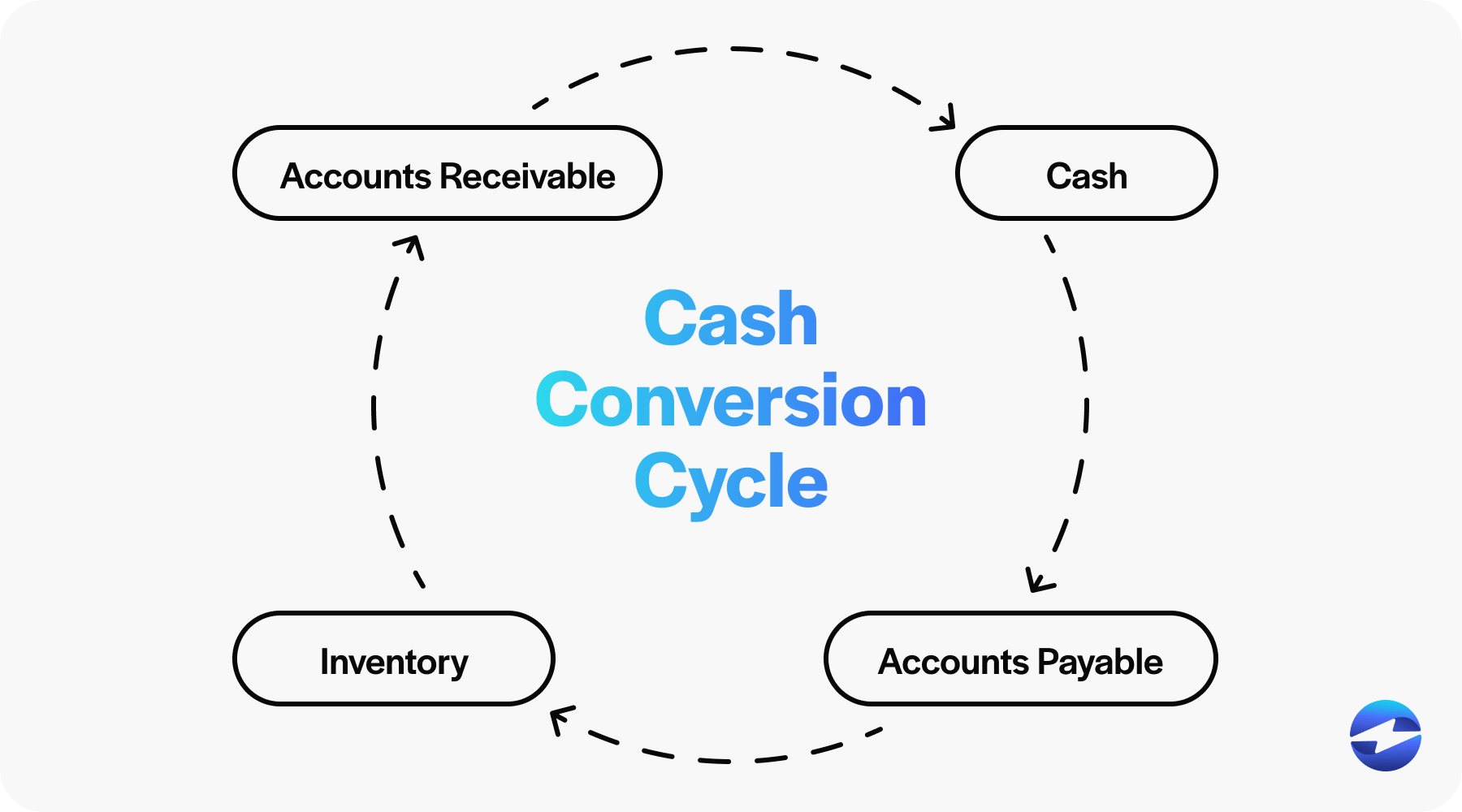

The cash conversion cycle is a fundamental metric that shows how long it takes for a business to convert its investments in inventory and other resources into cash flows from sales. In essence, it tracks the journey of cash from the moment it’s tied up in raw materials and inventory through the sales process until the final point, where the sale turns into actual cash in hand.

Why is the CCC important to understand?

Understanding a cash conversion cycle and its implications is vital for several reasons. First and foremost, it is an indicator of a company’s efficiency. A shorter cash conversion cycle suggests that a business can recover its investments quickly, reducing the need for additional funds to support operations. It signals that the business model and operational processes are working well, particularly regarding cash flow management.

Furthermore, understanding the CCC allows business owners to pinpoint areas where cash flow issues could occur. By dissecting the average time it takes to sell inventory (DIO), the average time it takes to collect receivables (DSO), and the average time the business takes to pay its bills (DPO), owners and managers can make strategic adjustments. For example, they might negotiate better credit terms with suppliers or hasten the collection of outstanding credit sales to improve their cash conversion cycle.

While it’s evident that understanding the CCC is important, it’s also crucial to know how to calculate the financial metric.

How the cash conversion cycle can help you evaluate performance

By optimizing the CCC, businesses can enhance operational efficiency, manage cash flow issues better, and, thus, improve their overall financial health. A negative cash conversion cycle is even more advantageous as it indicates that a company collects cash from sales before paying its suppliers.

Therefore, understanding the cash conversion cycle enables a business owner to make informed decisions about credit terms and inventory management to ensure the business operates smoothly.

How to calculate your CCC

To calculate your cash conversion cycle, you must follow a mathematical approach combining three essential business components. These are:

- Days Sales Outstanding (DSO): This represents the average number of days to collect payment after a sale.

- Days Inventory Outstanding (DIO): This measures the average number of days to turn your inventory into sales.

- Days Payable Outstanding (DPO): This indicates the average days your business takes to pay its bills and invoices.

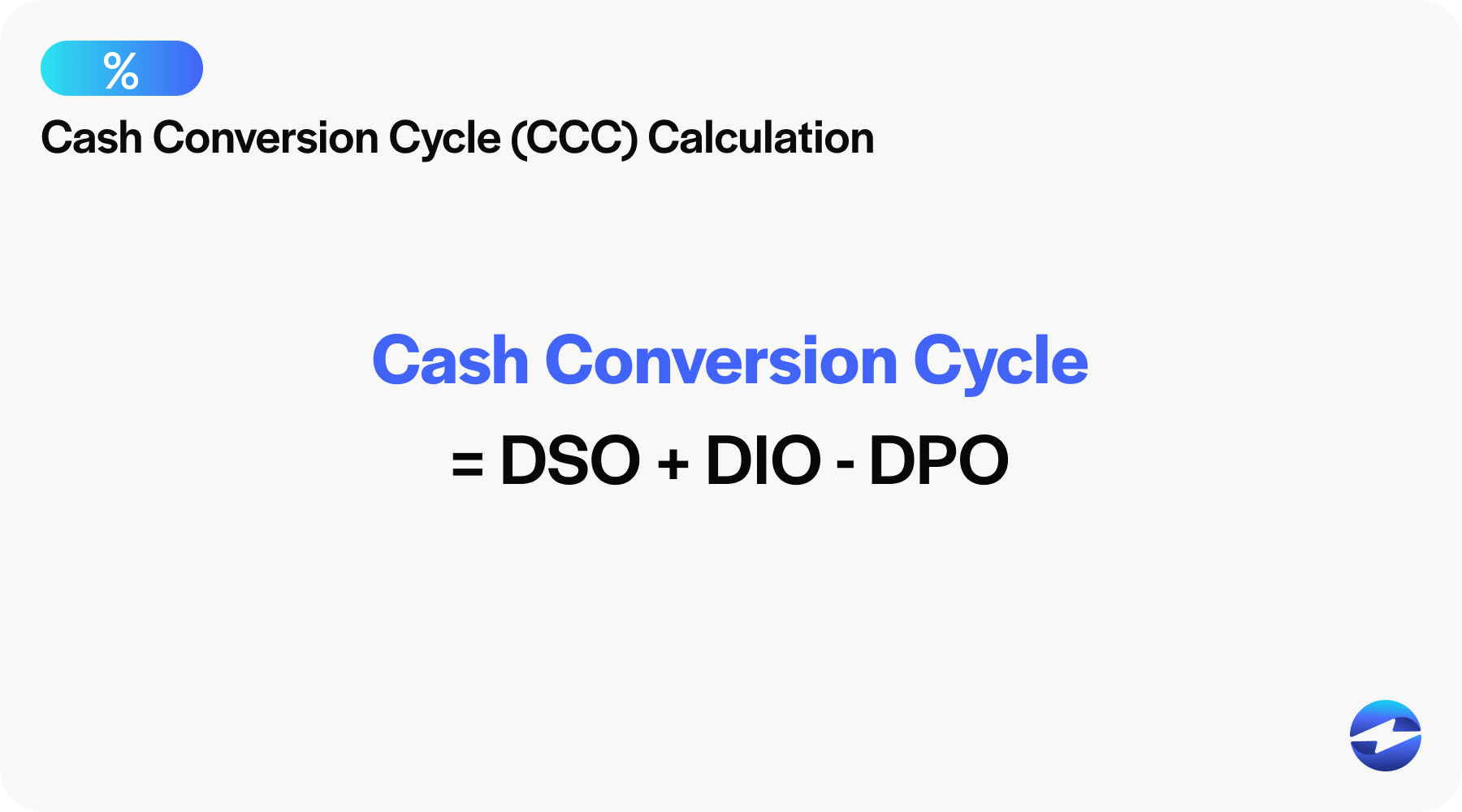

To find your CCC, add DSO and DIO and subtract DPO. The cash conversion cycle formula looks like this:

Cash Conversion Cycle (CCC) = Days Sales Outstanding (DSO) + Days Inventory Outstanding (DIO) – Days Payable Outstanding (DPO)

Remember, all these figures can typically be found in your business financial statements or accounting records. By plugging in the correct numbers, you’ll calculate the cycle time for your cash to travel through your business operation.

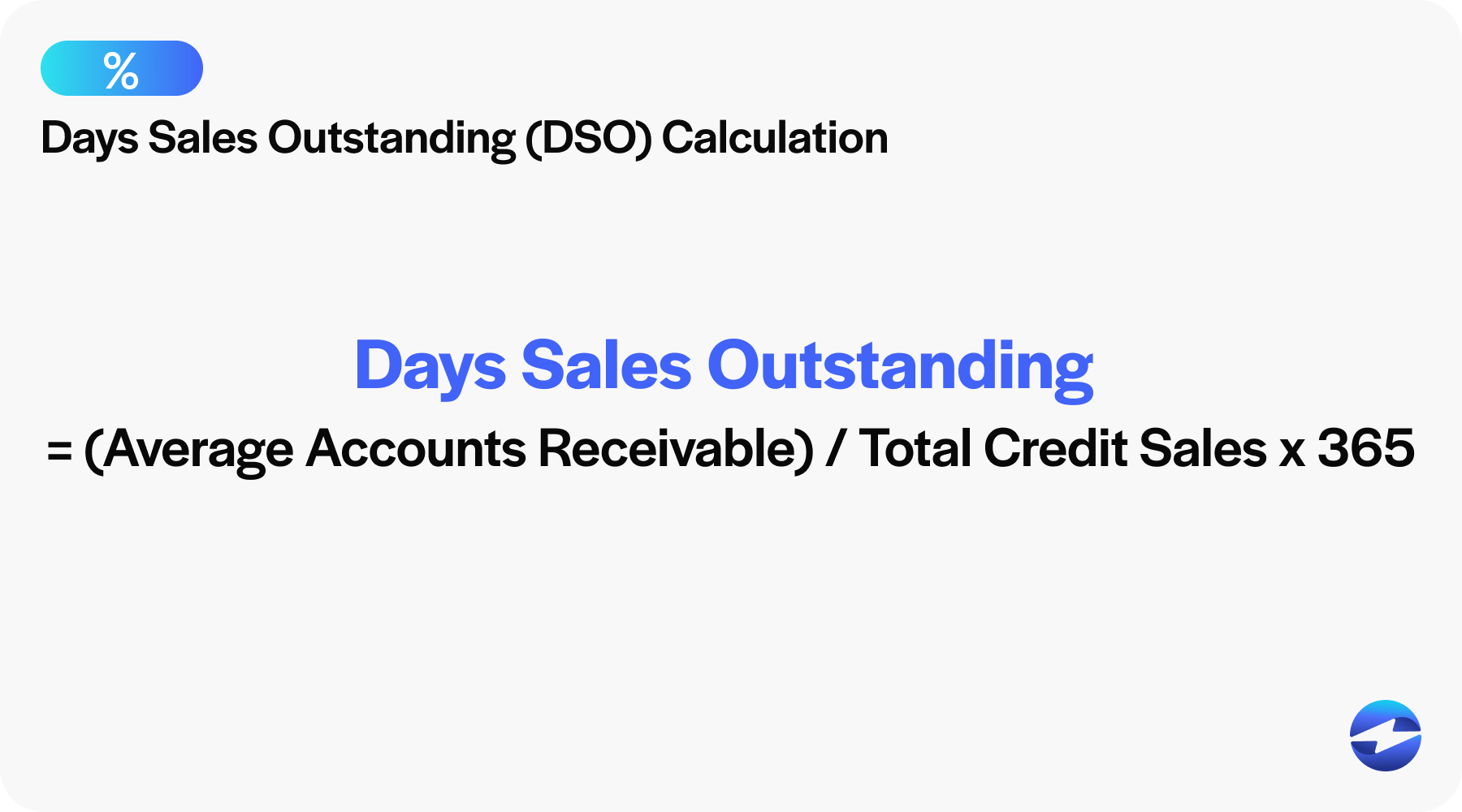

Days Sales Outstanding (DSO) formula

First, lets take a look at Days Sales Outstanding, commonly referred to as DSO. DSO is a crucial metric used to determine the average time a company takes to collect payment after a sale. It’s a key component of managing cash flow and integral to the cash conversion cycle.

In the formula, if the period is a year, it looks like this:

DSO = (Average Accounts Receivable / Total Credit Sales) x 365

For a shorter period, such as a month, it would be:

DSO = (Average Accounts Receivable / Total Credit Sales) x 30

A lower DSO number indicates that a company can convert credit into cash more quickly, essential for operational efficiency and financial health.

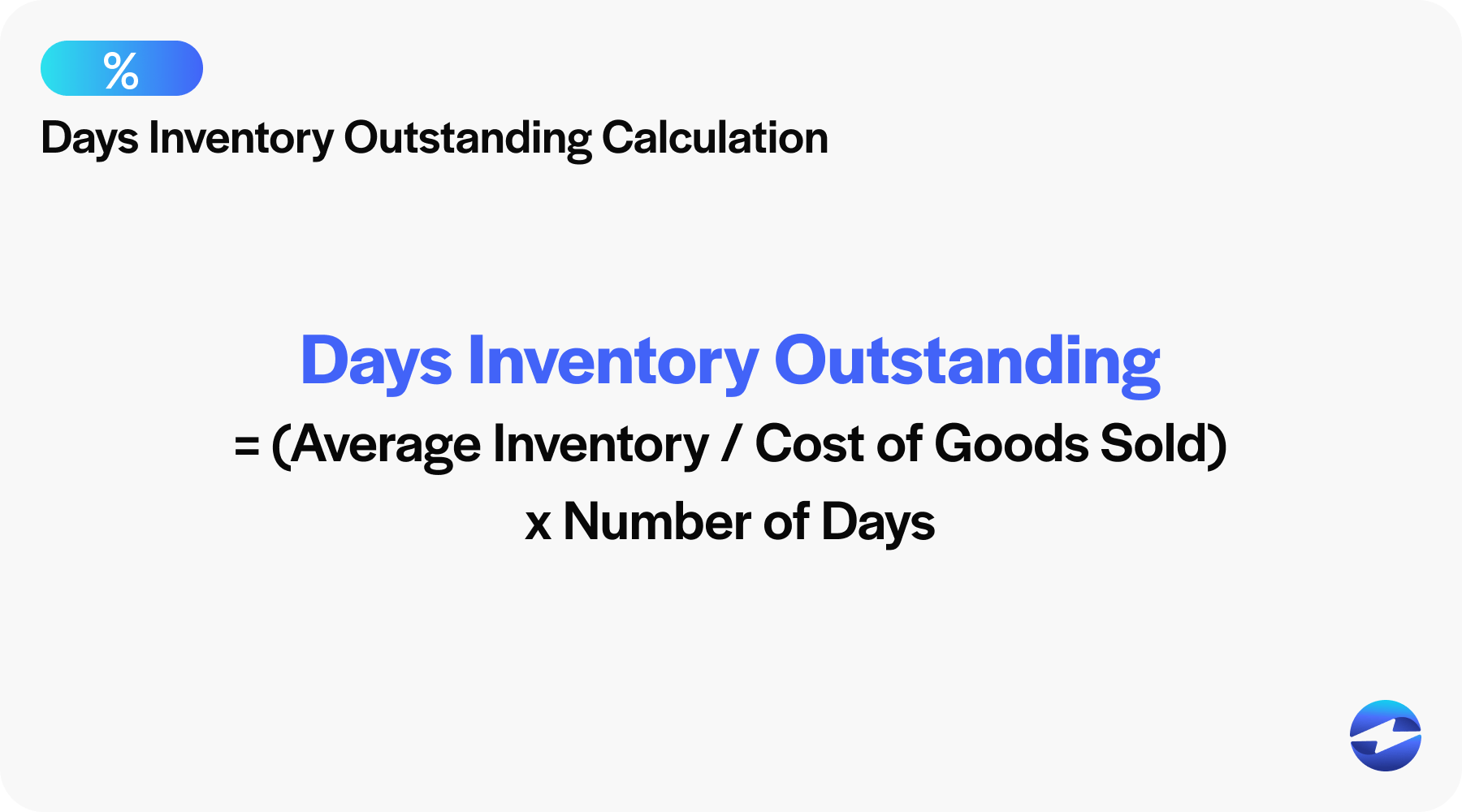

Days Inventory Outstanding (DIO) formula

The next piece of the puzzle is Days Inventory Outstanding, or DIO. DIO is a financial metric representing the average time a company holds inventory before turning it into sales. Understanding DIO is crucial for business owners in terms of cash flow management and operational efficiency.

Here is a simple breakdown of the Days Inventory Outstanding formula:

DIO = (Average Inventory / Cost of Goods Sold) x Number of Days

- Average inventory is calculated by adding the inventory levels at the beginning and end of a period and then dividing by two.

- The Cost of Goods Sold (COGS) reflects the direct costs of producing a company’s goods.

- The Number of Days generally refers to the number of days in the year, usually 365, for an annual calculation.

In practice, a lower DIO suggests that a business is more efficiently converting its investments in inventory into sales, indicating better performance and more rapid cash inflows. Conversely, a higher DIO may signal excessive investment in inventory, tying up valuable resources.

Keeping DIO short is essential for keeping the cash conversion cycle efficient, ensuring healthy cash flow for the business.

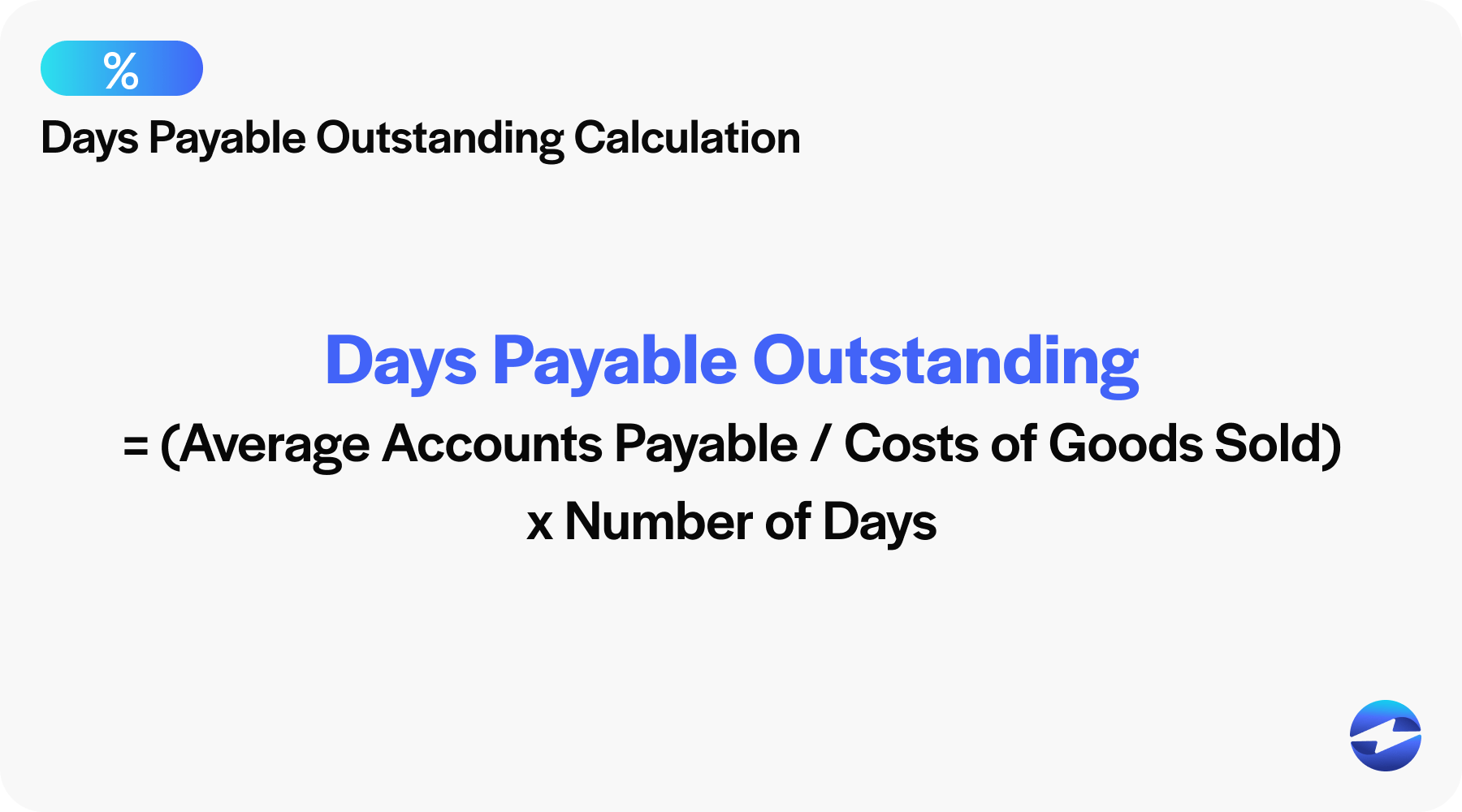

Days Payable Outstanding (DPO) formula

And lastly, Days Payable Outstanding, commonly known as DPO. DPO tells you the average time your business takes to pay its bills and suppliers. To calculate DPO, you can use the following formula:

DPO = (Average Accounts Payable / Cost of Goods Sold) x Number of Days

Once you have these figures, plug them into the DPO formula. A higher DPO can mean you’re using credit effectively, but a too-high DPO might strain supplier relationships.

What does a good CCC look like?

A good CCC is characterized by a low number, indicating that a business efficiently manages its inventory and receivables and effectively pays off its payables.

A shorter CCC can lead to less reliance on external funding to maintain daily operations, as you’re converting investments into cash sooner. This can be due to strong inventory management, proactive receivable collections, and well-negotiated credit terms with suppliers.

It’s a delicate balance that varies by industry, but generally, the lower the CCC, the better for cash flow and business operations.

What does a bad CCC look like?

In contrast, a high CCC suggests that a company takes more time to sell inventory and collect receivables or needs to be faster to pay its bills, holding up the cash that could otherwise be used to grow the business or address cash flow issues. This can tie up your business’s resources into long cash conversion periods, creating operational inefficiencies and potentially leading to cash flow problems.

A bad CCC may necessitate additional investments in cash flow to keep the business running smoothly, revealing opportunities for improvement in the business model and management strategies.

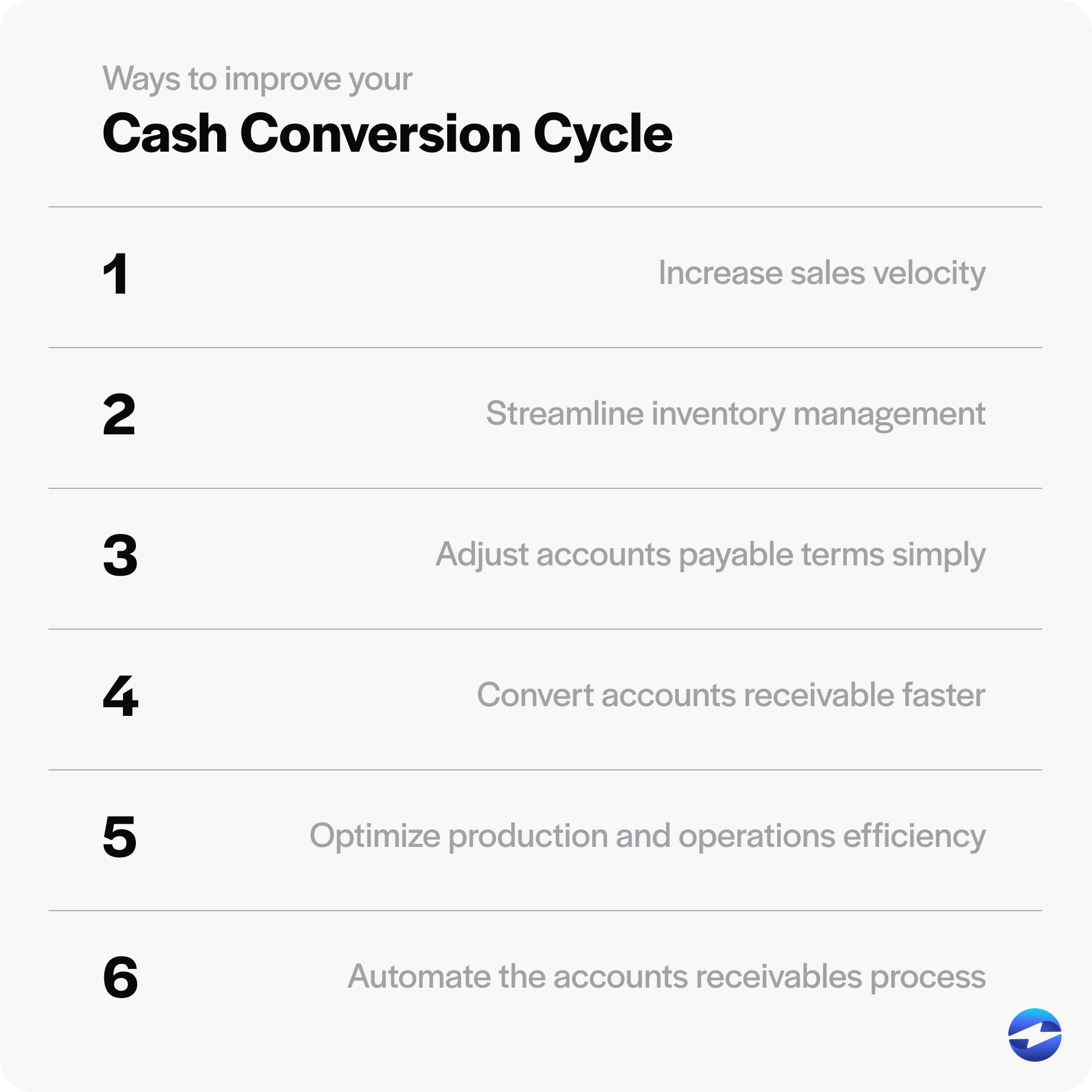

6 tips to improve your cash conversion cycle

Improving the cash conversion cycle is vital for a business’s liquidity and financial health. Here are six practical tips to help business owners manage their cash conversion cycle more effectively.

1. Increase sales velocity

Focus on increasing sales through targeted marketing efforts and sales strategies to generate revenue more quickly and shorten the cash conversion cycle.

Dedicating resources to targeted marketing efforts and strategic sales initiatives can significantly accelerate revenue generation and expedite the CCC.

2. Streamline inventory management

Aim to reduce the days inventory outstanding (DIO) by optimizing stock levels, avoiding overstocking, and implementing just-in-time (JIT) inventory management if it suits your business model.

Review your inventory turnover rates and identify slow-moving items that tie up cash. Streamlined inventory management means quicker conversion of investment in inventory to sales, positively impacting your cash flow.

3. Adjust accounts payable terms simply

Negotiate with suppliers for better credit terms to extend the days payable outstanding (DPO) without jeopardizing relationships or incurring late fees.

Striking a balance between taking advantage of credit periods and maintaining goodwill with suppliers can give you more breathing space to convert sales into cash before settling payables. Communicate transparently and establish mutually beneficial terms.

4. Convert accounts receivable faster

Analyze your accounts receivable to identify and address delays in payment collection.

Offer early payment discounts, enforce credit policies, and swiftly follow up on overdue accounts. Employ electronic invoicing and no fee credit card processing solutions to expedite payments, improving the days sales outstanding (DSO) figure.

5. Optimize production and operations efficiency

Assess your production process for bottlenecks and eliminate unnecessary steps.

Implement lean manufacturing principles to reduce waste and streamline the transformation of raw materials into finished goods. Doing so can speed up the cycle from investments in inventory to generating cash from sales.

6. Automate the accounts receivables process

Automating the accounts receivable process can significantly reduce the time needed to convert sales into cash. Utilize software that facilitates electronic invoicing, payment reminders, and direct payments. Automation reduces human error and improves operational efficiency, which can lead to a more favorable CCC. An efficient, automated system reduces the time spent on administrative tasks, and cash inflows are likely to accelerate.

By implementing these six tips, business owners can exert greater control over their cash conversion cycle, improving cash flow management and overall operational efficiency. While shortening the CCC is usually beneficial, it’s important to consider the unique context of your business operation to determine the most effective strategies.

How to use the cash conversion cycle in your business

Unlocking the potential of your financial operations begins with understanding and leveraging the cash conversion cycle.

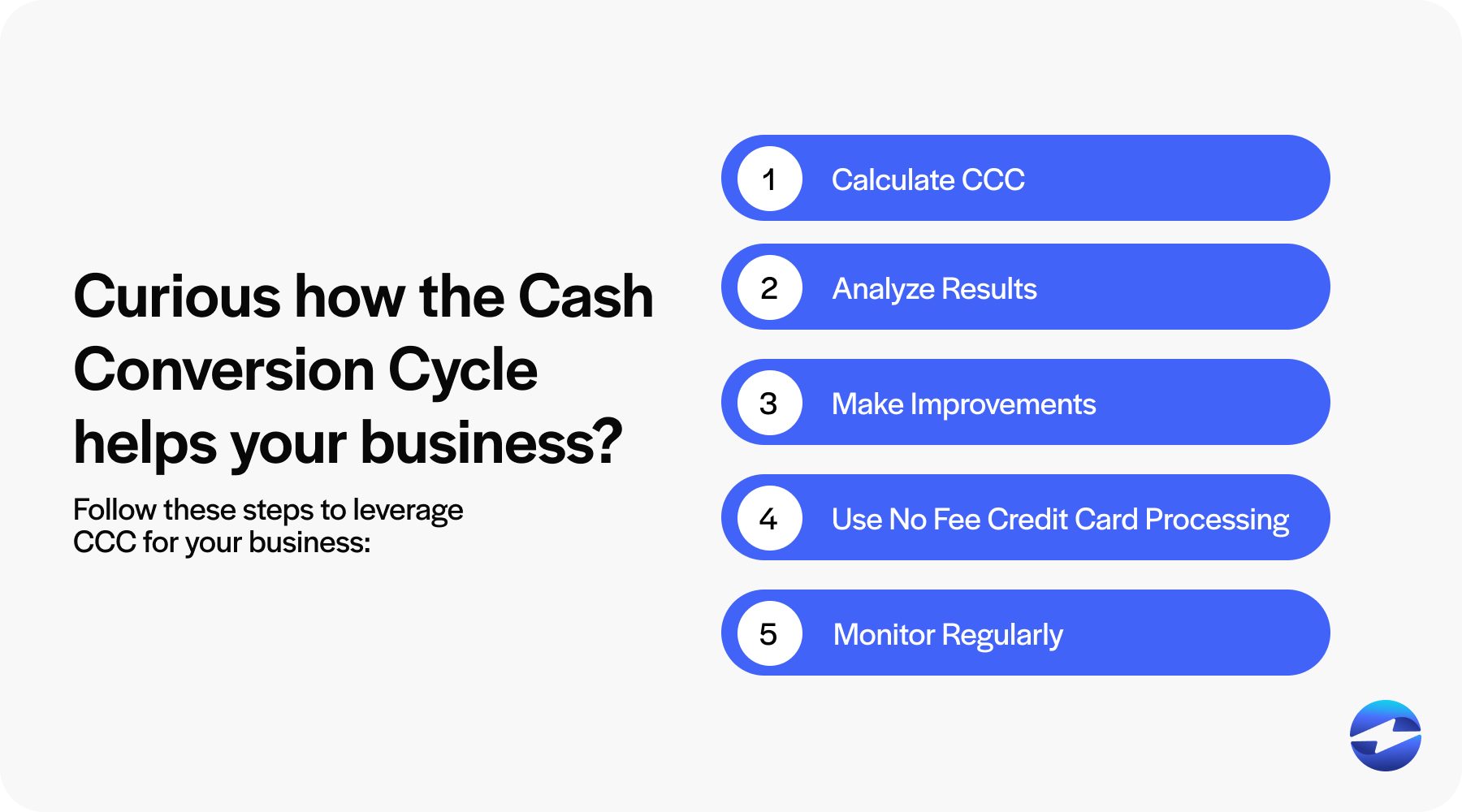

Here’s how to leverage the cash conversion cycle for your business:

- Calculate the CCC: Add your Days Sales Outstanding (DSO) and Days Inventory Outstanding (DIO). Then, subtract the Days Payables Outstanding (DPO). The formula looks like this: CCC = DSO + DIO – DPO.

- Analyze the Results: A shorter CCC indicates that your business quickly converts resources into cash flow. Conversely, a longer CCC suggests delays or inefficiencies.

- Make Improvements:

- Speed up your collection on credit sales to reduce DSO.

- Optimize inventory levels to lower DIO without hurting production.

- Extend payment terms with suppliers, where possible, to increase DPO.

- Use No Fee Credit Card Processing: By not charging customers extra fees, you encourage faster payments, thus improving your CCC.

- Monitor Regularly: Track the cash conversion cycle to spot trends and make necessary adjustments to preserve or improve your operational efficiency.

Employing these steps means better resource management, from raw materials to average inventory, and ensuring investments in inventory are turned into cash inflows swiftly.

Mastering CCC to increase the efficiency of your company

Mastering the cash conversion cycle is essential for the health and efficiency of your business operation. By knowing how to calculate the cash conversion cycle, you gain valuable insights into how long your company can convert its investments in inventory and other resources into cash flows from sales.

A shorter cash conversion cycle can indicate effective cash flow management, allowing quicker reinvestment or payment of obligations, thus creating a lean and agile business model. Remember, whether it’s reducing days sales outstanding, managing days inventory outstanding, or extending days payable without incurring fees, each component plays a vital role in operational efficiency.

By employing strategies that streamline each cycle stage—from purchasing raw materials to collecting receivables—you ensure that your resources are not tied up unnecessarily, preventing cash flow issues. For business owners keen on optimizing their business’s financial health, keeping a constant eye on and striving to improve the cash conversion cycle should be an ongoing priority.

Frequently Asked Questions

Frequently Asked Questions

Summary

- What is the cash conversion cycle?

- Why is the CCC important to understand?

- How to calculate your CCC

- What does a good CCC look like?

- What does a bad CCC look like?

- 6 tips to improve your cash conversion cycle

- How to use the cash conversion cycle in your business

- Mastering CCC to increase the efficiency of your company

- Frequently Asked Questions