Blog > 7 Things to Know Before Integrating Payment Processing with Sage 100

7 Things to Know Before Integrating Payment Processing with Sage 100

If you run your business on Sage 100 software, you already know it’s a reliable hub for managing accounting, inventory, and operations. It’s built to give you a single place for tracking your business performance. But when it comes to payments, many companies still run a separate process—using different systems, spreadsheets, or even manual entry to record transactions. That’s when the problems start: duplicated work, reconciliation errors, and delays in cash flow.

A well-planned Sage 100 integration for payment processing can bring everything together. It means your payment data flows directly into Sage 100 ERP, reducing mistakes and saving your team hours of repetitive work. But like any major change to your system, it’s important to understand the details before you begin. Rushing in without a plan can create more headaches than it solves.

This article will explore seven important things to consider before integrating payment processing with Sage 100 ERP.

1. Understand Sage 100’s Integration Capabilities

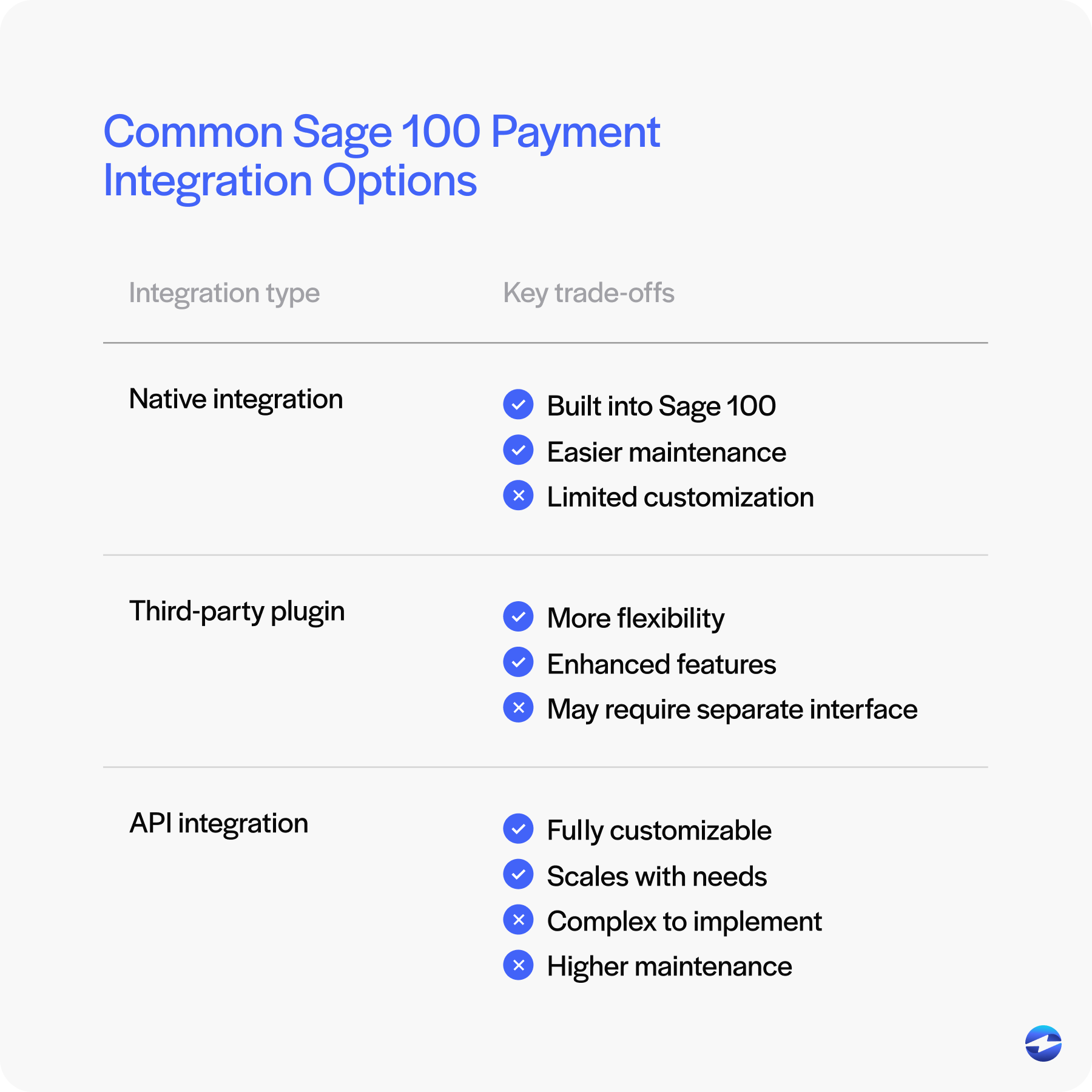

Not every Sage 100 integration works the same way. Some are native, built directly into the software and supported by Sage itself. Others require a third-party payment processor to connect. Which one is right for you depends on your version of Sage 100 ERP, the modules you use, and the payment methods you want to support.

If you’re running an older version of Sage 100 software, you may find that it doesn’t support certain integration features. In those cases, you might need an upgrade or a custom API connection. API integrations can be powerful, but they also mean extra work to set up, test, and maintain.

Before committing to a payment processing solution, make sure you fully understand what your current system supports. Review your Sage 100 ERP documentation, talk to your IT provider, and—if you use a third-party payment processor—ask them what level of integration they can deliver.

2. Evaluate Your Payment Processing Needs

Before you even start comparing payment solutions, you need to be clear on what you actually need. Ask yourself:

- Do you need Sage 100 credit card processing for in-person sales, online transactions, or both?

- Will you also be processing ACH transfers, wire payments, or mobile wallet payments?

- Do you handle one-time purchases, subscriptions, or recurring invoices?

Your answers will narrow the field. For example, if recurring payments are common in your business, you’ll want a payment processor that makes it easy to automate them inside Sage 100 ERP. If you take a lot of payments from mobile devices, your Sage 100 integration should be optimized for that.

Volume matters too. A payment solution that’s fine for 500 transactions a month might struggle with 5,000. Think about where you are today and where your business might be in a few years.

3. Ensure PCI Compliance

When dealing with payments, compliance with Payment Card Industry Data Security Standards (PCI DSS) isn’t negotiable—it’s required. PCI compliance means you’re following the security standards set by the Payment Card Industry to protect sensitive payment data.

The good news is that many Sage 100 payment processing integrations are designed to help with compliance. Features like tokenization and encryption mean sensitive data is never stored on your servers, reducing risk. A third-party payment processor might even handle much of the compliance burden for you.

Still, the responsibility ultimately falls on your business. Make sure you understand your compliance obligations before you go live. Ask your payment processor what specific tools and protections they offer for Sage 100 credit card processing.

4. Assess Security Measures

PCI compliance is just the starting point. True security means protecting your payment data against a wide range of external and internal threats.

A strong Sage 100 integration should include:

- Encryption: Protects payment data during transmission.

- Tokenization: Replaces sensitive data with a secure placeholder.

- Fraud prevention tools: Alerts you to suspicious transactions in real time.

Don’t forget internal security. Role-based access means only the people who need to see payment information can see it. Regular audits and updates keep your system protected as threats evolve.

5. Consider User Experience & Workflow

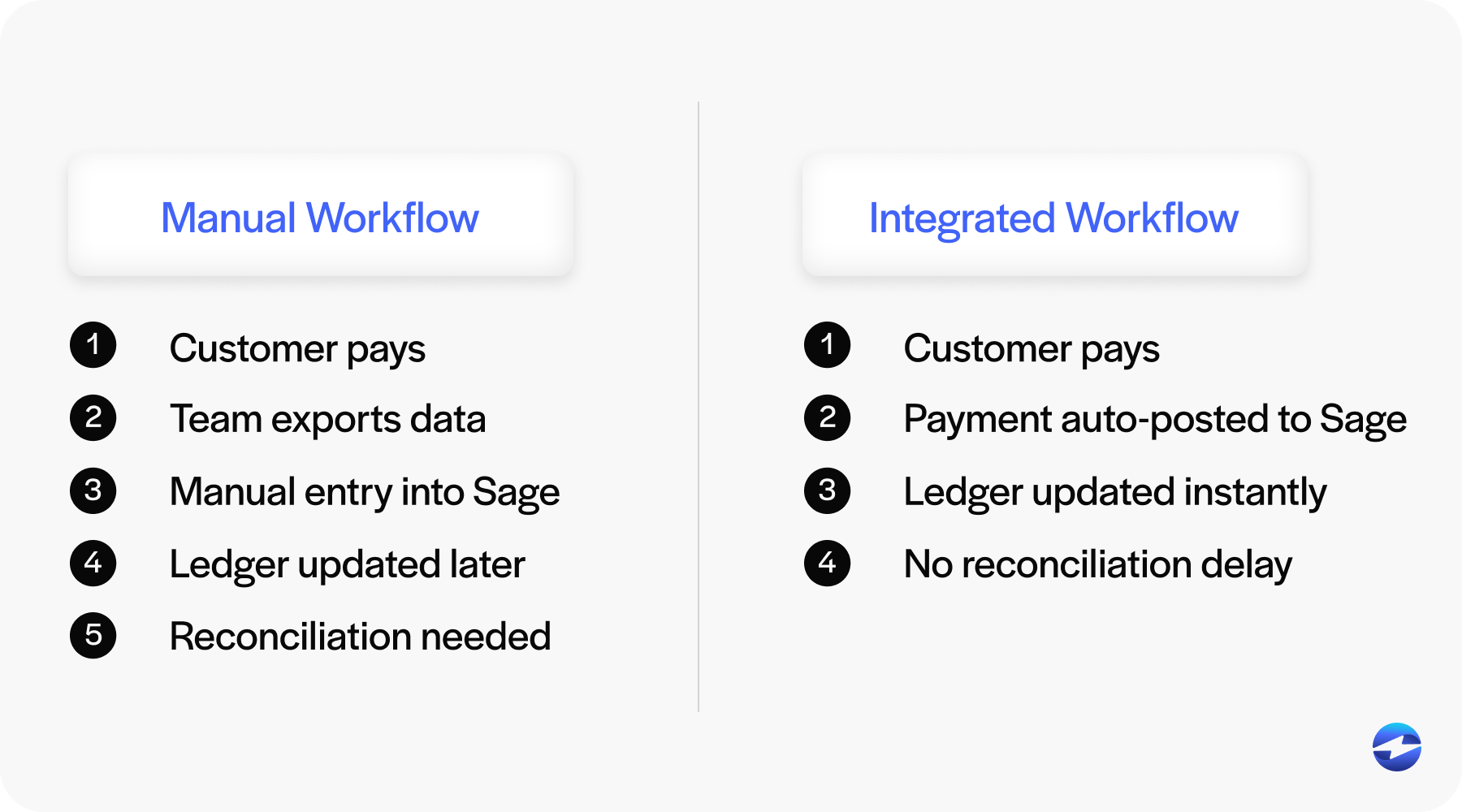

The whole point of integrating payment processing is to make life easier for your team. A good integration will post payments directly to the right accounts in Sage 100 ERP without the need for extra steps.

Picture this: a customer makes a payment, and within seconds, that payment is applied to their account, the ledger is updated, and your reports reflect the change. No manual entry. No duplicate records. No missed transactions.

But user experience matters beyond just automation. If your accounting team has to click through multiple screens or switch between systems, they’ll lose time and patience. Think about how refunds, chargebacks, and partial payments will be handled. The more seamless the process, the more value your payment solution will deliver.

6. Integration Costs & ROI

There’s no getting around it, integrations cost money. You’ll likely pay a setup fee, a monthly subscription, and transaction fees. But the cheapest payment processor isn’t always the best choice.

When evaluating costs, consider the return on investment (ROI). If your Sage 100 payment processing setup saves your team five hours a week, eliminates costly reconciliation errors, and speeds up cash flow, it may be worth paying slightly more in transaction fees.

Look at both the short-term and long-term picture. Will the payment solution still fit your needs as your business grows? Will it keep working when you upgrade Sage 100 software? These questions help ensure you’re making a smart investment.

7. Support & Scalability

Even the smoothest Sage 100 integrations will occasionally hit a snag. When they do, you’ll want a payment processor with fast, knowledgeable support.

Scalability matters too. Your payment solution should grow with your business. If you start selling internationally or add new payment methods, the integration should be able to handle those changes without a complete rebuild.

Think of it as future-proofing your business. The more flexible and adaptable your Sage 100 payment processing setup, the fewer headaches you’ll face down the road.

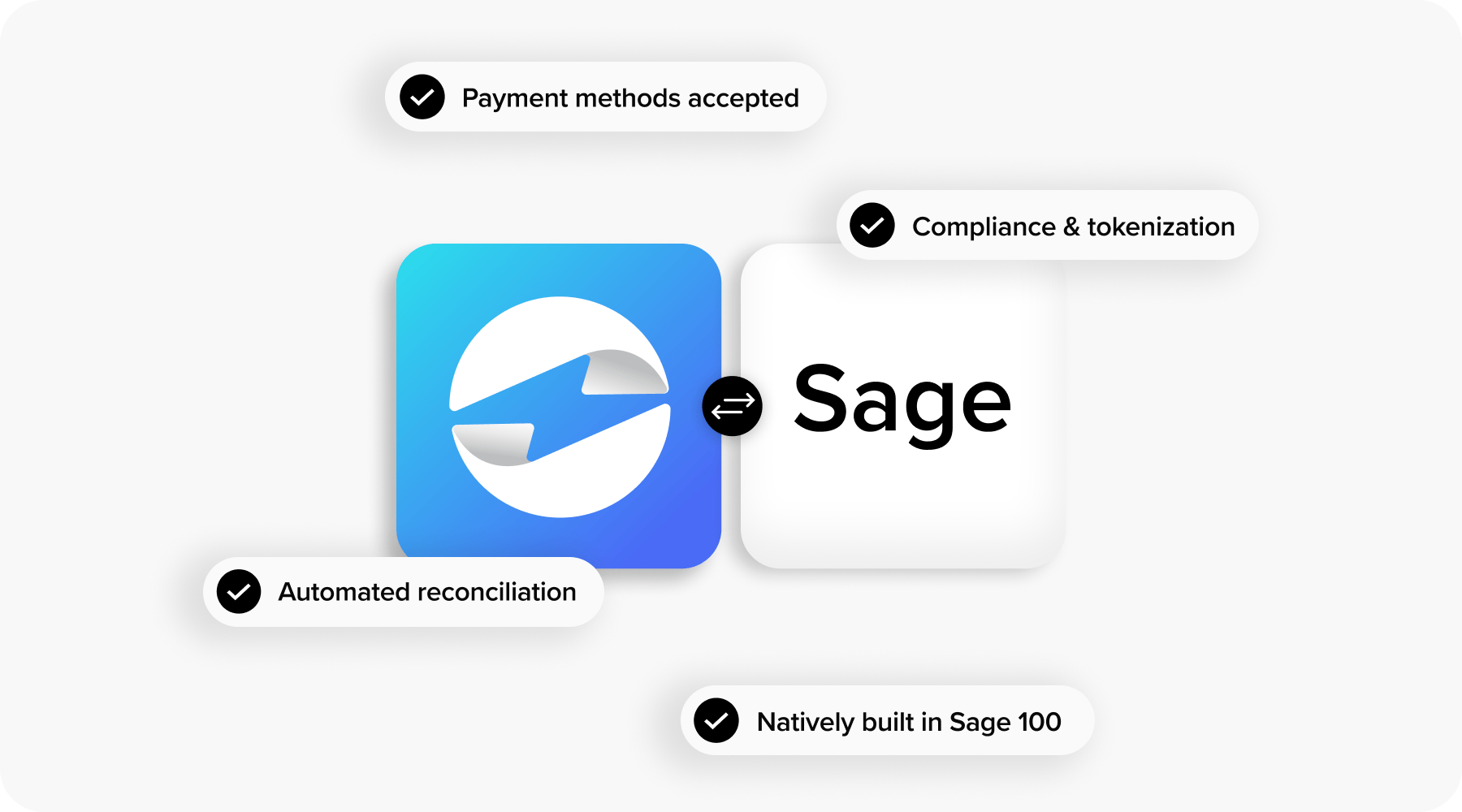

Streamlining Sage 100 payment processing with EBizCharge

EBizCharge offers a seamless Sage 100 integration for payment processing designed to remove friction from your workflows and improve both speed and accuracy. With EBizCharge, payments are processed and applied directly inside Sage 100 ERP, so your team doesn’t have to juggle multiple systems or re-enter data. This reduces reconciliation errors, shortens processing times, and keeps your accounting records up-to-date in real time.

Beyond convenience, EBizCharge’s payment processing solution for Sage 100 software is built with strong security features, PCI compliance support, and flexible payment options. It works natively within your Sage 100 environment, whether you need credit card processing, ACH, or other payment types, and scales with your business as it grows. For companies using Sage 100 ERP, this seamless integration isn’t just about adding technology; it’s about giving your team reliable tools to work smarter and delivering customers a smooth, secure payment experience.