Blog > How Does Merchant Underwriting Work?

How Does Merchant Underwriting Work?

Merchant underwriting is an essential component of the payment processing industry, ensuring the safety and security of electronic payments. This process is critical for payment processors, who must determine whether a business poses a high financial risk.

This article will explore the mechanics of merchant underwriting, from the essential steps involved in the process to the factors influencing it.

What is merchant underwriting?

Merchant underwriting is the process of evaluating a business’s risk before providing it with a merchant account to process electronic payments.

Merchant underwriting requires a thorough assessment of a business’s potential financial risks to ensure safe and secure transactions. The primary goal is to protect payment processors and merchants from financial losses associated with fraudulent activities or chargebacks.

Credit card underwriting examines various factors like business type, financial history, transaction volumes, and the potential risk they pose. By evaluating these elements, underwriters can determine whether a business is considered high or low risk.

The underwriting process consists of several steps to ensure the merchant and payment processor can handle the financial responsibilities involved in processing credit card payments.

What steps are involved in the merchant underwriting process?

Each step of merchant underwriting is designed to evaluate various aspects of the business, from its financial foundation to its transaction history, to gauge any potential risks it may pose.

Here are the six steps of the merchant underwriting process:

- Application and information gathering: Merchants must provide financial statements, bank statements, and detailed business information for underwriters to evaluate their financial and operational foundation.

- Risk assessment: After gathering the necessary information, a risk assessment is conducted to evaluate a business’s risk profile. Underwriters analyze factors such as transaction volumes and potential risks to determine the likelihood of financial instability or fraud. This helps in classifying the business as high risk or low risk.

- Credit history and financial stability check: Reviewing a business’s credit history and stability involves analyzing past financial activities to identify any red flags or reliability in handling credit responsibilities. A clean financial track record enhances the likelihood of approval for a merchant account.

- Business history and reputation review: Underwriters can assess a company’s history and reputation by looking at its past performance, customer reviews, and any previous chargebacks to predict future behavior and maintain the integrity of payment processing.

- Approval or rejection: Based on the collected data and assessments, underwriters will approve or reject the merchant account. Approval indicates that a business meets the necessary criteria for secure payment processing, while rejection often suggests room for improvement.

- Transaction monitoring setup: Once approved, monitoring is established to oversee ongoing merchant activities and detect unusual patterns or potential fraud, ensuring continuous security. Ongoing monitoring helps maintain the risk profile and allows for timely intervention if issues arise.

Now that you know the steps involved in the underwriting process, you can learn more about the factors that can affect this process.

What factors affect the merchant underwriting process?

Understanding the factors that affect the merchant underwriting process is crucial for merchants seeking to establish or maintain their merchant accounts.

This knowledge helps businesses assess their risk profile and address areas of concern before submitting a merchant application. Such preparation can improve approval chances and ensure smoother payment processing operations.

Below are eight factors that can affect the merchant underwriting process when applying for a merchant account.

Business type and industry

The business and industry type significantly influence the merchant underwriting process. Payment processors typically classify certain industries as high-risk based on historical data related to fraud and chargebacks.

Some high-risk industries include eCommerce and online retail stores that induce higher-than-average chargeback rates or businesses with regulatory financial instability concerns. These businesses face stricter scrutiny during merchant underwriting as payment processors aim to minimize economic and compliance risks.

Understanding this classification helps businesses choose appropriate payment offerings tailored to their risk category.

Business history and reputation

A company’s history and reputation are vital during underwriting since payment facilitators (PayFacs) review aspects such as the time a business has been operational and its track record in handling credit card payments.

A consistent, positive history in these areas indicates reliability and can expedite the merchant underwriting process. Conversely, businesses with a rocky past may face additional hurdles.

Financial stability

Financial stability is essential during the underwriting process, as this can dictate whether a business can acquire a merchant account.

Merchant account providers review financial statements, bank statements, and other financial history documents to assess a company’s fiscal health. A stable financial position reduces perceived risks for the provider and can result in more favorable terms or quicker approval times for a merchant account.

Chargeback history

Chargeback history is a crucial factor in determining a business’s risk level.

High chargeback rates suggest potential issues with customer satisfaction or fraud, prompting payment processors to apply more stringent criteria before providing services.

Businesses with a history of frequent chargebacks may be required to implement additional security measures or face higher fees.

Transaction volume and ticket size

Transaction volumes and ticket sizes are analyzed to understand a business’s operational scale and risk exposure.

High transaction volumes may indicate a thriving business but also pose a higher risk for fraud. Similarly, large ticket sizes can attract more scrutiny due to the increased potential for disputes and chargebacks. Payment facilitators use this data to assess financial risk accurately.

Fraud risk

Fraud risk assessments are essential in merchant underwriting to protect the payment processor and business.

Underwriting teams use tools and processes to evaluate potential fraud exposure, considering factors such as transaction patterns and geographic location.

High fraud risk necessitates more comprehensive security measures to combat threats effectively.

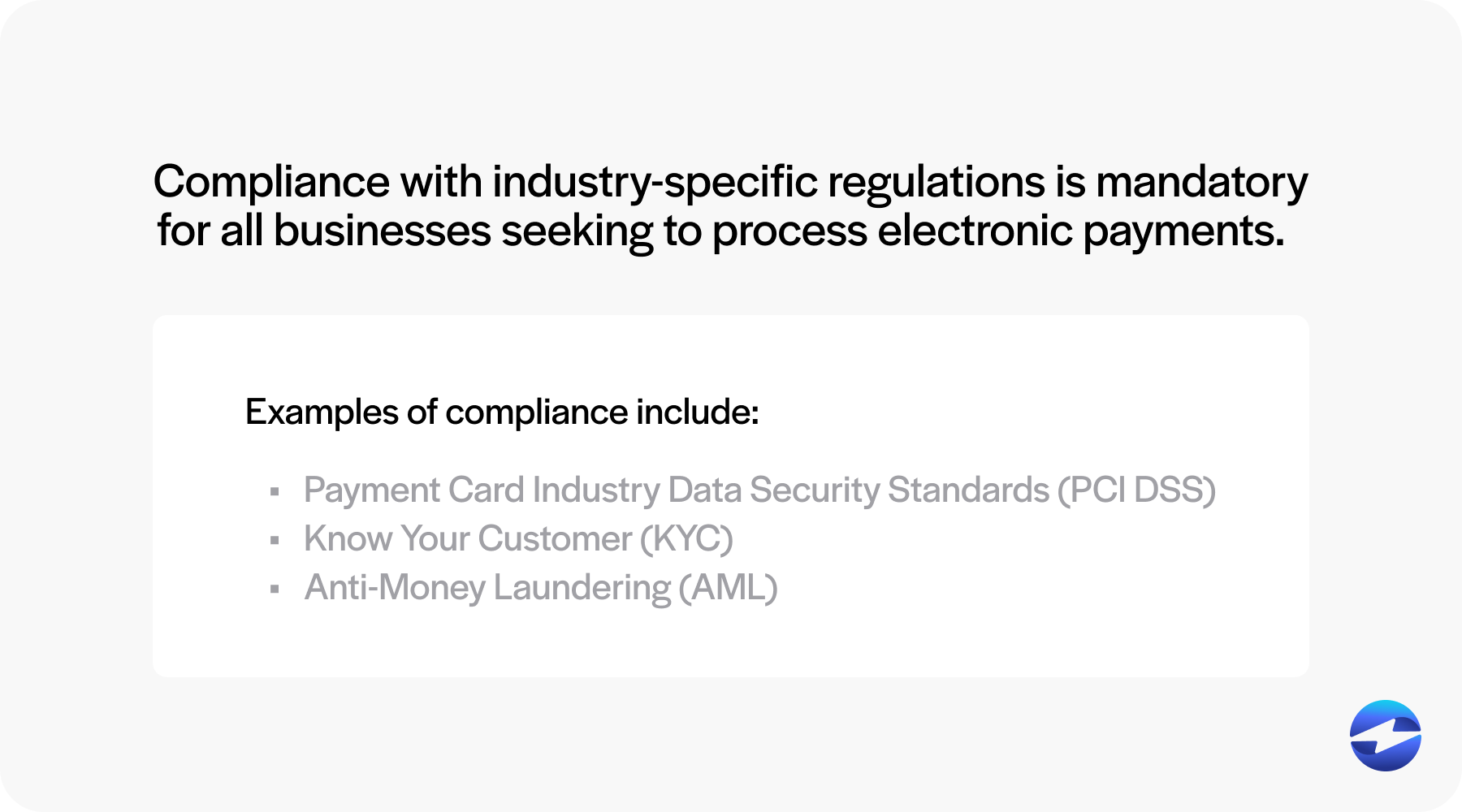

Regulatory compliance

Compliance with industry-specific regulations is mandatory for all businesses seeking to process electronic payments.

Regulatory requirements vary by industry and jurisdiction, impacting the underwriting process significantly. Some examples of this compliance include Payment Card Industry Data Security Standards (PCI DSS), Know Your Customer (KYC), and Anti-Money Laundering (AML) regulations.

Businesses that demonstrate full compliance with relevant legal standards present a lower risk, which can facilitate a faster approval process.

Billing policies

Billing policies are reviewed to understand how a business manages customer payments. Clear, transparent billing practices can minimize disputes and reduce chargeback risks.

The underwriting process evaluates a company’s billing policy to ensure it aligns with industry standards and provides adequate protection for the merchant and customer.

Awareness of these factors also helps businesses anticipate issues that may arise during electronic payments and work proactively to resolve them.

In addition to these factors, knowing which documents are needed for the merchant underwriting process is important.

What documents are needed for the underwriting process?

Several documents are necessary during merchant underwriting to help underwriters determine if businesses are eligible for merchant accounts.

Merchants should keep the following documents on hand when initiating the underwriting process:

- Their last three bank statements

- Last three merchant processing statements

- Income statements and balance sheets for the previous two years (specifically for those processing over 750k annually)

- A bank letter or copy of a voided check

- If providing a bank letter or a voided check, it must:

- Be on bank letterhead

- Contain the registered name of your business if operating under a Doing Business As (DBA)

- Contain an Automated Clearing House (ACH) routing number

- Contain an ACH account number

- Be signed by a bank representative and be dated within the last year

- If providing a bank letter or a voided check, it must:

- HTTPS web address

- Description of goods and services

- Business contact information

- Alternative contact information

- Currency type for transaction

- Customer service phone number

- Delivery standards

- Business’s country of origin

- Supported card networks

- Legal terms and conditions

With the appropriate documentation, payment processors and financial institutions can assess the potential risks associated with a business.

Without the proper steps and documentation, merchant underwriting can experience delays.

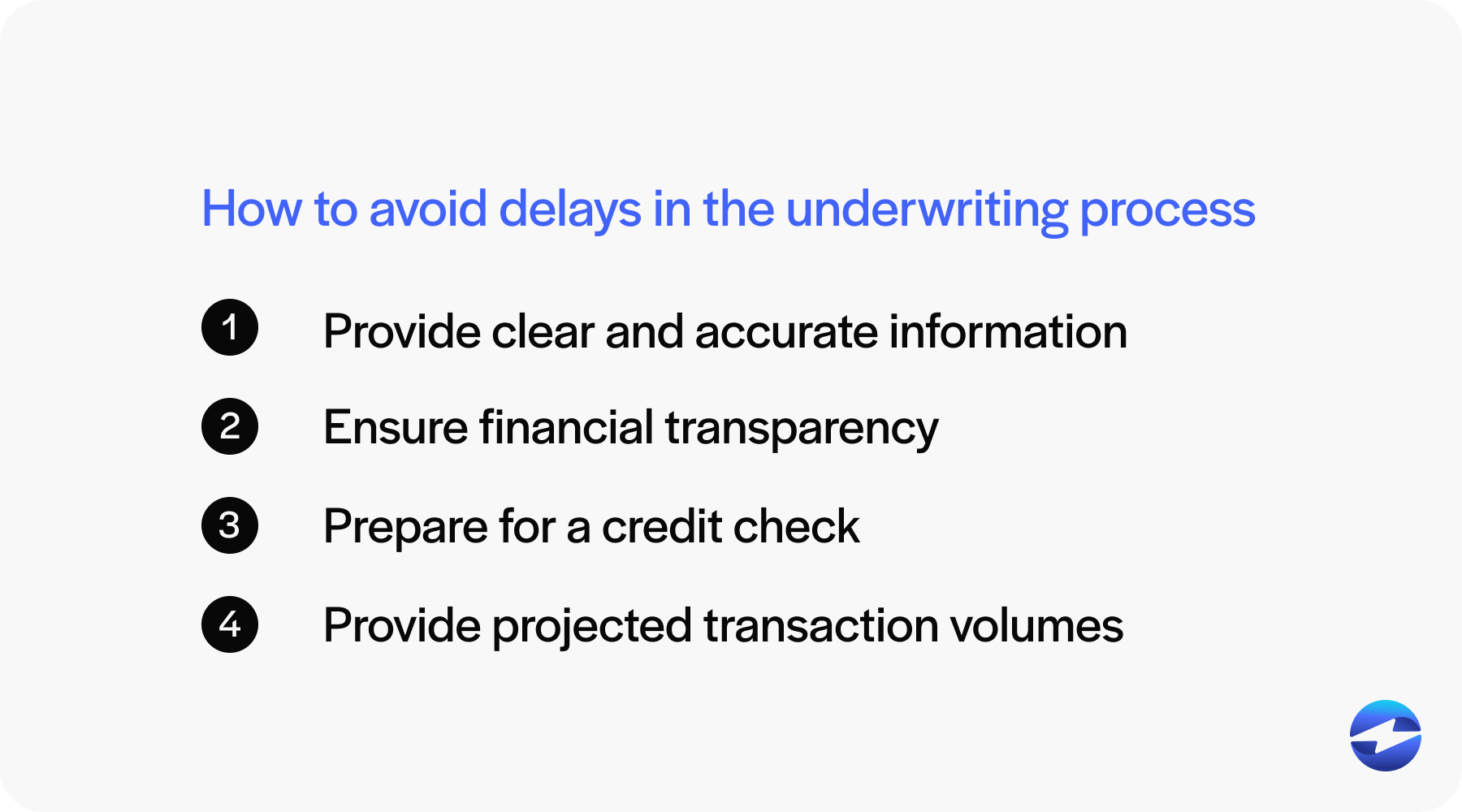

How to avoid delays in the underwriting process

Delays in the merchant underwriting process can hinder your ability to start processing electronic payments promptly.

Understanding how to navigate merchant underwriting efficiently can ensure quicker merchant account approval, allowing your business to seamlessly accept payments with minimal interruptions.

Merchants can proactively avoid delays to prevent revenue losses and keep operations running smoothly. Some ways to mitigate or eliminate underwriting delays include providing clear and accurate information, enhancing financial transparency, preparing for credit checks, and projecting transaction volumes.

Provide clear and accurate information

Providing clear and accurate information is fundamental to expediting the merchant underwriting process.

Ensure all details in your merchant account application, like your business type and financial history, are correct and complete. This reduces questions from the underwriting team and accelerates their risk assessment, which can otherwise lead to bottlenecks in obtaining approval.

Ensure financial transparency

With more financial transparency around your transaction history, your business can ensure a more efficient underwriting process.

Submit comprehensive financial and bank statements that clearly outline your business’s financial position. This allows payment processors and merchant account providers to accurately assess potential risks associated with your operations, minimizing the possibility of delays.

Prepare for a credit check

Preparing for a credit check helps avoid delays by ensuring your credit history is in order before applying for a merchant account.

Address any discrepancies in your credit report ahead of time to present a solid financial profile. A good credit standing reassures underwriters and payment facilitators that your business is well-managed, potentially speeding up their decisions.

Provide projected transaction volumes

Providing projected transaction volumes helps streamline risk assessment and reduce delays by giving the underwriting team a clear picture of potential business activity and helping them gauge the financial risk associated with your merchant account.

By accurately estimating your transaction volumes, you enable payment processors to match your business with suitable merchant services, facilitating quicker approval.

These tips can accelerate and improve the merchant underwriting process.

Along with knowing how to avoid delays, businesses should understand the distinctions between Independent Sales Organizations (ISOs) and PayFacs. The difference between the two has significant implications for the merchant underwriting journey, impacting the speed and complexity of approval criteria.

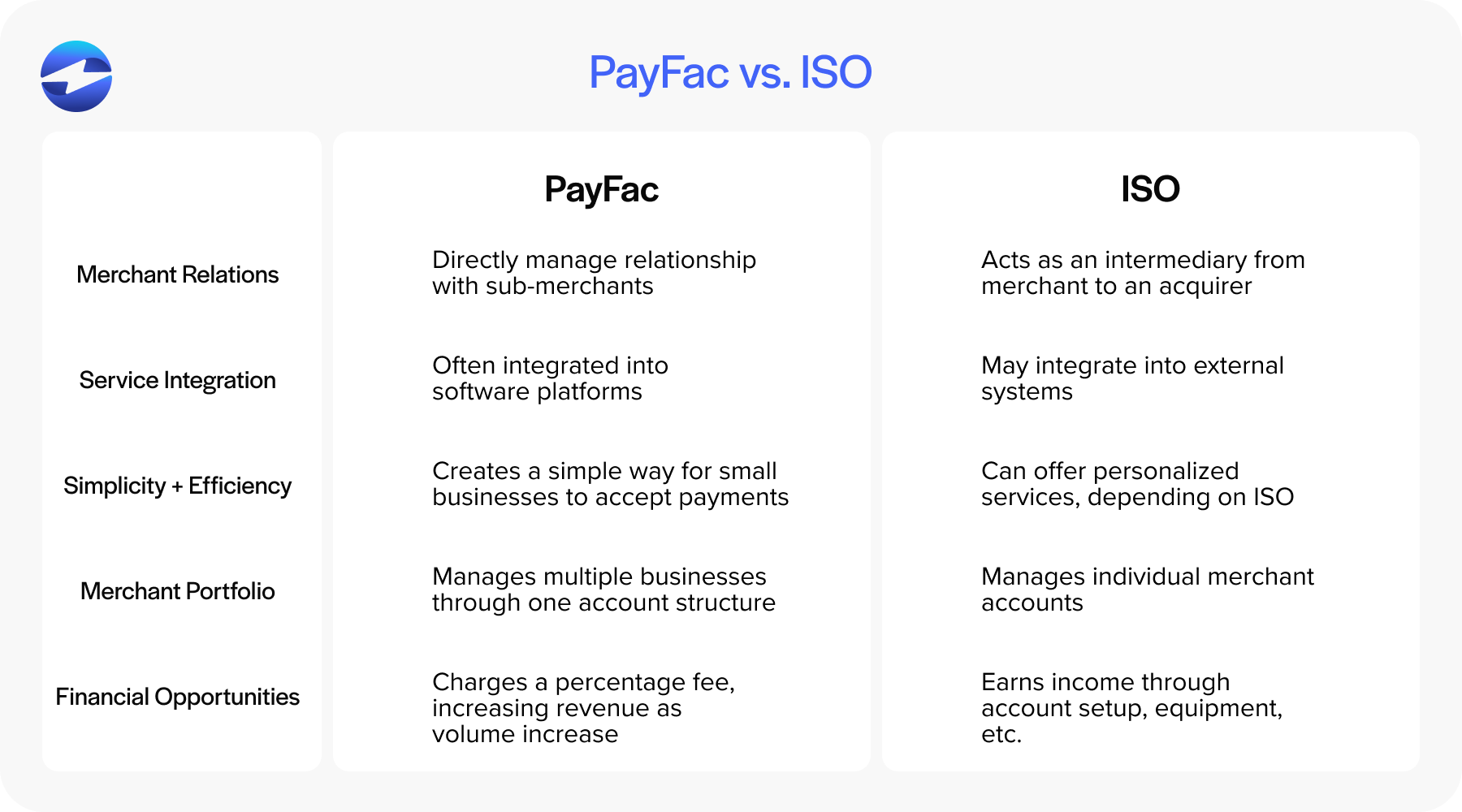

What’s the difference between ISO and PayFac?

While ISOs and PayFacs enable merchants to accept credit card payments, they operate differently.

ISOs act as intermediaries between merchant accounts and acquiring banks, primarily focusing on selling and managing merchant accounts. They provide merchants with credit card processing services, but the merchant agreements are held with acquiring banks, not the ISO itself.

In contrast, PayFacs streamline the process by directly allowing merchants to sign up for payment processing services without needing an individual merchant account from an acquiring bank.

PayFacs aggregate multiple merchants under a single master account, making the application process faster and simpler. They assume some of the risks and responsibilities related to underwriting that ISOs typically share with the acquiring banks.

Understanding the differences between ISOs and PayFacs is essential for businesses considering payment processing options. Each model presents unique advantages and risk responsibilities, impacting the onboarding experience and the level of control over merchant accounts.

Grasping these differences not only aids in choosing the right provider but also highlights the broader importance of merchant underwriting.

The importance of understanding the process

Merchant underwriting is a foundational process in the payment industry that balances risk management with the need for secure and efficient electronic transactions.

Understanding the steps, required documentation, and influential underwriting factors helps businesses better prepare for approval and smoother integration into the digital payment landscape.

As businesses navigate this process, they contribute to a safer transaction environment, enhancing trust and reliability across the payment ecosystem.