Blog > Healthcare Payment Processing with Sage Intacct

Healthcare Payment Processing with Sage Intacct

In healthcare, financial management can feel as complicated as the medical systems themselves. Between patient billing, insurance reimbursements, and government program payments, money is constantly moving—but not always efficiently. Payment delays, manual posting errors, and disconnected software systems can lead to significant administrative costs and even compliance risks. For busy finance teams in hospitals, clinics, and healthcare networks, the ability to automate these workflows is no longer a nice-to-have—it’s essential.

That’s where Sage Intacct for healthcare comes in. As a trusted cloud-based ERP system, Sage Intacct helps healthcare organizations manage their financial operations with accuracy and efficiency. By centralizing billing, payments, and reporting in one platform, finance teams gain a clear, real-time view of every transaction. More importantly, it makes automation possible across multiple payer sources—patients, insurers, and third-party partners—so organizations can spend less time fixing numbers and more time focusing on care.

Understanding Healthcare Payment Challenges

Healthcare payment processing involves far more complexity than standard business transactions. One day you’re managing insurance reimbursements, the next you’re handling patient out-of-pocket payments, or waiting for government remittances. Every payer follows different timelines and submission formats, and each payment source comes with its own rules. Without automation, these moving parts can turn into a logistical nightmare.

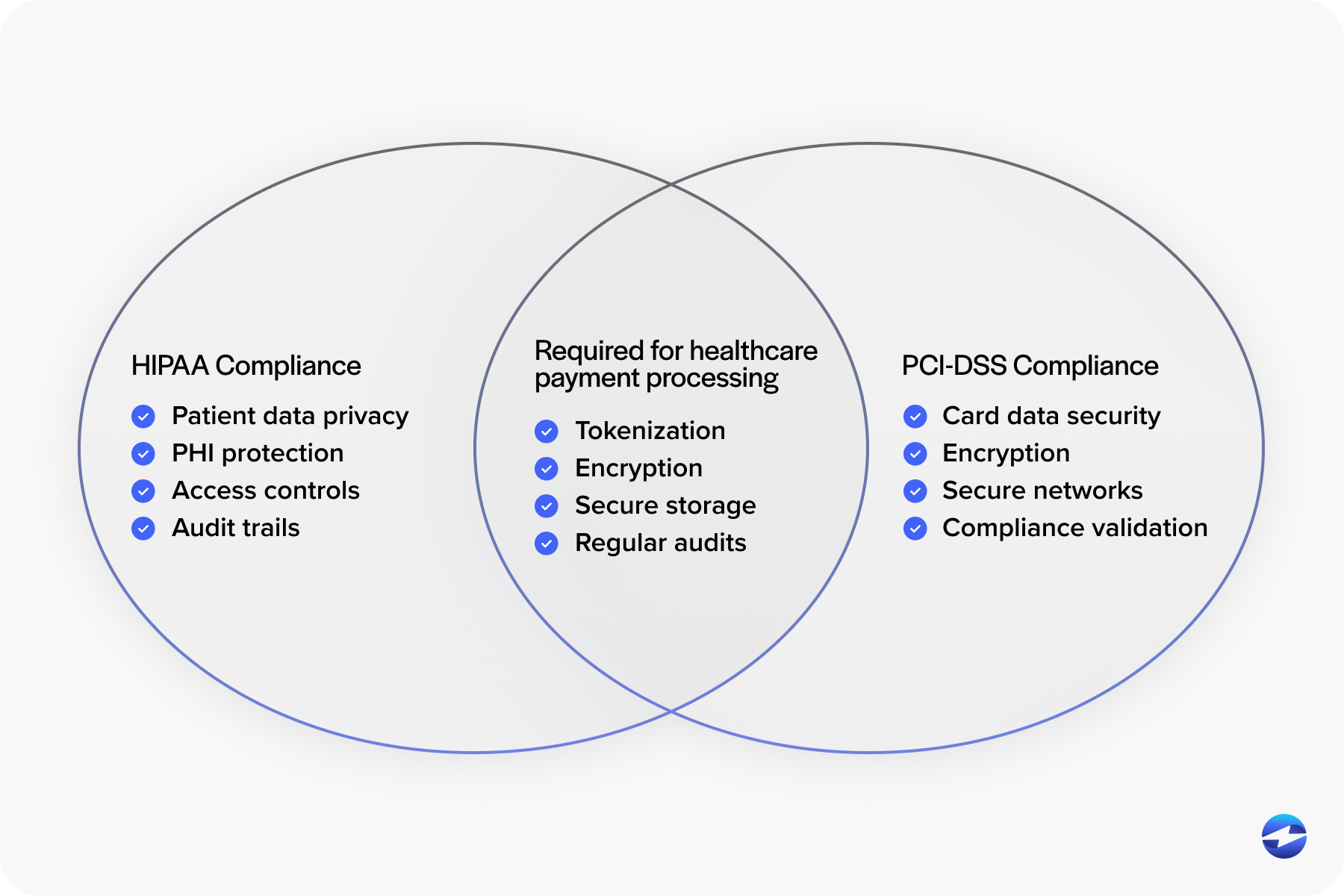

Data silos are one of the biggest pain points. Many healthcare organizations still rely on a mix of EHR (Electronic Health Records), billing software, and manual spreadsheets to track revenue. When those systems don’t communicate, reconciliation becomes tedious and error-prone. Finance staff spend hours comparing records, identifying mismatched data, and correcting entries—all while trying to stay compliant with regulations like the Health Insurance Portability and Accountability Act (HIPAA) and Payment Card Industry Data Security Standards (PCI-DSS).

Automation within Sage Intacct ERP for healthcare breaks down those silos. It allows every transaction, from patient payments to insurer reimbursements, to flow through a single connected platform. That transparency eliminates confusion and helps organizations maintain financial accuracy, even as payment volumes grow.

How Sage Intacct Simplifies Healthcare Payment Processing

Sage Intacct payment processing is built around automation and clarity. Instead of manually entering claim payments or uploading deposits, the platform automatically posts payments to the correct accounts. It tracks the entire payment journey—from the moment a claim is submitted to when the funds appear in your ledger. For finance teams, this means less time spent managing data and more time analyzing outcomes.

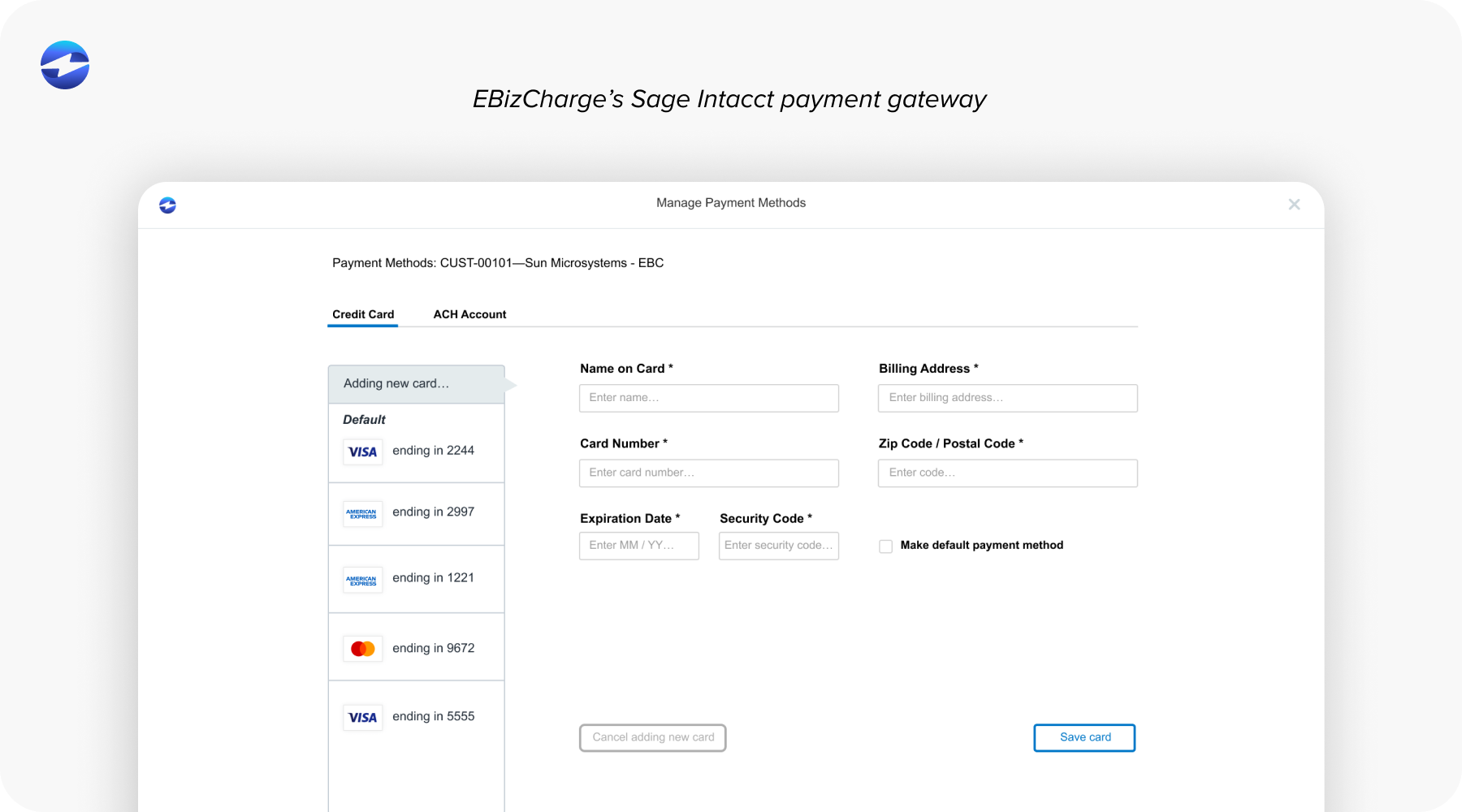

With Sage Intacct invoicing, healthcare providers can also simplify patient billing. Recurring invoices, automated payment reminders, and secure online payment options all help reduce the timeline of collection cycles. The system supports ACH transfers, credit cards, and eCheck payments—offering flexibility for patients while ensuring everything syncs directly into the general ledger. Every payment ties back to a corresponding invoice or patient record, improving both visibility and accountability.

The benefit isn’t just efficiency; it’s consistency. Automated billing ensures that invoices are always accurate, compliant, and traceable. Whether a payment comes from an insurer, a grant, or a patient, Sage Intacct ERP records it the same way—precisely and automatically.

The Role of Integration in Healthcare Finance Automation

One of the reasons Sage Intacct ERP stands out is its ability to integrate seamlessly with other systems. Using the Sage Intacct API, healthcare organizations can connect their EHR platforms, patient portals, CRMs, and insurance billing systems into a unified ecosystem. When those tools communicate automatically, data flows in real time. This means invoices can be created from patient records, payments can be updated directly in accounting, and reports always reflect the most accurate financial snapshot.

This same flexibility is what allows Sage Intacct to serve different industries, from construction to healthcare. For example, construction payment processing with Sage Intacct uses milestone-based automation to manage complex billing schedules—just like healthcare can use the same structure to manage recurring patient billing or claim reimbursements. The underlying goal is the same: less manual work and more accuracy.

By integrating a trusted payment processor into Sage Intacct, healthcare organizations can further streamline collections. Instead of juggling multiple logins or systems, teams process payments right inside the ERP. The integration ensures instant reconciliation, reduces the risk of data duplication, and delivers real-time visibility across departments.

Processing Credit Cards and ACH Payments in Sage Intacct

Credit card and ACH payments are becoming increasingly common in healthcare as patients take on more direct payment responsibility. With Sage Intacct payment processing, organizations can accept these payments securely and efficiently. The system uses tokenization to protect sensitive patient data and maintain PCI compliance. That means no credit card information ever lives inside your internal systems, reducing risk while maintaining convenience.

When integrated with a payment processing solution, Sage Intacct automatically applies payments to the correct invoices and updates ledgers instantly. Finance teams no longer need to manually post transactions or track down missing payments. Everything—from refunds to recurring charges—is logged within the system, ensuring a clean audit trail.

This automation also improves cash flow. By speeding up posting and reconciliation, payments clear faster, and organizations have a more accurate picture of daily cash positions. That’s especially important for healthcare providers managing tight budgets and multiple funding streams.

Common Sage Intacct Payment Integration Mistakes to Avoid

While integration brings major benefits, it also requires thoughtful setup. One of the most common mistakes healthcare organizations make is failing to connect all relevant systems—such as EHR, CRM, and payment gateways—to Sage Intacct accounting software. When any of these remain disconnected, data gaps appear, leading to inconsistent financial reporting.

Another common oversight is neglecting compliance requirements. In healthcare, both PCI and HIPAA compliance are essential when managing payment and patient data. Using unverified add-ons or skipping encryption measures can expose your organization to unnecessary risk.

Some teams also overlook the power of the Sage Intacct API, opting to move data manually instead of automating it. That decision limits visibility and creates redundant work. Finally, organizations often underestimate the need for ongoing integration monitoring, which ensures that data continues to sync correctly as systems evolve.

Avoiding these mistakes starts with careful planning. Healthcare organizations should regularly audit their financial integrations, confirm compliance protocols, and leverage automation wherever possible to minimize manual intervention.

Why Sage Intacct is a Strong Fit for Healthcare Payment Management

Sage Intacct healthcare solutions are designed to meet the industry’s unique financial demands. They combine automation, scalability, and compliance tools that help organizations stay on top of their financial operations without overwhelming their staff. With built-in reporting and analytics, teams can monitor cash flow, track reimbursements, and maintain audit readiness—all from within Sage Intacct ERP for healthcare.

Integrated payment processing further enhances transparency. Every transaction, whether it’s a patient payment or an insurer disbursement, is visible in real time. Finance leaders can identify delays, reconcile faster, and produce accurate reports for compliance or audits.

Trusted integrations—such as EBizCharge—extend Sage Intacct’s functionality even further. These partnerships offer advanced automation features, lower processing costs, and additional layers of security, helping healthcare providers simplify their payment workflows and strengthen financial stability.

How EBizCharge Streamlines Healthcare Payments in Sage Intacct

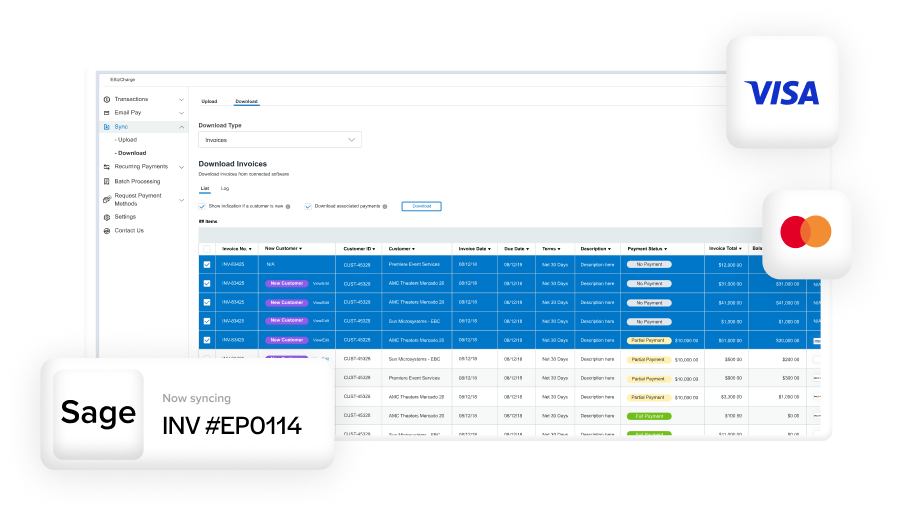

EBizCharge is a payment processing solution that pairs seamlessly with Sage Intacct ERP for healthcare. It embeds directly within the ERP, allowing staff to process payments, post transactions, and reconcile balances without leaving the Sage Intacct environment. This eliminates redundant steps, reduces the risk of errors, and speeds up reimbursement cycles.

The integration automates the exchange of payment data between systems. When a patient pays an invoice, EBizCharge posts the payment instantly in Sage Intacct invoicing, ensuring that accounts are updated in real time. Because the system is PCI and HIPAA compliant, sensitive payment information stays encrypted and secure.

For healthcare providers juggling multiple payment types—credit cards, ACH, or recurring billing—EBizCharge streamlines everything into one view. Finance teams can track payments across patients, insurers, and programs with full transparency. That means less time spent on manual posting and more time analyzing trends or optimizing operations.

Together, EBizCharge and Sage Intacct payment processing create a system that is both efficient and compliant. Healthcare organizations gain the visibility they need, the security they require, and the automation they’ve been missing.

A Healthier Financial Future with Sage Intacct

In healthcare, financial accuracy is just as critical as clinical accuracy. When payment systems are disjointed, they create extra work and unnecessary stress for already busy teams. With Sage Intacct for healthcare, finance departments can finally manage payments, billing, and reporting from one reliable platform.

By integrating a modern payment processor like EBizCharge, organizations eliminate manual steps, accelerate cash flow, and maintain compliance without compromise. It’s a practical approach that gives finance leaders what they really need: time, control, and confidence.

In the end, good financial health supports better patient outcomes. And with Sage Intacct ERP for healthcare, automation, and smart payment integrations, healthcare organizations can build systems that are as efficient and resilient as the care they deliver every day.

- Understanding Healthcare Payment Challenges

- How Sage Intacct Simplifies Healthcare Payment Processing

- The Role of Integration in Healthcare Finance Automation

- Processing Credit Cards and ACH Payments in Sage Intacct

- Common Sage Intacct Payment Integration Mistakes to Avoid

- Why Sage Intacct is a Strong Fit for Healthcare Payment Management

- How EBizCharge Streamlines Healthcare Payments in Sage Intacct

- A Healthier Financial Future with Sage Intacct