Blog > Understanding NetSuite Payment Processing and Its Benefits

Understanding NetSuite Payment Processing and Its Benefits

NetSuite is a comprehensive cloud-based Enterprise Resource Planning (ERP) platform designed to aid businesses in managing key operational processes.

The NetSuite platform provides a suite of tools for accounting, inventory management, supply chain operations, and customer relationship management (CRM), promoting scalability and allowing for the integration of various functions into a single, unified system. These tools allow merchants to streamline accounts receivable (AR) processes, making payment collections a breeze.

The ins and outs of NetSuite payment processing

NetSuite payment processing is a major component of the NetSuite cloud-based ERP system that ensures efficient cash flow and customer satisfaction. It facilitates the acceptance and management of customer payments within the NetSuite platform.

NetSuite provides an arsenal of comprehensive tools and features designed to facilitate efficient business management and financial operations.

What kinds of tools and features does NetSuite offer?

NetSuite’s tools and features aim to make the payment processing experience quick and seamless.

Some of these tools and features include:

- Email pay

- Payment portals

- Saved cards

- Analytics and insights

- CRM module

Email pay

NetSuite’s email pay feature simplifies payment collections by allowing businesses to send electronic invoices with secure payment links directly to customers’ email addresses.

This convenient method encourages prompt payments by enabling customers to pay directly via email, eliminating the need to log into a separate payment portal. The result is a streamlined billing experience that can help reduce AR delays and improve cash flow.

Payment portals

NetSuite’s payment portal enables businesses to offer a self-service experience where clients can view their billing history, update payment information, and make payments online.

These portals are designed to be secure and user-friendly, fostering a high level of customer autonomy and satisfaction. They also reduce the administrative burden on businesses, as customers can manage their own account details and NetSuite payments efficiently.

Saved cards

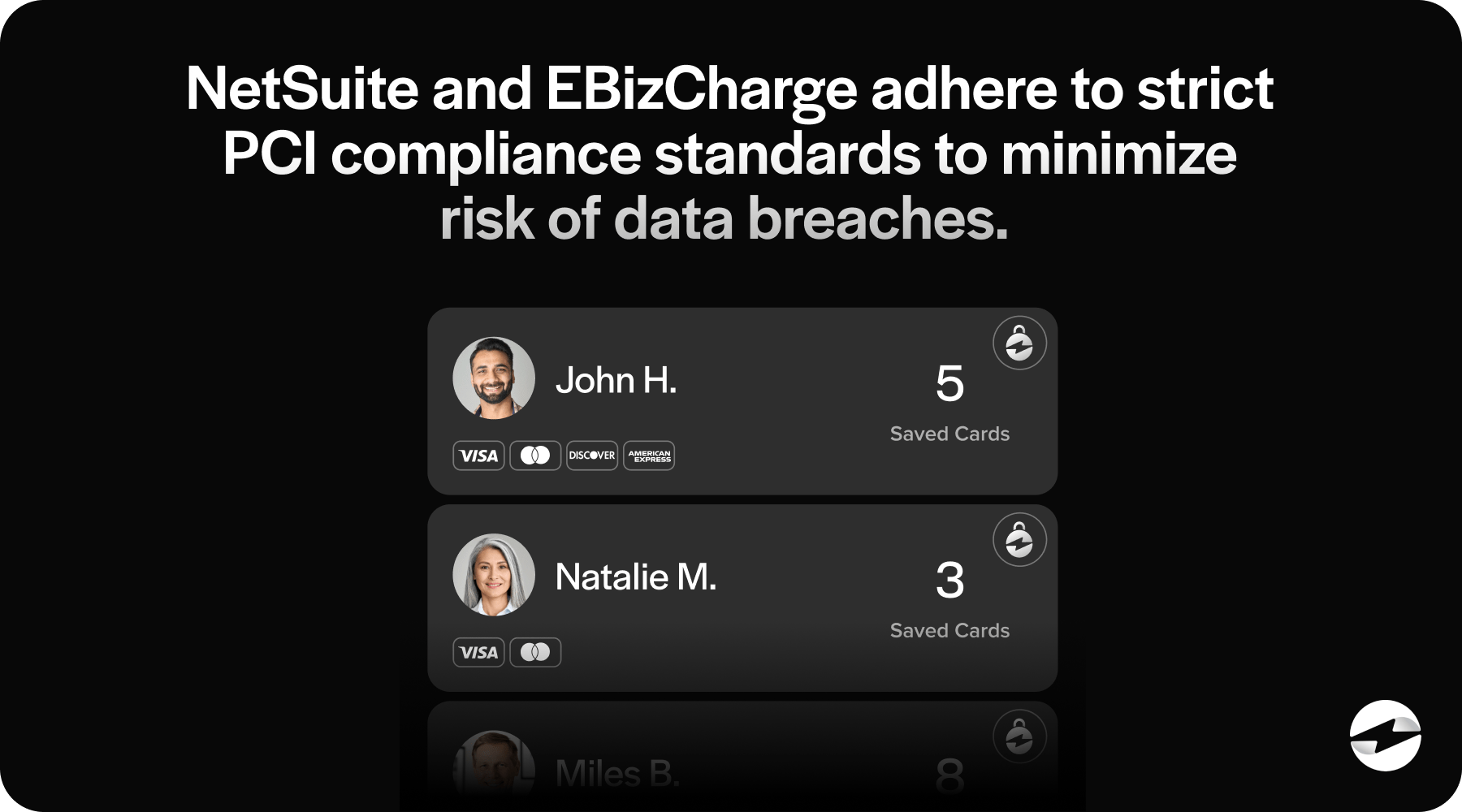

To further enhance the customer experience and expedite future payments, NetSuite allows customers to securely save their credit card information within their customer records.

The saved card feature follows Payment Card Industry Data Security Standards (PCI DSS) to ensure data security while offering a convenient option for customers who prefer to use the same payment method for recurring transactions. Saved cards can facilitate smoother, faster payments and improve customer loyalty.

Analytics and insights

Businesses require real-time data to make informed decisions, and NetSuite delivers this through its analytics and insights.

With comprehensive dashboards and customizable reporting tools, you can closely monitor your company’s financial health, track payment trends, and identify areas of improvement. This data-driven approach empowers organizations to optimize payment processing strategies and overall business performance.

CRM module

NetSuite’s CRM feature is a complete solution that supports the entire customer lifecycle, from lead to loyalty. It records every customer interaction, including transactions, support cases, and sales activities, offering a 360-degree view of each client.

The CRM module works seamlessly with the payment processing features to ensure information is up to date, enhancing customer service and driving sales.

Using these tools and features, NetSuite provides a robust platform that supports various business needs, with payment processing at the forefront of fostering substantial growth and operational efficiency.

Decoding NetSuite payment terms

When diving into NetSuite payment processing, it’s essential to familiarize yourself with common terms. These terms are foundational to understanding the intricate operations of financial transactions within the NetSuite ecosystem.

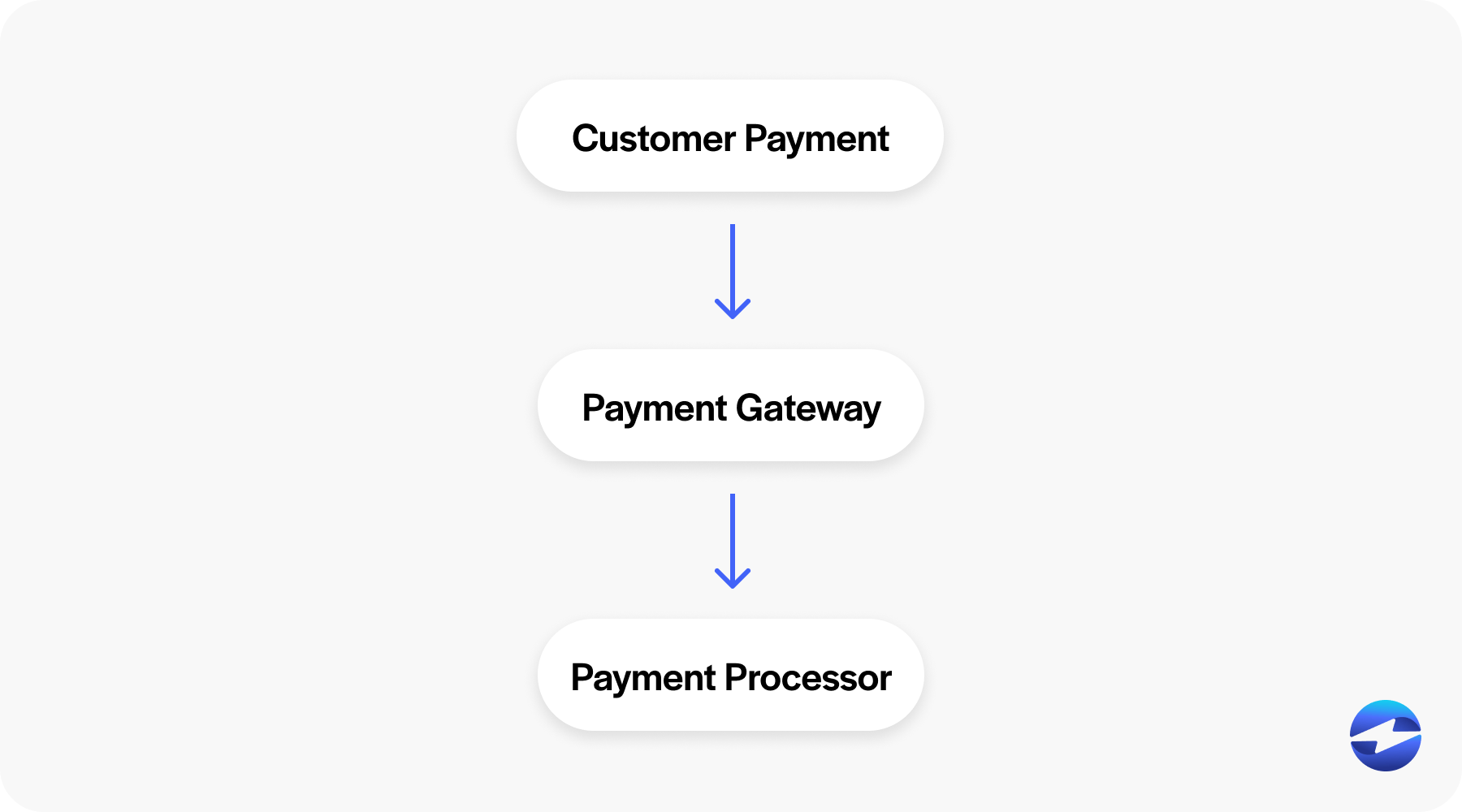

- Payment gateway: NetSuite payment gateways act as digital conduits connecting a merchant’s payment system to the payment processing network. When a customer initiates a credit card transaction, the gateway securely transmits the payment information from the point-of-sale (POS) terminal to the relevant parties, such as payment processors and banks, for authentication and approval.

- Payment processor: A NetSuite payment processor handles credit card payment details. Once the payment gateway transmits the cardholder’s data, the processor validates the transaction details with the card-issuing bank, authorizes the transfer of funds, and communicates the approval or decline back to the gateway.

- Acquirer: An acquirer is a financial institution with the authority to process credit and debit card transactions on behalf of a merchant. Acquirers maintain merchant accounts, which are necessary for a business to receive proceeds from credit card sales.

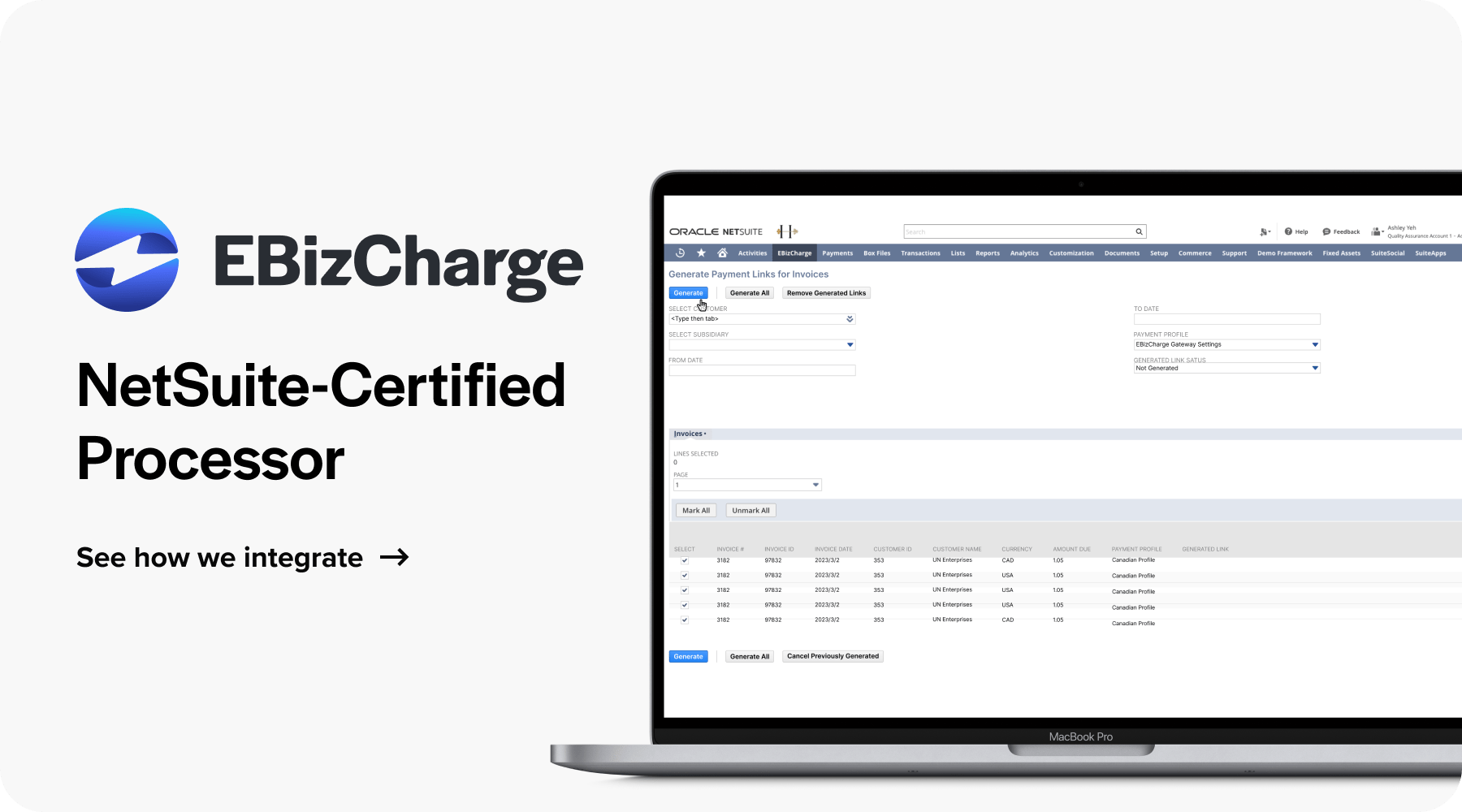

- Certified processor: A NetSuite-certified processor is a payment processor officially recognized by NetSuite that’s undergone rigorous validation to ensure its services are compatible with NetSuite’s platform. These processors have demonstrated adherence to specified NetSuite payment integration standards and have been tested to ensure they work seamlessly within the NetSuite environment.

- Non-certified processor: Conversely, a non-certified processor is a payment processing entity that NetSuite hasn’t officially accredited. While these processors may still function with the NetSuite platform, they haven’t undergone the same validation process as certified NetSuite payment processors. They may present a higher risk or potentially result in a less optimal user experience.

Understanding NetSuite’s payment terms, gateways, processors (certified and non-certified), and acquirers is essential for businesses to efficiently and securely manage their online transactions.

What are the benefits of NetSuite payment processing?

NetSuite delivers numerous benefits designed to simplify collections operations and provide a superior customer experience.

NetSuite payment processing yields several benefits, including embedded credit card processing, flexible payment options, industry-compliant security, and complimentary training and support.

Embedded credit card processing

Embedded credit card processing offers a significant advantage by integrating into the ERP system itself.

This integration means users can process credit card payments directly within their ERP, eliminating the need to toggle between systems or re-enter data — thereby reducing errors and saving time.

Flexible payment options

NetSuite supports various payment methods, catering to consumer preferences and modern commerce demands.

By accommodating major credit cards, digital wallets, and electronic payment methods, businesses can expand their reach and offer customers the convenience they seek. This flexibility helps attract a broader market that prefers a diverse range of payment methods.

Industry-compliant security

Since security is paramount, the NetSuite platform adheres to strict industry PCI compliance standards to ensure payment data is securely processed and stored.

NetSuite’s commitment to maintaining high levels of security protects businesses against fraud, provides customers with peace of mind, and helps companies preserve their reputations by minimizing the risk of data breaches.

Complimentary training and support

NetSuite enhances the customer experience by offering quick and efficient checkout processes. The system’s ability to handle diverse payment options and provide secure transactions builds customer trust and satisfaction.

A streamlined payment processing experience can increase customer loyalty and encourage repeat business, contributing to the company’s long-term success.

From reducing manual data entry to improving financial reporting and cash management, NetSuite helps businesses operate more efficiently by utilizing certified and non-certified payment processing solutions.

NetSuite’s diverse payment processing solutions

NetSuite offers a versatile range of payment processing solutions to facilitate businesses’ transactions. These solutions can be categorized as certified and non-certified solutions.

Certified NetSuite payment solutions

- EBizCharge: EBizCharge is a top-rated payment processing solution that seamlessly integrates with NetSuite, allowing businesses to securely process payments directly inside the platform. The EBizCharge for NetSuite payment integration delivers real-time payment processing, automatic reconciliation, customizable reporting, recurring billing capabilities, and fraud prevention, enabling businesses to manage their finances more efficiently and improve the overall customer experience.

- CyberSource: Owned by Visa, Cybersource offers a wide range of payment processing solutions, including online payments, fraud management, and payment security. It provides services to businesses of all sizes across various industries, focusing on scalability and security.

- Freedom Pay: Freedom Pay specializes in providing secure payment solutions for hospitality, retail, healthcare, and other industries. This platform offers payment processing, loyalty programs, data analytics, and more.

- Solupay: Solupay is another payment processor that supports credit card processing, ACH payments, and mobile payment solutions. It caters primarily to businesses in the B2B sector, providing customized payment solutions.

- Adyen: Adyen is a global processor that provides payment processing services for online, mobile, and in-store transactions. It offers a single platform for accepting payments in multiple channels and currencies, with a strong emphasis on international expansion and serving large-scale enterprises.

Non-certified NetSuite payment solutions

NetSuite supports integration with non-certified payment processing solutions. These solutions are typically third-party payment gateways or processors without formal certification testing by NetSuite.

Businesses can still integrate non-certified payment processing solutions with NetSuite, taking advantage of its flexible APIs, customization capabilities, and integration tools.

With multiple options to choose from, it’s important to know what to look for when choosing a payment processor to integrate with NetSuite.

Choosing the best NetSuite payment processor for your business

Choosing the best NetSuite payment processor for your business is essential to streamlining your financial operations and enhancing customer satisfaction. When selecting a processor, it’s crucial to consider several factors.

First, assess the types of NetSuite payment methods you want to accept, including major credit cards like Visa, MasterCard, and American Express, as well as digital payment options. Make sure your payment processing capabilities align with your customers’ preferred methods.

Next, evaluate the transaction fees and payment processing options offered. Financial institutions and credit card processors may differ in fee structures, which can impact your cash flow. Look for a payment processor with transparent, competitive fees that accommodate your budget.

Finally, your provider should provide a seamless NetSuite integration that minimizes the risk of duplicate data entry and offers robust fraud management tools. A good gateway ensures secure transactions and allows for faster payment collections, directly influencing your bottom line.

Improving the NetSuite experience with EBizCharge

From automated payment workflows to secure payment portals and comprehensive analytics, NetSuite offers a seamless user experience that simplifies collections and improves cash flow management.

Integrating your NetSuite system with a top-rated payment processor like EBizCharge will further enhance your AR process by allowing your business to process NetSuite payments directly within the platform. EBizCharge fortifies NetSuite’s existing infrastructure with features that simplify security, reduce the risks associated with fraud management, and offer transparent, competitive fees.

With EBizCharge, businesses can optimize operations, drive growth, and deliver exceptional customer service in today’s fast-paced digital economy.

FAQs regarding NetSuite payment processing

FAQs regarding NetSuite payment processing

Summary

- The ins and outs of NetSuite payment processing

- Decoding NetSuite payment terms

- What are the benefits of NetSuite payment processing?

- NetSuite’s diverse payment processing solutions

- Choosing the best NetSuite payment processor for your business

- Improving the NetSuite experience with EBizCharge

- FAQs regarding NetSuite payment processing