Blog > The Best NetSuite Payment Plugin

The Best NetSuite Payment Plugin

NetSuite provides business applications such as CRM and accounting software. They equip companies with tools to stay organized and create efficiency. But NetSuite’s accounting software lacks one thing: credit card processing.

Therefore, NetSuite users who want to accept credit card payments directly in their ERP, CRM, or accounting software need a NetSuite credit card processing payment plugin.

What is a payment plugin?

Merriam-Webster describes a plugin as “a small piece of software that supplements a larger program.” Adobe Flash Player is an example of a plugin. Certain videos require you to install Adobe Flash Player in order to play them. This plugin then adds a feature to your computer that enables you to view Adobe videos.

Similarly, when you install a NetSuite payment plugin, you can take credit card payments directly in your NetSuite software.

3 benefits of NetSuite payment plugins

-

No more double data entry

No more going back and forth between your payment software and your accounting software. NetSuite payment plugins keep all the action in one place. Plugins allow you to run credit cards directly in your NetSuite software and automatically apply payments to invoices, so you don’t have to enter payment data twice.

-

Fewer errors

Merchants who manually enter credit card information into their NetSuite system run a greater risk of mistyping a credit card number or forgetting to mark an invoice as paid. A payment plugin helps you avoid those mistakes. Since you enter credit cards directly in NetSuite, you avoid switching between a terminal and your accounting software. Keeping your activity in one place reduces your chance of making errors.

-

Lower processing fees

Manual payment processing systems often have high processing rates. But integrating your payment software with your NetSuite accounting software lowers your processing fees with no extra work on your part.

Why is that?

Well, most NetSuite payment plugins cut down on processing costs by automatically including additional information with each transaction. Credit card payments that include more information, like the customer name, address, and product purchased, are less likely to be fraudulent and therefore qualify at a lower rate.

5 ways to assess a payment plugin’s quality

NetSuite payment plugins save businesses time and money. But despite the three benefits listed above, some payment plugins fall short in key areas.

So to ensure you don’t end up in a bad deal, analyze prospective NetSuite payment plugins for these five qualities:

- Responsive in-house customer support

- Complimentary training on how to use the payment plugin

- Flat rate or interchange plus pricing models

- Good rating on the Better Business Bureau (BBB)

- PCI-compliant payment software with tokenization technology

NetSuite payment plugins with these qualities are reliable, trustworthy, and secure. Be wary of payment plugins that don’t hit all five marks. For example, a plugin that provides only a tiered pricing model option will most likely overcharge you and burden you with hidden fees. Checking for these five qualities is an easy way to select the best payment plugin for your business.

EBizCharge as your NetSuite payment plugin

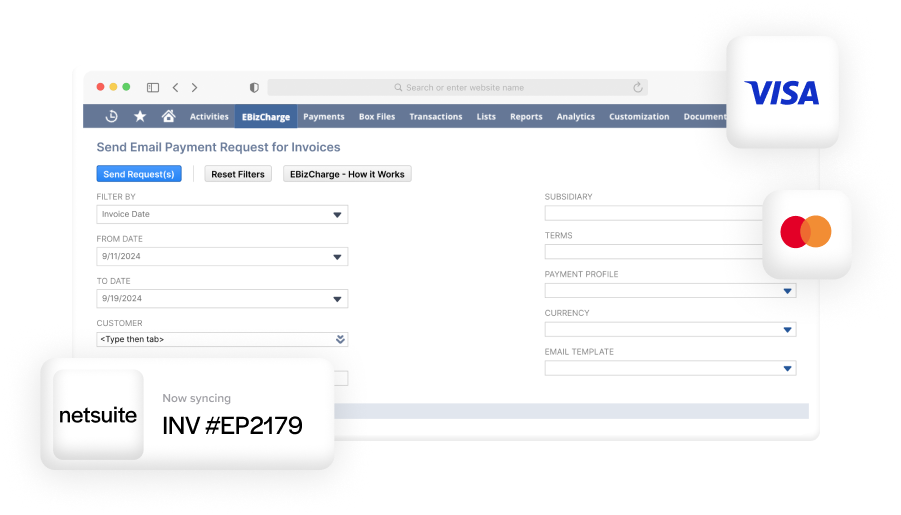

EBizCharge is a payment plugin that allows NetSuite users to eliminate double data entry, minimize mistakes, and lower processing fees.

Get a demo of EBizCharge for NetSuite here.

The PCI-compliant payment module has an A+ rating on the BBB and comes with in-house customer support, unlimited training, and flat rate and interchange plus pricing models.

EBizCharge also offers convenient features like email pay, which allows customers to pay their invoices via emailed payment links, and a customer payment portal.

Another unique benefit of using EBizCharge as your NetSuite payment plugin is that you’re equipped with a chargeback management team. Chargeback management teams notify you when you receive a chargeback and then walk you through the steps on how to best respond. They’ll submit your response and any necessary documentation.

Final remarks

Businesses save time, reduce errors, and lower their processing fees when they accept payments through a NetSuite payment plugin. In order to select the best plugin for your business, first narrow down your options by eliminating any payment plugin that doesn’t meet all five points on the checklist above. Then weigh your remaining options by the added value each payment plugin provides for your business needs. For example, if your company wants to give customers convenient payment options, then consider plugins that provide email pay and a customer payment portal. Or if your company receives a lot of chargebacks, look for a payment plugin that includes a chargeback management team.

If you need further assistance or would like to use EBizCharge as your NetSuite payment plugin. We’d love to help.