Blog > Setting Up Automated Invoice Payments in Sage Intacct

Setting Up Automated Invoice Payments in Sage Intacct

For any finance team, time and accuracy are two of the most valuable resources. When invoices pile up or manual payments slow down the cash flow, the process becomes more than just inefficient—it’s a drain on productivity and morale. That’s where automation comes in. Setting up automated invoice payments inside the Sage Intacct ERP system helps remove repetitive steps, eliminate human error, and provide a clearer view of financial performance.

Sage Intacct payment processing was built for businesses that want smooth, integrated workflows. Whether managing vendor payments, recurring customer invoices, or high-volume transactions in healthcare, automation reduces the clutter and keeps data consistent across your entire financial system. With tools like Sage Intacct AP automation and Sage Intacct integration, payments can move directly from approval to posting without manual handoffs that often cause delays.

Understanding Automated Payments in Sage Intacct

At its core, automated invoice payments are about removing unnecessary friction. In Sage Intacct ERP, every transaction connects seamlessly between accounts payable (AP), accounts receivable (AR), and your general ledger. When a payment is made, Sage Intacct integration ensures it syncs instantly across systems. No waiting for batch uploads or reconciliation later.

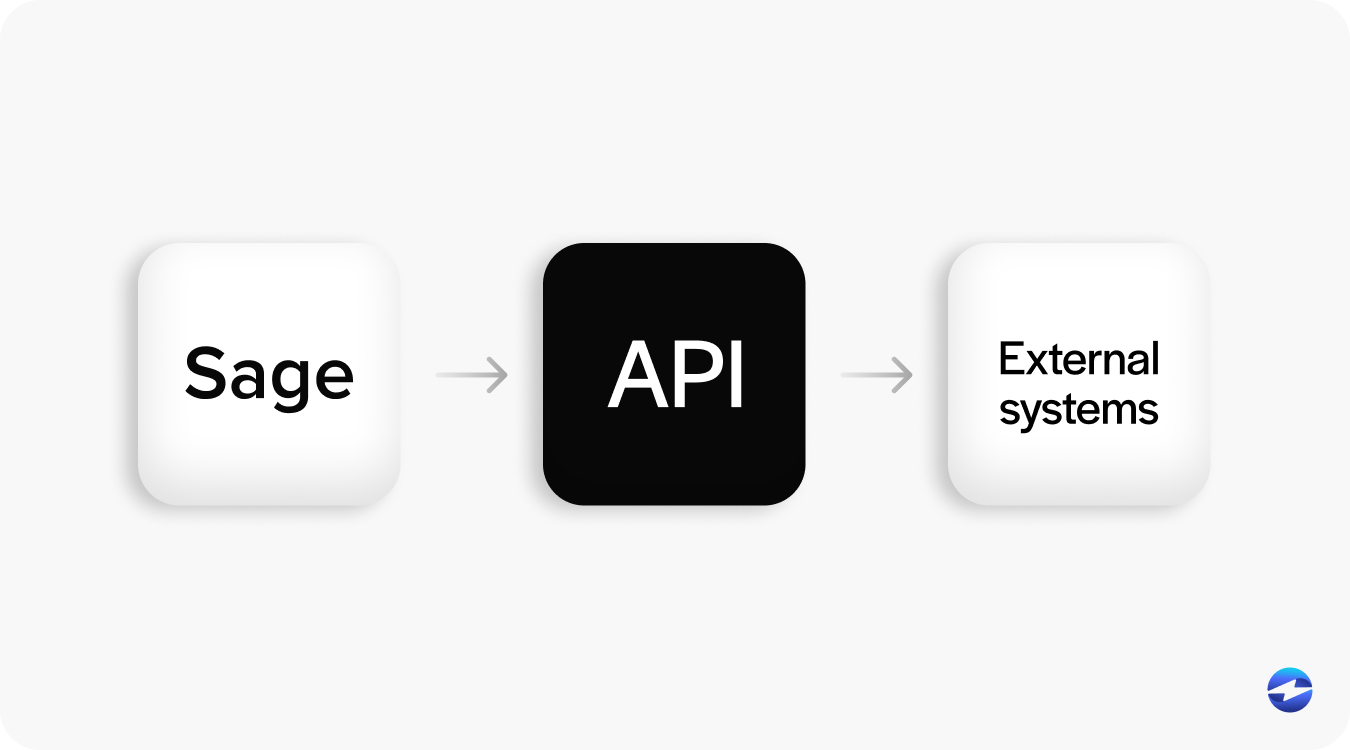

The Sage Intacct API plays a major role in this process. Through Sage Intacct API integration, you can connect your preferred payment processor, gateway, or third-party application to create a fully automated loop. Once a payment is initiated—whether it’s a customer paying by credit card or a recurring ACH transaction—the system handles posting, reconciliation, and reporting in real time. For finance teams, this level of automation means fewer late payments, faster cash application, and more accurate records.

Step-by-Step: Setting Up Automated Invoice Payments in Sage Intacct

Step 1: Configure Your Payment Gateway

Every automated payment setup begins with connecting your payment processor. Through Sage Intacct integration, you can link gateways that support both credit card and ACH payments. It’s important to verify that your provider follows PCI compliance standards and uses tokenization to protect sensitive data. Once your credentials are confirmed, the Sage Intacct API ensures that payment data moves securely between your processor and ERP system.

Step 2: Set Up Invoice Templates and Recurring Billing

Automation depends on consistency. Within Sage Intacct AP automation, you can design invoice templates, define recurring billing rules, and schedule when invoices are automatically generated and sent. For businesses that bill monthly or handle subscription services, these recurring setups eliminate hours of manual entry and follow-up.

Step 3: Enable Automatic Payment Capture and Posting

After billing rules are in place, you can turn on automatic payment capture. Sage Intacct payment processing tools record these payments instantly in accounts receivable. Whether you’re processing credit cards in Sage Intacct or accepting bank transfers, this setup ensures that every payment is logged correctly. The Sage Intacct API integration also supports triggers—automated actions that post payments once certain conditions are met, like a received invoice or approved batch.

Step 4: Reconcile Automatically

Once transactions are processed, reconciliation happens automatically. Payments are matched to invoices and reflected in your ledgers in real time. This is one of the biggest advantages of Sage Intacct ERP—its ability to unify payment data across modules, removing the need for separate spreadsheets or manual matching.

Processing Credit Cards in Sage Intacct

Credit card payments are one of the most common and complex parts of payment processing. Sage Intacct credit card processing simplifies this by integrating secure gateways that handle authorization, settlement, and reconciliation within the same environment. Tokenization keeps customer data safe by replacing card numbers with secure tokens, while fraud prevention tools flag suspicious activity before it causes chargebacks.

For teams accustomed to legacy setups like manual entry or Sage 100-style workflows, this represents a major upgrade. With Sage Intacct ERP and API-based automation, credit card transactions flow directly into the accounting system, reducing errors and speeding up month-end close. The result is faster collections, fewer disputes, and greater confidence in every payment record.

Healthcare Payment Processing with Sage Intacct

The healthcare industry faces some of the most complex billing challenges—high transaction volumes, recurring payments, insurance adjustments, and regulatory compliance. Sage Intacct healthcare solutions are designed to simplify those pain points. Automation ensures that patient invoices, recurring payments, and insurance reimbursements are processed consistently and posted automatically.

Using Sage Intacct payment processing tools, healthcare organizations can track every dollar across multiple entities and departments. Automation also minimizes billing delays, helping organizations maintain healthy cash flow and reduce administrative workload. When combined with a reliable payment processing solution, Sage Intacct healthcare users can scale without losing control over compliance or accuracy.

Best Practices for Maintaining Automated Workflows

Even the best setups need occasional fine-tuning. Here are a few ways to keep your automated payments running efficiently:

- Schedule routine audits to ensure your Sage Intacct API connections remain active and secure.

- Use dashboards to monitor real-time payment performance, failed transactions, and reconciliation status.

- Update credentials and API tokens periodically to maintain compliance and security.

- Leverage Sage Intacct AP reports to identify inefficiencies or bottlenecks early.

By staying proactive, your team ensures automation continues working for you, not against you.

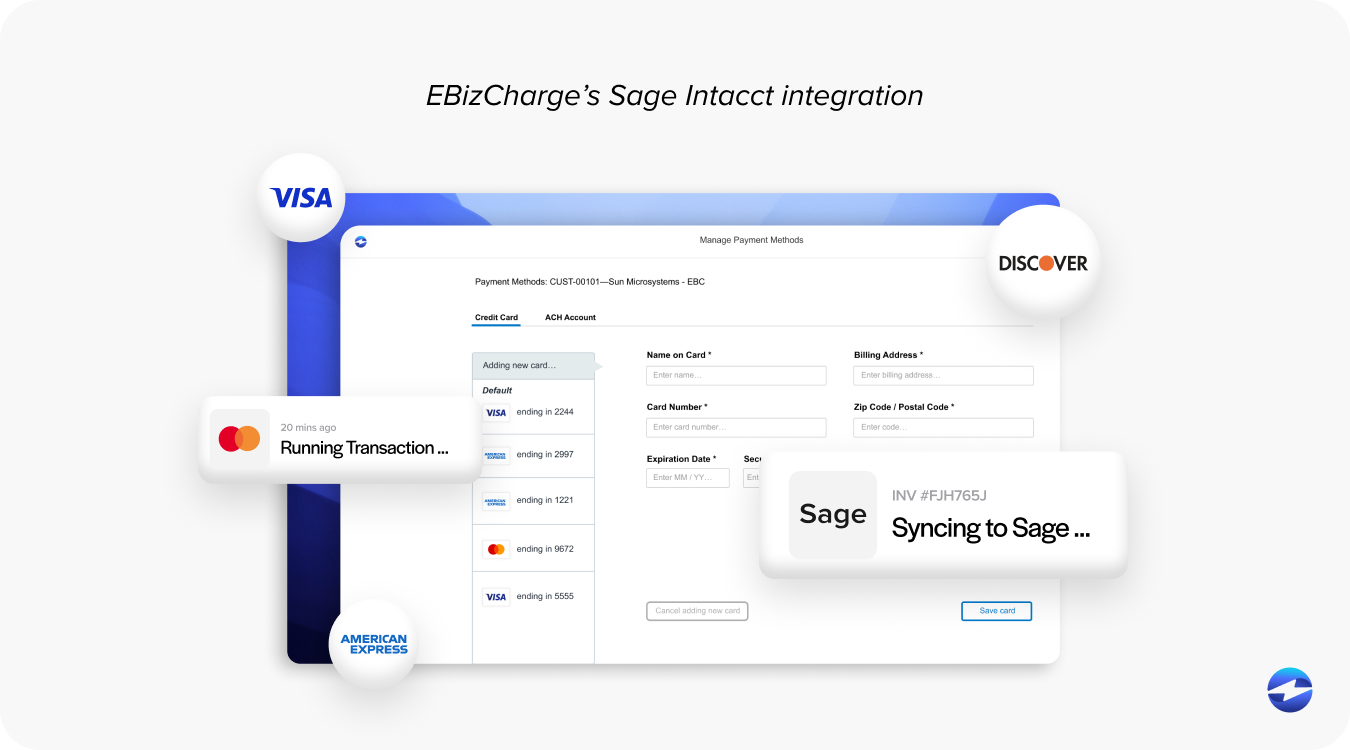

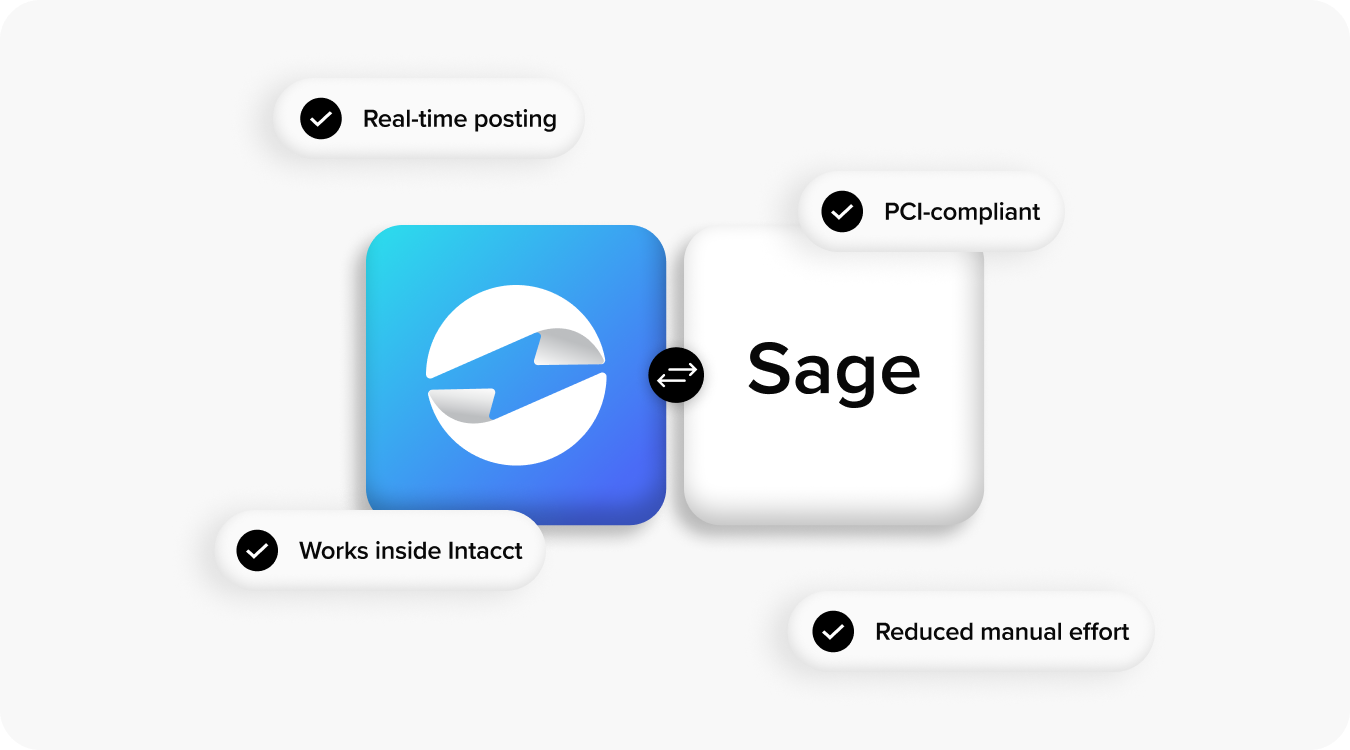

Why EBizCharge Is a Great Fit for Sage Intacct

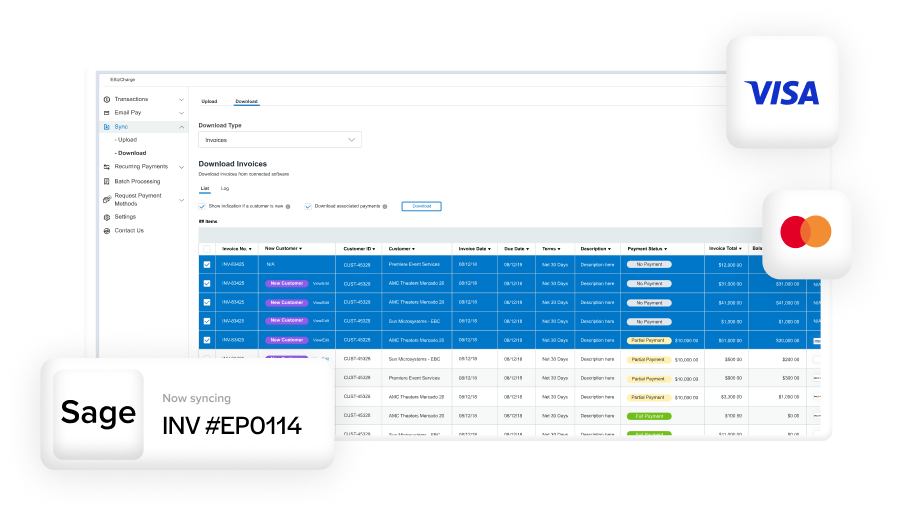

Among the many payment processors that integrate with Sage, EBizCharge stands out for its seamless automation and cost-saving features. As a native integration within Sage Intacct ERP, EBizCharge connects payments directly to invoices and ledgers in real time. That means no manual entry, no duplicate data, and no separate reconciliation tools.

EBizCharge’s automation features—like recurring billing, scheduled collections, and automatic payment retries—are built specifically for Sage Intacct payment processing. Its tokenization and interchange optimization not only improve security but also help lower overall processing fees. With Sage Intacct API integration, EBizCharge enables instant data syncing and real-time reporting, giving finance teams full visibility into every transaction.

For organizations managing large transaction volumes or complex workflows, this combination of automation and transparency makes EBizCharge an ideal payment processing solution. It simplifies day-to-day operations and ensures that your Sage Intacct AP automation runs efficiently from start to finish.

Building a Smarter Payment Workflow

Automating invoice payments in Sage Intacct isn’t just about convenience—it’s about building a system that works smarter over time. With the right integration and the right payment processor, businesses can eliminate unnecessary steps, cut processing costs, and free their teams to focus on higher-value work.

Sage Intacct ERP provides the foundation. The Sage Intacct API and integration capabilities make it adaptable. And when paired with tools like EBizCharge, it becomes a full-scale automation engine capable of handling payments, reconciliation, and reporting in one seamless loop.

For finance professionals looking to save time, reduce costs, and gain better control over cash flow, setting up automated invoice payments is one of the most valuable upgrades you can make within Sage Intacct.

- Understanding Automated Payments in Sage Intacct

- Step-by-Step: Setting Up Automated Invoice Payments in Sage Intacct

- Processing Credit Cards in Sage Intacct

- Healthcare Payment Processing with Sage Intacct

- Best Practices for Maintaining Automated Workflows

- Why EBizCharge Is a Great Fit for Sage Intacct

- Building a Smarter Payment Workflow