Blog > How Businesses Can Master Payment Terms to Improve Customer Payments

How Businesses Can Master Payment Terms to Improve Customer Payments

Whether you’re a seasoned entrepreneur or a budding business owner, understanding and mastering payment terms is essential in optimizing financial operations and encouraging growth.

What are payment terms?

Payment terms, or contract payment terms, are the specific conditions the buyer and seller agree upon regarding when the payment for goods or services is to be made.

Payment terms serve as a formal arrangement that governs the payment obligations for both parties. These terms ensure that the business owner and the customer clearly understand the payment expectations, thus playing a pivotal role in the success of your transactions and financial health.

Standard payment terms are a subset of industry-specific payment terms, setting a baseline for payment expectations for a particular industry. They include widely recognized conditions such as Net 30 or cash on delivery (COD), helping to streamline the payment process and maintain consistency throughout business transactions.

Understanding advanced payment terms and conditions

Advanced payment terms require customers to make a payment, a deposit or in full, on an invoice prior to receiving products and services.

Advanced payments are common in situations when a transaction needs to be secured, such as custom-made or high-value items or for new or unknown customers. These terms can also be part of contractual agreements or industry standards.

When outlining advanced payment options, businesses should include the estimated product or service delivery timeline, protocols for delivery discrepancies such as non-delivery, and payment progress updates, if applicable.

Now that you have a general understanding of payment terms, you can explore the different categories of contract payment terms included on invoices.

How payment terms relate to invoices

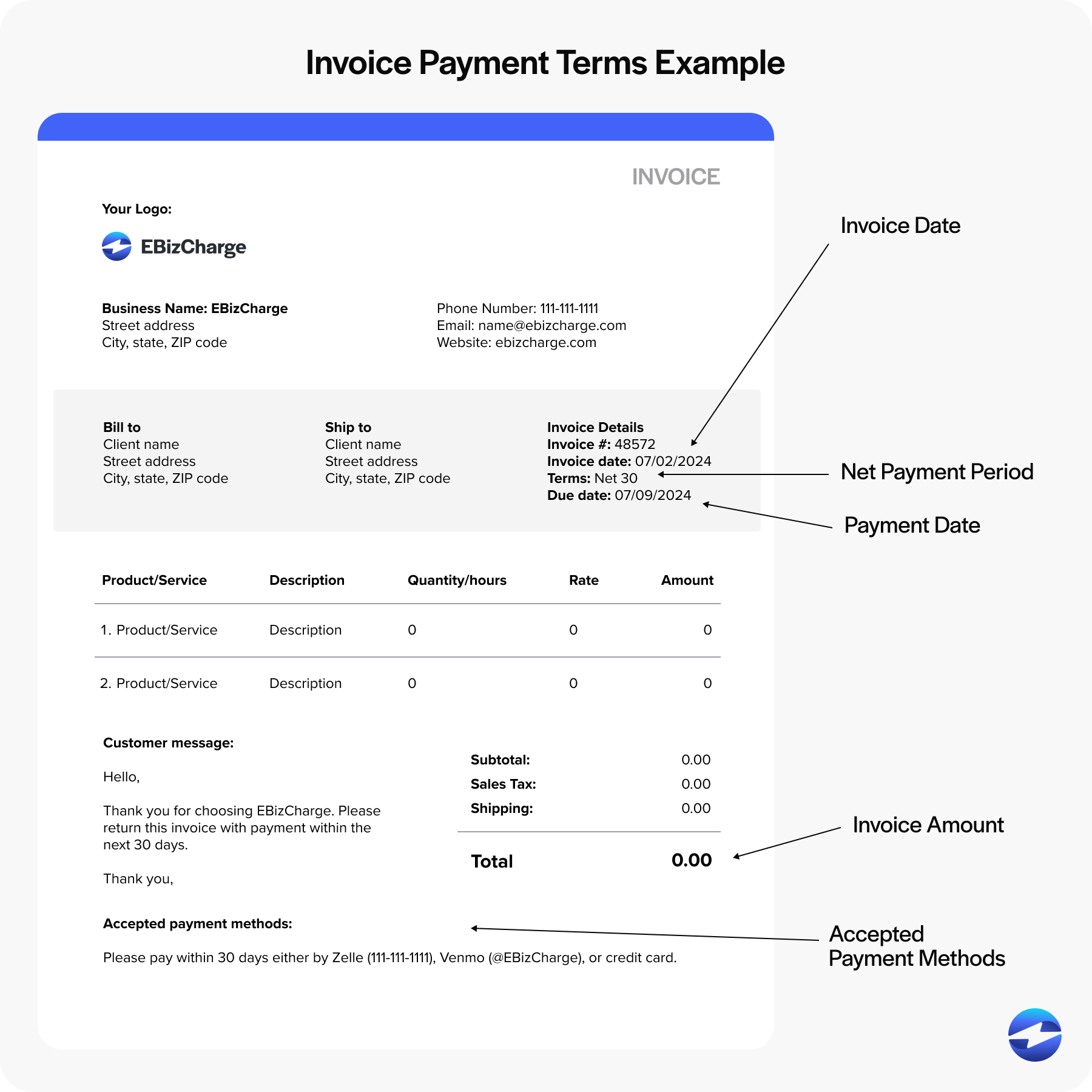

Payment terms are often found in the initial contract with customers and printed on each invoice to communicate when payment(s) are due, payment amounts, and late payment policies/fines.

To ensure these terms are met, businesses should include the following information when creating invoices:

- Invoice date

- Payment date

- Invoice amount

- Net payment period

- Accepted payment methods

- Guidelines for advanced payments or deposits

- Payment plan details

Businesses can also include other standard payment terms on these contracts or invoices.

Example of how payment terms are listed on an invoice

Here’s an example of an invoice for you to see what payment terms are listed to customers when viewing:

20 common invoice payment terms

While the various invoice payment terms may initially seem overwhelming, businesses can use them to facilitate successful transactions and enhance customer trust.

To help you get started, here are 20 common payment terms to familiarize yourself with:

- Net 30: Payment is due within 30 days of the invoice date.

- Net 60: Payment is due within 60 days of the invoice date.

- Net 90: Payment is due within 90 days of the invoice date.

- One-month date (1MD): 1MD tells the recipient that the full payment for a month’s supply of products or services is due within one month (or 30 days) from the date the invoice is issued.

- 21 MFI: 21MFI tells the recipient that the payment is due on the 21st day of the month after the invoice date.

- Accumulation discount: An accumulation discount can incentivize customers to make large or repeated purchases over a specified period.

- Due on receipt (DOR): DOR indicates the payment is due without delay, typically 24 hours after the invoice is delivered or made accessible to the client.

- Cash on delivery (COD): COD means the payment is due at the time of delivery rather than in advance.

- Cash in advance (CIA): CIA is a requirement for the buyer to pay the seller before the goods and services are delivered. It’s often used in international trade to minimize the risk of non-payment after the seller has shipped the goods.

- Cash before shipment (CBS): CBS ensures financial security before dispatching goods or services to the customer. It requires the buyer to pay the total amount upfront as a condition for the order to be processed and shipped.

- Payment in advance (PIA): PIA indicates that a payment is required before the delivery of goods and services. The timeline for these payments varies depending on the terms negotiated between the buyer and seller.

- Payment on account: Payment on account refers to a partial payment toward the total amount owed by the buyer to the seller.

- Installment payments: Installment payments refer to a billing arrangement allowing for a total sum to be paid incrementally over time.

- Partial payment discount: Partial payment discounts encourage customers to make payments for faster outstanding invoice settlements.

- Progress payments: Progress payments allow clients to pay for goods or services in multiple installments at different project stages. Unlike installment payments, which are divided into equal payments, progress payments can differ in price depending on which stage of the project has been completed.

- Retention: A financial term often used in contracts that pertains to a portion of the payment held back as a form of security to ensure all obligations are met.

- Open account: An open account refers to a transaction where the buyer can access the purchased goods and/or services before payment is due.

- Trade credit: Trade credit represents an agreement between businesses where the buyer can purchase goods or services on account and pay the supplier at a later scheduled date.

- Prompt payment: Prompt payment refers to settling a financial obligation on time as specified by the terms in the invoice.

- Rebate: A rebate indicates a discount or reduction in the amount owed by the buyer to the seller.

It’s also beneficial to familiarize yourself with standard payment terms across different industries.

Standard payment terms across industries

Standard payment terms can vary significantly across industries, reflecting the unique financial transactions and operational requirements that characterize different sectors.

Here’s a list of common industry-standard payment terms:

| Industry | Average DSO |

|---|---|

| Agriculture | Immediate – 3 days |

| Auto Repair | 30 – 90 days |

| Cleaning | Immediate – 14 days |

| Construction | 30 – 90 days |

| Finance | 30 days |

| Food and Beverage | Immediate – 3 days |

| Insurance | Immediate |

| IT | 30 days |

| Marketing | 30 days |

| Manufacturing | 30 – 60 days |

| Medical Supplies | Immediate – 30 days |

| Landscaping | Immediate – 7 days |

| Professional Services | 14 – 75 days |

| Retail | 3 – 7 days |

| Renewables and Environment | 30 – 60 days |

| Transportation | 30 – 120 days |

Understanding industry-standard payment terms will help you better structure your internal terms to meet payment obligations and satisfy your customers.

Before deciding which of these common invoice payment terms to implement in your invoices, your business should evaluate factors like internal operations, industry standards, and customer expectations.

5 factors to consider when choosing payment terms

When determining payment terms, businesses must consider several factors to safeguard their finances and encourage healthy revenue.

Here are five components to assess before choosing your payment terms:

- Cash flow management: Strong cash flow is the lifeblood of a business, enabling it to meet financial obligations such as payroll and supplier invoices. Shorter payment terms can improve cash flow by ensuring timely payments and reducing the gap between expenditure and income.

- Customer relationships: Payment terms can nurture customer satisfaction and loyalty. Extending terms can offer more customer convenience, but your business’s needs still need to be met to avoid late payments, which can strain client relations.

- Industry standards: Best industry practices can significantly influence payment expectations. Therefore, enforcing common payment terms (Net 30, Net 60, etc.) can help your business remain competitive and set predictable standards for its customers.

- Risk management: Longer payment terms can expose a business to higher credit risk. Assessing the clients’ credit history and setting fair terms can mitigate the risk of overdue payments and financial strain.

- Multiple payment methods: Offering various payment methods (credit cards, eChecks, online payments, etc.) can accelerate invoices and cater to customer preferences for more seamless payment collections and fewer late payments.

Now that you know what to consider when choosing payment terms, you should also know how to deal with unpaid invoices.

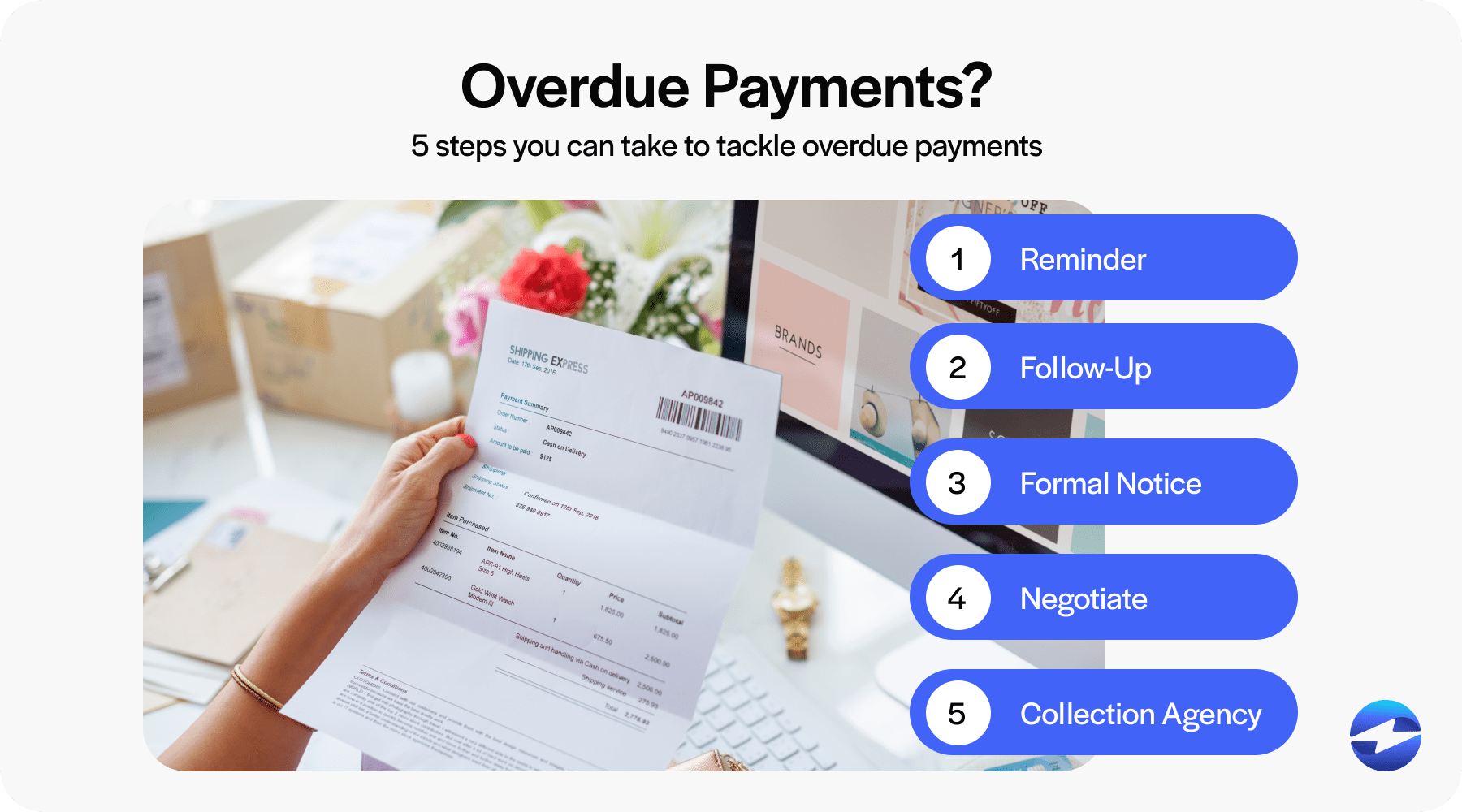

How to manage unpaid invoices

To efficiently manage unpaid invoices, businesses can implement a strategic approach to avoid jeopardizing important relationships while protecting financial commitments.

First, it’s essential to use a standardized follow-up procedure. Initial reminders should be courteous and reinforce the importance of maintaining a healthy business relationship. They can be in the form of an email or phone call. Subsequent reminders should be more formal and frequent if the invoice remains outstanding.

Keeping detailed records of all communication efforts and staying vigilant about invoice due dates is crucial. This ensures you can track the invoice’s history if the issue escalates. Sometimes, offering a small payment discount for immediate settlement can incentivize prompt payment without significantly impacting your profit margins.

Here’s an efficient step-by-step strategy to tackle overdue payments:

- Reminder: Send a polite reminder immediately after the payment due date has passed.

- Follow-up: Engage in a direct conversation or send a more assertive reminder within a week.

- Formal notice: Issue a formal notice or a demand letter outlining the consequences of continued non-payment.

- Negotiate: Offer a payment plan or a discount for prompt settlement.

- Collection agency: As a last resort, consider hiring a collection agency or seeking legal action to recover the debt.

Another option is to implement late fees.

Understanding late fees

Implementing late fees can serve as a deterrent to late payments, but it’s crucial to do so thoughtfully and transparently to maintain customer satisfaction.

Late fees should be clearly stated in your payment terms and conditions. This ensures customers know the extra costs associated with missing a payment.

The fees themselves should be reasonable and comply with any applicable industry standards and legal regulations. Often, a flat fee or a small percentage of the total invoice amount is deemed acceptable.

Regardless of how you structure these fees, it’s essential to communicate your late fee policy upon issuing invoices and again as soon as payments become overdue. You can also negotiate payment terms to deter unpaid invoices altogether.

Negotiating the best payment terms

Since efficient cash flow management hinges on securing prompt payments, businesses should explore different options to negotiate the best payment terms for their customers.

To incentivize timely settlements and expedite invoices, consider implementing modest discounts for early payments or offering preferred payment methods for clients that use ACH transactions over traditional checks or credit cards.

You can also extend a line of credit for long-time customers to foster loyalty and facilitate larger transactions. This can bolster client relationships but, if not used cautiously, can hinder cash flow.

If your business customizes its payment terms, verifying that your accounting or ERP system can support this initiative is essential. Therefore, investing in accounts receivable (AR) automation for invoice management and credit tracking is indispensable.

Automating AR processes can enhance efficiency and ensure a seamless customer experience, fostering faster payments and stronger relationships.

In addition to implementing these strategies to negotiate the best terms, your company can apply a few more techniques to enhance its overall payment collection process.

6 best practices for establishing payment terms

Businesses can establish clear and favorable invoice payment terms and best practices to improve customer relationships, accountability, and efficiency.

Here are six best practices to consider:

- Assess customer profiles: Review customer payment patterns to set sufficient terms that encourage prompt payment and reduce the risk of outstanding invoices.

- Be transparent: Clearly state the payment obligations, including the due date and acceptable forms of payment, to avoid any confusion or mistrust.

- Offer incentives: Consider payment discounts for early settlements to incentivize timely payments.

- Implement penalties: Enforce and outline penalties to discourage unpaid invoices and ensure customers prioritize on-time payments.

- Align with industry standards: Stay updated on relevant industry payment standards to adjust your policies to remain competitive and fulfill customer demand.

- Choose the right payment term: Choosing the best payment terms requires businesses to assess their financial stability, understand customer payment preferences, review industry standards and competitors, and find the most suitable solution to encourage on-time payments while maintaining positive business relationships.

Businesses can also work with a reliable payment processor like EBizCharge to facilitate quick and efficient accounts receivable (AR) operations and speed up collection efforts.

Get paid faster with EBizCharge

EBizCharge simplifies the invoicing process by offering integrated payment processing and automated features that reduce days of sales outstanding (DSO) and expedite collection efforts. By integrating seamlessly with accounting and ERP systems, EBizCharge enables businesses to process payments directly within their invoicing software, eliminating manual data entry and reducing errors.

EBizCharge offers recurring billing for businesses to install billing schedules for customers to make routine, timely payments. With online payment portals, automatic payment reminders for overdue invoices, and more, EBizCharge can transform your payment collection process and aid your long-term success.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.