Blog > Managing Accounts Receivable in NetSuite: Tips and Tricks to Handle Credit Card and ACH Transactions

Managing Accounts Receivable in NetSuite: Tips and Tricks to Handle Credit Card and ACH Transactions

Accounts receivable (AR) is a crucial component of any business, as it’s pivotal in transaction recording accuracy and providing critical insights into a company’s liquidity and financial health.

For enhanced customer payments and financial operations, merchants can sync their AR into popular systems like NetSuite, a cloud-based enterprise resource planning (ERP) platform to manage core financial, operational, and customer relationship processes in a single, integrated platform.

This article will explore the importance of AR management in NetSuite as well as best practices for effective management.

Understanding NetSuite accounts receivable

Accounts receivable are the funds customers owe for goods or services delivered but not yet paid for and are recorded as current assets on the balance sheet. AR can be an essential component of NetSuite’s financial management capabilities.

By centralizing AR data and automating processes in NetSuite, merchants can maintain more accurate records and streamline collections.

The NetSuite ERP system can sync with payment processing systems, offering a comprehensive solution for managing incoming payments directly inside this software.

Reliable NetSuite AR solutions can give users access to real-time reporting, automated invoicing, and seamless integrations that support various payment methods, such as Automated Clearing House (ACH) and credit card payments.

AR in NetSuite can also significantly improve the facilitation and management of card and ACH transactions.

How NetSuite-integrated AR platforms enhance card and ACH payments

NetSuite invoice processing enhances credit card payments and ACH transactions by streamlining operations, improving security, and increasing efficiency.

With NetSuite invoice processing, merchants can accept credit card payments directly inside NetSuite, reducing manual data entry and errors. This automation can also accelerate transaction approvals and reconciliation, saving time and resources.

ACH transactions also benefit significantly from accounts receivable services integrated with NetSuite. These solutions automate the processing of ACH payments, reducing the manual effort required to handle bank transfers and ensuring seamless reconciliation within NetSuite.

Additionally, most AR solutions for NetSuite offer full compliance with Payment Card Industry (PCI) standards to enhance data security, protect sensitive payment information, and reduce fraud risks.

NetSuite payment processors can also provide advanced reporting and analytics for users to gain better visibility into cash flow to optimize financial operations and make informed decisions.

Combining these features allows merchants to improve payment efficiency, reduce costs, and enhance the overall customer experience.

Overall, integrating effective payment systems into NetSuite can promote effective AR management, the importance of which can’t be overstated for financial operations.

The importance of accounts receivable management

Efficient AR management is essential to a company’s financial standing and overall success. Proper management ensures prompt payment collections, sustained liquidity, and achieved financial obligations.

Here are eight other reasons that outline the importance of AR management:

- Improves cash flow: Careful AR management ensures an efficient flow of funds to improve collection times, reducing outstanding invoices. This allows companies to have readily available cash for day-to-day operations and investments.

- Reduces bad debt: Effective accounts receivable management minimizes the risk of bad debts by setting clear credit terms and monitoring overdue accounts so businesses can avoid unpaid invoices. This helps to keep financial losses at bay.

- Optimizes working capital: Proper AR management helps optimize working capital by ensuring timely payments to give your business more cash. This allows you to manage expenses better and invest in more growth opportunities.

- Improves financial planning and forecasting: With predictable cash flows, businesses can forecast their financial needs accurately for more informed decision-making and strategic planning.

- Minimizes disputes and chargebacks: Efficient payment processing can mitigate disputes and chargebacks by implementing clear communication and established operations, thus avoiding discrepancies. This leads to smoother transactions and enhances customer satisfaction.

- Ensures compliance with financial regulations: Strong AR management will enable merchants to comply with financial regulations by enforcing accurate record-keeping and proper documentation. This keeps your business in good standing with financial authorities.

- Strengthens business creditworthiness: A well-managed accounts receivable process enhances a company’s creditworthiness. A business appears reliable by showing a track record of timely collections and low overdue accounts, which can aid in gaining favorable terms when seeking credit for customers or loans.

- Increases operational efficiency: Managing AR improves operational efficiency by streamlining payment collections with convenient payment methods and automated reminders, reducing time and errors for merchants. Businesses can shift their focus to more growth initiatives and customer satisfaction efforts.

Now that you understand the importance of efficient AR management, you should familiarize yourself with best practices for maintaining this efficiency in NetSuite.

11 best practices for managing AR in NetSuite

Efficient NetSuite accounts receivable processes can significantly improve cash flow, reduce payment delays, and lead to more long-term success for your company.

These 11 best practices will help you optimize your AR management in NetSuite:

- Automate invoicing and payment reminders

- Work with a reliable processor

- Use real-time AR dashboards and reporting

- Set up dunning management for overdue accounts

- Offer multiple payment options

- Regularly monitor AR aging reports

- Secure customer payment data

- Frequently reconcile AR transactions

- Establish clear credit policies

- Integrate AR with other NetSuite modules

- Ensure PCI compliance and NACHA regulations are met

1. Automate invoicing and payment reminders

Automating invoicing and payment reminders improves efficiency, reduces errors, and accelerates cash flow. By automating invoice generation, businesses ensure billing is accurate, timely, and consistent, minimizing the risk of missed or incorrect charges.

Automated payment reminders help reduce late payments by proactively notifying customers of upcoming or overdue invoices, decreasing the need for manual follow-ups. This improves collection rates and customer relationships by providing transparent and timely communication.

Automation also reduces administrative workload, allowing finance teams to focus on higher-value tasks while ensuring a steady and predictable revenue stream.

2. Work with a reliable processor

A seamless integration between NetSuite and a trusted payment processor allows businesses to automate invoice processing, accept multiple payment methods, and reconcile transactions in real-time.

A reliable payment processor can also provide a robust suite of payment collection tools and automation that reduce manual data entry, minimize human error, and enhance financial reporting accuracy.

By providing a seamless user experience, payment processors will enable merchants to accelerate their invoicing process while enhancing customer satisfaction.

3. Use real-time AR dashboards and reporting

With real-time data, finance teams can quickly identify overdue accounts, track payment performance, and make informed decisions to improve collection efforts. This level of transparency allows businesses to proactively address potential payment issues and prioritize follow-ups on delinquent accounts before they become significant financial risks.

Automated reporting features in NetSuite also help streamline reconciliation processes, reduce errors, and improve forecasting accuracy by offering insights into customer payment behavior.

4. Set up dunning management for overdue accounts

Dunning management allows merchants to systematically follow up with customers with overdue invoices by sending automated reminders, escalating notifications, and applying late fees when necessary.

This structured approach provides real-time insights to ensure past-due accounts are quickly addressed, reducing the risk of non-payment and minimizing manual collection efforts.

Implementing an effective dunning strategy not only improves AR efficiency but also strengthens customer relationships by maintaining clear and consistent communication regarding payment obligations. By firmly but politely prompting customers through the use of dunning letters, companies can reduce the involuntary churn caused by failed payments and help business owners keep delinquent accounts in check.

5. Offer multiple payment options

Various payment methods, such as credit and debit cards, ACH transfers or eChecks, digital wallets, and installment plans, enable businesses to cater to numerous customer preferences and encourage on-time or early payments.

With improved payment accessibility and automation, businesses can streamline payment operations while enhancing the customer experience for greater retention.

6. Regularly monitor AR aging reports

AR aging reports categorize outstanding receivables based on the amount of time they’ve been unpaid, allowing merchants to quickly identify delinquent accounts and take proactive measures to recover payments.

By regularly reviewing these reports, finance teams can detect potential revenue risks, adjust credit policies if necessary, and determine which customers require follow-ups or escalated collection actions.

With better visibility into payment trends and outstanding balances, your company can optimize its collection strategies, minimize bad debt, and maintain healthier finances.

7. Secure customer payment data

Implementing PCI-compliant security measures allows businesses to safeguard credit card and bank account details to prevent data breaches.

A reliable AR platform provides built-in encryption, tokenization, role-based access controls, off-site data storage, and more to secure payment data while allowing authorized personnel to process transactions efficiently.

Strengthening security builds customer trust, as clients feel confident that their payment data is protected.

8. Frequently reconcile AR transactions

Routine reconciliation enables your company to quickly identify discrepancies between recorded transactions and received payments to ensure alignment and more accuracy.

AR reconciliation verifies balances recorded in a company’s general ledger align with amounts owed by customers. This involves matching unpaid customer invoices with the corresponding entries in the general ledger to ensure consistency and accuracy in financial records.

A standard reconciliation schedule, such as weekly or monthly, promotes consistency in AR oversight.

Automated reconciliation tools enhance accounts receivable management by overseeing what were previously manual tasks to accelerate this process and eliminate errors.

9. Establish clear credit policies

Transparent credit policies will clearly outline terms for extending credit to customers to reduce bad debts, eliminate risks, and establish consistent credit extension guidelines.

Credit limits based on customer risk profiles manage exposure to bad debts.

Effectively communicating credit policies to customers can foster more brand trust and long-term customer retention.

10. Integrate AR with other NetSuite modules

By connecting AR with NetSuite modules such as accounting, order management, customer relationship management (CRM), and payments, businesses can automate invoicing, track payments in real-time, and ensure accurate financial reporting.

This integration eliminates manual data entry, reducing errors and saving time while providing a comprehensive view of customer transactions and payment history.

With synchronized data across NetSuite, businesses can improve cash flow management, enhance customer service, and maintain more effective accounts receivable processes.

11. Ensure PCI compliance and NACHA regulations are met

Compliance with PCI Standards protects credit card transactions and sensitive customer payment data by enforcing strict data security standards, including encryption, tokenization, and access controls.

National Automated Clearinghouse Association (NACHA) compliance governs ACH payments, ensuring secure electronic transactions and reducing the risk of unauthorized debits or fraud.

Working with a PCI-compliant payment processor, alongside NetSuite’s built-in compliance tools, will enable your business to automate security measures and reduce manual efforts while maintaining the integrity of financial transactions.

In addition to enforcing all these best practices for responsible AR management, finding a top-rated solution like EBizCharge is pivotal.

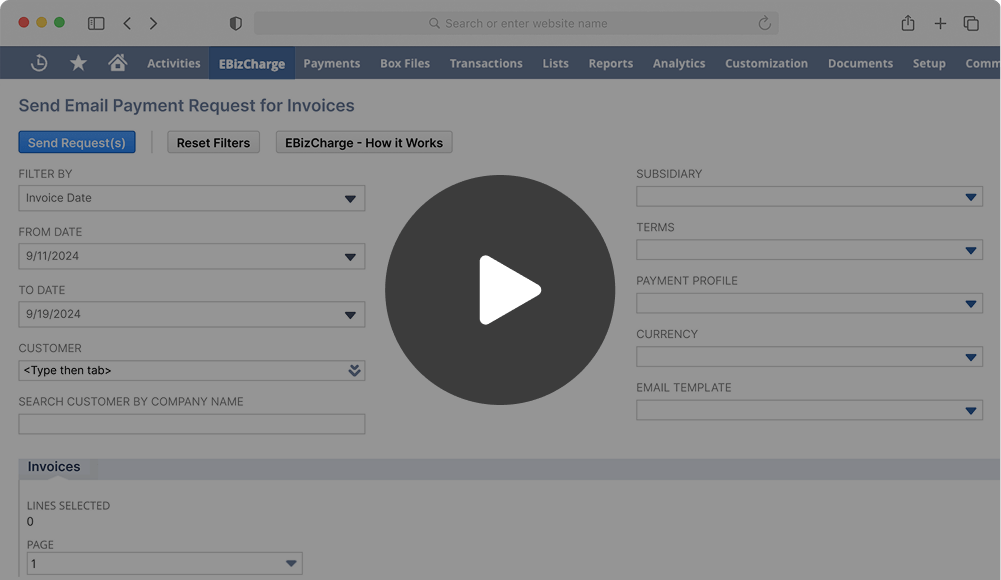

EBizCharge provides a powerful payment integration into NetSuite

The EBizCharge for NetSuite payment integration significantly improves and accelerates the accounts receivable processes with its all-in-one platform that manages payments in NetSuite, enabling businesses to securely accept credit, debit, and ACH/eCheck payments directly inside this ERP system.

With EBizCharge, merchants can leverage robust features, including automated invoicing, real-time reporting, and secure data handling. Its automated payment collection tools, such as scheduled recurring billing and payment reminders, ensure invoices are sent and followed up on without manual intervention. EBizCharge also offers real-time reporting and reconciliation for instant visibility into transaction statuses, outstanding balances, and cash flow.

The EBizCharge payment software is PCI compliant and provides advanced security measures like encryption, tokenization, off-site data storage, 3D Secure, and more to protect sensitive payment data and reduce fraud risks.

The EBizCharge for NetSuite integration also offers multiple payment methods and features like email pay, online billing portals, auto-pay, mobile pay, and physical terminals to simplify the AR workflow further.

By integrating seamlessly with NetSuite, EBizCharge empowers businesses to optimize customer payments while maintaining security, efficiency, and convenience.

FAQs regarding AR management in NetSuite

FAQs regarding AR management in NetSuite

- Understanding NetSuite accounts receivable

- How NetSuite-integrated AR platforms enhance card and ACH payments

- The importance of accounts receivable management

- 11 best practices for managing AR in NetSuite

- EBizCharge provides a powerful payment integration into NetSuite

- FAQs regarding AR management in NetSuite