Blog > How to Find the Best Payment Processor for NetSuite

How to Find the Best Payment Processor for NetSuite

NetSuite payment plugins enable businesses to integrate payments into this enterprise resource planning (ERP) software to provide secure and efficient transactions.

This article will help you choose the right payment processor for your NetSuite system, key features to look for, and best practices for implementation.

What is NetSuite payment processing?

NetSuite is a cloud-based ERP software that enables merchants to manage internal business operations in one platform, such as accounting, orders, inventory management, and more.

NetSuite payment processing works by allowing businesses to directly accept, process, and manage customer payments inside this ERP system, further optimizing their internal operations.

This integrated payment solution allows companies to process various types of transactions, including credit cards, debit cards, and Automated Clearing House (ACH) payments, also known as electronic checks. NetSuite can work with multiple payment gateways and providers, ensuring flexibility and security in handling transactions.

The best NetSuite payment processing solutions will maintain Payment Card Industry (PCI) compliance, ensuring sensitive payment card data is protected during processing to reduce the risk of breaches and enhance data security.

Processing payments in NetSuite is an important tool for merchants to leverage to streamline their financial operations and stability.

The importance of efficient payment processing for your business

Efficient payment processing is the backbone of any successful company, guaranteeing transactions are completed quickly and securely.

For businesses, especially small ones, the ability to accept debit and credit card payments and seamlessly manage transactions can significantly impact their cash flow and financial health. When customers can pay quickly and securely, these businesses get paid fast, improving liquidity and financial planning.

In addition to speed, security is a key component of well-rounded payment processing operations. Efficient payment processing systems help protect sensitive customer data, reduce fraud risks, and enhance customer trust.

With the rise of digital transactions, having a secure payment gateway that complies with industry standards, such as PCI Standards, is crucial. This compliance not only protects your business but also reassures customers that their information is safe, fostering loyalty and repeat business.

A robust payment processing system is even more critical for merchants that rely on recurring payments, such as subscription-based models, since it ensures more timely payments, reducing the administrative burden of chasing payments and managing late fees. By automating these processes, businesses can focus more on growth and less on managing cash flow issues.

It’s important to thoroughly review the functionality and components of each payment processor to find the most reliable payment processing solution. The following section can help with this.

How to choose the right payment processor for NetSuite

Selecting the right payment processor requires a clear understanding of your business’s needs and requirements. Knowing key features, functionality, and services to look for is vital when choosing a payment processor for your NetSuite system.

Here are 10 critical features to consider, each pivotal in enhancing your payment processing capabilities:

- Seamless integration

- Security and PCI compliance

- Transparent pricing and fees

- Supported payment methods

- Streamlined recurring payments

- Chargeback management and dispute resolution

- Customer support and service

- Reporting and analytics

- Scalability

- Ease of use and setup

1. Seamless integration

A seamless integration with your existing NetSuite system is essential for minimizing disruptions and enhancing operational efficiency.

An effortless payment integration process into NetSuite enables direct synchronization of transaction data, reducing the need for manual entry and minimizing errors. This synchronization streamlines workflows and ensures that financial data is always up-to-date and accurate.

2. Payment security and PCI compliance

Payment security and PCI compliance are non-negotiable when choosing a payment processor. Ensuring the payment processor adheres to PCI Security Standards is crucial for protecting sensitive customer data from breaches and fraud.

A reliable payment processing solution should include advanced security measures such as tokenization and encryption, which replace credit card data with a secure token to prevent exposure of sensitive information and safeguard payment data during transmission, making it nearly impossible for hackers to intercept or misuse it.

Trustworthy providers will also secure your payment processing system with multi-factor authentication (MFA) or two-factor authentication (2FA), real-time authentication monitoring, 3D Secure, and more.

Your NetSuite payment processing solution should be able to handle payment card data securely, reducing the complexities associated with maintaining PCI compliance.

3. Transparent pricing and fees

Transparent pricing structures are essential for effective financial planning and avoiding unexpected costs. Understanding transaction fees or hidden charges associated with a payment gateway can help businesses budget more accurately.

NetSuite payment processors should offer clear pricing structures, outlining all their transaction fees, monthly fees, and any additional charges for specific services.

4. Supported payment methods

Supporting various payment methods is vital for catering to diverse customer preferences and improving sales conversion rates.

The best payment gateways provide options for credit and debit cards, ACH/electronic payments, digital wallets, and more, ensuring customers can choose their preferred payment method.

5. Streamlined payment operations

A good payment processing solution should streamline payment operations by automating key financial tasks, reducing manual work, and improving cash flow management.

Recurring billing ensures businesses can securely process subscription-based payments on a set schedule, eliminating the need for manual invoicing and reducing missed payments.

Automated invoice collections send timely reminders to customers, helping to minimize overdue payments and improve overall collection rates.

Additionally, a robust payment processor should integrate seamlessly with accounting systems, enabling real-time payment reconciliation and reducing errors in financial reporting.

6. Chargeback management and dispute resolution

Effective chargeback management and dispute resolution tools are essential for handling disputes efficiently and reducing the financial impact of chargebacks.

Payment gateways often provide specific chargeback reason codes to inform merchants of the underlying dispute issues, helping them address and resolve disputes more efficiently.

7. Customer support and service

Reliable customer support is crucial for resolving payment processing issues quickly and mitigating service interruptions.

NetSuite payment processors should provide various customer support channels to assist clients with payment integration challenges, including phone and comprehensive online resources.

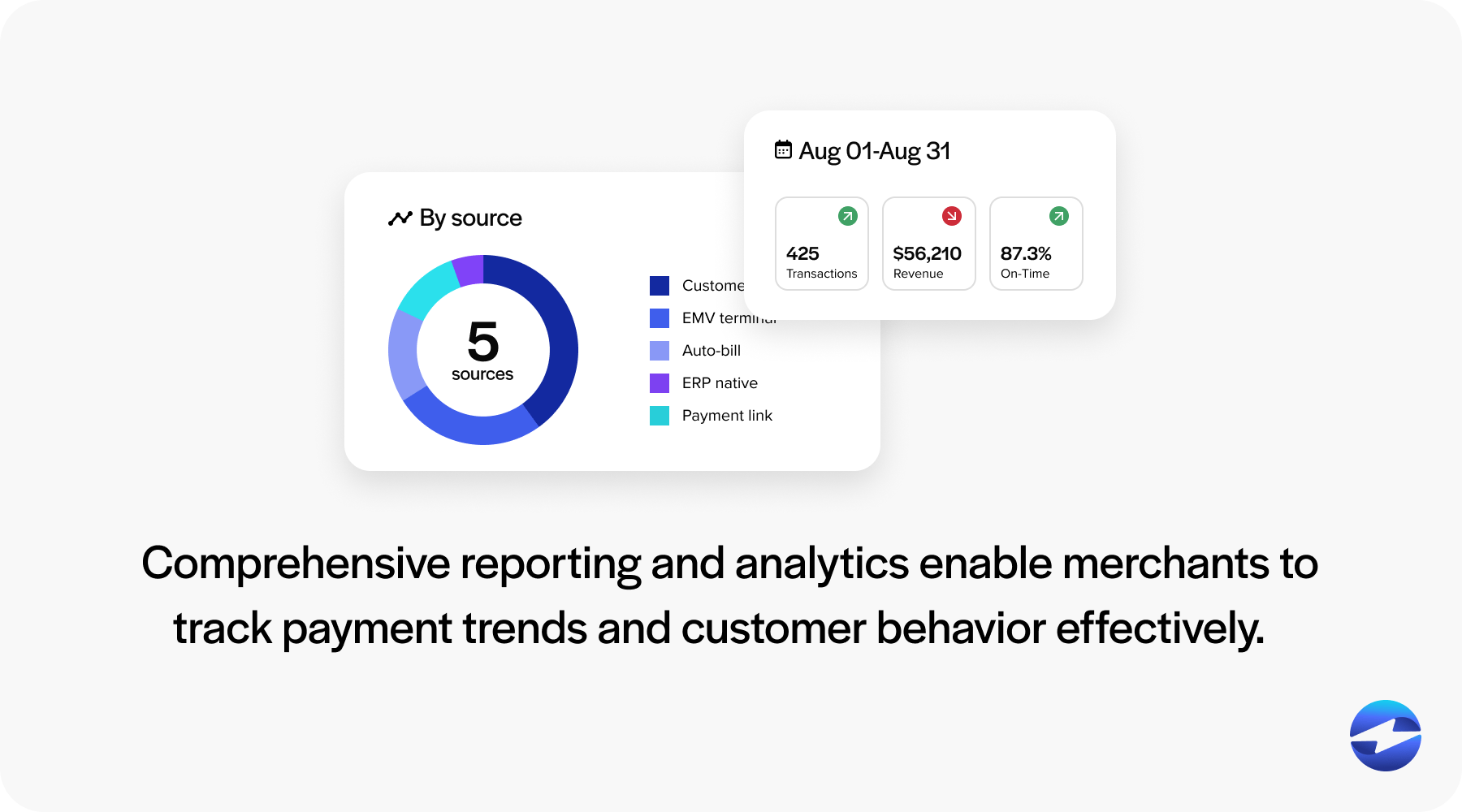

8. Reporting and analytics

Comprehensive reporting and analytics enable merchants to track payment trends and customer behavior effectively.

NetSuite payment integrations should offer robust analytics and reporting capabilities to provide immediate visibility into operational and financial performance, aiding in decision-making and financial reporting.

9. Scalability

A payment processor that can support scalability in customer payment volumes will enable more growth for your company.

Therefore, finding a scalable processor with services and functionality built to adapt to transaction increases without hindering your current operations is essential.

10. Ease of use and setup

A user-friendly interface and straightforward setup process are critical for minimizing internal learning curves. Payment solutions for NetSuite should provide an effortless integration with the platform, allowing businesses to quickly set up and manage payment gateways without extensive technical expertise.

NetSuite payment providers often include pre-configured integrations for a smooth transition that maintains operational efficiency. Clear instructions and dedicated support will also help users maintain and update their payment processing, enabling them to easily manage transactions, refunds, and reconciliations.

Additionally, NetSuite payment solutions should enhance the user experience by offering automated workflows, real-time transaction tracking, and customizable reporting tools that simplify financial management within NetSuite.

With these functionalities and features in mind, you can find a payment processor that not only meets your current needs but can also grow with your business.

In addition to these components, there are various best practices to integrate your payment processing solution for NetSuite effectively.

5 best practices for implementation and optimization

To successfully implement and optimize your payment processing solution in NetSuite, you should follow multiple best practices for a smooth transition and efficient operations.

Merchants can familiarize themselves with various practices to streamline payments and enhance customer satisfaction.

Five standard practices can include working with a payment processor with native integration, offering customizable payment methods, routine monitoring of transaction data and reports, thorough training of staff, and applying automation tools.

Choose a payment processor with a native integration

Opting for a payment processor with native integration enhances the ease of payment processing and provides better analysis capabilities. Such integrations eliminate the need for manual data entry and reduce potential errors, ensuring that payment data automatically syncs with your financial system in real-time.

Certified NetSuite payment processors provide seamless payment workflows, enhancing efficiency in transaction management and improving the overall customer experience.

Using native integrations also minimizes the risk of errors and facilitates better tracking of orders, inventory, and invoices by consolidating data into one platform.

Customize payment methods to meet customer needs

Tailoring payment methods to align with customer preferences can significantly improve their checkout experience and boost sales conversion rates. Offering various payment options caters to diverse customer preferences, enhancing their shopping experience and increasing satisfaction.

A payment processor for NetSuite should allow businesses to set up customer payment methods based on specific business requirements, such as supporting multiple currencies and merchant accounts. The ability to integrate alternative payment methods, including ACH payments, credit and debit cards, and digital wallets, ensures a seamless and secure customer payment experience.

A robust payment solution should also offer flexibility in managing recurring payments, installment plans, and customized invoicing options to accommodate diverse business models. By providing a smooth checkout process with secure payment acceptance, businesses can enhance customer satisfaction while optimizing cash flow and operational efficiency.

Monitor transaction data and reporting

A robust payment processor should provide merchants with advanced reporting and analytics tools to help them monitor transaction data and gain valuable insights into customer behavior.

By analyzing transaction trends, businesses can identify spending patterns, detect potential fraud, and address operational inefficiencies before they become more significant.

Real-time reporting features enable immediate responses to suspicious activity, enhancing overall payment security and reducing chargeback risks. Automated analytics tools further strengthen fraud detection by identifying anomalies in payment data, flagging irregular transactions, and helping businesses implement proactive risk management strategies.

Customizable reports allow merchants to track key performance indicators (KPIs) such as transaction success rates, chargeback frequency, and payment processing times, ensuring continuous improvement in payment operations.

With these tools, businesses can optimize payment workflows, reduce financial risks, and make data-driven decisions to enhance efficiency.

Train staff and optimize user experiences

Thoroughly training staff on your NetSuite payment processing system can lead to a smoother user experience and reduce transaction errors.

Comprehensive training ensures that staff are well-versed in the functionalities of the payment processor and can strengthen customer relations. Utilizing tailored training plans and in-app guidance can significantly enhance user engagement and adoption of the payment gateway.

Additionally, regularly updating training material can ensure your staff is well-versed in the latest features and best payment processing practices to further solidify your internal and external payment operations.

Use automation tactics

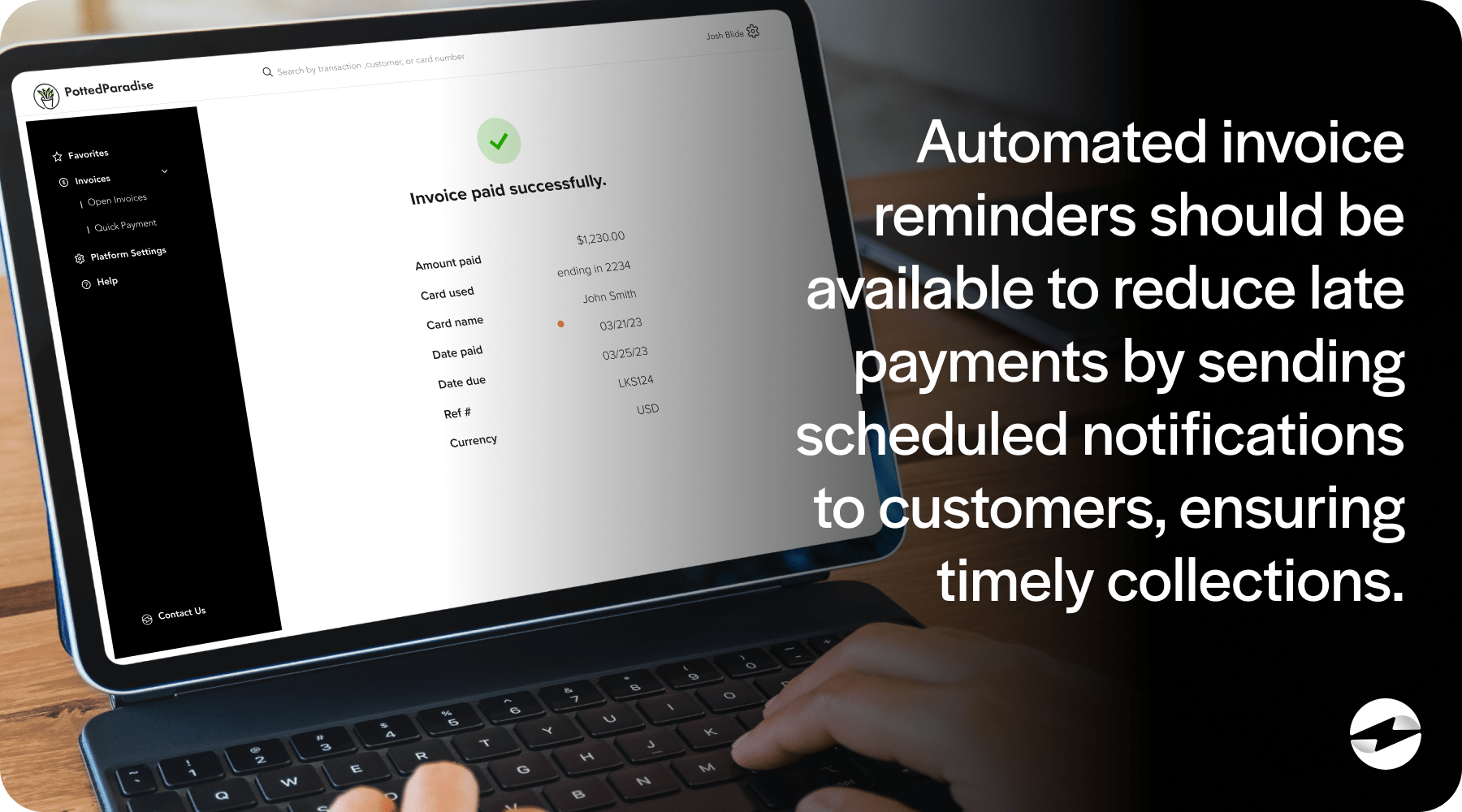

A payment processor should offer automation tools that streamline invoicing, reconciliation, and collections to enhance efficiency and accuracy.

Automated invoice reminders should be available to reduce late payments by sending scheduled notifications to customers, ensuring timely collections. Recurring billing functionality is also essential for businesses with subscription-based models, allowing for seamless and secure payment processing without manual intervention.

Integrated reconciliation tools can automatically match payments to open invoices, eliminating manual entry and minimizing accounting errors.

Additionally, real-time data tracking capabilities can provide instant insights into transaction statuses, outstanding balances, and payment trends, improving reporting and decision-making processes.

NetSuite payment processing software that integrates automation with existing tools can provide a seamless flow of data across departments, optimizing cash management and speeding up transaction approvals. This integration ensures businesses can handle transactions efficiently, improving overall operational performance.

As your company grows, refining these strategies will help you maintain the most efficient operations, eliminate fraud risks and human error, and optimize financial performance.

For the best payment processing experience, look for top-rated platforms like EBizCharge.

EBizCharge: A powerful NetSuite payment integration

EBizCharge is a top-rated payment processing solution with a comprehensive suite of NetSuite payment plugins, thanks to its robust features and seamless integration capabilities.

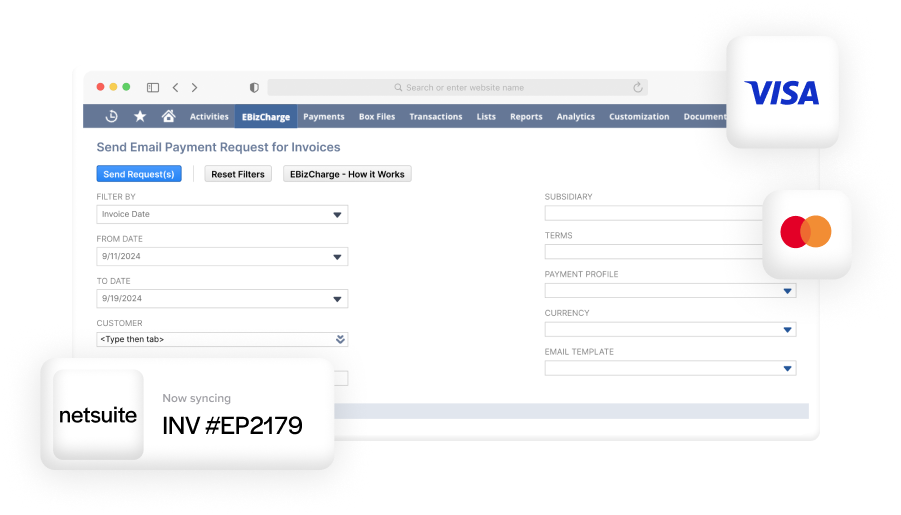

The EBizCharge for NetSuite payment integration syncs directly with your ERP system to eliminate manual data entry, mitigate user error, and automate reconciliation.

The powerful EBizCharge platform offers a seamless integration into NetSuite, advanced security, and automation tools that simplify financial operations. Businesses can accept credit cards, debit cards, and ACH/eCheck payments directly within NetSuite while reducing manual entry and processing errors.

EBizCharge automates invoicing and provides recurring billing and real-time reconciliation to ensure payments are collected efficiently. Alongside its robust features, it enforces strict payment security measures that include tokenization, encryption, and fraud prevention tools to protect sensitive data and maintain PCI compliance.

Merchants can also leverage EBizCharge’s top-rated payment processing platform in NetSuite to utilize a secure customer payment portal, secure email payment links, and robust reporting tools to access valuable insights into payment trends and cash flow.

With lower processing fees, flexible payment options, and 24/7 customer support, EBizCharge will streamline your payment processing operations in NetSuite while improving security and efficiency.