Blog > The Benefits of Using a Customer Payment Portal Alongside NetSuite

The Benefits of Using a Customer Payment Portal Alongside NetSuite

As businesses’ management of incoming payments rapidly evolves, customer payment portals have become vital to enhance the user experience, accelerate invoice collections, and boost operational efficiency. Therefore, understanding these portals is essential for modern companies looking to improve their financial interactions.

Customer payment portals can significantly impact on cloud-based financial management software like NetSuite in transforming payments in this system.

This article will explore the benefits of using a customer payment portal alongside NetSuite, including its key features, setup process, and ongoing maintenance.

What is NetSuite?

NetSuite is a cloud-based enterprise resource planning (ERP) platform that provides businesses with a comprehensive suite of tools for managing various operations, including accounting, financial management, inventory, order processing, customer relationship management (CRM), and eCommerce.

As an integrated solution, NetSuite helps companies streamline workflows, improve efficiency, and gain real-time visibility into their business performance. Designed for scalability, it’s used by organizations of all sizes, from small startups to large enterprises, and supports multiple industries by offering customizable modules that cater to specific business needs.

Since it operates entirely in the cloud, NetSuite eliminates the need for complex on-premises IT infrastructure, offering flexibility, accessibility, and lower operational costs.

What is a customer payment portal, and how can it work with NetSuite?

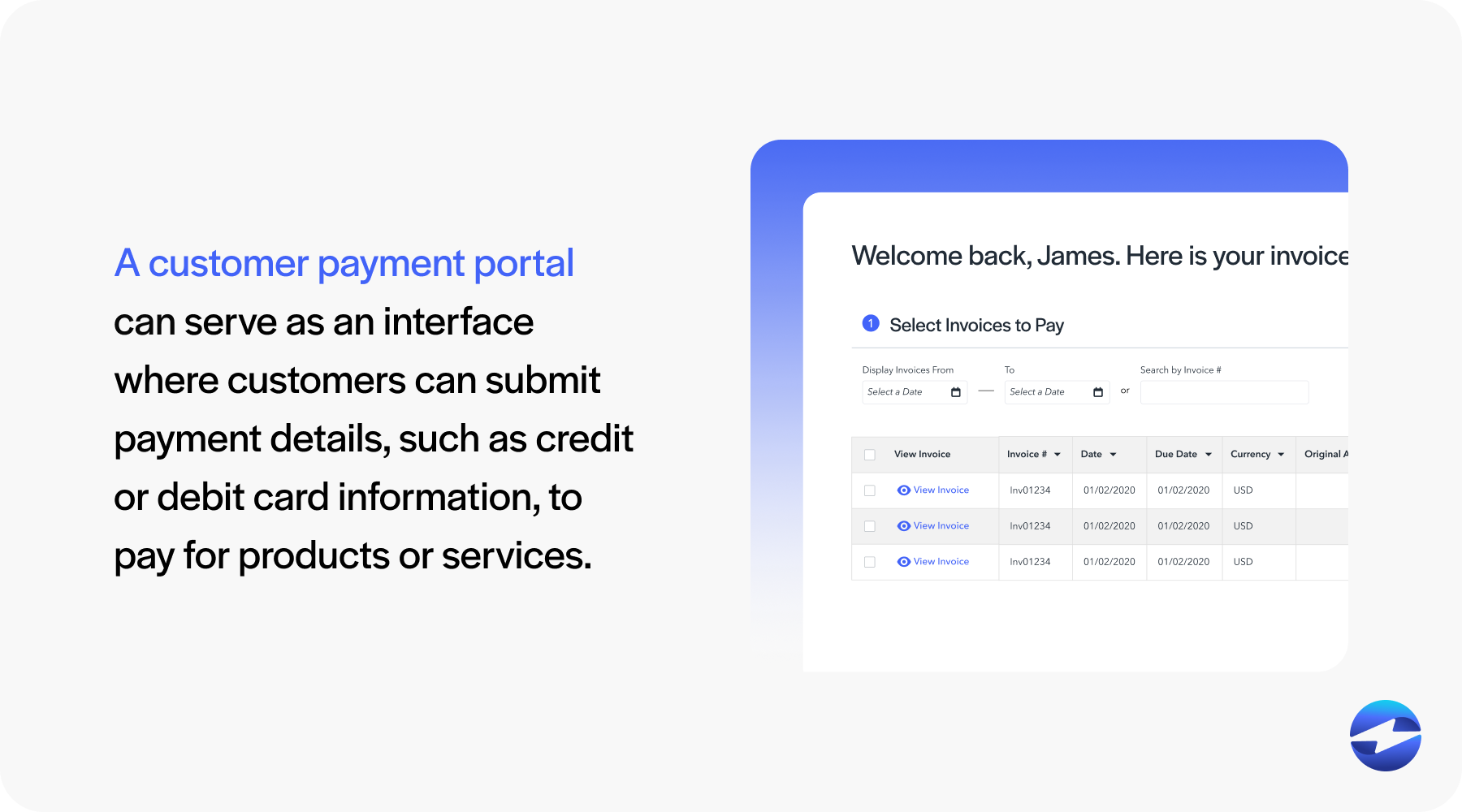

A customer payment portal is an online platform designed to facilitate customer payment processing. These portals serve as an interface where customers can submit payment details, such as credit or debit card information, to pay for products or services.

The primary purpose of an online payment portal is to provide customers with convenience and security while ensuring that merchants can efficiently process and track transactions.

Payment portals are equipped to handle a variety of payment methods, including traditional and digital payment methods. They’re usually protected by strong encryption standards to maintain the security of sensitive data. This high level of security leads to trust among customers, encouraging usage and adoption.

Payment portals in NetSuite work by integrating with the system to enable customers to make payments directly through secure, web-based platforms. When a business sends an invoice through NetSuite, it can include a payment link that directs the customer to the payment portal. The portal connects to various payment gateways, such as credit card processors, allowing customers to choose their preferred payment method.

Once the payment is made, the transaction is automatically recorded in NetSuite, updating the invoice status and reflecting the payment in the company’s financial records.

NetSuite customer payment portals help refine the payment process, reduce manual data entry, and improve cash flow by offering quick and easy payment options. These portals can accomplish this by providing several features.

4 features of a customer payment portal in NetSuite

Businesses that employ NetSuite with a compatible customer payment portal can use several features to optimize their financial operations.

Here are four customer payment portal features you can utilize in NetSuite:

- Self-service invoice management: NetSuite’s self-service account management functionality empowers customers to take charge of their transactions. Users can log into their payment portal to view transaction histories, manage account details, and review billing information at their convenience. This enhances customer satisfaction as clients can access data and make adjustments without contacting the business directly.

- Multiple payment methods: NetSuite understands the diverse preferences of customers, which is why its portal supports various payment methods. Whether paying via credit card, bank transfer, digital wallet, or direct debit, NetSuite’s payment portal allows businesses to cater to all. With this flexibility, customers can make consistent and timely payments, enhancing their user experience and your company’s financial robustness.

- Mobile compatibility: In an on-the-go world, mobile compatibility is crucial for any payment solution. NetSuite’s payment portal is designed to be fully functional on various mobile devices, letting customers manage their payments from anywhere. This adaptability improves the customer experience and helps customers make faster payments, aiding in better cash flow management for your business.

- Real-time data integration: A standout feature of NetSuite’s customer payment portal is the real-time data integration with its ERP system. This ensures that every transaction processed through the portal is automatically and instantly updated in the company’s financial records in NetSuite. This synchronization eliminates the lag between different systems and reduces errors caused by manual entry. It also gives businesses an up-to-date view of their finances for more informed decision-making and effective accounts receivable (AR) management.

These features yield numerous benefits, leading to a more streamlined payment experience for all parties.

What are the benefits of using a payment portal for NetSuite?

As a fully integrated component of the NetSuite service, the customer payment portal will enable your business to offer a sophisticated, secure, and user-friendly payment solution to efficiently facilitate transactions and financial management.

Here are a few benefits of using NetSuite payment portals:

- Enhanced payment convenience for customers: NetSuite payment portals are designed with customer convenience in mind. They support numerous payment methods and offer an intuitive interface that supports major credit cards (Visa, MasterCard, American Express, etc.) for a more seamless checkout experience. This flexibility enables customers to choose the payment option that best suits their needs. Customers can also access these portals at their convenience using the device of their choice.

- Improved cash flow and faster payments: Timely payments are essential for maintaining healthy cash flow in any business. NetSuite’s payment portals help expedite payments by automating the approval process and minimizing the time to process transactions. This automation ensures payments are received more quickly and helps reduce the number of days sales are outstanding (DSO). Consequently, businesses experience a positive impact on their cash flow, which is essential for operational stability and growth.

- Increased transparency and reduced disputes: The transparency provided by NetSuite payment portals helps reduce payment disputes and foster consumer trust. Customers can readily access transaction history and payment statuses, allowing them to verify and confirm their financial activities.

- Enhanced security and compliance: NetSuite payment portals uphold high security standards to protect sensitive data during transactions, including encryption and Payment Card Industry (PCI) compliance. This security gives customers and merchants peace of mind by mitigating potential breaches and fraud. Compliance with industry standards ensures that the business is up to date with regulations, which is crucial for avoiding legal issues and maintaining trust.

- Reduced administrative work and manual errors: Manual payment handling and AR processes can be prone to human errors and are often time-consuming. NetSuite payment portals automate these operations to significantly reduce the administrative workload for businesses to allocate resources more efficiently and minimize the likelihood of costly mistakes that can affect financial reporting and customer relationships.

- Customization and scalability: NetSuite payment portals offer customization options to fit the unique needs of a business. Whether a company needs specific payment methods, customized approval workflows, or tailored user interfaces, NetSuite’s payment solution can adapt accordingly. This scalability ensures that as a business grows and its needs evolve, the portal can fulfill these needs to provide a consistent and reliable payment processing solution.

- Data synchronization via third-party integrations: NetSuite users can use third-party payment service providers that integrate with NetSuite to offer robust customer payment portals and transfer this data across multiple tools in their software. These third-party NetSuite integrations may also be able to sync this data across other business systems, such as CRM and eCommerce platforms. Centralized data and processes help deliver a comprehensive view of the customer lifecycle and enable better decision-making, encouraging coordinated and efficient business practices.

Now that you know the benefits payment portals provide to improve the overall payment experience, you can learn how to properly install these systems in your infrastructure.

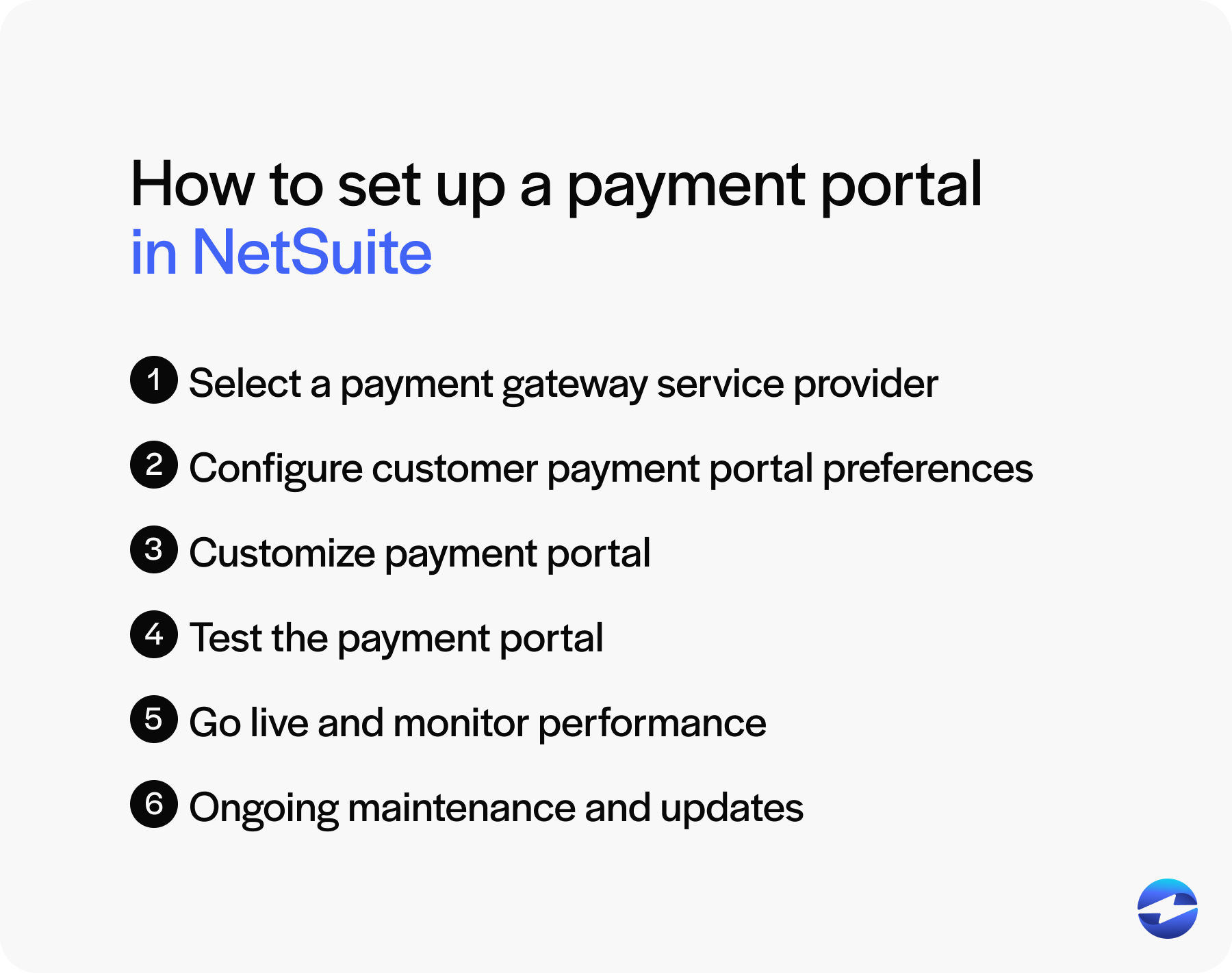

How to set up a payment portal in NetSuite?

Understanding how to set up a payment portal in NetSuite will allow your business to synchronize transaction data and reduce transaction fee expenses and errors associated with manual processes.

Businesses can follow these seven steps to set up their NetSuite payment portals:

- Select a payment gateway service provider: First, you’ll need to select a payment gateway service provider that’s compatible with NetSuite and meets your business’s requirements. Consider the range of payment methods offered, security standards, transaction fees, and the ability of the payment solution to scale with your business growth. Ensuring that your payment gateway provider has a reliable track record of NetSuite integrations is pivotal for seamless financial transactions.

- Configure customer payment portal preferences: Configuring customer payment portal preferences means tailoring the payment experience to your business needs and customer expectations. You can set preferences for accepted payment types, whether payments are one-time or recurring, and applicable currency types. Your business can also establish access permissions and delineate customer notification protocols for payment confirmations and receipts.

- Customize the payment portal: Customizing the payment portal enables it to fit within your existing brand and workflow. Incorporate your company’s visual branding elements and decide on the fields and data points that must be captured during the payment process. Tailoring these elements can reduce confusion and reinforce trust in the payment process.

- Test the payment portal: Before going live, it’s essential to thoroughly test the payment portal’s functionality to verify all aspects of the payment process, from the initial transaction to payment posting in NetSuite, work correctly. Be sure to test the portal in various scenarios, including different payment methods and amounts, to ensure a smooth customer experience.

- Go live and monitor performance: The payment portal can go live after thorough testing. Continuous monitoring is essential at this stage to ensure that transactions are accurately and securely processed and systems operate normally. Analyzing this performance can help businesses identify any irregularities and customer payment behaviors early on.

- Ongoing maintenance and updates: Routine payment portal maintenance and updates are necessary to correct any issues, improve functionality, and adjust to evolving payment processing standards. Consistently updating your system can protect against security vulnerabilities and ensure compatibility with NetSuite’s upgrades.

Each of these steps contributes to creating a robust customer payment portal that, when used in conjunction with NetSuite, significantly enhances the efficiency and security of financial transactions within your business.

In addition to these steps, selecting a trusted payment gateway service provider is imperative to optimize your payment operations.

Take advantage of EBizCharge’s powerful integration into NetSuite

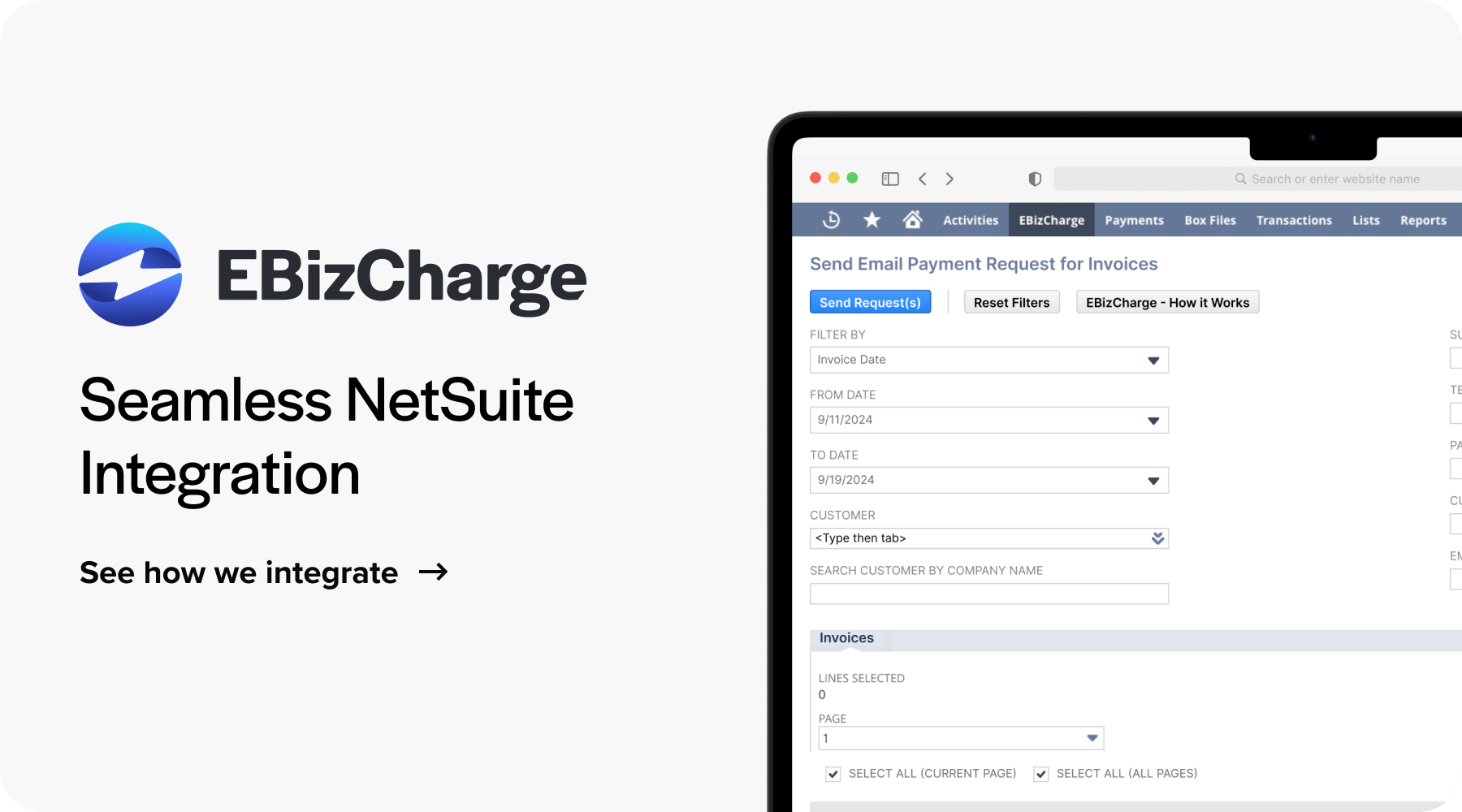

EBizCharge is a top-rated Netsuite credit card processing integration expertly designed to sync within the ERP system to ensure a powerful solution that transforms and simplifies payment collections for merchants.

By implementing EBizCharge, companies can avoid the hassle of manual processes and enjoy more streamlined financial operations. EBizCharge’s extensive payment processing capabilities support numerous electronic payment methods and reduce transaction fees. Finance teams will also benefit from the comprehensive view of transactions, timely payments, and automated invoice collections that EBizCharge provides.

Adopting EBizCharge as a payment solution in tandem with your NetSuite service not only boosts the efficiency of payment workflows but also improves the user experience by offering secure, flexible, and fast online payments.

Finally, the EBizCharge for NetSuite integration can increase your overall cash flow to support more business growth and sustainability.

FAQs regarding NetSuite customer payment portals

FAQs regarding NetSuite customer payment portals

Summary

- What is NetSuite?

- What is a customer payment portal, and how can it work with NetSuite?

- What are the benefits of using a payment portal for NetSuite?

- How to set up a payment portal in NetSuite?

- Take advantage of EBizCharge’s powerful integration into NetSuite

- FAQs regarding NetSuite customer payment portals