Blog > The Ultimate Guide to Salesforce Payments

The Ultimate Guide to Salesforce Payments

Since the ways merchants handle transactions can make or break their success, integrating a reliable and robust payment processing system that syncs with their other business systems can be invaluable.

Salesforce, a popular customer relationship management (CRM) solution, allows businesses to manage customer data, sales, operations, and finances within a single, cloud-based system, eliminating the need for disconnected systems. Seamless payment processing software can also be synced directly inside of it when partnered with the right payment gateway.

Understanding how to leverage Salesforce payments can significantly enhance operational efficiency and customer satisfaction.

This guide will explore the intricacies of Salesforce payments, offering insights into the key benefits, features, and integration processes that can transform your business transactions.

What is Salesforce?

Salesforce is a cloud-based CRM platform designed to help businesses manage and improve their interactions with current and potential customers.

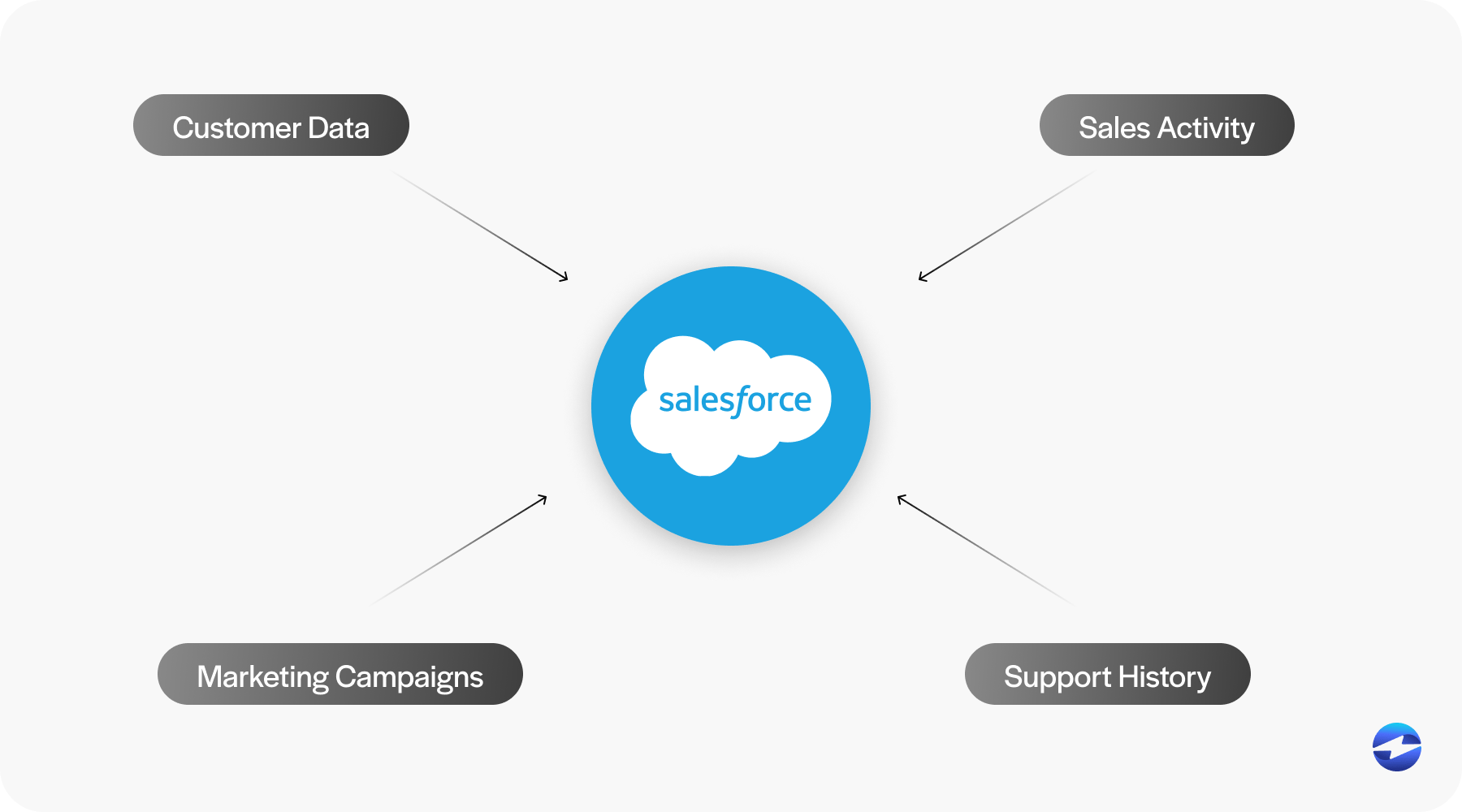

Salesforce centralizes customer data, sales activity, support history, marketing campaigns, and other vital information in one unified system. This allows teams across departments like sales, marketing, and customer service to access real-time insights, track engagement, and collaborate more effectively.

Salesforce also offers powerful automation tools, customizable workflows, and Artificial Intelligence (AI)-driven analytics that help businesses streamline operations, personalize customer experiences, and make data-informed decisions. Its scalability and vast ecosystem of integrations make it a popular choice for companies of all sizes looking to drive growth and build stronger customer relationships.

While the Salesforce platform focuses on customer relations, it can be integrated with trusted third-party payment processors like EBizCharge to facilitate seamless integrated payments.

Integrating payment into Salesforce

Salesforce integrated payments refer to the ability to process and manage financial transactions directly within the Salesforce platform.

Merchants can sync a payment gateway into Salesforce to enable users to accept credit card payments, Automated Clearing House (ACH)/eCheck payments, and other forms of electronic payments without leaving the CRM interface.

A reliable Salesforce payment gateway enables users to accept payments through any Salesforce object and platform like Experience Cloud or a pre-built app the payment provider offers.

These integrations streamline the quote-to-cash cycle by allowing sales, finance, and customer service teams to initiate, track, and reconcile payments in real-time.

By integrating payments inside Salesforce, merchants can improve cash flow, enhance the user experience, and centralize data management.

8 key benefits of Salesforce payment integrations

Integrating payments into Salesforce offers more than just processing transactions – it transforms how businesses manage sales cycles, billing, and customer relationships.

Some of the most impactful benefits include a streamlined quote-to-cash process, a better user experience, centralized data management, and more.

Streamlined quote-to-cash process

From generating quotes and closing deals to collecting payments and issuing receipts, integrating payments into Salesforce allows all these operations to be managed from one platform to reduce errors, delays, and manual entry.

Enhanced customer experience

With payment functionality embedded directly into Salesforce, you can provide customers with fast, secure, and flexible payment options.

Whether it’s a one-click payment from an invoice or a self-service portal, a seamless experience boosts satisfaction and encourages on-time payments.

Centralized data management

All payment data is automatically captured and stored in Salesforce, alongside customer and transaction records.

This centralization enables a 360-degree view of each account, making it easier for teams to manage relationships, track payment history, and deliver personalized service.

Real-time payment tracking

Salesforce payment integrations allow you to monitor the status of transactions in real-time.

Sales and finance teams can instantly see whether a payment is pending, completed, or failed, enabling quicker follow-up and more accurate forecasting.

Improved cash flow

Reliable Salesforce payment integrations typically provide automated payment reminders, recurring billing, and real-time payment processing, all of which can accelerate cash flow.

Therefore, these integrated payments can reduce the time between deal closures and payment collections, improving liquidity and reducing days sales outstanding (DSO).

Enhanced reporting and insights

By storing all transaction data inside Salesforce, merchants can access powerful analytics and reporting tools.

Thanks to this enhanced reporting and insights, Salesforce users can generate dashboards that track payment trends, forecast revenue, or identify at-risk accounts, supporting better decision-making across departments.

Operational efficiency and automation

Salesforce payment processing automation (like workflows and process builders) can trigger emails, update fields, or alert users based on payment activity.

Automating operations in Salesforce can reduce the need for manual intervention, minimize human error, and free up time for your staff to focus on other high-priority projects or strategic initiatives.

PCI compliance and security

Integrated payment gateways typically come with built-in security features such as full compliance with Payment Card Industry Data Security Standards (PCI DSS), tokenization, and encrypted data transmission.

With robust security features and PCI-compliant payment processing, merchants can ensure that sensitive payment information is handled safely and in line with industry standards.

Thanks to the numerous benefits of integrating payments into Salesforce payment processing, businesses can simplify payment collections and gain more visibility into revenue operations. This allows them to improve the customer experience, drive more stable and long-term revenue, and increase productivity.

Now that you know the benefits of Salesforce integrated payments, it’s time to set it up.

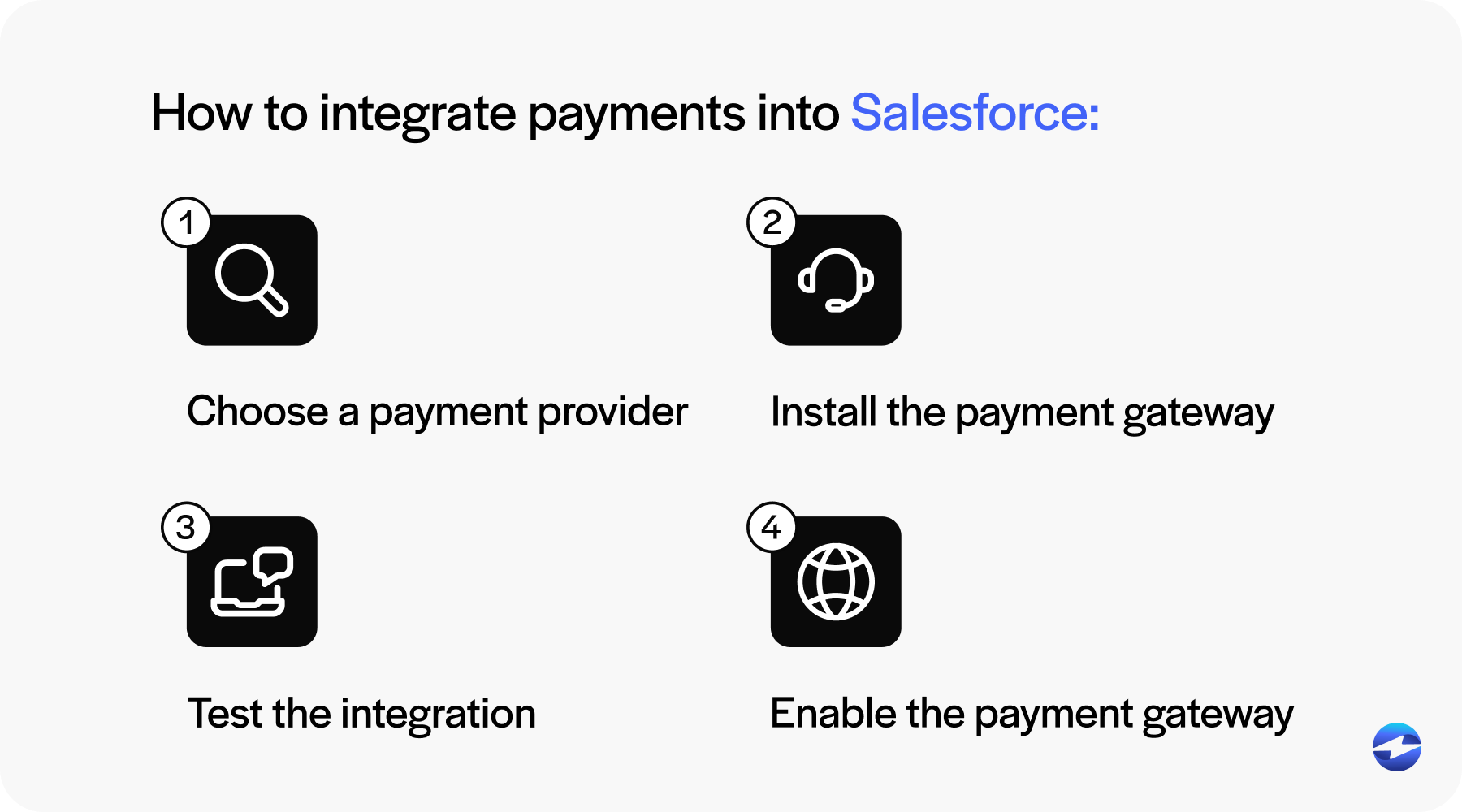

How to integrate payments into Salesforce

Integrating a payment gateway into Salesforce can dramatically accelerate and enhance your accounts receivable (AR) process and enhance the overall user experience.

To ensure a smooth and secure setup, follow these four steps:

- Choose a payment gateway provider

- Install the payment gateway

- Test the integration

- Enable the payment gateway

1. Choose a payment gateway provider

Before processing payments into Salesforce, selecting a payment gateway provider that meets your needs and offers an effortless integration is essential.

Choosing the most suitable payment software for your Salesforce system may involve evaluating several providers and features, such as compatibility, supported payment methods, PCI compliance and security, and more.

Popular options include providers with native Salesforce integrations, like EBizCharge, that reduce development time and make the integration process quick and easy.

2. Install the payment gateway

After choosing your payment gateway provider, the next step is to install it within your Salesforce environment.

Most providers require that you set up a merchant account, which acts as a secure intermediary to transfer funds from customer payments to your business bank account. Once your merchant account is established, you’ll need to connect it to Salesforce using Application Program Interface (API) credentials or other authentication methods provided by the gateway.

A well-executed installation lays the foundation for seamless payment operations, helping to minimize potential issues and keep your billing workflows running smoothly.

3. Test the integration

Before going live, it’s crucial to thoroughly test the payment processing workflow in a Salesforce sandbox environment to ensure everything works correctly without affecting real data.

Testing should involve the review of successful and failed transactions, transaction logging and updates to Salesforce records, and email notifications and reporting accuracy.

During this testing phase, training your sales, finance, or service teams on how to use the payment functionality inside Salesforce, including how to process a transaction, issue refunds, or generate reports, is vital.

After getting the relevant departments up to speed and completing several tests to verify that your Salesforce integration successfully processes and records customer transactions, your gateway is ready to go live.

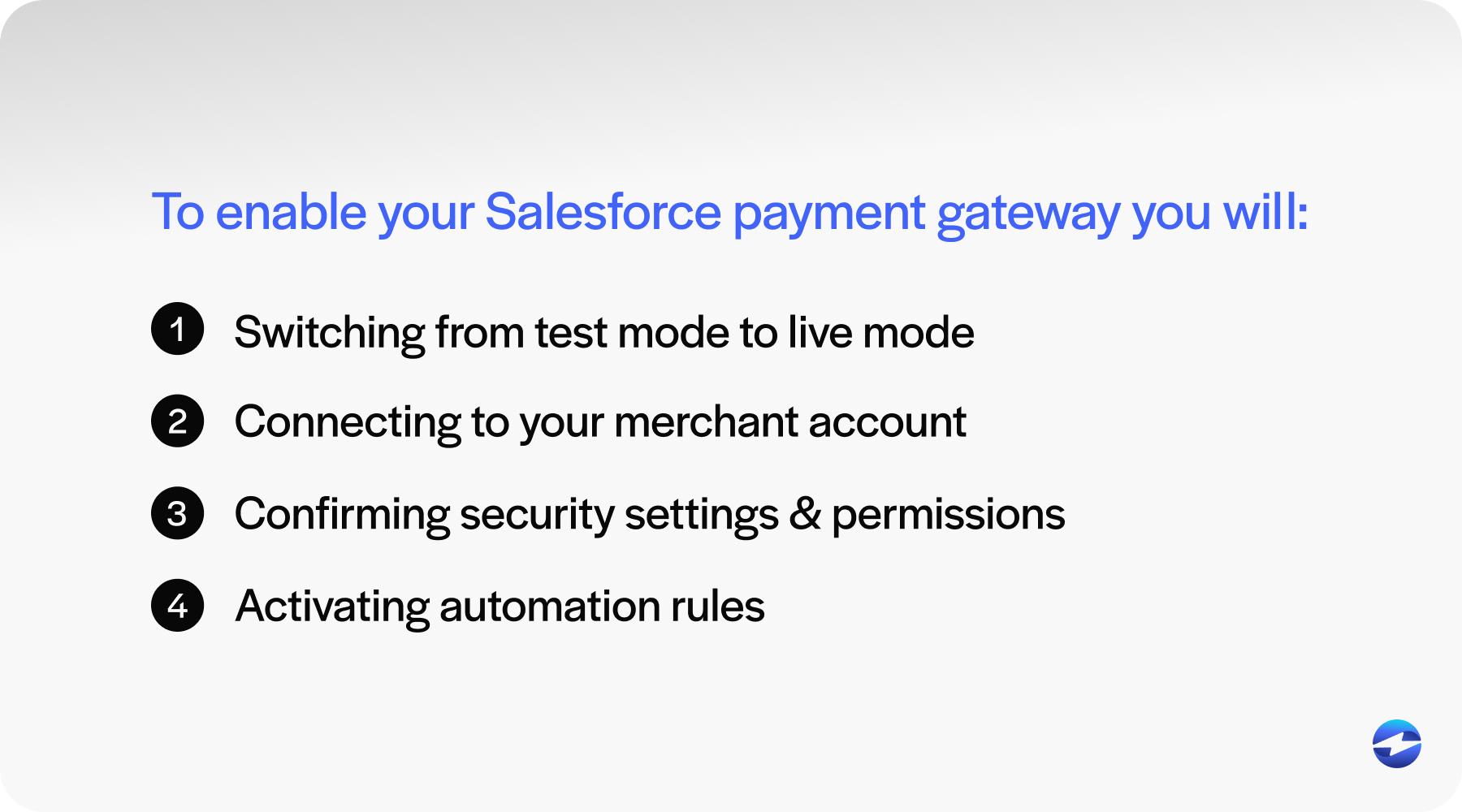

4. Enable the payment gateway

The final step is enabling your payment gateway in your live Salesforce environment to start accepting customer payments.

Enabling your Salesforce payment gateway to go live typically involves:

- Switching from test mode to live mode

- Connecting to your merchant account

- Confirming security settings and permissions

- Activating automation rules

A properly integrated payment gateway turns Salesforce into a powerful revenue engine – allowing you to process transactions, automate billing, and track payments without leaving the CRM.

In addition to understanding the integration process, it’s important to understand best practices for managing Salesforce payments to ensure seamless payment operations.

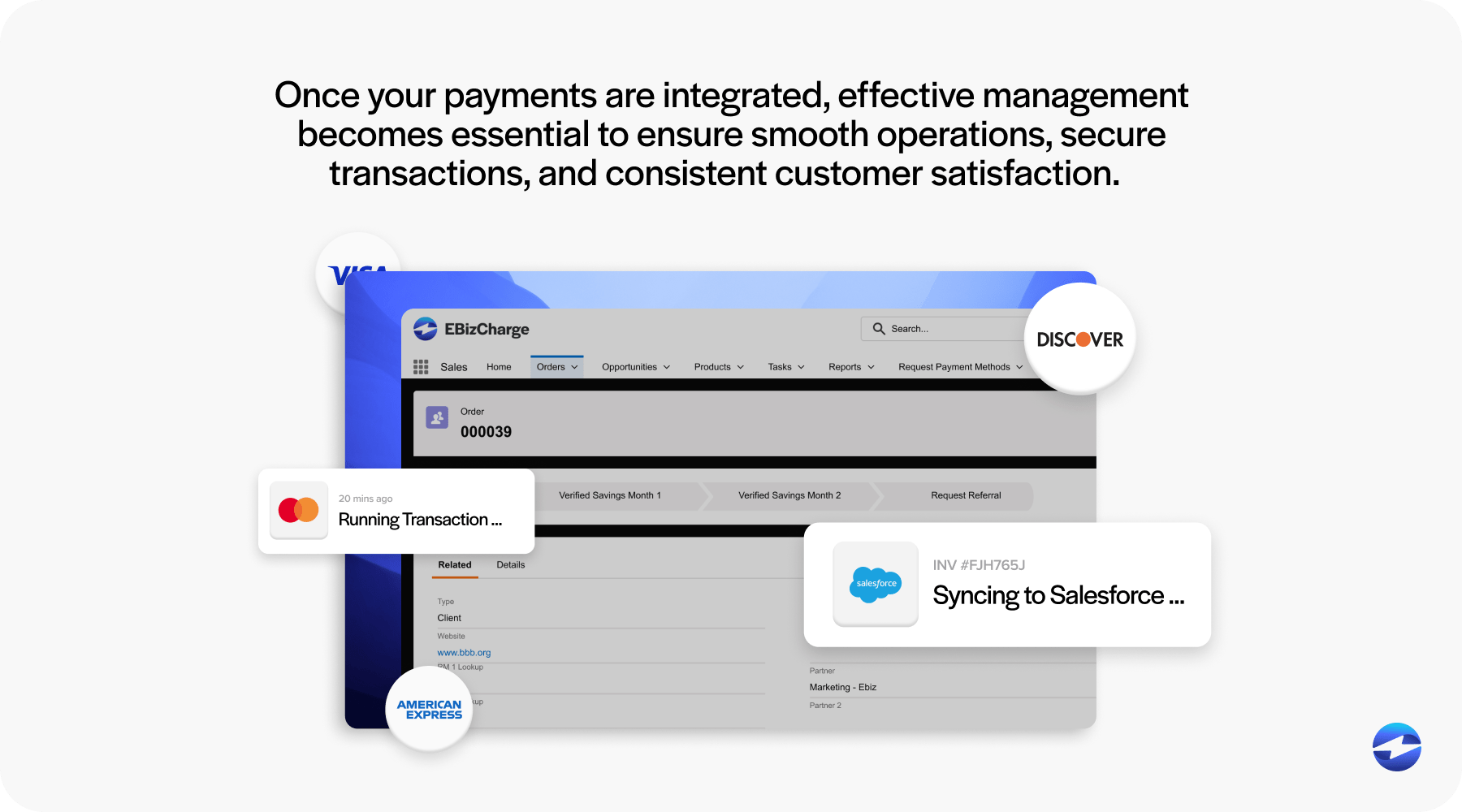

8 best practices for managing Salesforce payments

Once your payment gateway is integrated with Salesforce credit card processing, effective management becomes essential to ensure smooth operations, secure transactions, and consistent customer satisfaction.

To achieve this, merchants can follow several best practices, including ensuring consistent maintenance of payment data, workflow automation, payment reconciliation, and more.

Keep payment data clean and synced

Maintaining clean, accurate payment data is essential to keeping your Salesforce credit card processing system efficient and reliable.

Ensure that payment records are consistently formatted, adequately mapped to the correct Salesforce functions, and updated in real-time. Synchronizing payment data with your accounting or ERP systems can prevent discrepancies and reduce manual data entry errors.

Automated syncing tools or third-party integrations can streamline this process, ensuring your financial and customer data stay aligned across platforms.

Set up automated payment workflows

Automation is one of the most powerful features of a Salesforce-integrated payment system.

By setting up workflows, businesses can automatically trigger actions such as sending payment receipts, updating payment statuses, initiating follow-ups on outstanding invoices, or closing opportunities once payment is received.

These automated processes reduce manual workload, eliminate delays, and ensure a consistent experience for your internal team and customers.

Monitor and manage failed payments

Failed payments are an inevitable part of processing transactions, but they don’t have to disrupt your operations.

Set up alert systems or dashboards to flag failed transactions immediately. You can also create automated retry logic or notification workflows that prompt your team or the customer to resolve the issue.

Proactive management of failed payments helps recover revenue quickly, improves customer trust, and prevents revenue leakage from unnoticed or unresolved issues.

Secure payment data and access management

Businesses should implement strong data encryption protocols to protect sensitive information both in transit and at rest.

Role-based access controls should be established within Salesforce to ensure only authorized users can view or manage payment data, reducing the risk of internal breaches. It’s also important to regularly audit user permissions and activity logs to detect any unauthorized access or unusual behavior.

Additionally, integrating with PCI-compliant payment solutions and enabling multi-factor authentication (MFA) adds an extra layer of security, helping businesses meet compliance requirements and safeguard customer payment data.

Routine payment reconciliation

Regular reconciliation ensures that the data in Salesforce matches what’s recorded in your payment gateway and accounting systems.

This process can identify any discrepancies, such as duplicate transactions or missed payments, before they become more significant financial issues.

Automating reconciliation through scheduled reports or third-party integration tools can also simplify this process, increase accuracy, and support timely financial reporting.

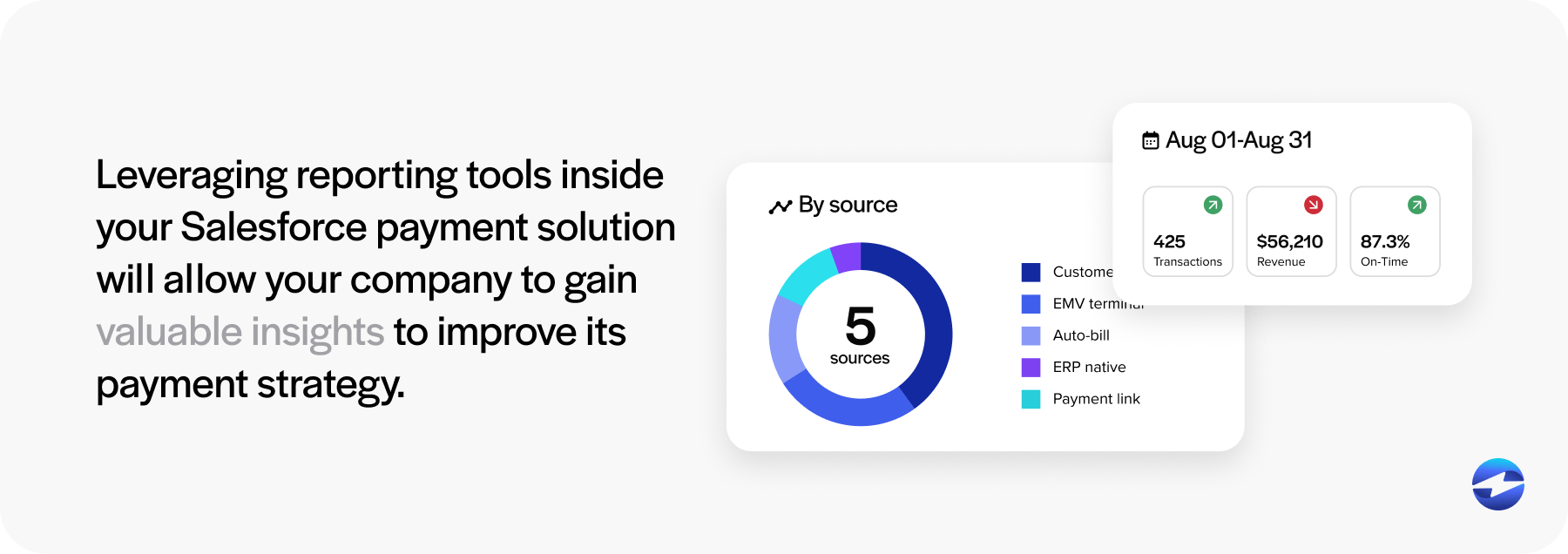

Use reporting and dashboards for insights

Leveraging reporting tools inside your Salesforce payment solution will allow your company to gain valuable insights to improve its payment strategy.

Merchants can track key payment metrics, such as total revenue collected, outstanding balances, average payment times, payment method trends, and more.

Visual dashboards give stakeholders a real-time view of financial performance and help identify areas for improvement.

Provide training and documentation for users

To maximize the benefits of your integrated payment system, ensure that your team knows how to use it effectively.

Provide training for relevant departments on processing payments, issuing refunds, generating reports, and troubleshooting common issues. Your team should also document key processes and make this information easily accessible within Salesforce or your internal knowledge base.

Ongoing education can reduce user errors and promote consistent, confident usage across your company.

Regularly review and optimize your setup

As your business evolves, it’s essential to review your payment processing operations in Salesforce to identify opportunities for improvement.

Routine evaluations and optimization may include adding new payment methods, refining automation methods, updating permissions or field mappings, employing new payment collection tools or features, and more.

Continuous improvement ensures your system remains efficient, scalable, and aligned with business needs.

In addition to these best practices, businesses should consider various factors when choosing a payment provider for their Salesforce integration.

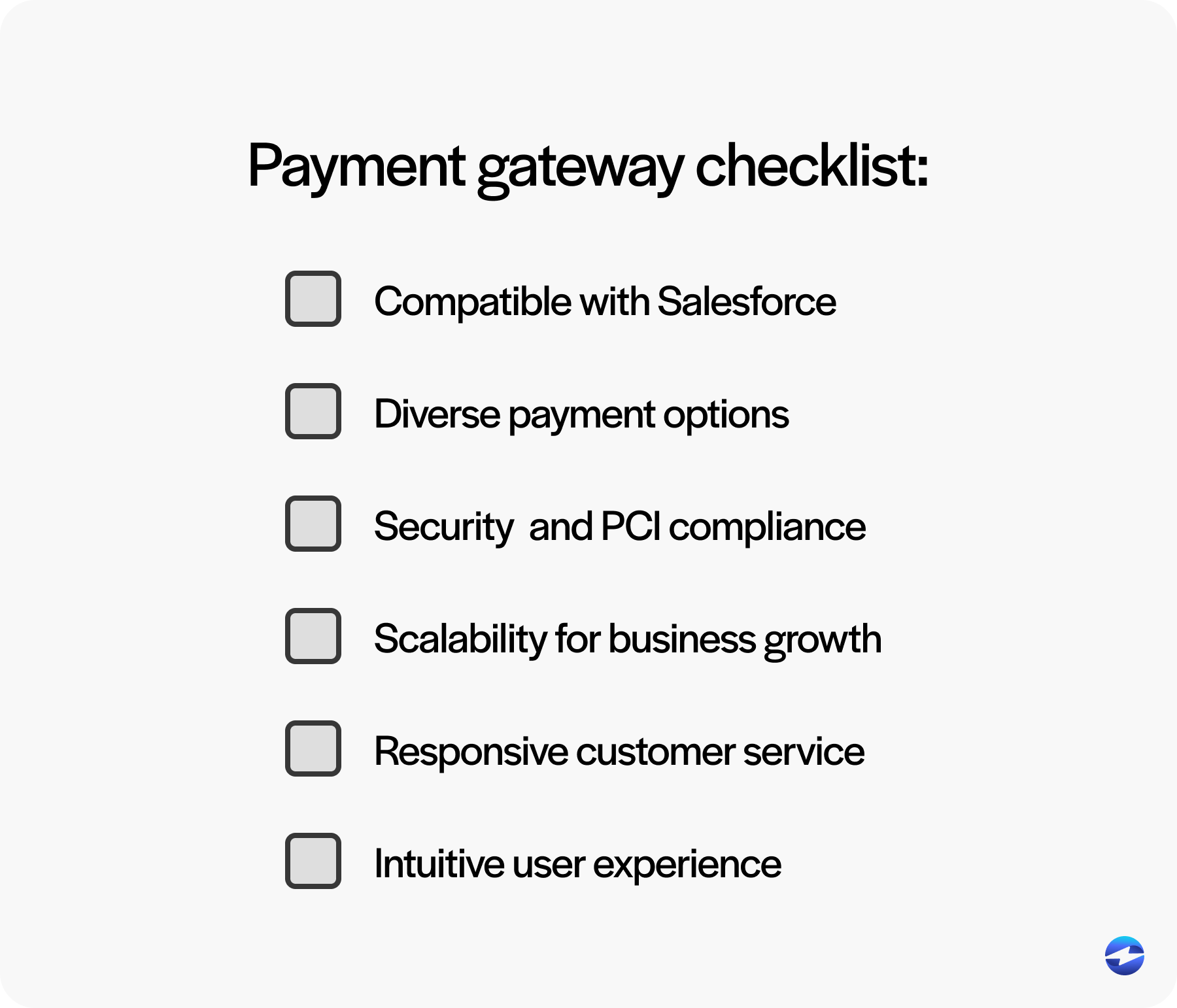

Choosing the right Salesforce payment provider

Selecting the right payment provider for your Salesforce environment is a critical decision that can affect your operations, long- and short-term revenue, and growth. It’s also important to remember that not all payment solutions are created equal, especially regarding your Salesforce integration.

Five factors to consider when determining which payment provider is the best for your Salesforce system include compatibility, payment options, security and compliance, scalability, and customer support.

1. Compatibility with Salesforce

Compatibility with Salesforce is essential when selecting a payment provider because it ensures seamless integration between your CRM system and payment processing tools.

When a payment provider is fully compatible with Salesforce, it enables real-time synchronization of transaction data, customer profiles, invoices, and payment histories directly within the Salesforce environment. This eliminates the need for manual data entry, reducing the risk of errors and saving valuable time for sales and finance teams.

2. Diverse payment options

Nowadays, there are various payment methods available to meet diverse consumer preferences. Therefore, businesses need to assess their customer demographics to determine which methods are essential to offer.

Choosing a provider that supports credit and debit cards, ACH/eChecks, recurring payments, subscription billing, digital wallets, or even multi-currency support for global transactions is wise.

The more payment options you can offer, the easier it will be to accommodate customer preferences and reduce friction during checkout or invoicing.

3. Security and compliance

Since payment security is non-negotiable when handling payments, your provider should be PCI compliant and provide various security measures to safeguard cardholder data.

The most reliable payment software providers will offer tokenization, encryption, fraud detection, 3D Secure, role-based access controls, and other security features to protect sensitive payment information.

Since Salesforce handles sensitive customer and transaction data, the payment integration must uphold the highest standards for data protection.

4. Scalability for business growth

As your business grows, so will your payment processing needs, making finding an adaptable and scalable solution essential.

A good provider should be able to handle increasing transaction volume, support complex pricing models (like tiered or usage-based billing), and integrate with additional Salesforce modules or other business systems.

Look for API extensibility, performance under high load, and flexible pricing structures that grow with your business.

5. Responsive customer service

Even the best payment processing solutions can encounter technical errors or other service-related issues, making fast and knowledgeable support vital.

Merchants should find a provider known for responsive customer service, ideally with dedicated Salesforce support specialists who understand your infrastructure.

When evaluating different providers, you should verify if their support teams offer 24/7 availability, onboarding assistance, technical documentation access, live chat or phone support, and service-level agreement (SLA)-backed commitments.

6. Intuitive user experience

Your integrated Salesforce payment software should provide a frictionless payment experience for your company and its customers.

Internally, your Salesforce users should find the interface easy to navigate, with clear dashboards, payment statuses, and automation tools. Externally, customers should experience fast, mobile-friendly, and branded payment flows.

Externally, a high-quality user experience should include one-click payments from invoices or quotes, real-time status updates in Salesforce, customizable payment pages or portals, and precise resolution management.

For a comprehensive payment provider, look for trusted solutions like EBizCharge.

Leverage the powerful EBizCharge payment integration in Salesforce

EBizCharge offers a robust Salesforce integration that elevates the entire payment experience by embedding a comprehensive suite of tools directly into your CRM.

This seamless integration enables businesses to process payments without leaving the Salesforce interface, significantly reducing manual effort and improving overall efficiency.

With features like one-click invoice payments, automated recurring billing, and real-time transaction updates, EBizCharge empowers teams to accelerate cash flow and eliminate redundant data entry. It’s also fully PCI-compliant software that includes customizable payment portals, tokenized card storage for secure repeat transactions, and detailed reporting dashboards that give users actionable insights into payment performance.

By centralizing financial data and payment activity within Salesforce, EBizCharge streamlines operations across departments and enhances customer satisfaction through fast, flexible, and secure payment options.

Whether you’re managing one-time transactions or complex billing cycles, EBizCharge delivers a scalable, intuitive solution designed to grow with your business.

FAQs regarding Salesforce payments

FAQs regarding Salesforce payments

Summary

- What is Salesforce?

- Integrating payment into Salesforce

- 8 key benefits of Salesforce payment integrations

- How to integrate payments into Salesforce

- 8 best practices for managing Salesforce payments

- Choosing the right Salesforce payment provider

- Leverage the powerful EBizCharge payment integration in Salesforce

- FAQs regarding Salesforce payments