Blog > Working with NetSuite Payment APIs for Custom Integrations

Working with NetSuite Payment APIs for Custom Integrations

If you’re a merchant running your business on NetSuite and you’re starting to explore options for integrating a custom payment system, you’re not alone. Plenty of businesses hit a point where the standard tools just don’t cut it anymore. Maybe you’ve already bumped into limitations. Maybe you’ve noticed inefficiencies or gaps that slow down your payment processing. Or maybe you’ve realized that your current system just doesn’t play well with your preferred payment provider.

In any case, a custom NetSuite payment integration could be the right move. This guide is built specifically for merchants and finance leaders like you—people who care about getting paid on time, maintaining good data, and offering customers a smooth, trustworthy payment experience. We’ll walk through how to use the NetSuite payment API to build smart, reliable payment workflows that meet your business’s specific needs.

Understanding NetSuite Payment APIs

Let’s start with the basics. An Application Programming Interface (API) is what lets two systems talk to each other. Think of it like placing an order at a coffee shop: the API is the menu that defines what you can ask for and how you ask for it, and the barista—NetSuite in this case—returns your order.

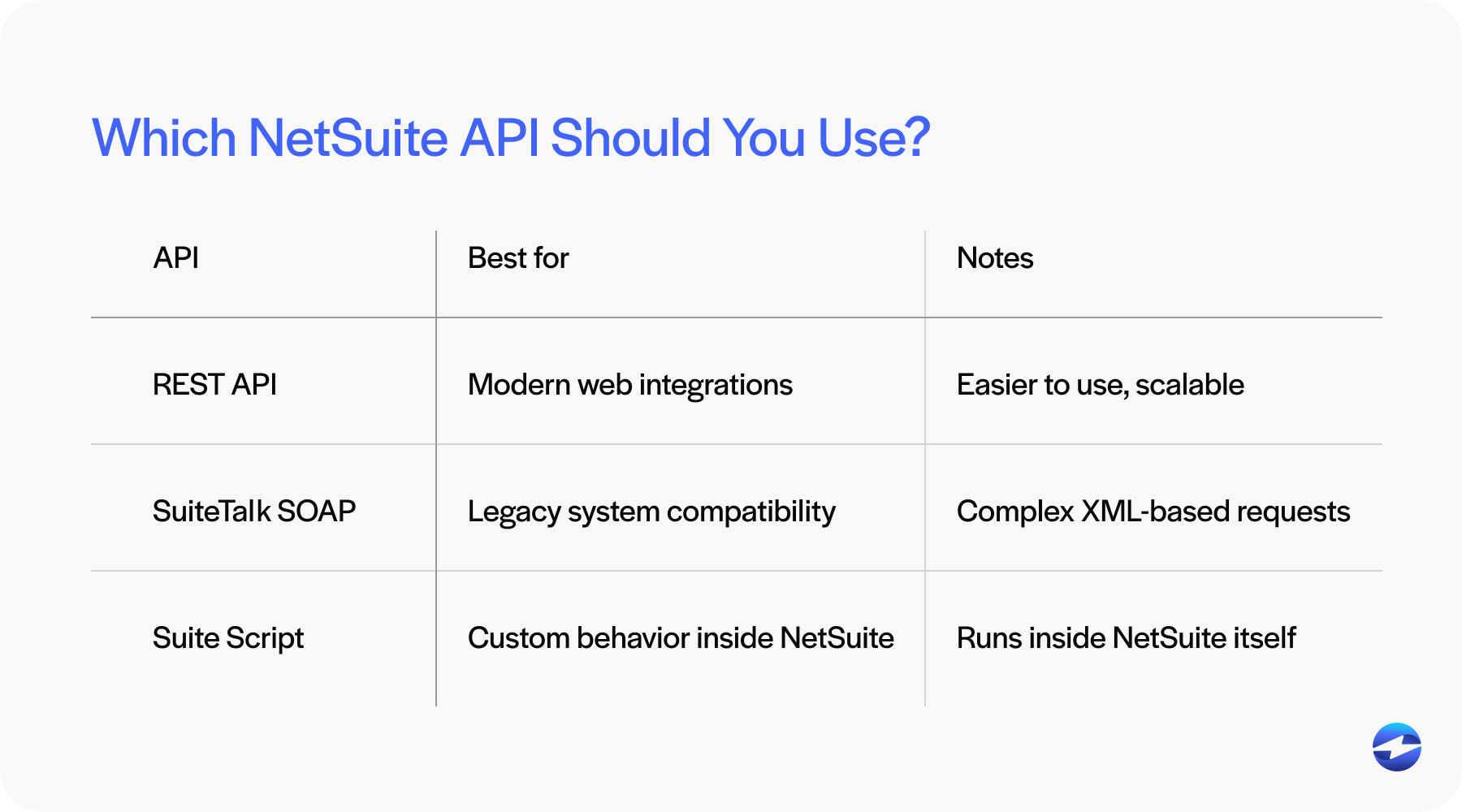

NetSuite offers several APIs that are useful for payment processing. Choosing the right one is an important part of any NetSuite integration project. The main options are:

- REST API: Newer, easier to use, and more intuitive if you work with modern web tools.

- SuiteTalk SOAP API: Older and a bit more complex, but still powerful and widely supported.

- SuiteScript: Lets you write JavaScript that runs inside NetSuite itself—great for handling events or customizing on-screen behavior.

Each of these can support different payment scenarios, and the best choice depends on your comfort level and the nature of your integration.

The benefits of custom payment integrations

There are various reasons a merchant might need a custom Oracle NetSuite payment integration. NetSuite’s built-in tools can handle some payment scenarios, but they’re not always enough. If you’re constantly running into roadblocks, duplicating data entry across systems, or relying on workarounds that don’t scale, a tailored solution might be your best bet.

For example, merchants who use a specific payment provider that isn’t natively supported by NetSuite often turn to custom integrations to bridge the gap. Others might want to consolidate payment processing across multiple platforms—e-commerce, point of sale, and billing—into one seamless NetSuite integration.

Some merchants also want tighter control over how payment data flows between systems. A custom NetSuite payment integration can help you reduce human error, avoid data silos, and stay compliant with security standards like Payment Card Industry Data Security Standards (PCI-DSS). Additionally, it lets you design workflows to match your business operations, rather than forcing you into rigid, one-size-fits-all processes.

Key benefits of custom payment integrations:

- Eliminate double data entry and reduce human error

- Improve real-time visibility into payment statuses and cash flow

- Enhance the customer payment experience through embedded or self-service tools

- Simplify PCI compliance by centralizing payment processing through secure APIs

- Automate tedious tasks like applying payments to invoices or issuing refunds

- Adapt and scale payment workflows as your business grows

The point is: it’s not just about convenience—it’s about building a more reliable, efficient payment solution that works seamlessly with your business.

Planning Your Integration

Before you even begin development or coordinate with a provider, it’s important to zoom out and look at the big picture. Taking the time to properly plan your NetSuite payment integration can save you time, effort, and backtracking later on. Payment integrations touch sensitive data, impact customer experience, and often interact with other critical systems in your business, so it’s not something you want to rush.

The last thing you want is to end up halfway through a project only to realize you missed something important.

Here are a few questions to think through:

- What’s your current payment processing setup, and what’s not working?

- Which payment provider do you want to connect with?

- What types of payments do you need to handle—one-time, recurring, partial, refunds?

- Do you need the integration to connect with other systems like your website, CRM, or fulfillment tools?

Be sure to factor in security early on, especially when dealing with credit card processing. Even if you’re not storing card data yourself, how you pass that data between your systems matters a lot. Work with your payment processor to ensure your flow is secure and PCI-compliant.

Implementing the Integration

Now comes the hands-on part. Once you’ve mapped everything out and decided on your preferred payment processor and NetSuite API approach, it’s time to put that plan into action. The good news is that in many cases, your chosen payment provider or integration partner will take care of the technical setup for you. They’ll handle the API connections, configure authentication, and ensure data flows into NetSuite as expected.

That said, it’s still important to understand what’s happening behind the scenes. Knowing how your NetSuite payment integration works allows you to communicate better with your provider, catch small issues before they become big problems, and adjust the workflow when your business needs change.

Here are a few key steps typically involved in the setup:

- Setting up authentication using OAuth 2.0 or token-based credentials. This is what allows your external systems to securely interact with NetSuite. If you’re working with sensitive financial data or credit card processing, OAuth 2.0 is the safer, more robust option.

- Work with the relevant API endpoints. NetSuite provides endpoints for a variety of actions, and your provider will likely configure some combination of:

- Creating customer payment records

- Applying payments to invoices

- Retrieving transaction statuses

- Refunding or voiding payments

You’ll also want to pay close attention to how data flows from your external system into NetSuite. Are you sending full customer and transaction details with each request? Are payments being linked to the right invoices? How are errors and rejected transactions handled?

Even if you’re using a middleware platform—like an integration platform-as-a-service (iPaaS) or a plugin—it helps to know what’s going on under the hood. A little technical fluency goes a long way when debugging payment issues, managing updates, or working with developers and IT teams. And the more you understand about the NetSuite payment API and its expected data structures, the better equipped you’ll be to avoid hiccups down the line.

Maintenance and Optimization

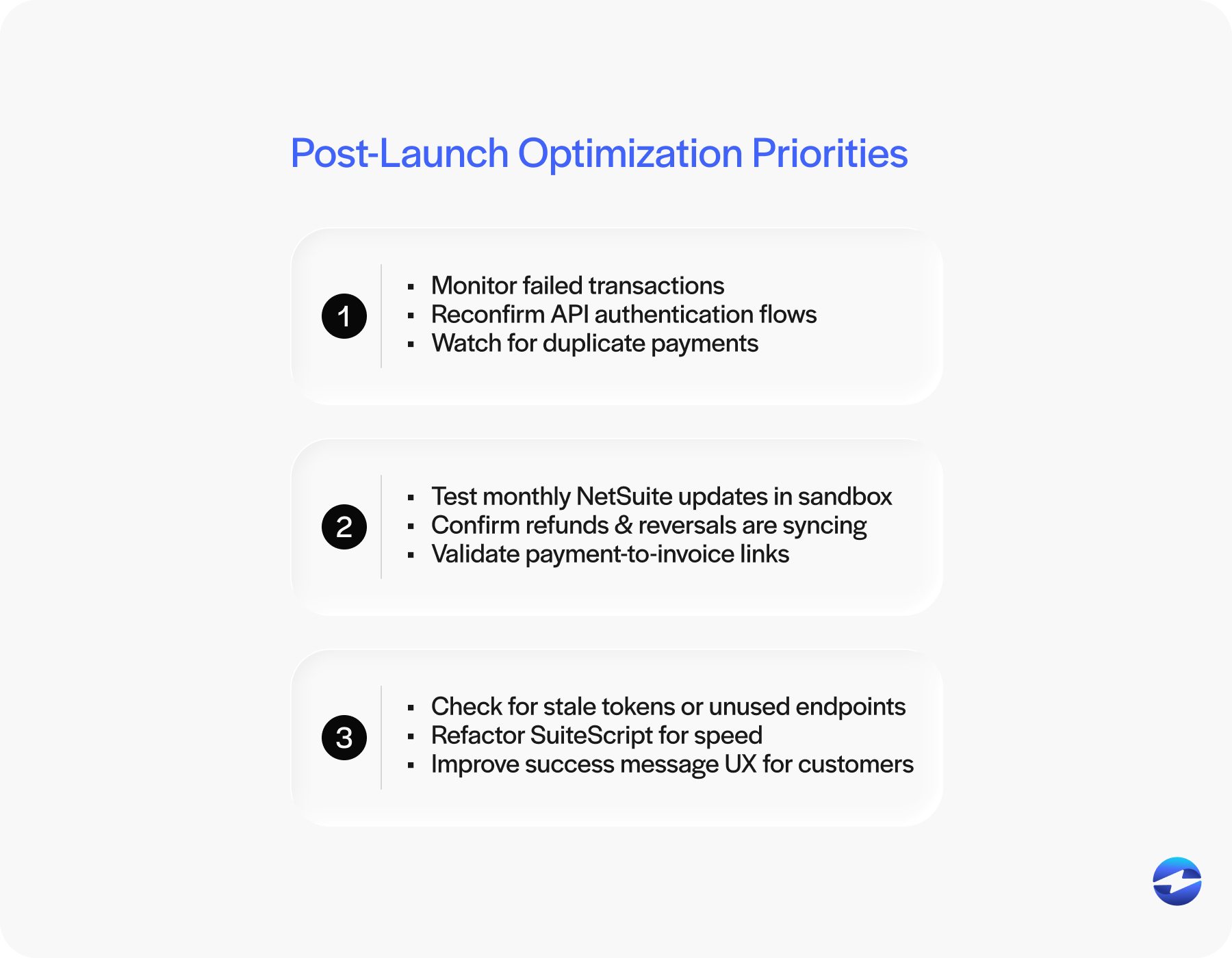

Once everything’s live, your work isn’t done. A good NetSuite payment integration needs love and care. This is where the long-term success of your system really takes shape. Many merchants build a solid integration but neglect to maintain it, and that’s when issues start to creep in.

Watch API performance closely. A sudden spike in latency or timeout errors could indicate a larger problem. Monitor error rates and look for patterns. Are certain types of transactions failing more often? Is your connection to your payment provider still stable and reliable?

Keep an eye on how your payment processor behaves over time. If they make changes to their API, or sunset a feature, your integration might need a tweak or two to keep everything running smoothly. If available, check in with your provider periodically or subscribe to their developer updates.

Also, remember that NetSuite gets regular updates. These updates can impact how your scripts run, how records are structured, or how authentication works. Make it a habit to review NetSuite’s release notes and test your integration in a sandbox before applying major updates in production. Keeping your scripts, connections, and assumptions current will help ensure that your payment processing remains reliable and your business keeps moving forward without disruption.

EBizCharge’s seamless NetSuite payment integration

A custom Oracle NetSuite payment integration can unlock smoother operations, better customer experiences, and much less manual work. For merchants juggling multiple systems and trying to simplify how money moves, working directly with the NetSuite payment API can make a big difference.

If you’re looking for a solution that reduces the technical complexity while still giving you robust functionality, EBizCharge offers a seamless API integration built specifically for NetSuite users. It’s designed to minimize setup time, reduce manual effort, and keep your payment processing secure and efficient. With EBizCharge, much of the heavy lifting—like authentication, endpoint mapping, and invoice syncing—is handled for you, making it easier to stay focused on your core business operations.

Whether connecting a specific payment processor, automating credit card processing, or building a streamlined payment solution for your customers, having a trusted integration partner like EBizCharge means fewer headaches and more reliability.

Take your time. Test thoroughly. Ask questions when you need to. And remember: a solid NetSuite integration doesn’t just process payments—it helps your business run better.