Blog > Understanding the Purpose of Dunning Letters in Invoice Collections

Understanding the Purpose of Dunning Letters in Invoice Collections

Getting paid is the main objective for most businesses. However, when invoices go unpaid, dunning letters become necessary to help the collections process.

A dunning letter may seem like a relic of the past, but its purpose is deeply anchored in the present-day reality of managing receivables. So, what is a dunning letter, and why does it matter?

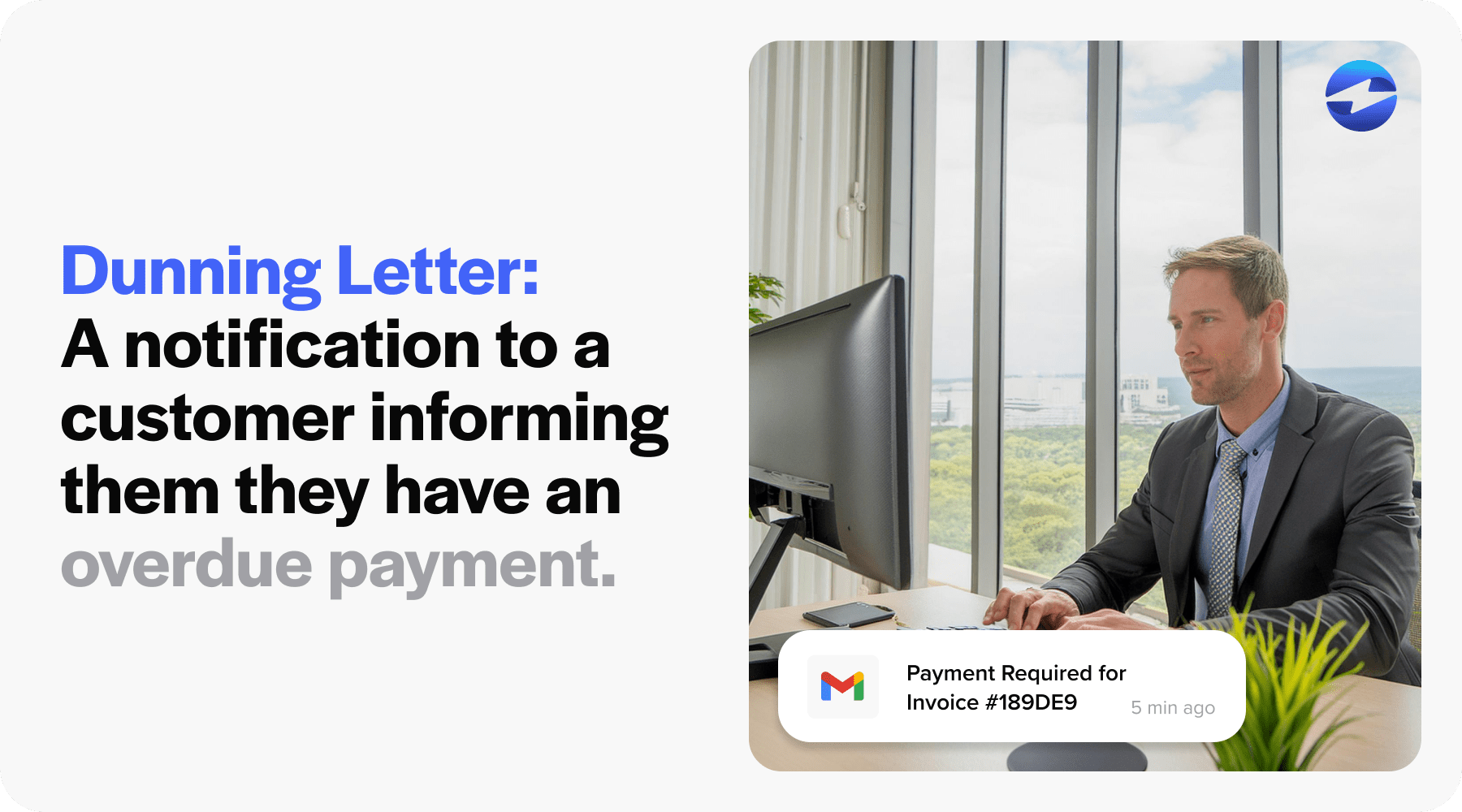

What is a Dunning Letter?

A dunning letter is a notification to a customer informing them they have an overdue payment. This communication is typically courteous and professional, serving as a reminder that the customer has an outstanding balance that must be settled.

The term “dunning” refers to methodically communicating with customers to ensure timely collection of amounts due. While the nature of these letters can seem intimidating, dunning letters are a standard procedure in accounts receivable management. These communications can take various forms; they might be physical letters sent through snail mail or electronic notices delivered via email.

While dunning letters seem like a straightforward concept, there are many other reasons why they are essential.

Why are Dunning Letters Essential?

Dunning letters play an integral role in managing a company’s cash flow. By reminding customers of their overdue invoices, these notices prompt action, either payment or initiating a conversation about the delay. This is particularly crucial for businesses involved in no fee credit card processing, where margins might be thin and timely payments are necessary for maintaining operational liquidity.

Dunning notices can reduce the involuntary churn caused by failed payments and help business owners keep delinquent accounts in check. By firmly but politely prompting customers, these letters can foster better customer relations and prevent overdue accounts from slipping through the cracks.

Customers with overdue accounts will be placed in the delinquent accounts category of customer payments.

What is a delinquent account?

A delinquent account is a financial term for a situation where debt payments are overdue. This can apply to credit card debt, personal loans, mortgages, and other forms of credit where payment has yet to be made by the agreed-upon due date.

In business, it often refers to unpaid invoices unsettled within the stipulated payment term. Delinquent accounts can lead to negative consequences for both the creditor and the debtor, potentially impacting credit ratings and leading to more stringent collection actions.

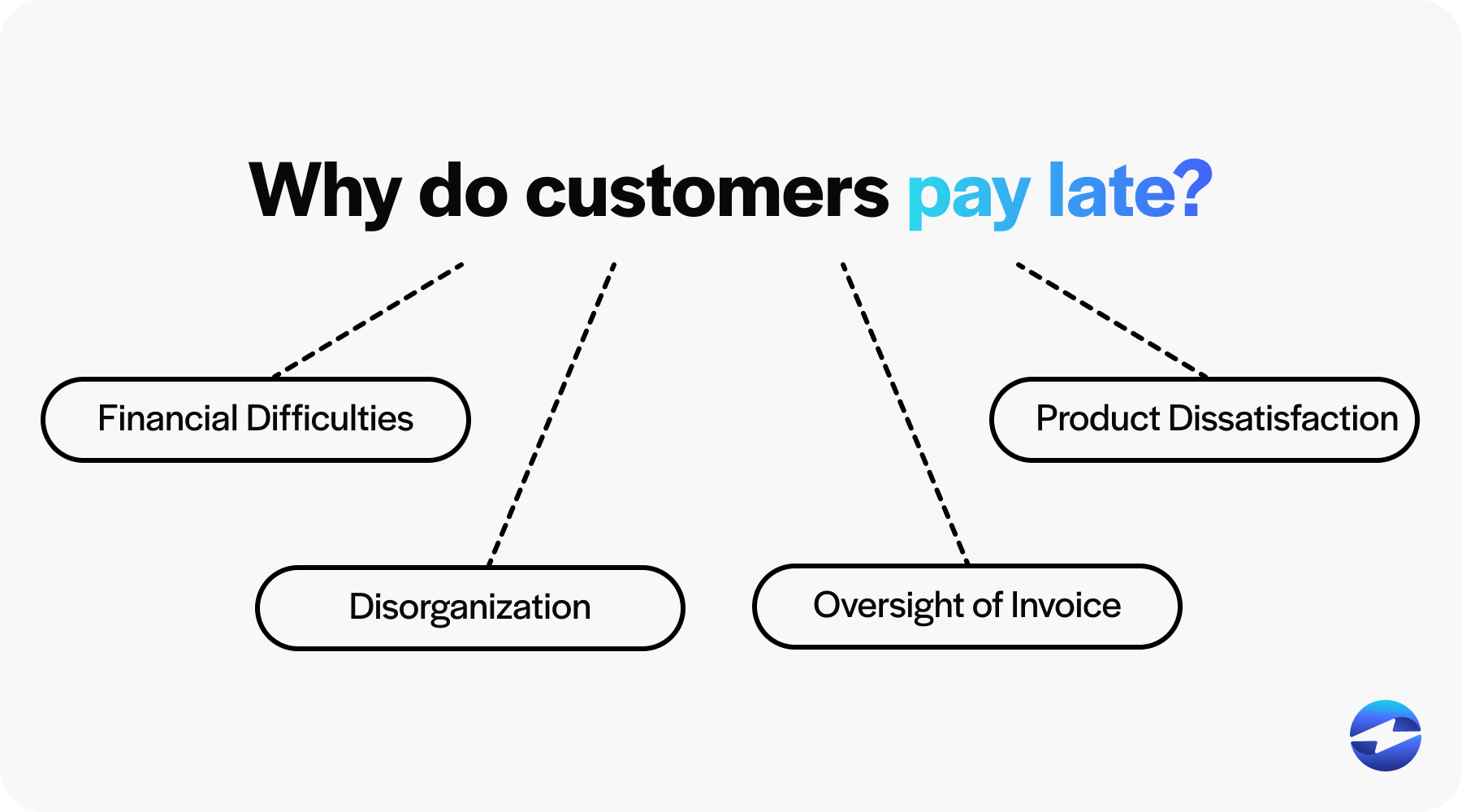

Why do customers pay late?

Customers might pay their invoices late for various reasons. Financial difficulties can prevent timely payments, while oversights and disorganization can also contribute to delays. Sometimes, dissatisfaction with the purchased goods or services may lead to intentional withholding of payment. Understanding these reasons is essential for effective accounts receivable management.

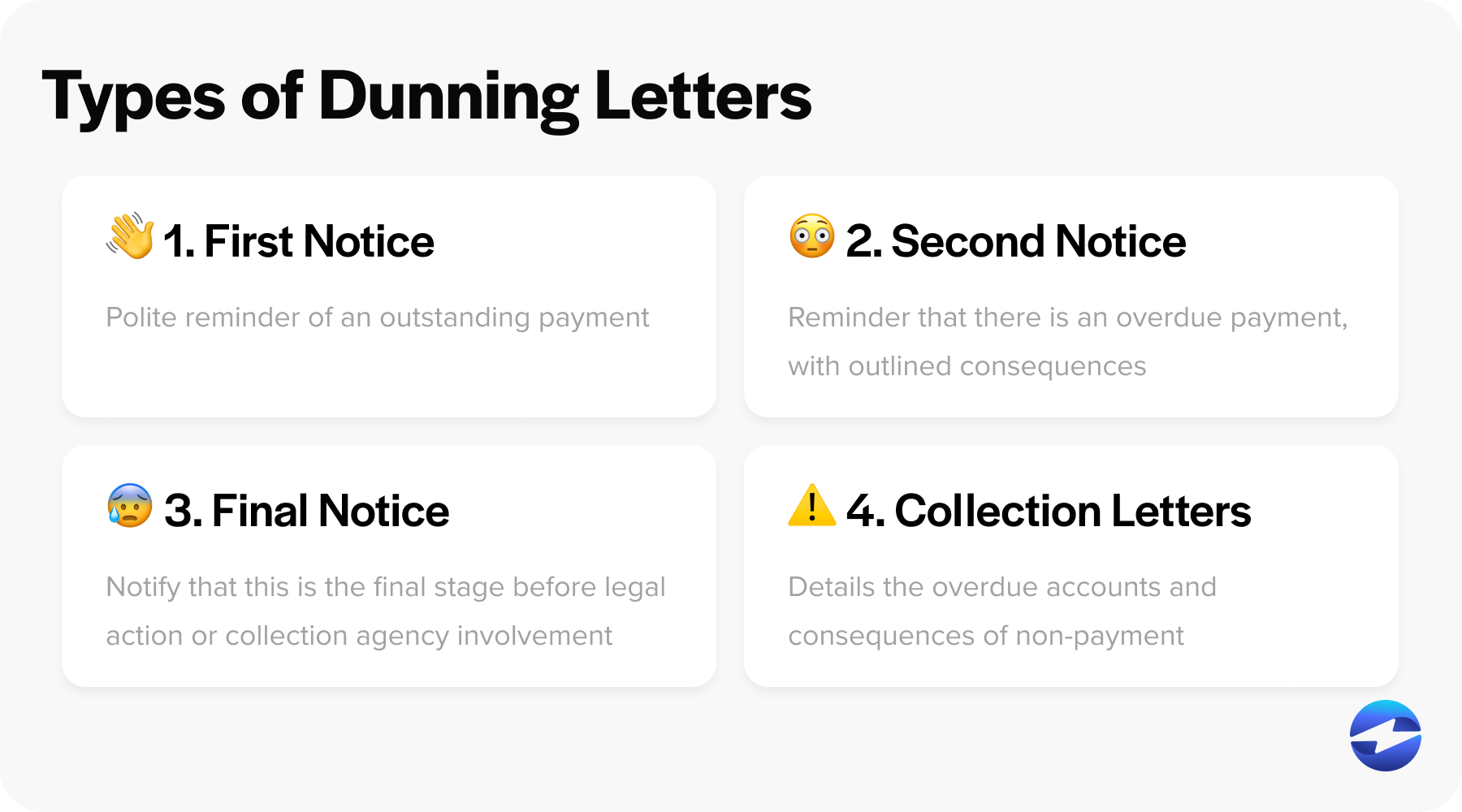

The different types of dunning letters

Dunning letters come in various forms, each with a specific tone and purpose designed to prompt action from the recipient. Here’s a breakdown of the different types:

- First Notice: This initial dunning letter is a polite reminder of the outstanding balance. It typically includes the invoice details, such as the amount due and payment terms. It serves as a nudge for the customer who may have missed the payment deadline.

- Second Notice: If the first dunning letter doesn’t result in a payment, the second notice adopts a firmer tone. It reminds the recipient of the overdue payment and may begin to outline the potential consequences of continued non-payment.

- Final Notice: This dunning notice communicates that the recipient has reached the final stage before the matter escalates. It strongly urges the customer to settle the unpaid invoice, warning about the imminent legal action or transfer of the account to a collection agency.

- Collection Letters: If earlier notices are ignored, collection letters are sent. These are more direct and may come from a collection agency. They detail the overdue accounts and the severe repercussions of non-payment, including legal action.

An effective dunning letter process involves a series of these communications, gradually increasing in seriousness, to recover delinquent accounts and ensure timely payments without causing involuntary churn.

What does the traditional dunning process look like?

The traditional dunning process is a systematic approach businesses follow to manage and collect overdue customer payments. This methodical process involves several steps, each designed to enhance the effectiveness of collection efforts. Here are the steps involved:

Step 1. Figure out the overdue accounts

The initial step in the dunning process is identifying which accounts are overdue. Companies regularly monitor their accounts receivable to pinpoint invoices that have surpassed their payment term. Tracking late payments is crucial to begin the dunning process and helps businesses focus on the right customers.

Step 2. Create a repository of delinquent accounts

After identifying overdue accounts, businesses compile this information to create a centralized repository of delinquent accounts. This repository often includes details such as the customer’s contact information, the outstanding balance, and the duration of the overdue payment. This organization aids in keeping a structured record that is critical for effective follow-up.

Step 3. Create the dunning letters

Once the repository is in place, the next step involves creating the actual dunning letters. These communications are tailored based on the severity of the outstanding balance and the duration of the invoice has been overdue. Drafting an effective dunning letter is a crucial step; it should be clear and professional and provide all necessary details for customers to understand and act upon the issue.

Here are some examples of a dunning letter:

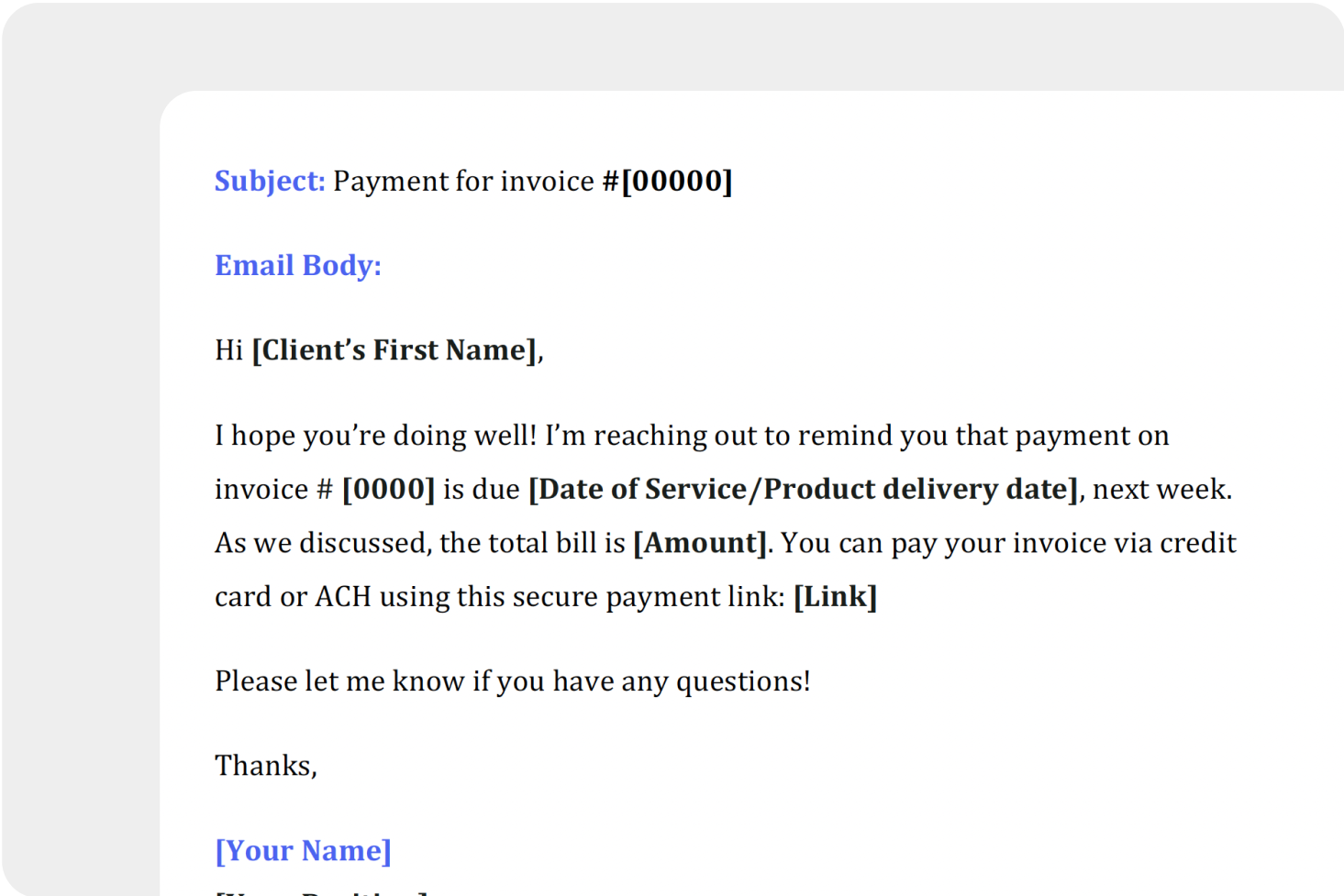

Example for the first dunning letter

The initial dunning letter is a friendly reminder about an overdue payment. It’s vital for maintaining good client relations while signaling the need for timely payments. This example of a dunning notice is polite and assumes the best of the customer:

When crafting a dunning letter, it’s essential to be concise and clear while offering avenues for support, should the recipient require it.

However, if your customers aren’t responding to the first few letters, it’s important to be a little bit more urgent and serious with the 4th letter.

Example for the 4th dunning letter

Once you’ve finished drafting your dunning letters, it’s time to review and send them out.

Step 4. Review and start sending dunning letters

Before dispatching the dunning letters, reviewing them must ensure all details are accurate and the tone is appropriate. After a thorough check, businesses then send out the letters. Sending out these notices is an official reminder and often prompts customers to settle their outstanding invoices to avoid further action.

Step 5. Finally receive payments on overdue invoices

The ultimate objective of the dunning process is to receive payment on overdue invoices. As dunning letters are sent out, some customers will respond with payments. However, those who continue to delay payment may require additional follow-ups such as subsequent letters, phone calls, or even referral to a collection agency.

Each step of the traditional dunning process is critical for businesses to maintain healthy cash flow and reduce involuntary churn due to non-payment. Efficient dunning can lead to a resolution of delinquent accounts and foster a culture of timely payments.

Once the dunning letter process is completed, it’s important to keep track of the dunning letter and collections performance.

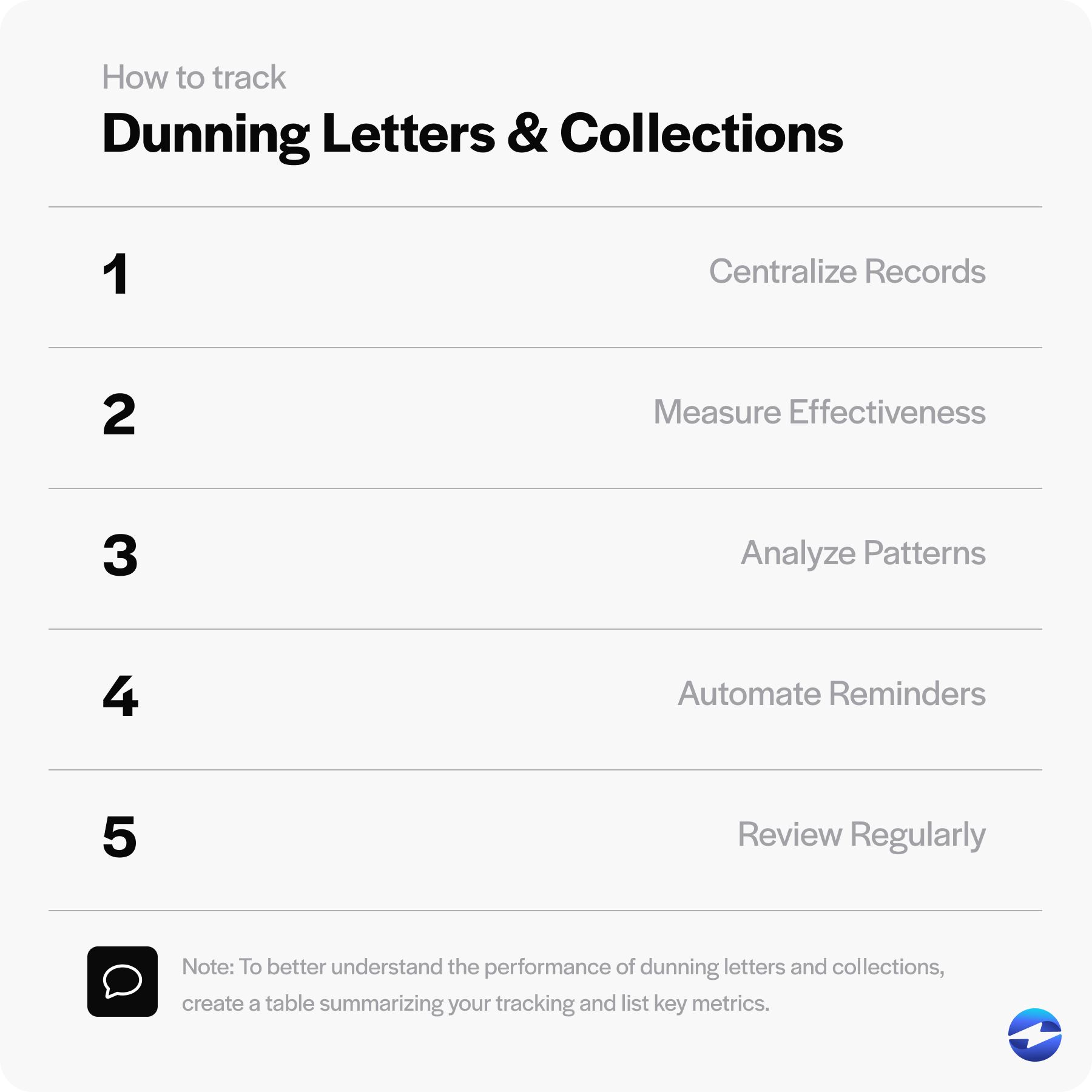

How to track dunning letter and collections performance

Tracking dunning letters and collections performance is crucial to ensure dunning letter protocols were successfully implemented.

To effectively monitor this process, consider these steps:

- Centralize Records: Utilize a designated software or spreadsheet to log all dunning notices sent. Include client information, the date each dunning letter was sent, amounts owed, and any responses received.

- Measure Effectiveness: Assess the success rate of your letters. Track how many payments are made promptly after sending a dunning notice versus those that require further follow-up.

- Analyze Patterns: Look for patterns in payment behavior. Are there specific times of the year when late payments increase? Are specific clients repeatedly in the dunning process?

- Automate Reminders: Employ automation software that will alert you when to send subsequent letters and help you consistently schedule them for overdue accounts.

- Review Regularly: Schedule regular reviews, such as weekly or monthly, to analyze collections performance, adjust the dunning letter process as needed, and determine if further action, like enlisting in a collection agency, is warranted.

A table summarizing the status and outcomes of dunning actions can provide a clear visual aid. Additionally, creating a list of key metrics to review during each analysis session can ensure consistency and thoroughness in tracking performance.

5 methods to improve the collection process

Improving the collection process is critical for businesses to maintain healthy cash flow and minimize the risk of bad debt.

If companies focus on improving the collection process, dunning letters may not be necessary at all. Your business can work to eliminate these letters by adopting several methods to enhance its collections and ensure timely payments.

Method 1: Establish clear credit policies

Method 1: Establish clear credit policies

Establishing and communicating clear credit policies is vital for setting payment expectations. When customers know their payment obligations from the outset, confusion is reduced, and the likelihood of timely payments increases.

Credit policies are concise and transparent and include details like payment terms, late payment penalties, and guidelines for extending credit. These policies are the foundation for all subsequent collection efforts, providing a reference point for the customer and the business owner if payments become overdue.

Method 2: Offer multiple payment options

Method 2: Offer multiple payment options

Offering multiple payment options can significantly enhance the collection process. Businesses can offer various payment methods, such as credit cards, online transactions, mobile payments, and traditional checks, so customers can choose the most convenient method.

Convenience is critical to reducing payment friction and can encourage customers to settle their dues without delay.

Furthermore, this flexibility demonstrates customer care, fortifying the business-customer relationship and encouraging cooperation during the collection process.

Method 3: Restructure the collections team

Method 3: Restructure the collections team

Optimizing your collections team’s structure can directly impact the collection efforts’ effectiveness. A well-structured team should be able to manage accounts receivable efficiently with clear roles and responsibilities.

Collection team members need to be trained in customer service and negotiation techniques to handle potentially delicate communications tactfully. They should also recognize when to escalate issues internally or take further action. A restructured team equipped with the right skills and organization can target overdue accounts strategically and work towards reducing outstanding payments.

Method 4: Increase AR headcount

Method 4: Increase AR headcount

Sometimes, an overload of work can lead to less effective collections as team members may have too many accounts to manage. Increasing the headcount of your accounts receivable (AR) department can alleviate this burden.

Having more hands on deck can help team members focus on a manageable portfolio of customers, ensuring that each account gets the attention it deserves. This can result in quicker response times, more personalized follow-up, and improved collection results.

Method 5: Automate your collections efforts

Method 5: Automate your collections efforts

Automating collection efforts can be a game-changer for businesses looking to streamline their collection process.

Automation software can help manage and send out dunning notices, keep track of outstanding invoices, and even prioritize collection efforts based on a customer’s payment history. It reduces the potential for human error and frees time for collection teams to focus on more complex tasks, such as dealing with disputes or handling negotiations with delinquent accounts.

The consistency and efficiency brought by automation can lead to a more productive collection process and increased payments on time.

Utilizing the dunning letter to get your business paid

At the end of the day, getting paid is essential to the operations of your business. Dunning letters help with these collections by being tailored with various payment options to encourage debtors to clear their debts.

Advanced automation software may streamline the dunning process, helping businesses manage overdue accounts more efficiently and reducing the rate of involuntary churn.

Keep the dunning notices clear, concise, and professional to maintain positive customer relationships while safeguarding the business’s financial interests. Remember, the goal is to recover overdue payments without sacrificing customer goodwill or using a formal collections process.

FAQs

FAQs

Summary

- What is a Dunning Letter?

- What is a delinquent account?

- The different types of dunning letters

- What does the traditional dunning process look like?

- How to track dunning letter and collections performance

- 5 methods to improve the collection process

- Utilizing the dunning letter to get your business paid

- FAQs