Blog > What is a Payment Facilitator: Understanding PayFac

What is a Payment Facilitator: Understanding PayFac

Imagine a world where seamless transactions are the norm and businesses thrive on swift, hassle-free payments.

Your business can achieve this level of payment efficiency by knowing what a payment facilitator is and how it connects merchants and banking systems to accelerate and secure the flow of funds.

What is a PayFac (payment facilitator)?

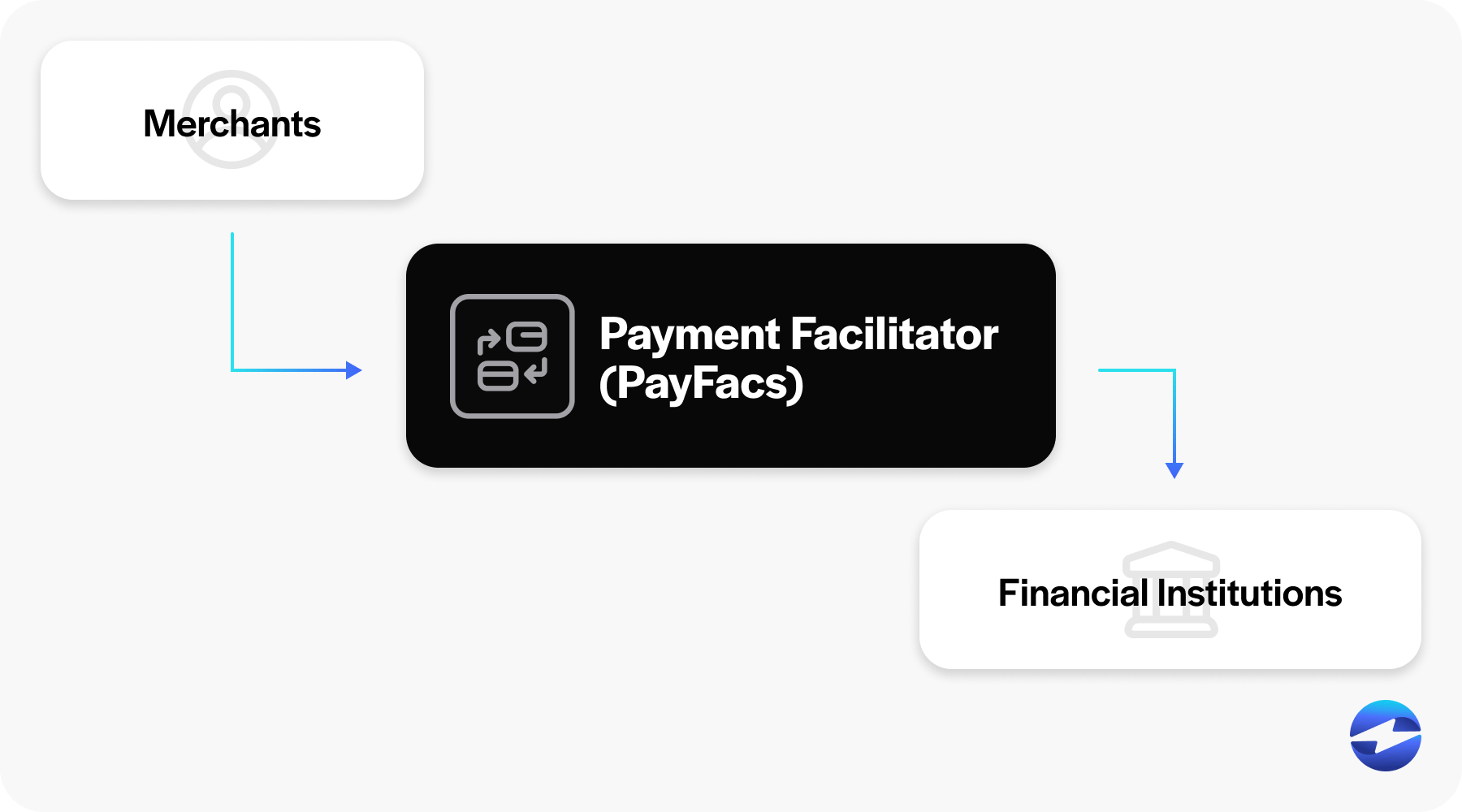

PayFac, short for payment facilitator, acts as a go-between for merchants and financial institutions to simplify electronic payments.

Instead of individual businesses having to create a merchant account with banks or other merchant account providers, PayFacs have a master merchant account that they use to provide payment services to numerous sub-merchants. This simplifies the onboarding process for businesses looking to accept credit card payments, granting them faster access to payment systems.

A PayFac takes the burden of managing the complex aspects of payment processing, such as PCI compliance standards, risk management, and handling various payment methods like credit and debit cards, online payments, and mobile payments.

The payment facilitator model is often a good fit for software companies and other service providers that want to incorporate payment acceptance into their offerings to enhance the user experience.

Some key features of PayFac services include merchant onboarding, payment processing services, risk and compliance management, and offering multiple payment methods.

With this setup, businesses can concentrate on their core products or services, leaving the complex yet crucial task of payment facilitation to a specialized provider.

How does a PayFac work?

Since PayFacs act as middlemen between businesses and banks during the payment process, it’s important to understand their role behind the scenes.

Instead of individually setting up a merchant account with banks or other financial institutions, which can be a lengthy and complex process, businesses can quickly onboard through PayFac.

Here’s how it works:

- Sign-up: Businesses can easily sign up with a PayFac provider who becomes the master merchant.

- Simplified onboarding: The PayFac handles the underwriting and due diligence by evaluating and verifying businesses for eligibility, usually with quick approval turnaround times.

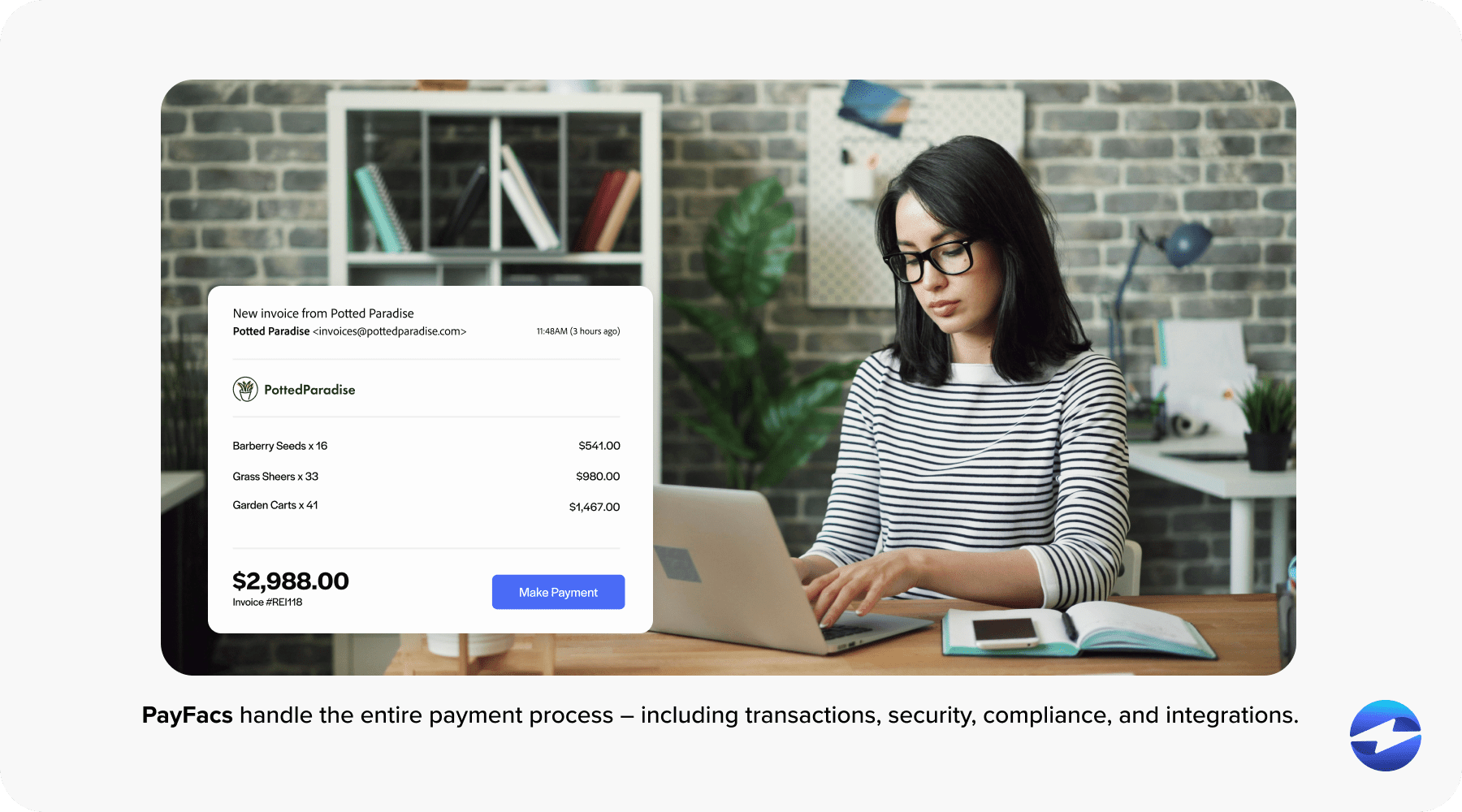

- Integrated processing: The PayFac handles the entire payment process, including transactions, security, compliance, and integrations with ERP, eCommerce, or CRM software.

Through payment facilitation, businesses gain access to a robust payment ecosystem without the individual burden of managing their payment processing operations.

Why are they important?

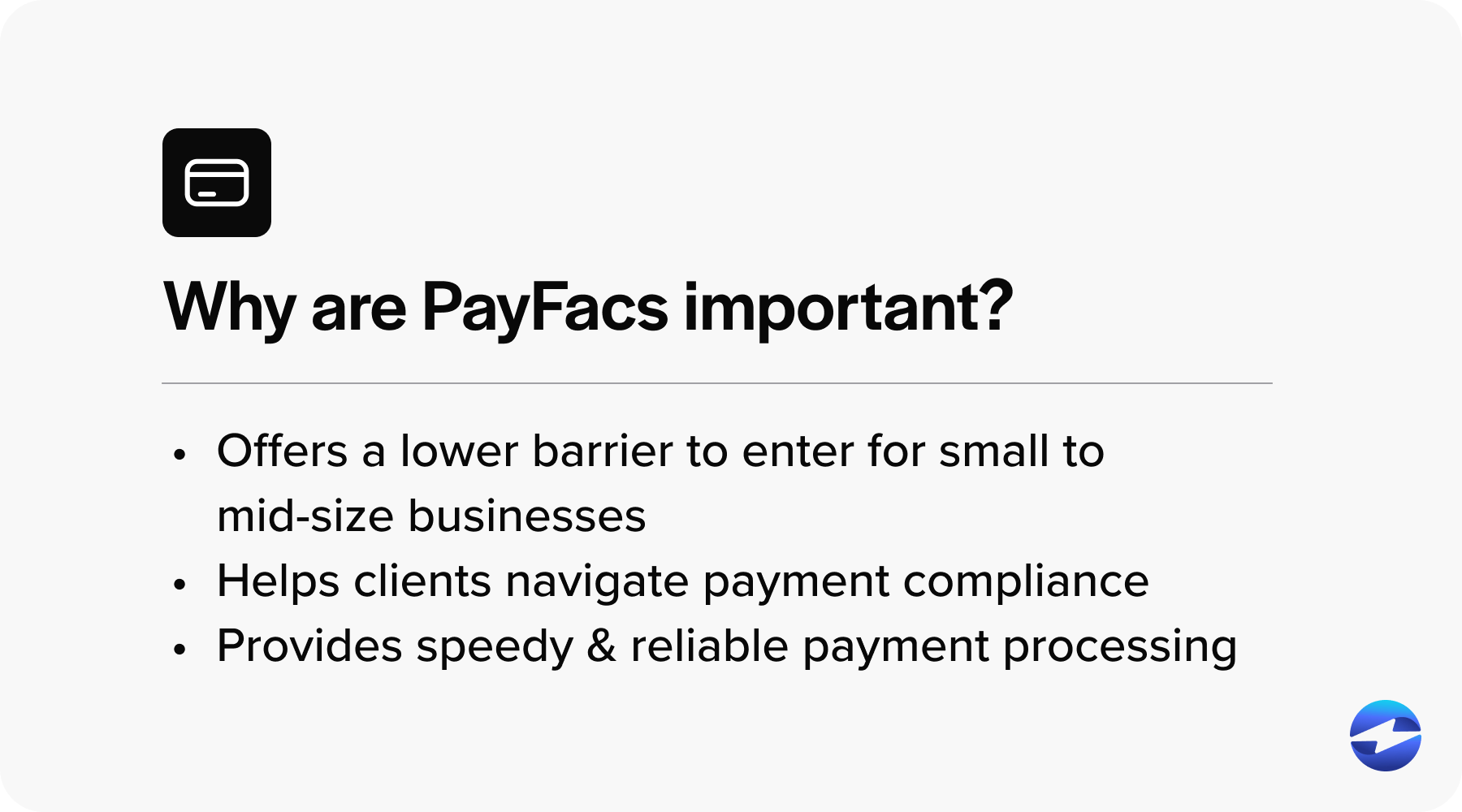

PayFacs have become crucial cogs in the modern payments landscape for several reasons.

Firstly, PayFacs significantly lower the barrier to entry for small to mid-size businesses when it comes to accepting digital payments by offering a more straightforward onboarding process.

PayFac providers also help their clients navigate payment compliance with regulations like PCI compliance, which governs how credit card data is handled. Since failure to comply with such regulations can result in substantial fines and legal issues, these facilitators alleviate merchants’ stress.

Lastly, PayFacs provide speedy and reliable payment processes to enhance customer satisfaction and loyalty, enabling businesses to grow and maintain a competitive edge.

What are the main differences between PayFac solutions, payment processors, and ISOs?

Understanding the roles and differences between a PayFac, payment processor, and an Independent Sales Organizations (ISO) is essential for businesses looking to select a payment solution that best suits their needs.

Each offers a distinct business model with various degrees of service, control, and responsibility in the payment acceptance process.

PayFac vs Payment Processor

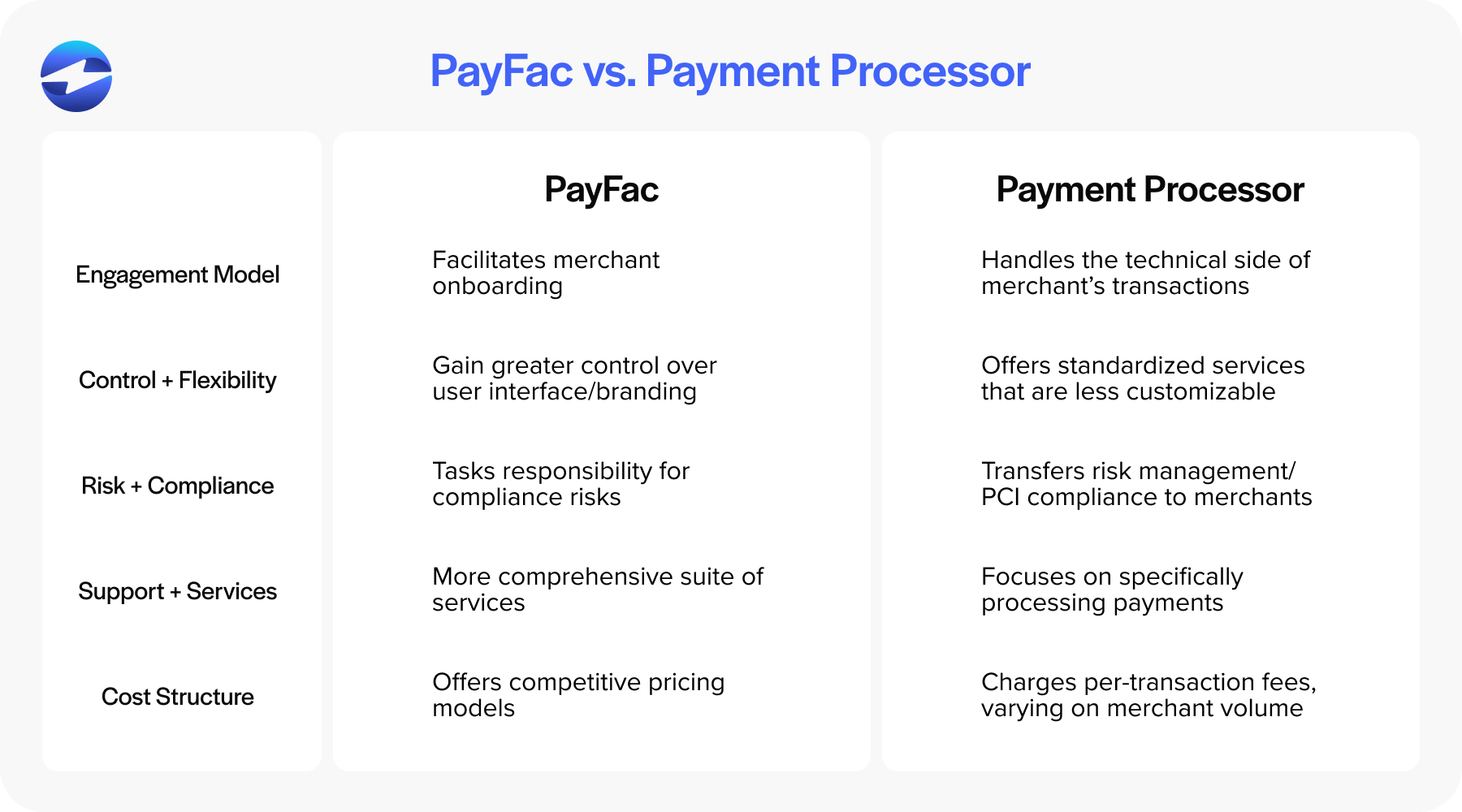

Payment facilitators and payment processors offer essential services in processing online and electronic payments, yet they function differently in the payment value chain.

- Engagement model:

- PayFacs act as master merchants, signing up businesses (sub-merchants) under their umbrella and facilitating a simplified merchant onboarding process.

- Payment processors handle the technical aspect of processing transactions but don’t manage merchant accounts directly.

- Control and flexibility:

- PayFacs provide greater control over the payment experience and customer journey, including branding and user interface.

- Payment processors offer standardized services that are more rigid and less customizable.

- Risk and compliance:

- PayFacs assume responsibility for underwriting and compliance risks as they onboard and manage sub-merchant accounts.

- Payment processors transfer risk management and PCI compliance to the merchants, who must manage these obligations directly.

- Support and services:

- PayFacs typically offer a more comprehensive suite of services, including billing, customer support, and handling disputes.

- Payment processors focus on processing payments and often require merchants to handle frontline customer service and dispute resolution.

- Cost structure:

- PayFacs may offer competitive pricing models due to their aggregated volume and often cater to niche markets.

- Payment processors generally charge per-transaction fees and other associated costs, which may vary based on individual merchant volume

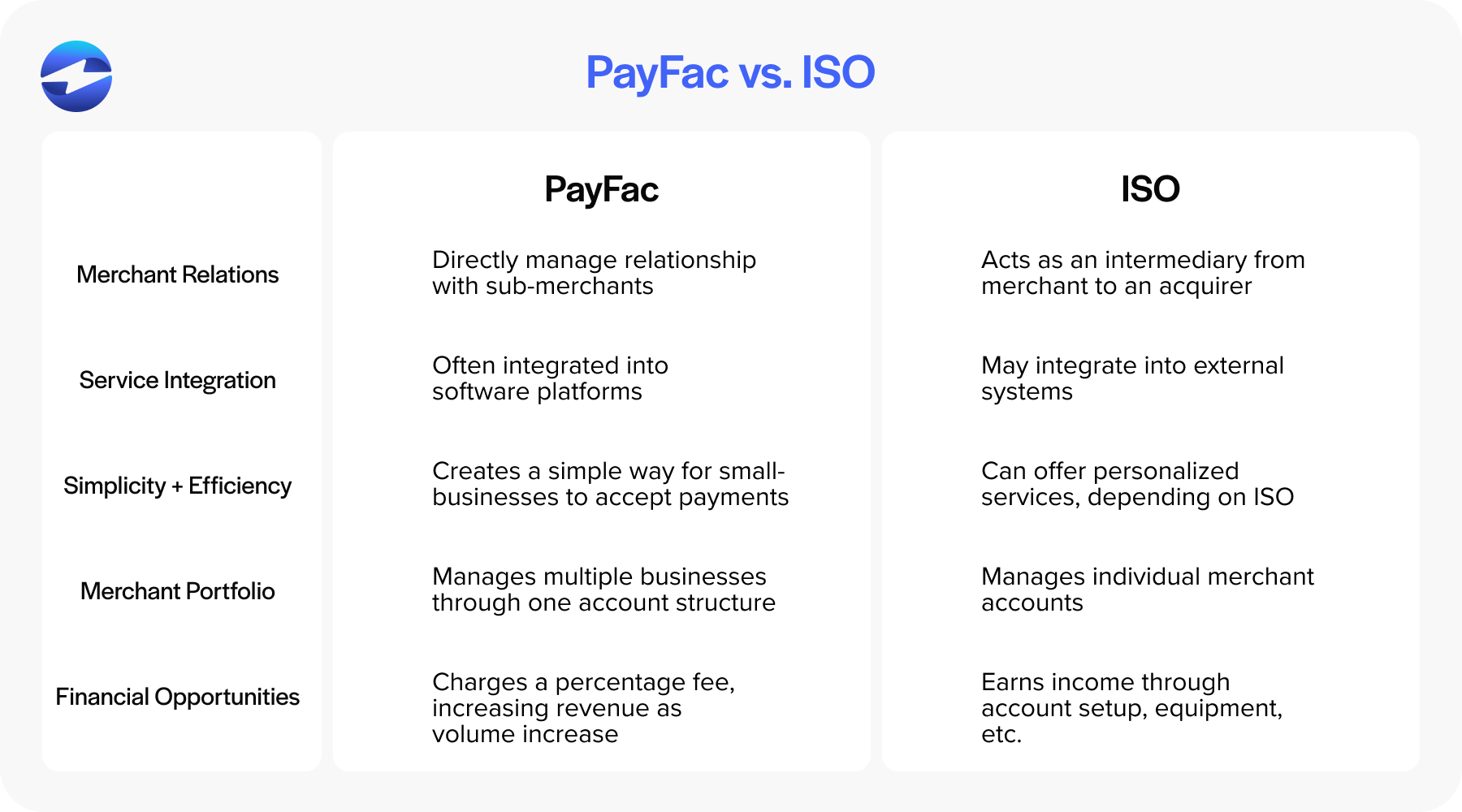

PayFacs vs ISOs

While PayFacs and ISOs are both involved in merchant services, they serve businesses differently.

- Merchant relations:

- PayFacs directly manage the relationship with their sub-merchants and offer a more seamless payment facilitation service.

- ISOs act as intermediaries that work with merchant acquirers to set up individual merchant accounts, which can result in a longer setup process.

- Service integration:

- Payment facilitators are often integrated into software platforms, providing a cohesive user experience for businesses and their customers.

- ISOs provide payment services that may integrate with various external systems, but the need for a unified platform can pose integration challenges.

- Simplicity and efficiency:

- PayFacs enhance the payment acceptance process, making it simpler and more efficient for small businesses to start accepting payments.

- ISOs can offer personalized service but may require more extensive documentation and longer approval times for merchant accounts.

- Merchant portfolio:

- PayFacs manage many small to mid-sized businesses through a single merchant account structure.

- ISOs manage individual merchant accounts, which can provide businesses with more autonomy but also more responsibility.

- Financial opportunities:

- PayFacs earn a portion of the transaction revenue by charging a percentage fee, which allows them to benefit from the efficiencies gained as transaction volumes increase.

- ISOs earn income through account setup, equipment, and transaction fees that are often tailored to each merchant’s processing volume.

Overall, PayFacs offer integrated, streamlined services ideal for software platforms and SMEs looking for fast payment acceptance with minimal hassle. Whereas payment processors focus strictly on transaction handling, and ISOs focus on individual account services that suit businesses seeking more direct relationships with merchant service providers.

5 main benefits of utilizing a payment facilitator

PayFacs offer a variety of advantages for businesses, each designed to streamline and safeguard your payment processes.

Here are the top five benefits of PayFacs:

- Enhanced payment security

- Streamlined payment processing

- Scalability and flexibility

- Added value for merchants and their customers

- Simplified onboarding

1. Enhanced payment security

One of the primary advantages of engaging with a PayFac is the strengthened security it brings to your transactions.

PayFacs are well-equipped with advanced tools and protocols, such as encryption technologies and fraud detection systems, to protect against fraud and data breaches. They also adhere to stringent PCI security standards without transferring the burden of securing transactions to individual merchants.

Therefore, transactions processed through a PayFac are guarded by robust security measures, giving merchants and their customers peace of mind.

2. Streamlined payment processing

Payment facilitators simplify the payment process by consolidating various payment methods into one platform, making it easier for businesses to accept payments from customers.

3. Scalability and flexibility

PayFac solutions optimize the payment experience, encouraging more scalability and flexibility for growing businesses.

As your business expands, you can rely on a PayFac to adapt to your evolving payment volumes and needs without requiring significant changes to your infrastructure. This adaptability means that whether your transactions are increasing due to seasonal demands or long-term growth, your facilitator can promptly adjust to support your business’s trajectory.

4. Added value for merchants and their customers

Integrating PayFac services into your platform does more than handling payments; it adds intrinsic value.

PayFacs often come with additional features such as analytics, customized reporting, and specialized customer support tailored to the nature of your business. These features can aid in improving the overall user experience and gaining valuable insights to enable more data-driven decision-making.

5. Simplified onboarding process

The PayFac model simplifies the traditional and sometimes time-consuming process of setting up payment services.

Rather than navigating through paperwork and compliance checks, merchants can enjoy a streamlined onboarding process to start processing payments faster, minimizing downtime and frustration.

Reshaping the payments ecosystem with PayFac

The rise of payment facilitation has revolutionized the payments landscape, providing a flexible solution for digital and mobile payments while ensuring adherence to major security standards. Choosing a payment facilitator represents a strategic advantage for software firms and businesses seeking seamless payment processing integration without the complexities associated with traditional processors.

Ultimately, PayFacs emerge as pioneers of payment innovation, delivering an effective mechanism for payment acceptance that aligns with the evolving needs of modern businesses and consumers.