Blog > What Are Virtual Terminals? A Guide for Businesses

What Are Virtual Terminals? A Guide for Businesses

Virtual terminals are revolutionizing how companies manage transactions, eliminating the need for physical systems or point-of-sale (POS) systems. Understanding this functionality is crucial for businesses looking to adapt to customer preferences and improve financial transactions.

This article will explore what virtual terminals are, their key features, and how they can benefit businesses.

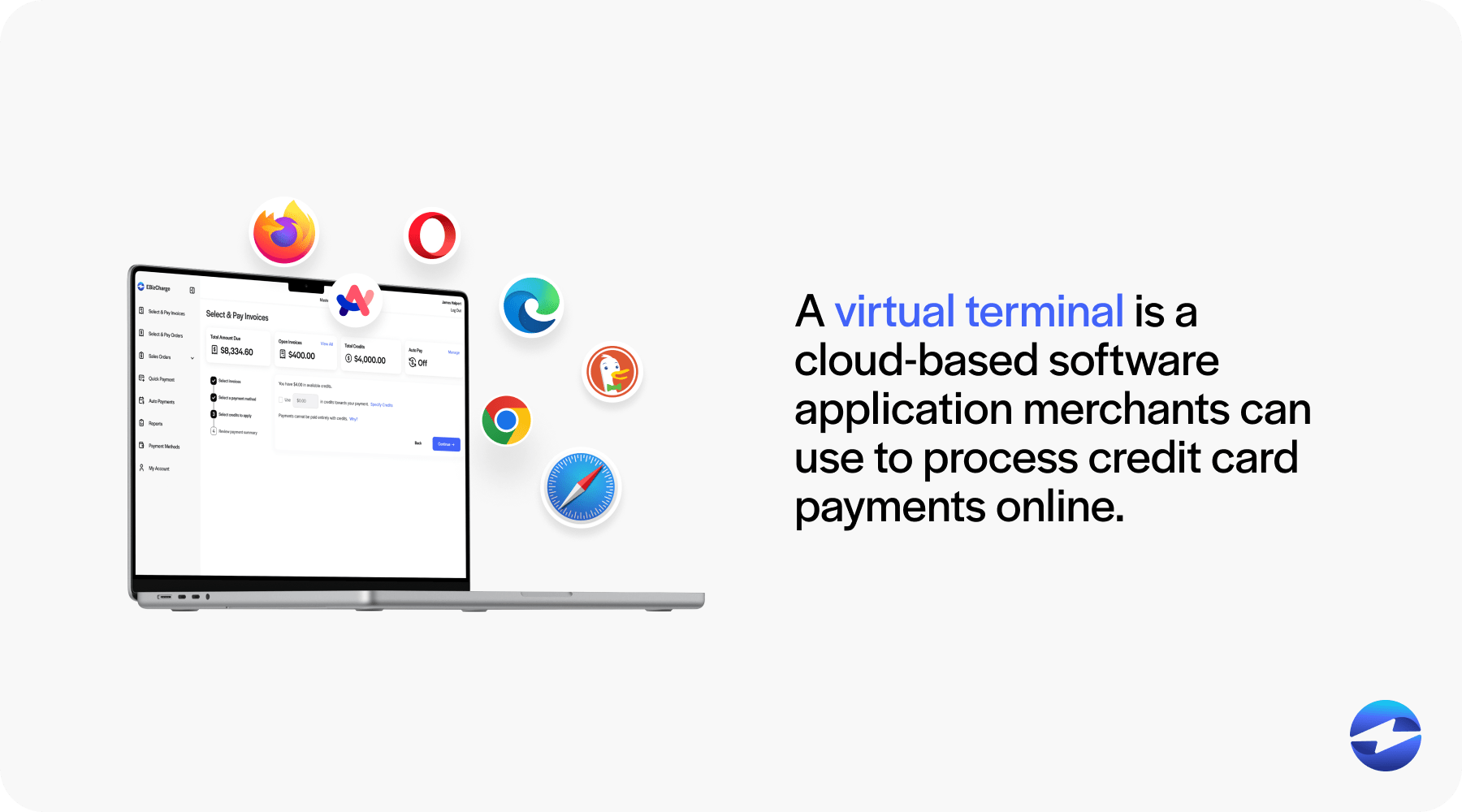

What is a virtual terminal?

A virtual terminal is a cloud-based software application merchants can use to process credit card payments online. Unlike traditional methods, it doesn’t require a physical card reader, making it ideal for card-not-present (CNP) transactions.

Businesses can use virtual terminals to easily manage and process payments from any internet browser. This type of payment processing is essential for digital transactions.

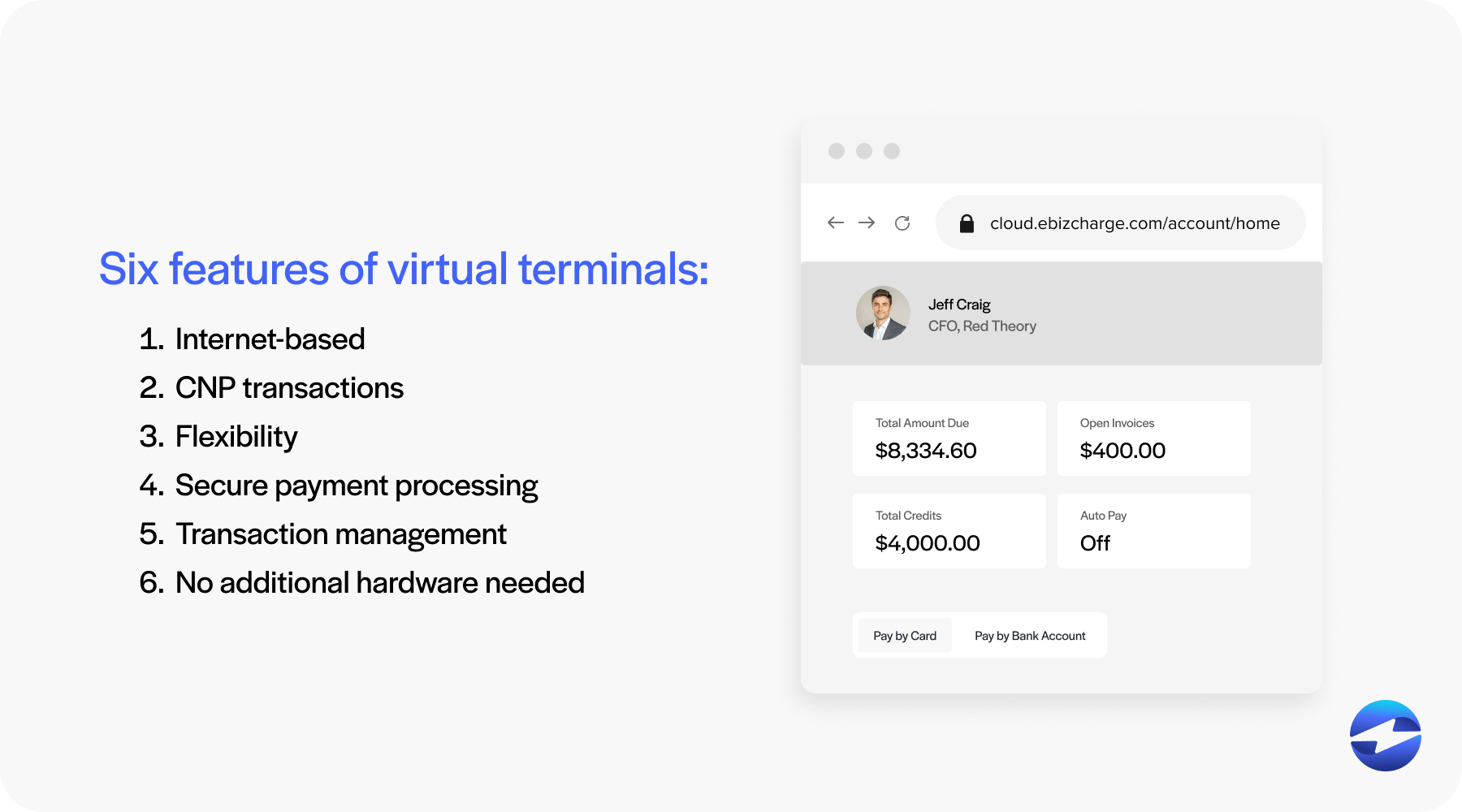

6 key features of a virtual terminal

A virtual payment terminal consists of various features that enable businesses to process payments online without physical hardware.

Here are six features of virtual terminals:

- Internet-based: Virtual terminals operate through an internet browser, requiring only a computer or mobile device and internet access.

- CNP transactions: Virtual terminals can process payments without the card physically being present, which is ideal for phone or online orders.

- Flexibility: Businesses can accept payments from debit and credit cards and ACH/eChecks, accommodating various customer preferences.

- Secure payment processing: Data encryption ensures that credit card details and payment data are secure, reducing fraud risk.

- Transaction management: Easily track payment history and transactions through the virtual terminal interface.

- No additional hardware needed: Unlike a credit card terminal, no extra equipment or card reader is required, minimizing setup costs.

Implementing a virtual payment terminal can provide a more flexible and secure payment processing system for your business and its customers while eliminating the need and costs of physical equipment.

Despite virtual terminals becoming a standard tool for modern transactions, not all businesses use them.

Who uses virtual terminals?

Virtual terminals are commonly used by merchants who need to process payments without a physical card present, such as businesses that accept orders over the phone, through mail order, or via email.

Retailers, service providers, and even freelance professionals often use virtual terminals for digital transactions.

Many small businesses (independent consultants or home-based companies) also use virtual terminal payments to process card and electronic payments without additional hardware or a card reader. Since all that’s required is internet access and an internet browser, it’s both cost-effective and convenient.

Now that you know what virtual terminals are and who uses them, it’s essential to know how this payment software works.

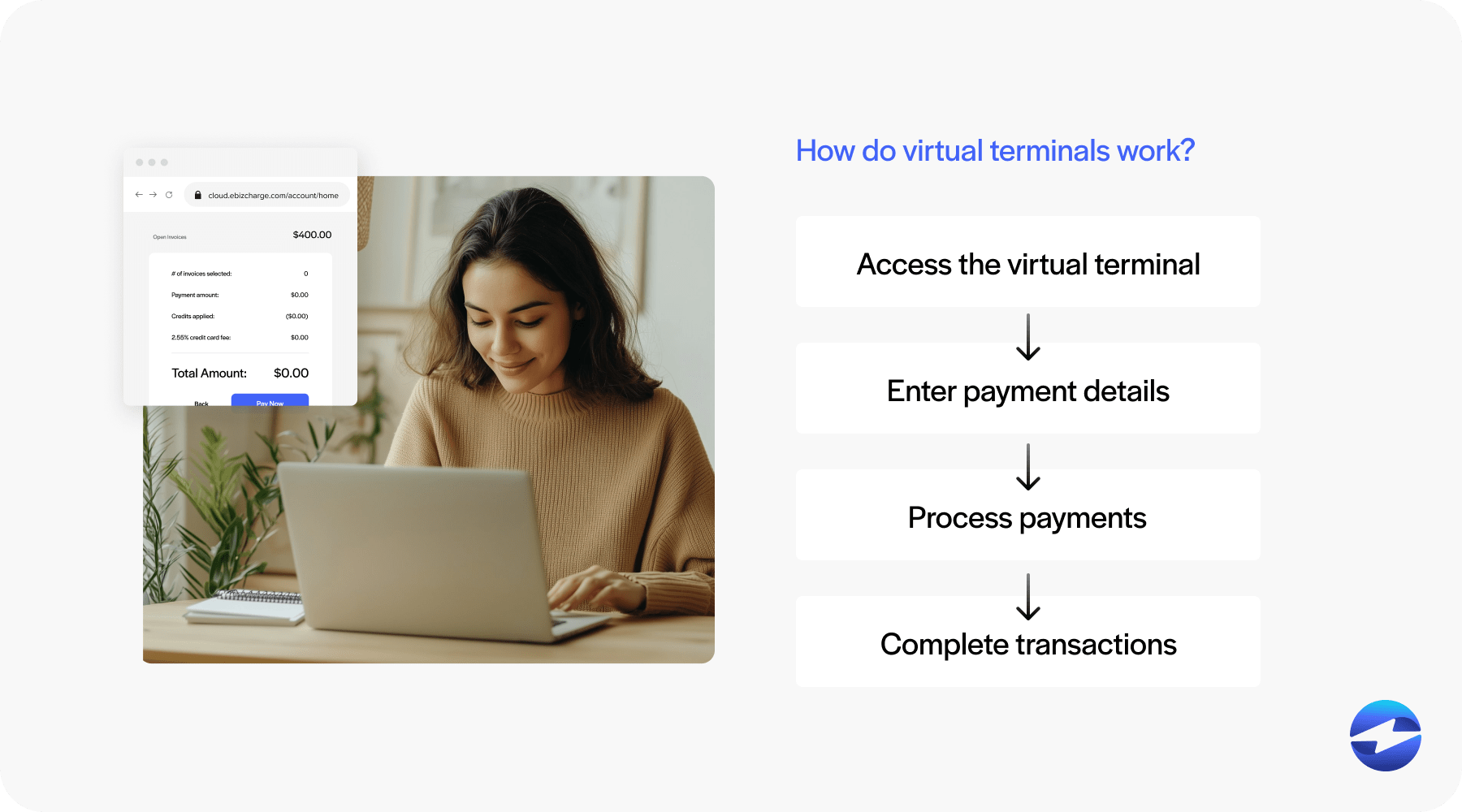

How do virtual terminals work?

Understanding how a virtual terminal payment operates is vital for businesses that rely on CNP transactions.

Virtual terminal transactions are designed to be intuitive and efficient, allowing businesses to securely manage payments and effectively maintain detailed transaction records.

Here is a quick breakdown of how virtual terminals work:

- Access the virtual terminal: The user logs into a secure internet browser or payment gateway to access the virtual terminal.

- Enter payment details: The business owner or authorized user manually inputs the customer’s card information. This includes debit or credit card or electronic payment details, payment amount, and any additional payment information.

- Process payment: Once the details are entered, the virtual terminal connects to the online payment processing system to ensure sufficient funds are available and to validate the transaction.

- Complete transaction: Upon approval, the payment is processed, and the user can view the transaction history for records.

Although virtual terminals carry numerous benefits, it’s important to note that they also have limitations.

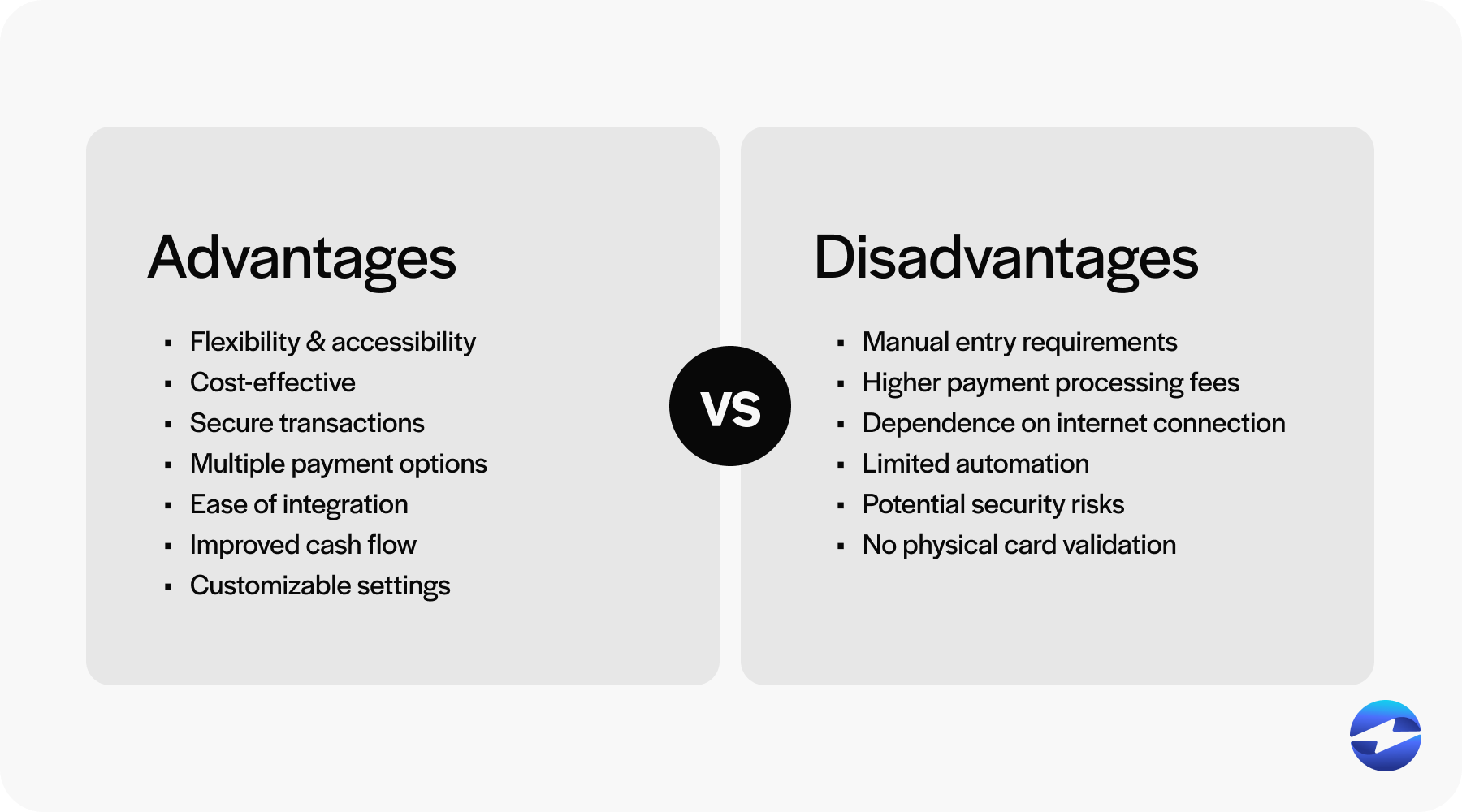

The pros and cons of virtual terminals

Understanding the advantages and disadvantages of virtual terminals allows merchants to determine if they will align with their business needs, enhance their payment operations, and make informed decisions before integrating them into their infrastructures.

7 advantages of using a virtual terminal

- Flexibility and accessibility: Virtual terminals allow businesses to accept payments from anywhere with an internet connection, making them ideal for CNP transactions on the go.

- Cost-effective: Virtual terminals eliminate the need for expensive hardware like card readers or POS systems, reducing upfront costs for businesses.

- Secure transactions: Virtual terminal providers that offer full Payment Card Industry (PCI) Compliance and built-in security features like encryption, tokenization, off-site data storage, and more can ensure safer payment processing to protect sensitive customer data.

- Multiple payment options: Virtual terminals typically support credit and debit cards, ACH/eCheck payments, and more, catering to various customer preferences.

- Ease of integration: Virtual terminals can integrate with accounting, enterprise resource planning (ERP), customer relationship management (CRM), and online shopping cart systems to streamline workflows and simplify transaction management.

- Improved cash flow: Virtual terminals can deliver faster payment processing and settlement, helping merchants maintain and increase cash flow.

- Customizable settings: Businesses can tailor virtual terminals to fit their specific needs, including recurring billing and transaction tracking.

6 disadvantages of using a virtual terminal

- Manual entry requirements: Manual entry of payment details into virtual terminals can increase human error and slow down the process for high transaction volumes.

- Higher payment processing fees: Virtual terminal payments typically incur higher processing fees for CNP credit card transactions than in-person payments due to increased fraud risks.

- Dependence on internet connection: A stable internet connection is required, meaning any downtime can disrupt payment processing.

- Limited automation: Virtual terminals may not be ideal for businesses with high transaction volumes that require automated payment systems or advanced POS features.

- Potential security risks: Since a virtual terminal transaction typically relies on authorized users to properly handle payment details, poor practices can result in unauthorized data exposure and fraud.

- No physical card validation: Since the card isn’t physically present, it can be hard to detect fraudulent transactions compared to using a card reader.

While virtual terminals are a valuable tool for flexible and secure online payment solutions, it’s essential to understand their limitations to ensure they compliment your business.

The following section will help you find the right virtual terminal for your business.

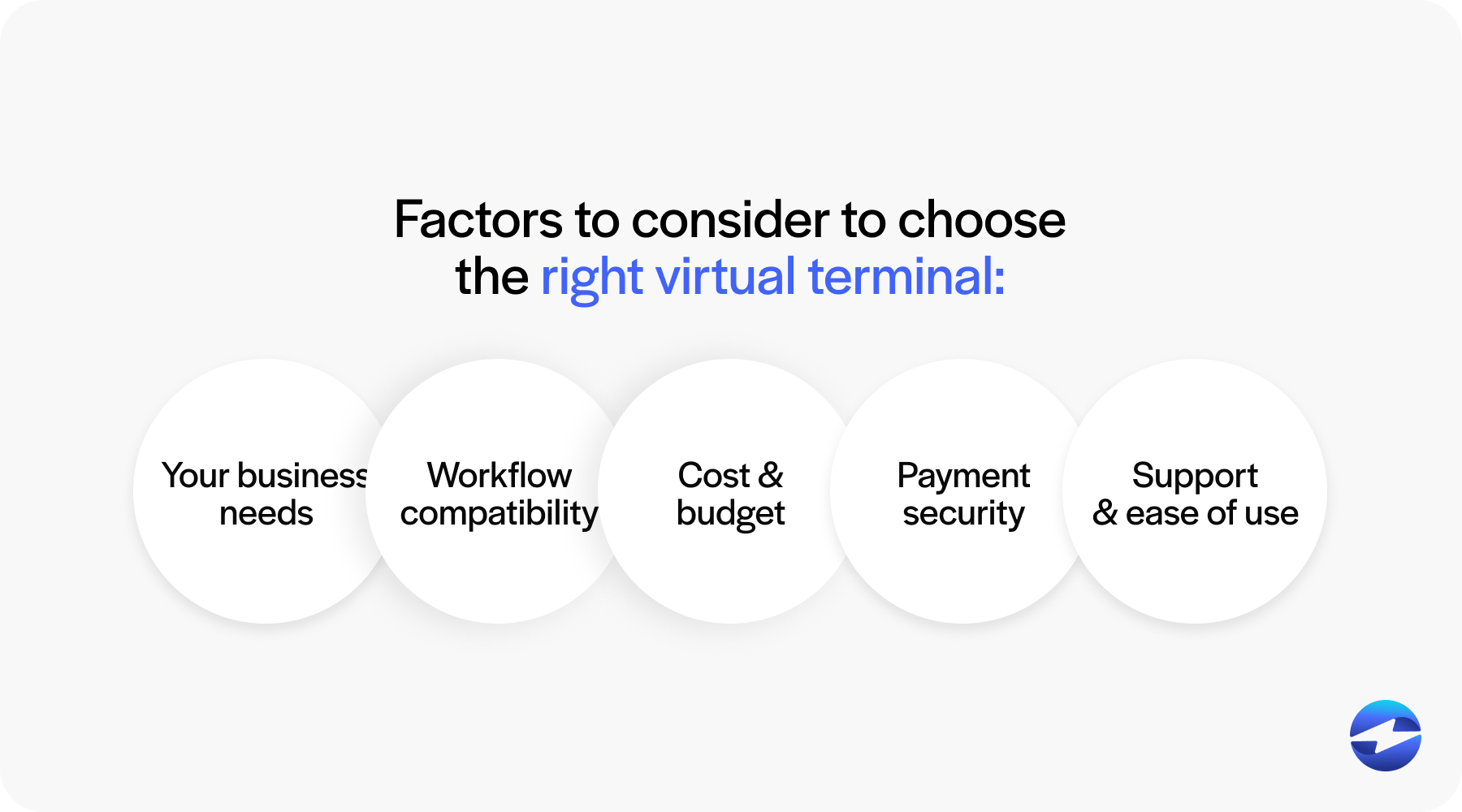

Choosing the right virtual terminal

Selecting a suitable virtual terminal can enhance your customer experience, improve efficiency, and protect sensitive payment data.

Merchants should evaluate different virtual terminals to select the software that best aligns with their industry expectations and specific initiatives and can enhance customer trust, streamline payments, and reduce unnecessary costs.

Identify your needs

Before selecting a virtual terminal, it’s important to identify your business needs. Consider the transactions you frequently process, such as credit, debit, or ACH/eCheck payments.

Determine whether you operate remotely or at a fixed location and if you require integration with existing systems like mobile devices or accounting software.

Compatibility

Compatibility is vital when choosing a virtual terminal since this software should integrate seamlessly with your existing business systems.

Virtual terminals should be able to sync with your accounting, ERP, POS, and eCommerce systems and mobile devices to ensure a smooth payment process and efficient financial management.

Compatibility across devices and operating systems provides the flexibility and scalability needed to support business growth.

Cost considerations

Since cost is a key consideration when choosing a virtual terminal, evaluating all processing fees (including transaction fees, setup costs, monthly charges, and fees for additional features) is vital to ensure they fit into your budget.

Businesses, especially small businesses, should prioritize balancing cost and functionality to maintain profitability and avoid unexpected expenses.

Payment security

Payment security is paramount when selecting a virtual terminal, so choosing a reliable provider that meets PCI compliance standards and delivers robust security protocols and features is a must.

Virtual terminals should implement strong payment security measures like encryption, tokenization, address encryption, address verification, and secure gateways to prevent fraud and data breaches.

Merchants should do their due diligence to implement a secure virtual terminal that protects their business and builds customer trust.

Support and ease of use

Working with a virtual terminal provider with reliable customer support and a user-friendly interface can allow your business to quickly adopt this software, minimize errors, and streamline transactions for improved efficiency and customer satisfaction.

Using these tips to research and review each virtual terminal thoroughly can allow you to find the best option that fits your needs, compatibility requirements, cost considerations, security features, support requirements, and long-term goals.

Thankfully, top-rated payment processors like EBizCharge offer a robust virtual terminal solution.

EBizCharge offers a powerful virtual terminal for merchants

EBizCharge offers a seamless virtual terminal solution designed to streamline and optimize the payment process for businesses of all sizes. This cost-efficient, fast, and user-friendly tool enhances customer payment experiences while offering advanced security features.

With the EBizCharge virtual terminal, businesses can securely run transactions using credit cards and ACH/eChecks, all through a cloud-based system, enabling effortless payment processing while maintaining full PCI Compliance.

EBizCharge also supports recurring billing for customers with repeat invoices, making it easier to manage long-term client relationships. Additionally, businesses can send secure payment links via email, allowing customers to pay conveniently from anywhere, or add payment buttons to their websites that lead to a secure checkout page.

EBizCharge further enhances payment management by hosting all invoices on a centralized payment portal. This feature enables customers to easily view and pay invoices and reduces administrative workloads for businesses.

EBizCharge ensures that payments are synchronized across systems, minimizing errors and maximizing efficiency. By combining convenience, security, and functionality, EBizCharge virtual terminals are an invaluable asset for modern businesses.