Blog > Optimizing Customer Payment Terms in NetSuite

Optimizing Customer Payment Terms in NetSuite

Getting paid on time shouldn’t be a guessing game. If you’re running your business in NetSuite, you already have the tools to manage customer payment terms—but how you use them can make a big difference. Whether you’re trying to speed up cash flow or just bring more consistency to your invoicing process, optimizing NetSuite payment terms is one of the most overlooked levers in improving financial health.

This article is for finance teams, NetSuite admins, and operations folks who want to get more out of their enterprise resource planning (ERP). We’ll walk through how NetSuite handles payment terms, how to analyze and adjust them, and how to support better results through automation, reporting, and the right payment processing solution.

Understanding Payment Terms in NetSuite

Before you can optimize anything, you need to understand how NetSuite payment terms work under the hood.

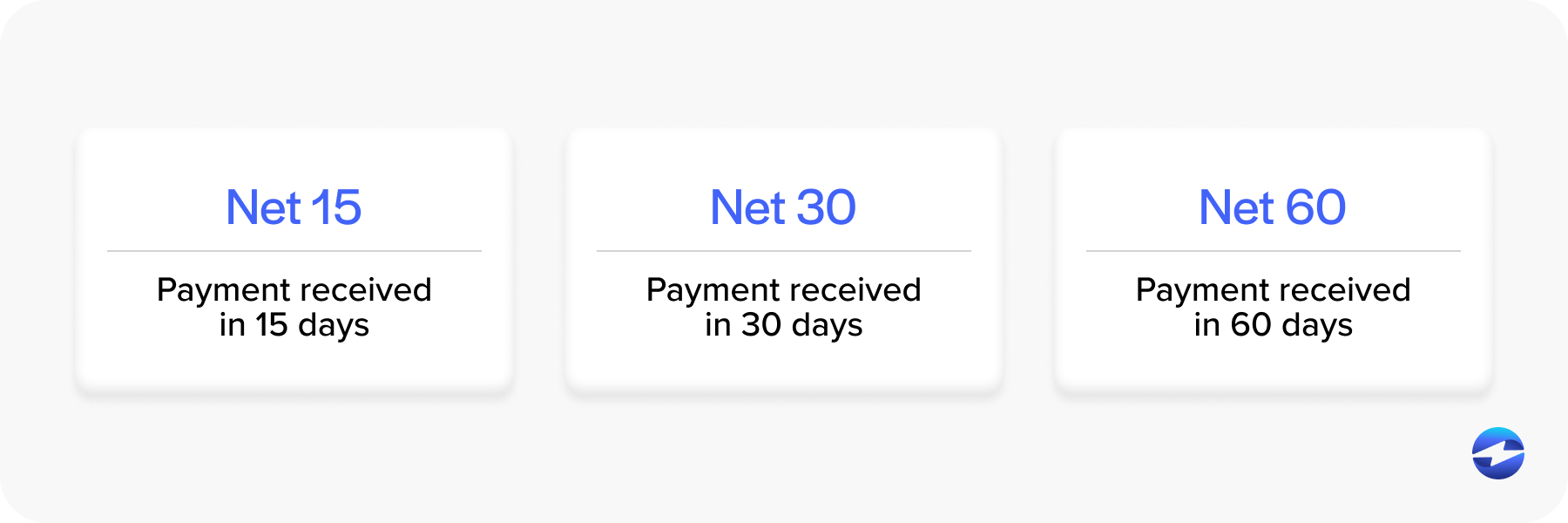

In NetSuite, payment terms define when a customer is expected to pay an invoice. Common examples include Net 30 (payment due 30 days after the invoice date), Due on Receipt, or even custom terms like 2% 10 Net 30 (which offers an early payment discount).

You can assign payment terms at the customer record level, and NetSuite billing software will automatically apply them when you create new invoices. Terms can also be manually selected or overridden during invoicing if needed. It’s all about setting expectations and giving your billing process a consistent structure.

The Impact of Payment Terms on Cash Flow

Payment terms aren’t just administrative details—they directly affect how long it takes to turn sales into cash. If your terms are too loose, you might be unintentionally funding your customers’ operations. If they’re too tight, you might be straining relationships or creating friction that slows down collections.

The difference between Net 15 and Net 60 might not sound like much, but it adds up quickly across dozens—or hundreds—of invoices. That’s why regularly reviewing your NetSuite payment terms can help keep your Days Sales Outstanding (DSO) in check.

NetSuite billing is most effective when it supports real-world customer behavior. Finding that balance between flexibility and discipline is key to optimizing your cash flow.

How to Review and Adjust Payment Terms in NetSuite

If you’re not sure where to start, begin with a report. Use NetSuite’s built-in AR Aging and customer balance reports to see which customers are consistently late or which terms are underperforming.

Look for patterns. Are wholesale clients paying slower than retail? Are certain geographies more reliable? Is one-off leniency creating long-term issues?

From there, you can make informed changes. Go into customer records and update the payment terms directly. If you use transaction templates or recurring billing, make sure those are updated too. NetSuite billing software will apply the new terms automatically moving forward.

Automating Payment Terms Based on Customer Profiles

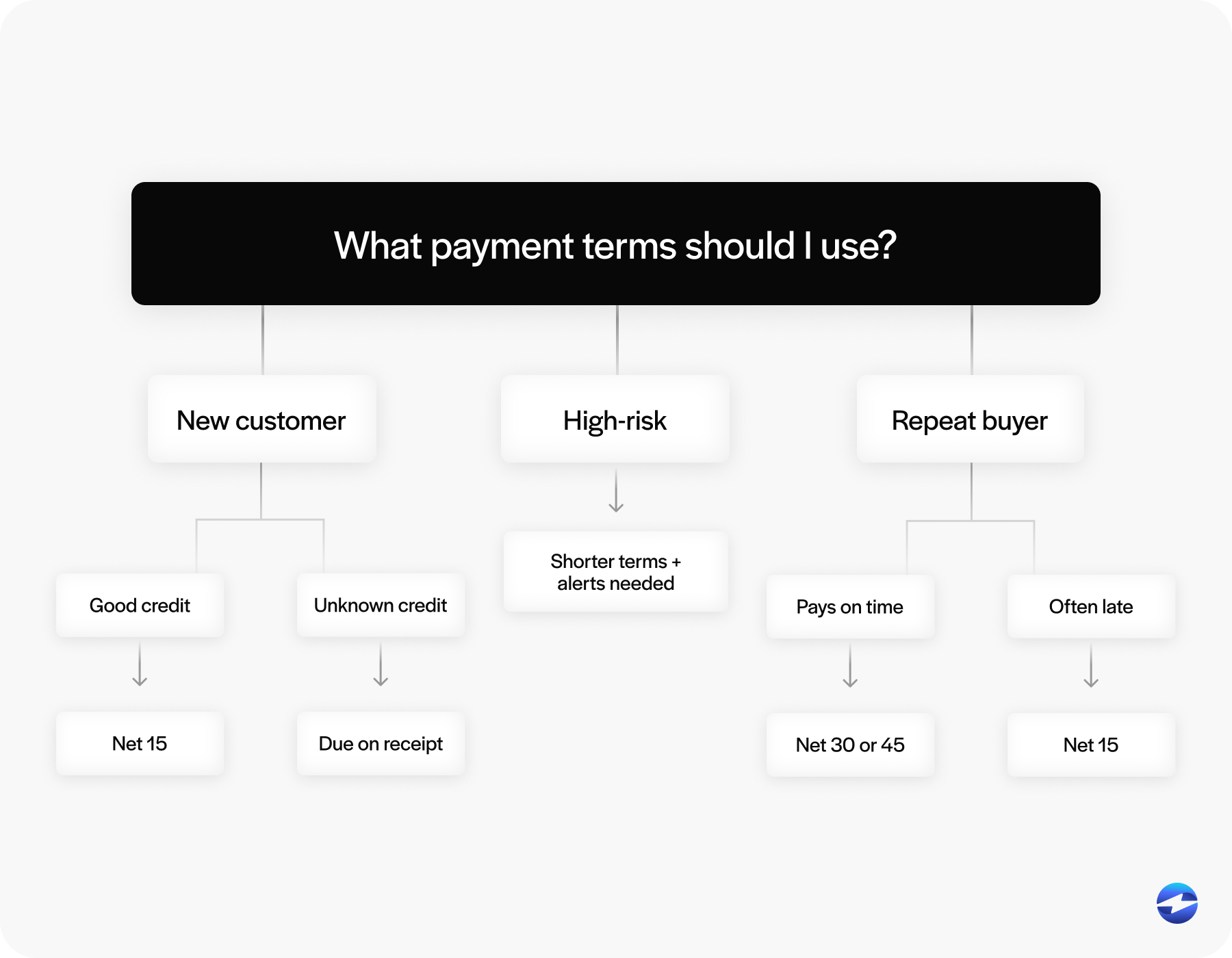

You don’t have to manage payment terms manually. NetSuite integration tools like SuiteFlow allow you to automate term assignments based on rules you define.

For example, you could:

- Assign Net 15 to new customers with a good credit score

- Use Net 30 for accounts with moderate activity

- Flag and escalate accounts that require shorter terms due to late payment history

Saved searches and custom scripting can help you segment customers based on order volume, payment behavior, or risk profile. A thoughtful automation setup saves time and helps you apply terms consistently across your customer base.

Best Practices for Managing Customer Terms

Optimizing NetSuite payment terms isn’t a one-and-done project. It should be part of your broader AR strategy. Here are some practical tips:

- Review terms during monthly AR meetings to spot issues before they grow.

- Align terms with business goals. Shorter terms might boost cash flow, but longer terms could support customer retention.

- Document and communicate changes, especially if you’re adjusting terms for longtime customers.

- Coordinate with your sales team to make sure everyone understands and reinforces term expectations.

When your NetSuite billing policies are aligned across teams, it’s easier to avoid misunderstandings and enforce consistency.

NetSuite Tools and Reports for Monitoring Terms Effectiveness

NetSuite payment processing gives you the reporting power to back up your decisions. Use dashboards, aging reports, and custom key performance indicators (KPIs) to track how your payment terms are performing.

Some ideas:

- Set up alerts for invoices past due by 15+ days

- Monitor DSO trends by customer segment

- Use saved searches to highlight accounts that regularly exceed terms

The more visibility you have, the better decisions you can make. NetSuite billing software is built to support this kind of proactive AR management—it’s just a matter of taking advantage of the tools.

Integrating Payment Solutions to Support Payment Terms

Optimizing NetSuite payment terms is even more effective when you make it easy for customers to pay. That’s where integrated payment processing solutions come in.

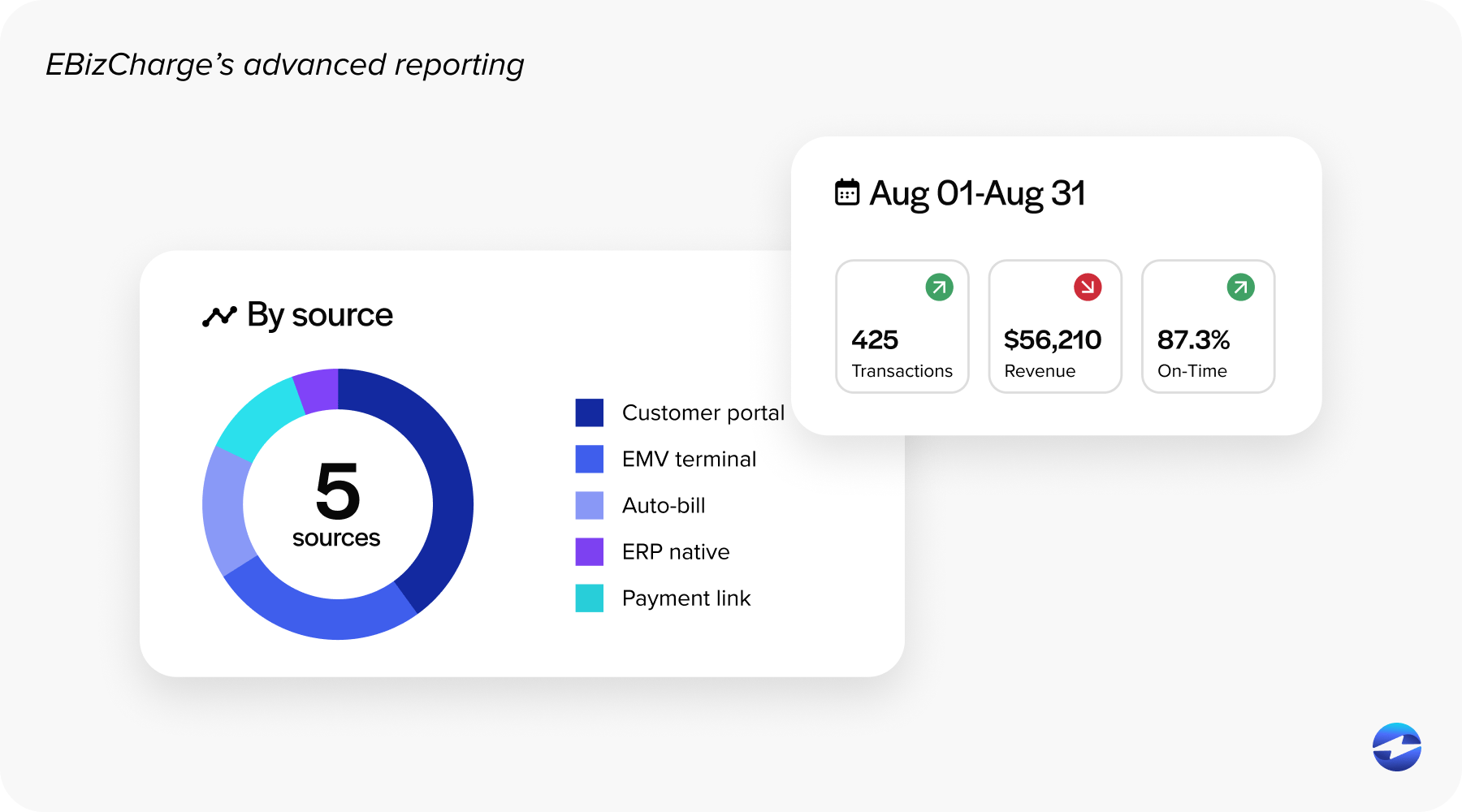

A good third-party integration—like EBizCharge for NetSuite—lets you embed payment links directly into invoices, offer customer portals, and accept various payment methods. When you remove friction, payments come in faster.

These integrations also support NetSuite credit card processing, so you can accept and apply payments without leaving the system. That reduces manual entry, speeds up reconciliation, and improves accuracy.

When your payment processor works seamlessly with NetSuite, your payment terms are more likely to be followed, and your AR team has fewer headaches.

Optimizing payment terms in NetSuite with EBizCharge

Optimizing payment terms in NetSuite isn’t just about assigning due dates; it’s about making those terms easy to follow. That’s where EBizCharge comes in. As a fully embedded third-party integration, EBizCharge enhances NetSuite billing workflows by making it easier for customers to pay and easier for your team to manage collections.

EBizCharge supports NetSuite credit card processing directly within the platform, allowing you to include secure payment links in invoices and customer portals. That means fewer excuses for delayed payments and faster reconciliation for your AR team. The payment processing solution also automates receipt delivery and updates customer balances in real time, making NetSuite payment terms more actionable and effective.

By reducing manual steps and creating a seamless flow between invoicing and collections, EBizCharge helps ensure your payment terms aren’t just set, but respected. When you combine thoughtful term management with a strong NetSuite integration, you turn billing from a reactive process into a strategic advantage.

- Understanding Payment Terms in NetSuite

- The Impact of Payment Terms on Cash Flow

- How to Review and Adjust Payment Terms in NetSuite

- Automating Payment Terms Based on Customer Profiles

- Best Practices for Managing Customer Terms

- NetSuite Tools and Reports for Monitoring Terms Effectiveness

- Integrating Payment Solutions to Support Payment Terms

- Optimizing payment terms in NetSuite with EBizCharge