Blog > Sending Email Payment Requests in NetSuite: Overview and Benefits

Sending Email Payment Requests in NetSuite: Overview and Benefits

As many businesses share the common goal of accelerating transactions, the ability to send email payment requests directly from enterprise resource planning (ERP) systems offers a valuable solution.

NetSuite is a leading cloud-based ERP platform where merchants can use email payment links to enhance efficiency when collecting payments. It provides real-time visibility into a business’s performance, streamlining processes and integrating data across departments. NetSuite is known for its scalability, making it suitable for companies of all sizes, from small startups to large enterprises.

This article will explore the process of sending email payment requests in NetSuite, highlighting the numerous benefits it offers.

What does it mean to send email payment requests from NetSuite?

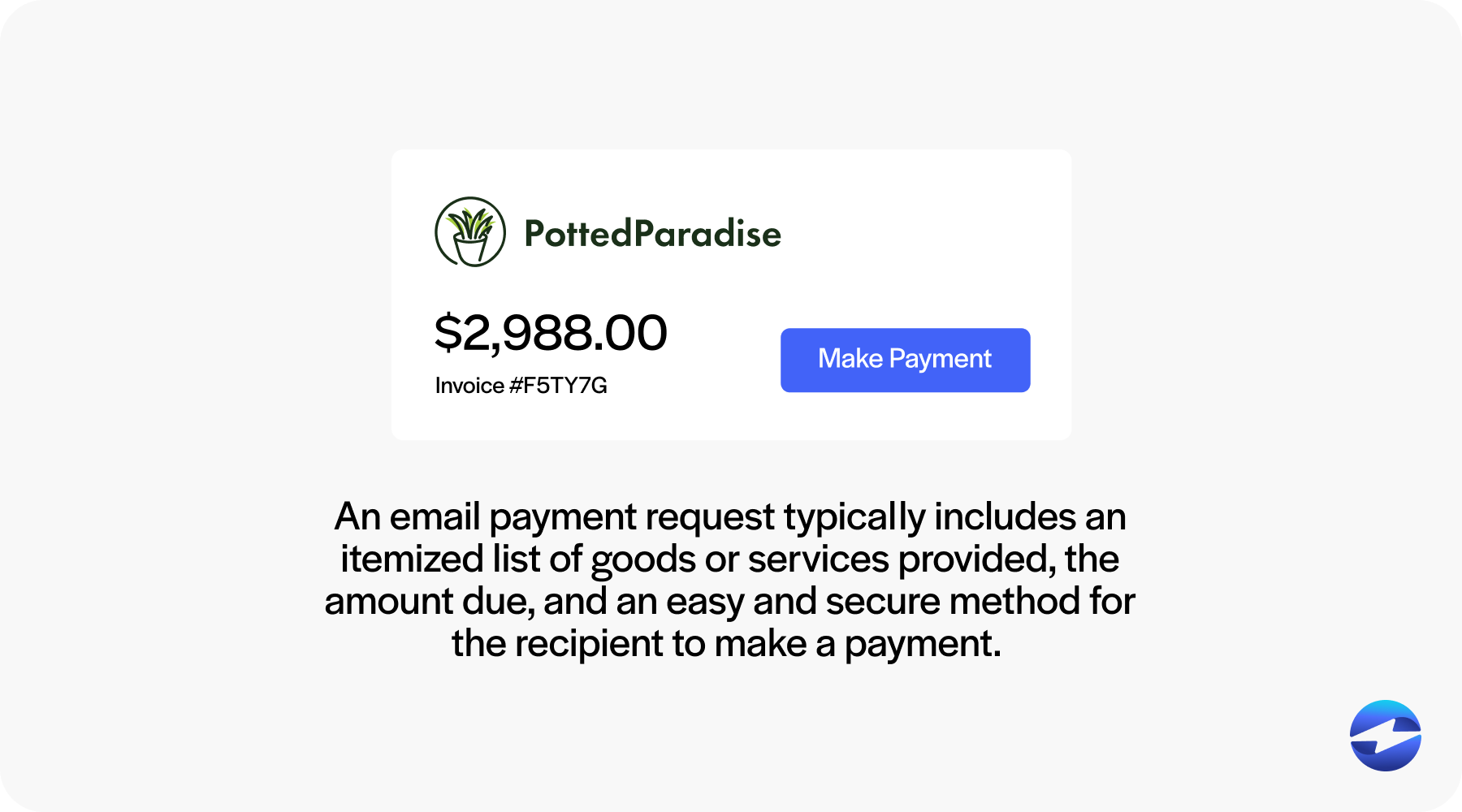

Sending email payment requests from NetSuite involves using the platform to generate and send invoices or payment reminders directly through the customer’s email. These emails contain links that enable the customer to pay an invoice with a few clicks.

An email payment request typically includes an itemized list of goods or services provided, the amount due, and an easy and secure method for the recipient to make a payment.

Utilizing NetSuite’s integrated payment solution, these emails can contain online payment links that facilitate immediate and efficient electronic payments, streamlining accounts payable (AP) and accounts receivable (AR) processes.

Email payment links also incorporate several features to facilitate seamless transactions.

9 features of NetSuite payment requests

NetSuite payment requests contain numerous features businesses can use to optimize payment operations.

Here are nine prominent features of email payment requests in NetSuite:

- Integrated payment processing: Email payment requests allow merchants to accept credit cards, debit cards, and other electronic payments via seamless integrations with third-party payment processors.

- Online payment links: NetSuite users can send customers payment links that direct their customers to digital invoices, encouraging immediate action to settle balances.

- Vendor and customer record management: Vendor and customer record management automatically associate payment requests with existing vendor and customer records, ensuring precise record-keeping and transaction history.

- Approval routing: Approval routing incorporates customizable workflows that require the approval of payment requests to align with internal controls and payment terms.

- Automated reminders: Automated reminders allow businesses to schedule follow-up reminders for payment due dates or outstanding invoices to reduce delinquent accounts.

- Partial payments: Email payment requests support the receipt of partial payments, providing flexibility to customers and vendors and better cash flow management.

- Financial reporting: Financial reporting enhances visibility into financial operations by directly feeding payment data into reporting and analytics tools within NetSuite.

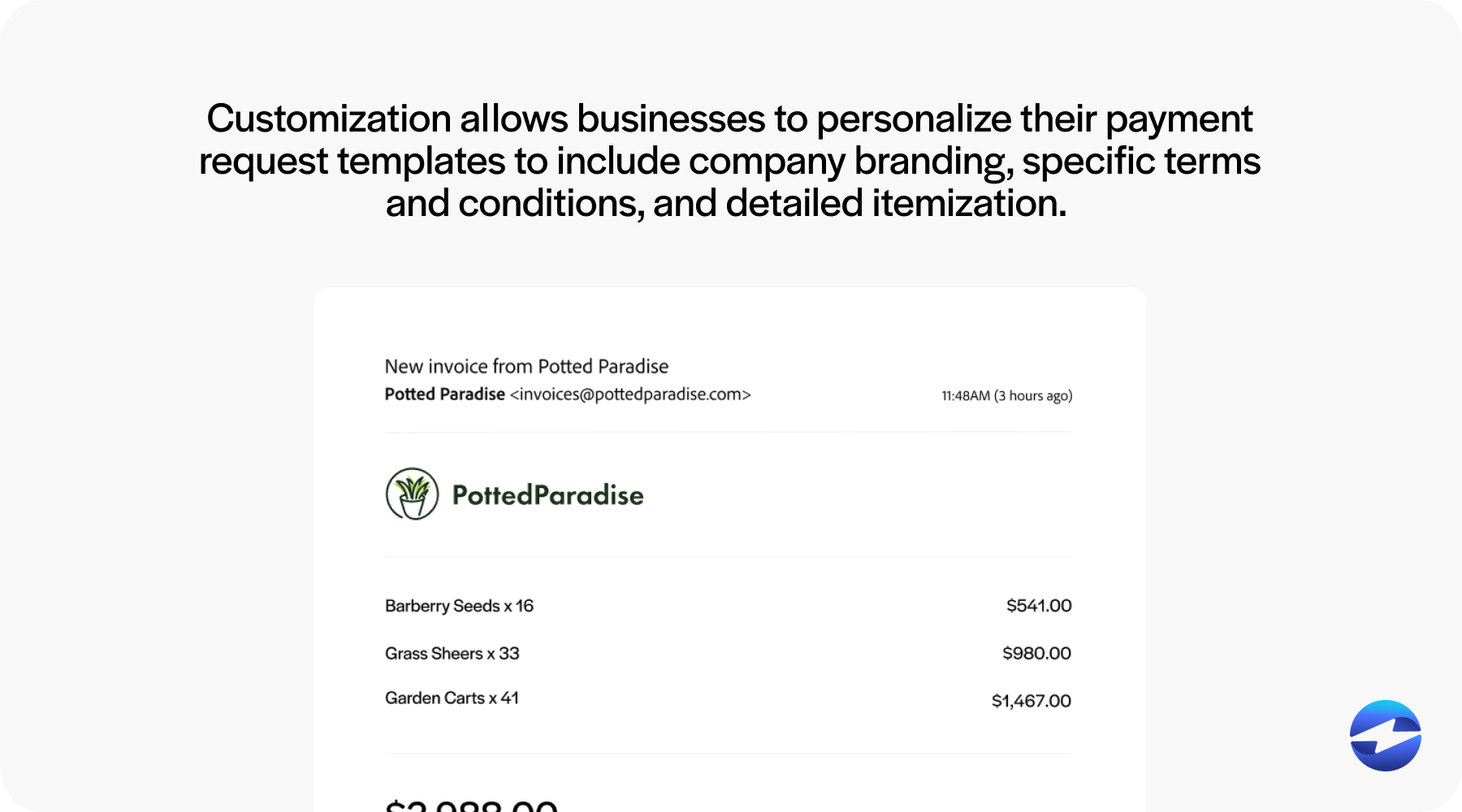

- Customization: Customization allows businesses to personalize their payment request templates to include company branding, specific terms and conditions, and detailed itemization.

- Security compliance: Email payment requests adhere to industry-standard security protocols to protect sensitive data during transactions.

By leveraging these essential features when using email payment requests, your business can simplify this process for all parties, mitigate financial risks, and strengthen consumer trust and brand loyalty.

Additionally, you’ll need to learn the necessary installation steps and the importance of working with a reliable online payment solution that integrates with the NetSuite software.

Getting started with email payment requests in NetSuite

To get started, merchants must find a trustworthy payment solution that can handle email payments in NetSuite.

By syncing an integrated payment solution with the NetSuite software, your business can effectively streamline its AR by sending email payment requests directly from this system.

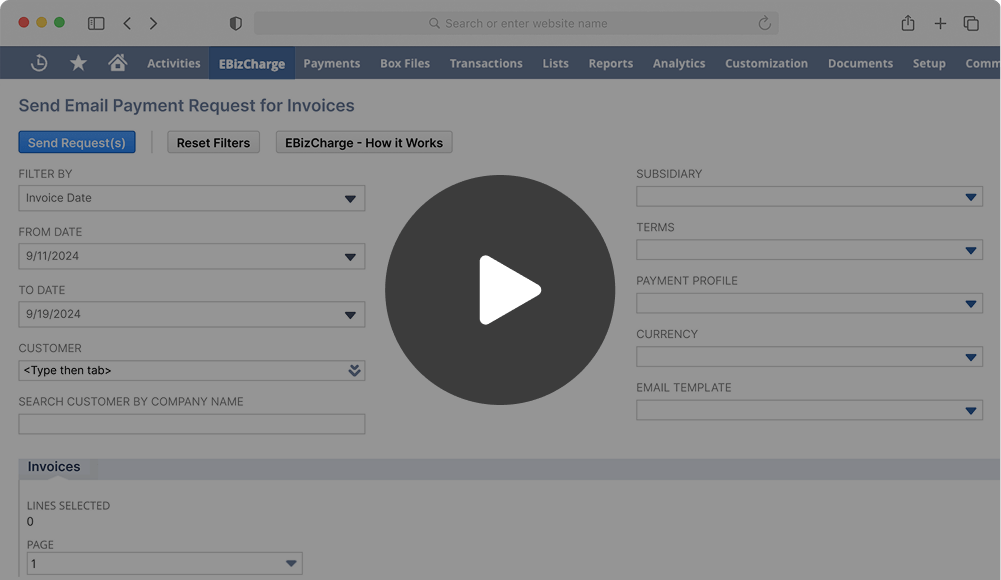

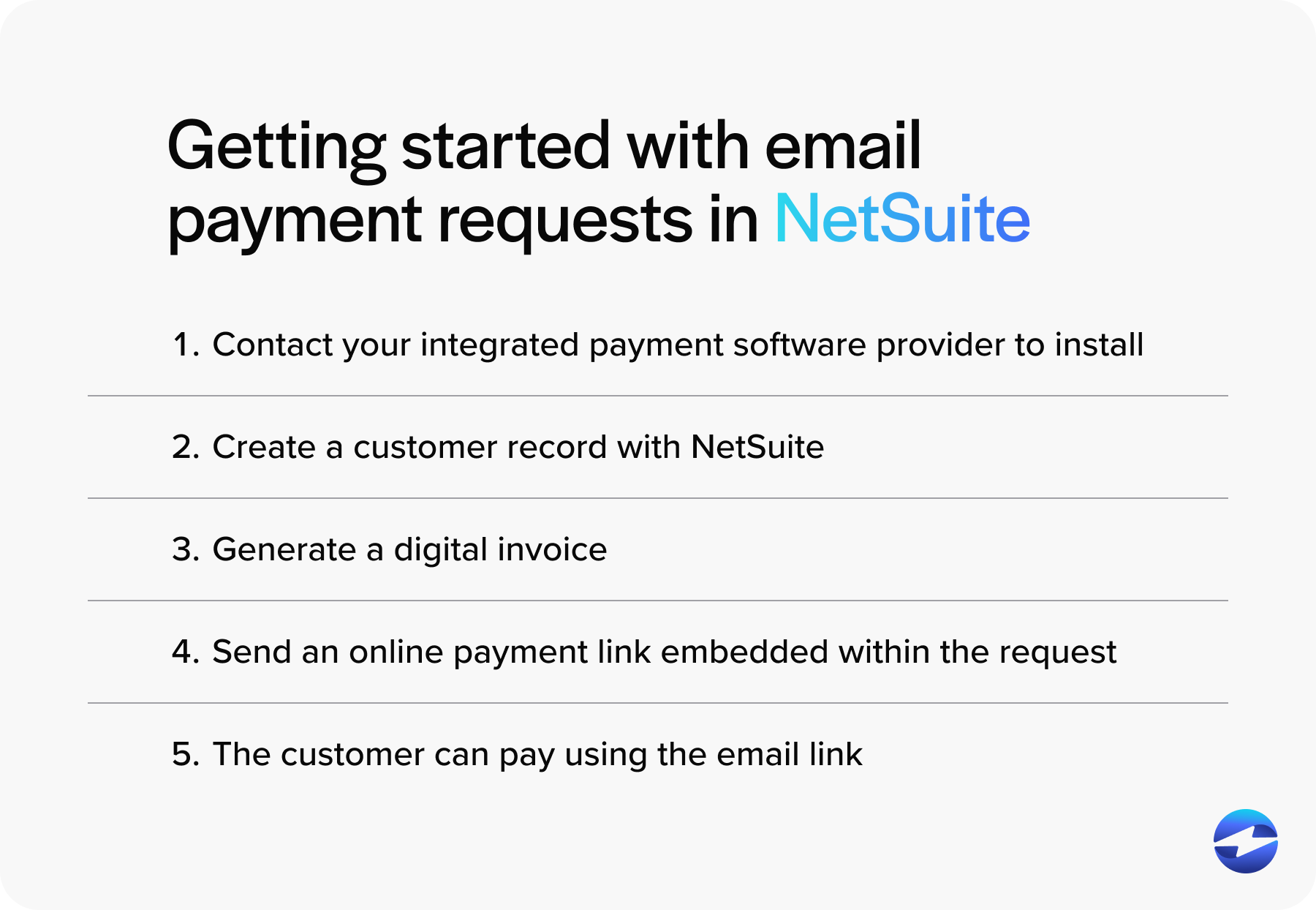

After selecting a suitable provider, you can get started with email payment requests in NetSuite by following these five steps:

- Contact your integrated payment software provider to properly install its payment solution within NetSuite’s suite of tools, ensuring seamless integration to manage and track your financial operations.

- Create a customer record with NetSuite, complete with contact and credit terms, ensuring all transaction types will be linked for that customer.

- Generate a digital invoice that includes the details of the vendor invoice, purchase requests, or contract terms as required.

- Once the invoice is ready, send an online payment link embedded within the email payment request.

- The customer can make a full or partial payment (if applicable) via credit card, debit card, or electronic methods using the email link, thereby updating the vendor records and the days sales outstanding (DSO) metric.

Integrating your online payment solution within NetSuite can result in numerous benefits.

The benefits of sending email payment requests in NetSuite

Using an online payment solution in NetSuite to send email payment requests can yield many advantages for businesses and consumers.

Whether improving financial operations or bolstering customer relations, an integrated NetSuite solution can elevate your business processes to encourage growth, sustainability, and adaptability for an evolving marketplace.

Four benefits that can result in this success are time efficiency, increased cash flow, better user experience, and transparent, simplified record-keeping.

Time efficiency

Incorporating payment requests via email within NetSuite significantly reduces the time typically associated with traditional payable processes.

Businesses can eliminate the lag of postal deliveries and manual follow-up efforts by sending digital invoices directly to customers. Immediate delivery and prompt receipt of payment links can streamline workflows and decrease DSO.

This time efficiency can be seen in features like approval routing and automatically updating account balances and vendor records, thus eliminating redundant steps and ensuring that your business and its customers save valuable time.

Increased cash flow

Sending email payment requests via NetSuite encourages more cash flow, which is vital for the health of any business.

With features that facilitate quick online transactions, including partial payments and flexibility in payment terms, customers are more likely to settle invoices quickly. This immediate transaction facilitated by the payment link optimizes cash flow by reducing the waiting period for receivables, thus enhancing overall liquidity and financial stability.

Email payment requests typically result in faster fund deposits than traditional methods that depend on checks or manual credit card entry.

Improved user experience

Utilizing NetSuite to manage email payment requests can directly correlate to improving the user experience.

The convenience of paying through online payment links, the security of an integrated payment solution, and the availability of advanced features such as electronic payments and credit memos contribute to a positive brand perception. This also ensures that every interaction in the customer lifecycle is efficient and smooth.

Email payment requests can provide an upgrade in service that can improve customer satisfaction, loyalty, and business through positive word-of-mouth referrals.

Transparent and simplified record-keeping

NetSuite’s system provides exceptional transparency and simplifies record keeping by storing transaction histories, payment confirmations, and communication exchanges within the customer’s record.

With NetSuite email payment links, all payment activities are automatically tracked and logged, ensuring that the business and customer can access clear and accurate payment history. These details are critical for audit trails, financial reporting, and dispute resolution.

Digitized invoices and automated payment records are also pertinent for internal reviews and analyses of financial operations. This organized and accessible data helps maintain compliance, inform decision-making, and strengthen the confidence of stakeholders in the business’s systematic approach to economic governance.

For more seamless invoicing operations in NetSuite, merchants can look to top-rated payment processing solutions like EBizCharge.

Transform customer payment collections in NetSuite with EBizCharge

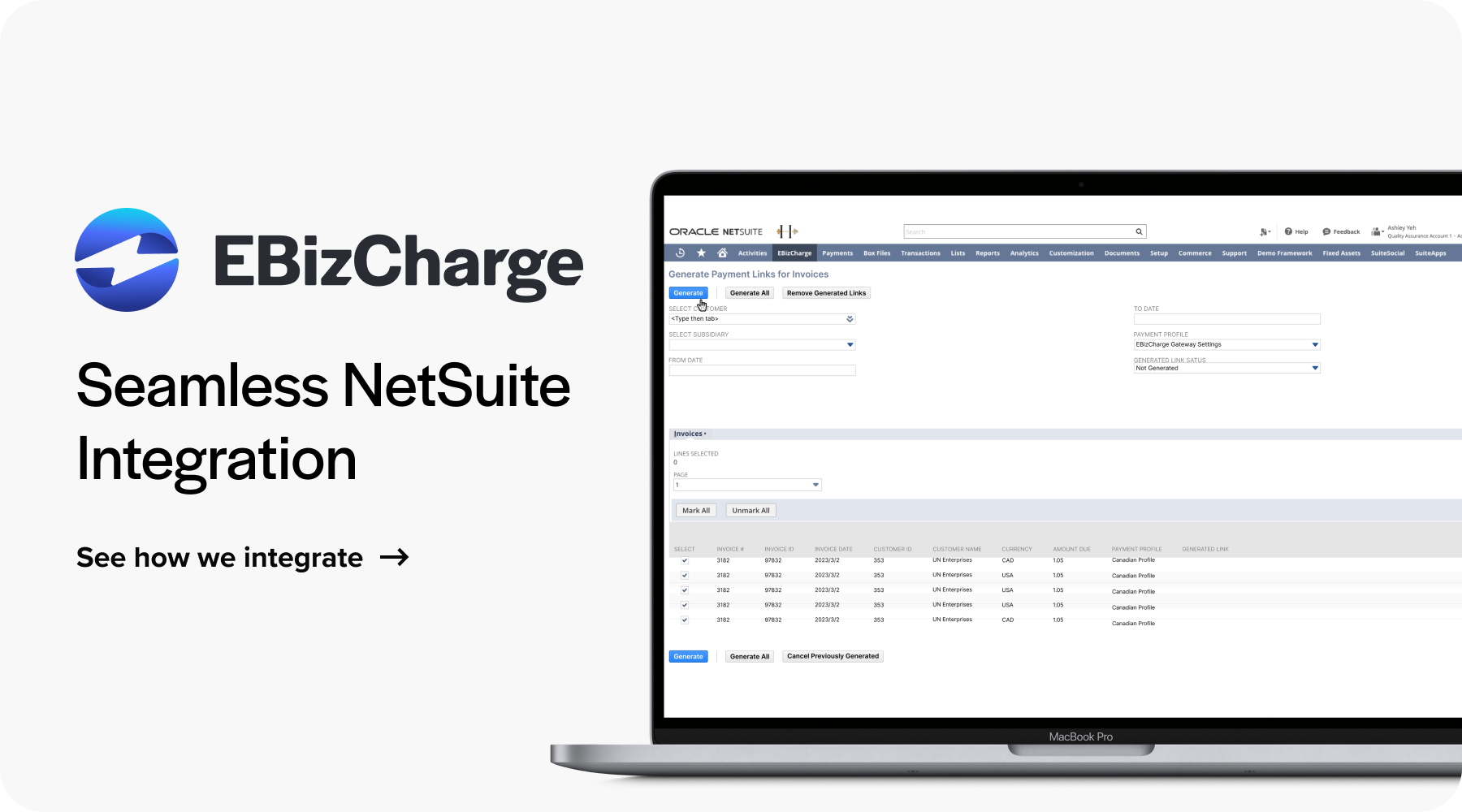

Integrating EBizCharge into NetSuite can significantly enhance, simplify, and accelerate your email payment requests. This integration enables businesses to send digital invoices with online payment links directly to customers, resulting in better customer relationship management.

EBizCharge reduces DSO, accelerates the AR process, and allows for a diversification of payment terms such as credit cards and partial payments. This payment software transitions merchants from manual data entry and contract terms validation to more efficient invoicing systems for greater operational efficiency.

Additionally, EBizCharge improves vendor interactions by automating payments and managing their associated records and bills.

The convenience and advanced features provided by EBizCharge’s online payment solution for NetSuite give businesses an operational advantage by streamlining their internal payment collection operations and reducing their reliance on manual and potentially error-prone systems.