Blog > What is a Ledger Balance?

What is a Ledger Balance?

To maintain a firm grip on the financial health of your business, it’s imperative to understand the difference between your ledger balance vs available balance. While the two balances are similar, they represent different aspects of an account’s financial health.

This article explains the difference between ledger balance and available balance and answers some common questions.

What is a ledger balance?

Also known as an opening balance, daily ledger, or current balance, a ledger balance is the amount of money in your business bank account at the beginning of each day. Even if you complete multiple financial transactions throughout the day, the ledger balance doesn’t change since these transactions will apply to the following day’s opening balance.

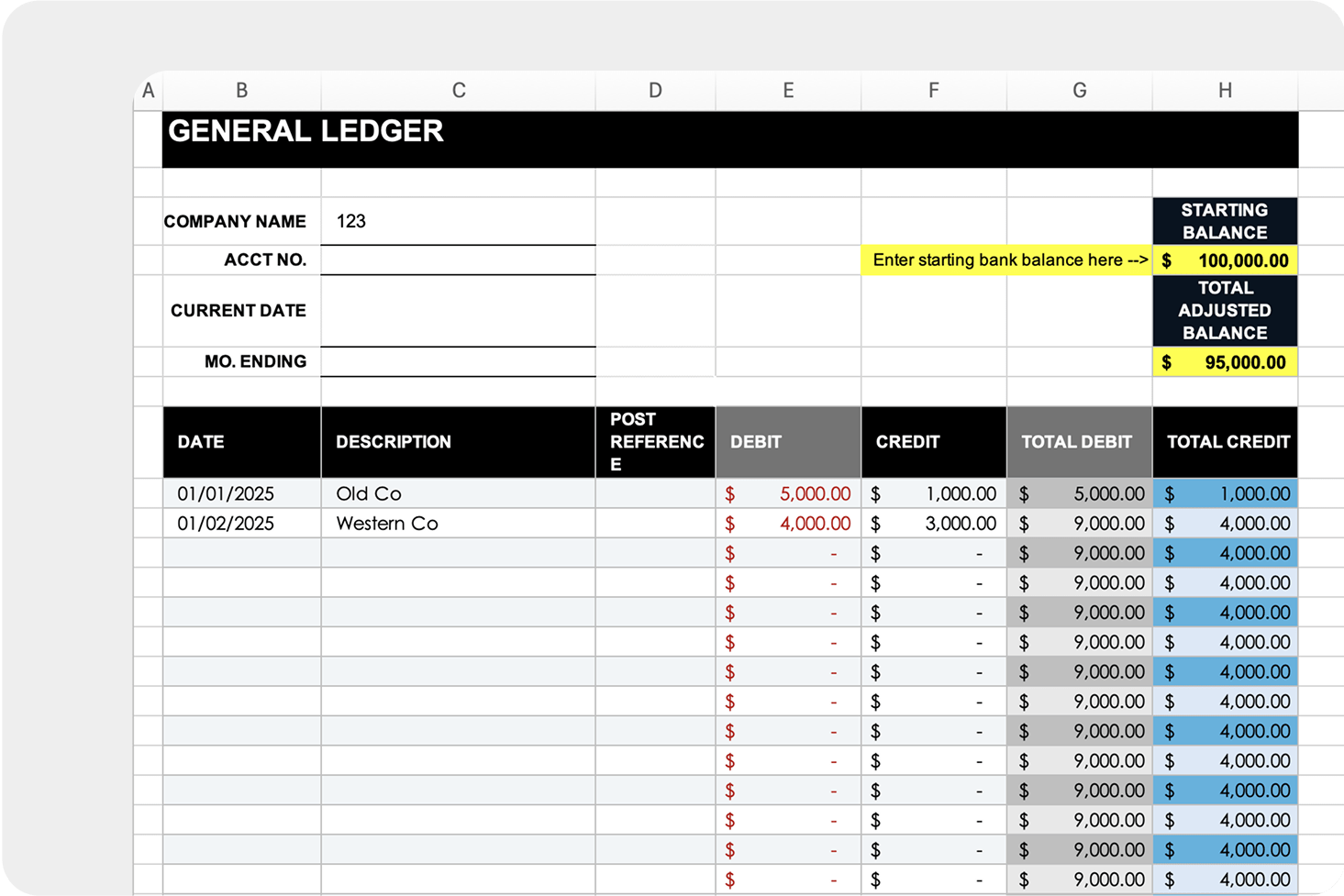

For more clarification, here’s a ledger balance example:

If you begin the day with a $2,000 balance, your ledger will remain at $2,000 all day. Even if you pay bills, use your business debit card for online shopping, or receive customer payments, the balance will remain at $2,000 for the entire day. All transactions processed during the day will be applied to the ledger the following day.

For a more accurate look at your funds, you’ll need to look at your available balance.

Ledger balance vs. available balance: What’s the difference?

While a ledger balance logs a company’s account funds at the beginning of a business day, the available balance is the amount of money accessible and ready for use in its bank account at any particular moment.

The available balance considers the ledger balance while factoring in pending transactions, temporary holds, or any relevant restrictions imposed by the bank.

Unlike ledger balances, an available balance changes throughout the day as payments are made or received, providing a more accurate picture of your available funds.

To compare these two balances, you can look at the available vs ledger balance example below:

A company begins its day with an opening balance of $2,000. Throughout the day, the company pays an automated electricity bill of $100, spends $200 online for office supplies, and receives a payment for a $500 invoice. Therefore, the company’s available balance is now $2,200, and the ledger balance is still $2,000 and won’t increase until the following business day. When determining your available balance for the day, make sure to consider both holds and pending transactions to ensure an accurate representation of your funds.

How to convert ledger balance to available balance

To convert your ledger balance to your available balance, consider any transactions made that are still waiting to be processed. Then, subtract that amount from your opening balance. Here’s a general guideline:

Identify pending transactions:

Check your recent transactions for any pending items. These are transactions that still need to be fully cleared or processed.

Consider holds:

If there are temporary holds on your account, like those from a hotel stay or gas station, subtract these amounts.

Subtract pending and holds:

Subtract the total amount of pending transactions and holds from your ledger balance. The result is an estimate of your available balance.

The exact method to convert ledger balance to available balance can vary depending on your bank’s policies and the specific circumstances of your transactions. For the most accurate information, contact your bank’s customer service or refer to their online banking system, which often provides real-time available balance information.

Now that you understand the difference between available versus ledger balances, it’s essential to also be aware of the various components that contribute to maintaining its accuracy.

The components of a ledger balance

A ledger differs in structure and components compared to your standard banking account.

A ledger balance can consist of incoming and outgoing transactions, referred to as debits and credits, which are individual journal entries on your balance sheet.

What’s a debit balance?

A debit balance indicates that the withdrawals or expenses from an account have exceeded the savings or deposits made into the account.

The most common debits are assets and expenses. Assets refer to cash, accounts receivable, inventory, prepaid bills, and equipment, while expenses refer to rent, payroll, utilities, automated bills, and day-to-day purchases.

Debits are often added to the left side of your bank ledger or balance sheet, while credits are added to the right. If reading in chronological order, any numbers on the bank ledger with a parenthesis surrounding them reference a negative number.

Overall, an increase in assets or expenses is recorded as a debit and a decrease in assets or expenses is recorded as a credit.

What’s a credit balance?

A credit balance is a surplus or extra funds in a given account. Credits typically increase the balance of liability, equity, and revenue or gain accounts.

- Liabilities are financial obligations that include loans, supplier payments, accrued expenses, and upcoming payroll.

- Equity is total assets (cash, accounts receivable, inventory, prepaid bills, and equipment) minus total liabilities.

- Revenues are the total amount (gross sales) of income generated by your business.

In addition to understanding fundamental components like credit and debit balances, it’s important to grasp the importance of ledger balances.

Why are ledger balances so important?

Keeping track of your ledger balance equips you with a detailed picture of your account’s history and current financial standing. By monitoring this along with your available funds, your business can ensure:

- Accurate financial reporting

- Compliance with auditing procedures

- Strategic decision-making insights

- Improved budgeting and planning

Accurate financial reporting

Recording all financial transactions allows you (or your bookkeeper) to create monthly, quarterly, and annual financial reports.

The most accurate financial reporting includes every category and line item on your profit and loss statement. Your ledger is just a piece of the puzzle, so reading, comprehending, and reconciling your financial records are crucial.

Payment solutions like EBizCharge simplify this process by syncing transactions directly to your accounting system. Whether you need a QuickBooks payment gateway, Sage Intacct payment processing, or an Acumatica payment gateway, EBizCharge posts every payment automatically — so your ledger reflects real-time activity without manual data entry.

Compliance with auditing procedures

An accurate and up-to-date ledger amount, along with credits and debits, is required for compliant bookkeeping and accounting.

Ledgers are used for internal audits and quarterly and annual taxes. Therefore, maintaining compliant ledger practices will simplify the IRS audit process.

Strategic decision-making insights

Understanding ledger and available balances allows you to make strategic purchases and financial decisions.

These balances can assist your business in assessing its cash flow, highlighting overspending areas, and inspiring new revenue streams.

Daily monitoring of the ledger and daily balances will inform your team of returns, reversals, and other transactional issues that can lead to costly overdraft fees.

Improved budgeting and planning

Analyzing your daily finances and ledger amounts can empower your company to identify business trends and make financial projections, essential to ongoing budgeting and planning.

For example, identifying a spike or dip in sales impacts staffing needs, inventory, and countless operational decisions.

With these benefits in mind, your business can better manage its opening balance to improve its finances.

How your company can effectively maintain its balance to transform its financial standing

Whether managing personal finances or overseeing a business, understanding ledger balances empowers you to maintain financial clarity, make more informed decisions, and accurately assess your overall financial position.

By distinguishing between ledger and available balances and understanding the components influencing it, you can effectively steer your business to make the most profitable financial decisions to grow into the future.

Frequently Asked Questions

What does ledger balance mean?

Calculated at the end of the day, a ledger balance is the total amount of money in a bank account. The Ledger balance considers everything deposited, withdrawn, or incurred as debits or credits to determine the starting balance for the next day. This means the opening balance is the funds you have available for the next day.

Why is my money in ledger balance?

Your money is in the ledger balance because it represents the total of everything you did with your money in your bank account, like putting some in or taking some out. The ledger balance is like a clear picture showing exactly how much money you have right now after you’ve done all those things. It helps you know exactly how much is available for you to use.

How to withdraw ledger balance?

Withdrawing from your ledger balance is no different from a regular bank withdrawal. It involves accessing your account and using a chosen method to take funds out, such as ATM or electronic transfer. Just ensure the amount doesn’t exceed your available balance to avoid issues.

When will the ledger balance be available?

Your ledger balance is usually updated at the end of each business day. Keep in mind that some transactions, especially those made with debit or credit cards, may initially appear as pending and might not be included until fully processed. If you have specific concerns or need real-time information, it’s advisable to check with your bank or refer to their online banking system for the most up-to-date ledger balance.

What is an average ledger balance?

The Average Ledger Balance is calculated by taking the sum of the daily ending ledger balances (both positive and negative) and dividing it by the total number of days in the analysis period.