Blog > Ten Steps to Reduce Days Sales Outstanding (DSO) and Improve Your Company’s Cash Flow

Ten Steps to Reduce Days Sales Outstanding (DSO) and Improve Your Company’s Cash Flow

What is DSO?

Days Sales Outstanding (DSO) is defined as the average number of days that it takes for an organization to collect payment for an invoice.

A higher DSO displays that a business is selling its products or services on credit and waiting a long time to actually collect the cash. On the other side, a lower DSO shows that a company is receiving the money sooner and can use that cash flow to invest in new ventures.

DSO (Days Sales Outstanding) is generally determined on a monthly, quarterly, or annual basis and is a key measure to determine the health of a company’s cash flow.

Why is it important to reduce DSO?

Since cash flow is an essential component for a company that allows them to pay its shareholders, it’s crucial to reduce DSO and the accounts receivable (AR) credit to increase the overall cash flow of the company.

The sooner a company receives the actual cash from a sale, the sooner that company will be able to invest in other opportunities and increase its financial position.

A high DSO can also lead to doubtful accounts, which is an accounts receivable with the potential to turn into bad debt.

The difference between DSO and DPO…

DPO stands for Days Payable Outstanding and is the DSO’s opposite. Instead of calculating the accounts receivable (AR) balance and credit sales, DPO calculates the accounts payable (AP) and the costs of goods sold. The formula for DPO is as follows:

DPO = Accounts Payables/Cost of Goods Sold x number of days in that pay period

How to calculate Days Sales Outstanding(DSO)…

DSO is calculated using the formula below:

DSO = Accounts Receivables Balance/Credit Sales x number of days in that pay period

For example, in the month of March, Bob’s Toy Shop sold $80,000 worth of toys, with $50,000 in accounts receivable (AR) on its balance sheet at the end of the month of March. Bob’s Toy Shop would have a DSO of:

DSO = $50,000/$80,000 x 31 days = 19.375 days sales outstanding

This example suggests that it takes Bob’s Toy Shop around 19 days to turn their accounts receivables (AR) into cash. Generally speaking, a DSO is considered favorable if it is under 45 days.

Here are the ten steps to reduce days sales outstanding (DSO) in accounts receivables (AR) and improve your overall cash flow…

1. Understand the data about your current DSO status

Attempting to reduce your company’s DSO and increase your cash flow, you need to have an understanding of your current DSO status by creating an analysis that shows how your company’s DSO levels compare to your competitors. As mentioned previously, it’s favorable to have your DSO levels under 45 days, so set goals to meet that standard.

Include your accounting and finance managers in the data analyzing process so they can cooperate with each other on discussing the DSO status and how to reduce it. By creating an environment where DSO reductions are a strategic priority, leaders within your company can emphasize the importance of DSO improvement tactics to the individuals in the company directly involved with invoice management.

In summary, your company should focus on DSO reductions that are realistic in regards to the data you gathered about your current DSO status.

2. Set goals that inspire long-term commitment with your new DSO policies

Before any of the next tips on reducing your company’s DSO, you should first create a plan and set goals that promote long-term adherence to your new DSO policies. Your company should get ready to make major administrative policy changes and communicate their significance to the rest of the team to make sure they update their business procedures as well.

One strategy for promoting long-term commitment to the new DSO reduction policies is to motivate cooperation between all of your company’s departments. Since their daily workflow will now include DSO reduction strategies, you’ll need to ingrain the importance of these new strategies by inspiring cooperation with each department.

Not only will these new policies improve your cash flow, but it will allow your departments to develop a comradery by having shared goals and projects.

3. Set clear customer payment terms

DSO metrics are largely determined by the payment terms set by the company to its customers. The payment terms determined by the company must be carefully selected to balance the company’s DSO goals as well as consider the needs of the customers. This suggests that your company needs to understand under what conditions your company will offer certain incentives to customers to receive payment quickly and increase your immediate cash flow.

Be sure to have clearly stated payment terms on your invoices to reduce any chance of confusion for the customer when the payment is to be expected. Your company should also be on top of outstanding invoices and constantly be communicating with customers about those invoices. To avoid this issue, make it as easy as possible for your customers to pay the invoice, offering many methods to do so.

4. Offer incentives

If your company isn’t already offering incentives to your customers to receive quicker payments, you might want to reconsider. Generally, if you want to reduce your DSO, you could offer an early payment discount. For example, if you send over an invoice to a customer to pay within 30 days, you could offer a ten percent discount if they pay within 10 days.

Incentives are an excellent method of motivating customers to pay their invoices early, but be sure that the invoice discounts don’t significantly damage your company’s revenue.

5. Carefully administer your accounts receivable

Once your company sends out invoices, you must develop a plan to deal with outstanding balances and create strategies to remind customers of these unpaid invoices. The focus of these strategies should be to identify the problems associated with the customer being prevented from paying the invoice. This could be an internal problem with your accounting and finance team, or it could be on the customer themselves.

You can administer and manage your accounts receivable in a multitude of ways. Here are a few of the ways to do so:

- Segregate duties to individuals in your company to create a set of standards for managing your accounts receivable.

- Analyze the risk of extending credit to your customer before choosing to do business with them.

- Make sure to have an efficient credit policy so customers understand the risks of not paying their invoices on time.

6. Understand a customer’s credit risks

DSO is highly dependent on your customers’ ability to pay their invoices in a timely manner. Therefore, when developing strategies to reduce your DSO and improve your cash flow, you must understand customer credit risk. Credit risk is the risk associated with having a customer who makes a purchase from you on credit and fails to pay that invoice. This will evidently obstruct your cash flow and reduce your profit.

Your sales team needs to understand the credit risks associated with particular customers so they don’t make a sale to an individual or business that has a history of credit problems. Therefore, your company should set strict credit guidelines so your sales team and managers know what is expected of your company.

7. Timely billing initiatives

An efficient method of reducing DSO is timely billing through fast invoicing, payment incentives, and abundant payment methods. To quickly send out invoices your company can automate the invoice process through unique programs, such as EBizCharge, that integrate with accounting ERP software. EBizCharge also has an abundance of different payment methods that give your customers the option to choose the easiest and best option for the invoice.

Within these accounting ERP software, your company can set clear payment terms and discounts to motivate your customers to pay on time and reduce DSO.

While timely billing does not always solve the issue of unpaid invoices, it does generally correlate with timely payments.

8. Observe your invoicing processes

Having an unprepared accounting team with inefficient accounting processes will also disrupt DSO and increase the time it takes to receive a payment from the customer. Therefore, to improve DSO in your company you’ll need to make sure invoices are being sent out on time, contain all the required information, and have no errors. By having your team double-check this process, you’ll understand where the issue of unpaid invoices is coming from.

In order to avoid unpaid invoices and DSO, your company should constantly update invoicing policies and make sure that your team is following the new policies.

9. Create better strategies for contacting customers about unpaid invoices

While it is unfortunate, there will always be customers of yours that don’t pay their invoices on time, or even at all. Organizing your team and developing a clear plan for these situations is crucial in your efforts to reduce DSO.

First, determine whether the unpaid invoice is the fault of your invoice processing. Then, if it isn’t, reach out to the customer politely without jumping to conclusions and ask if they had a chance to review the invoice.

Unfortunately, polite words will not always be effective for some customers, so you can take a more aggressive approach. If the customer refuses to pay the invoice, you can always add a late penalty fee to the invoice to motivate the customer to get on top of their overdue invoices.

While there are many different strategies for contacting your customers about unpaid invoices, be sure to pick the right one that is appropriate for the situation and to not jump to conclusions.

10. Keep up the long term momentum

Once your strategies on DSO reduction are set, you need to make sure that your departments have goals that allow your DSO levels to remain stable for the long term. Therefore, your company needs to be adamant in your efforts to ensure your company does not return to its old ways of handling DSO measures. By continuously scheduling meetings to monitor your DSO levels, individuals within your company will understand the importance of this matter and continue their efforts to lower DSO.

Reducing DSO requires a shift in habits within your company as well as changes in administrative policies and processes. So, company executives and leaders need to create an environment that allows these changes to be ingrained in their employees and motivate them to develop new DSO centric habits.

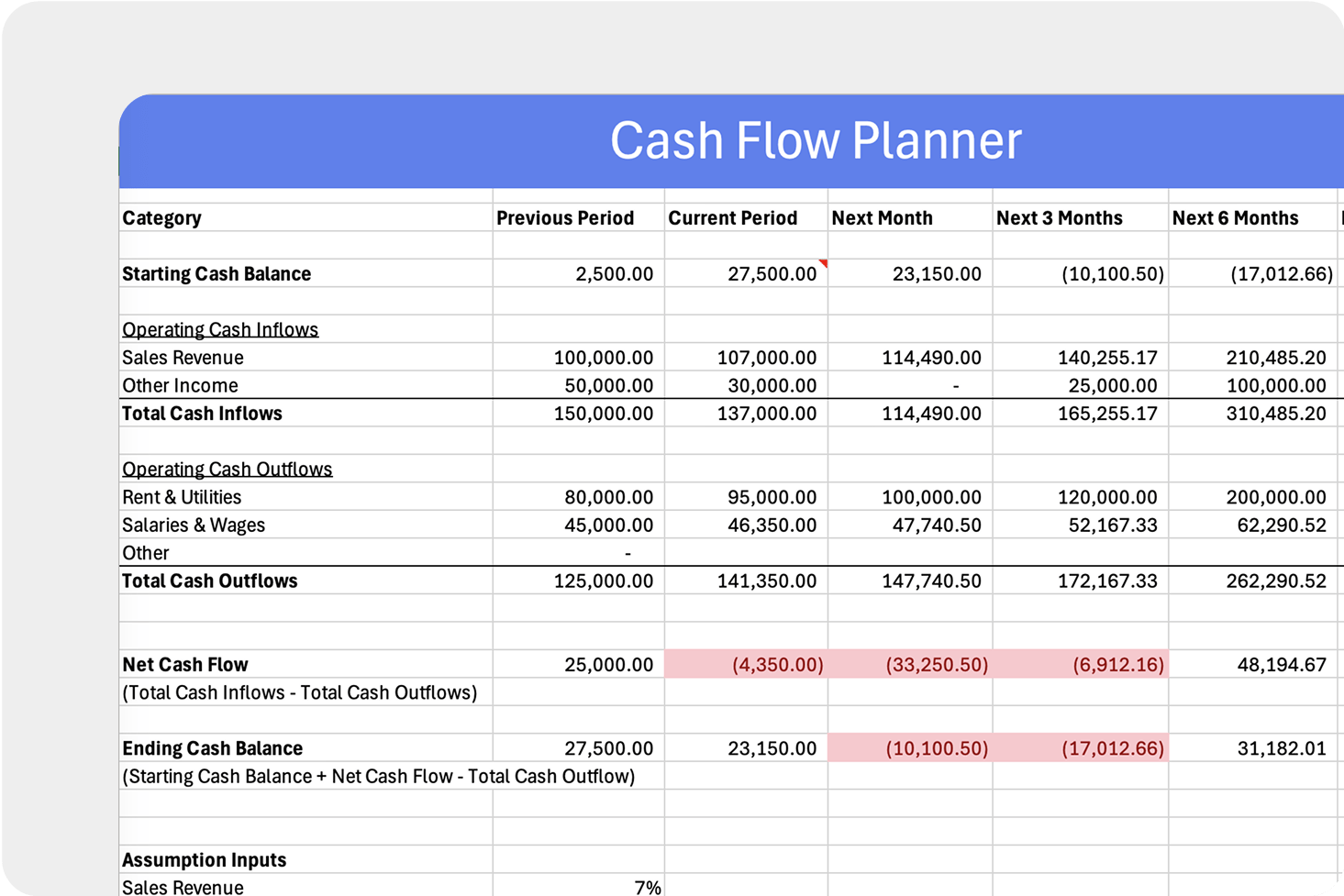

Improve your company’s cash flow by reducing DSO

Strengthening your cash flow by reducing DSO is an excellent way to allow your company to invest in new endeavors to further your economic growth. While it is seemingly straightforward, it takes a combined effort between your company’s executives and employees. Ingraining healthy DSO habits into each of your departments will allow you to reach efficient DSO levels and improve your cash flow.

Frequently Asked Questions

Frequently Asked Questions

Summary

- What is DSO?

- Why is it important to reduce DSO?

- The difference between DSO and DPO…

- How to calculate Days Sales Outstanding(DSO)…

- Here are the ten steps to reduce days sales outstanding (DSO) in accounts receivables (AR) and improve your overall cash flow…

- Improve your company’s cash flow by reducing DSO

- Frequently Asked Questions