Blog > NetSuite Payment Gateway Management: Streamlining Your Integration Strategy

NetSuite Payment Gateway Management: Streamlining Your Integration Strategy

Managing payments within your ERP isn’t just about plugging in a tool and hoping it works. It takes thoughtful planning, clean execution, and the right mix of technology and people. For businesses running on NetSuite, payment gateway management is especially critical.

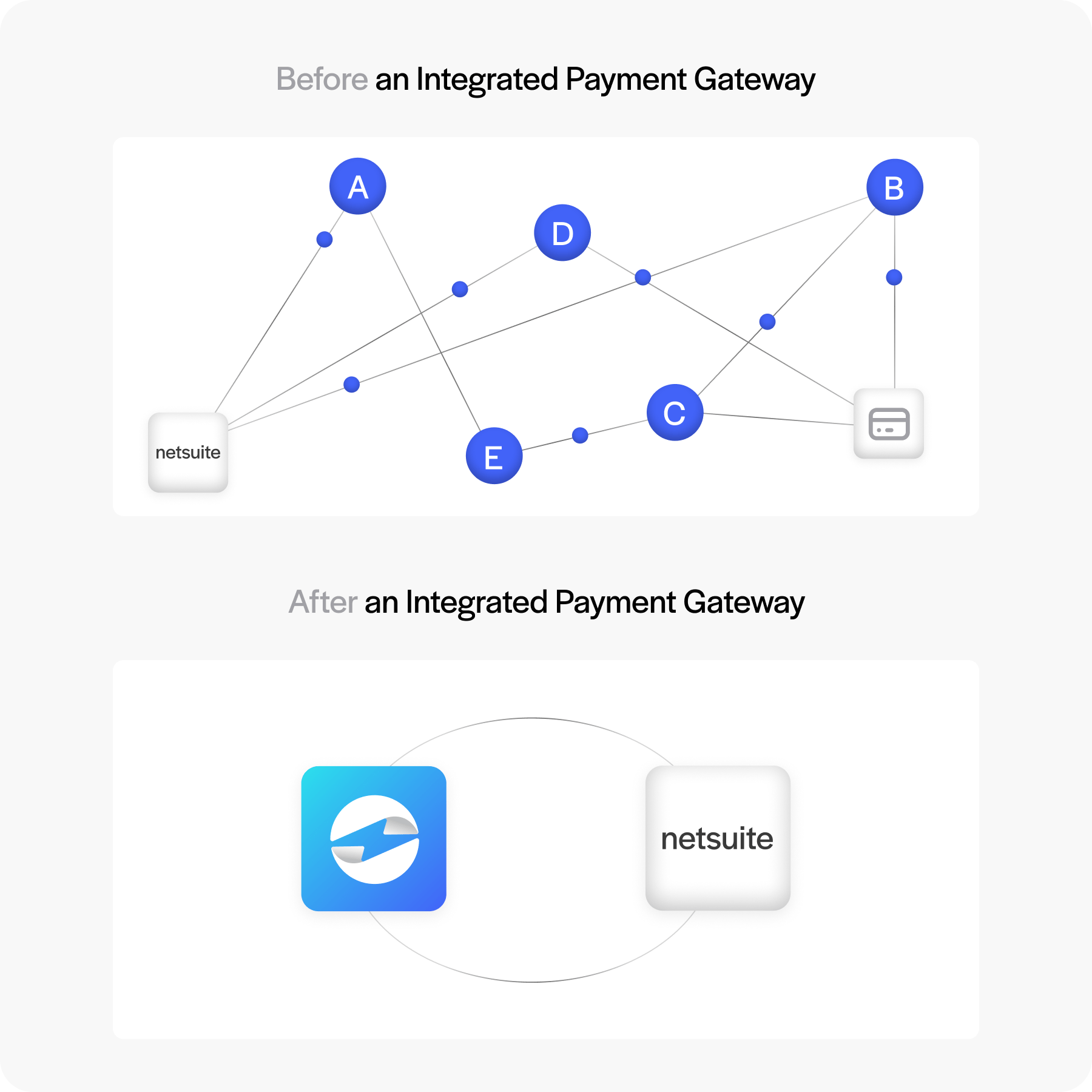

As a robust ERP, NetSuite brings finance, operations, and data together in one place. But when your payment processing lives outside of that ecosystem—or worse, across multiple disconnected systems—it can turn daily tasks into time-wasting messes. That’s why a streamlined approach to integrated payment gateway management in NetSuite can save time, reduce risk, and support growth without creating more administrative work.

Understanding NetSuite Payment Gateway Architecture

At its core, a payment gateway is the system that handles credit card or ACH transactions between your customers and your business. Inside NetSuite, this process needs to feel seamless—authorization, settlement, and reconciliation should happen without you having to think too hard about it.

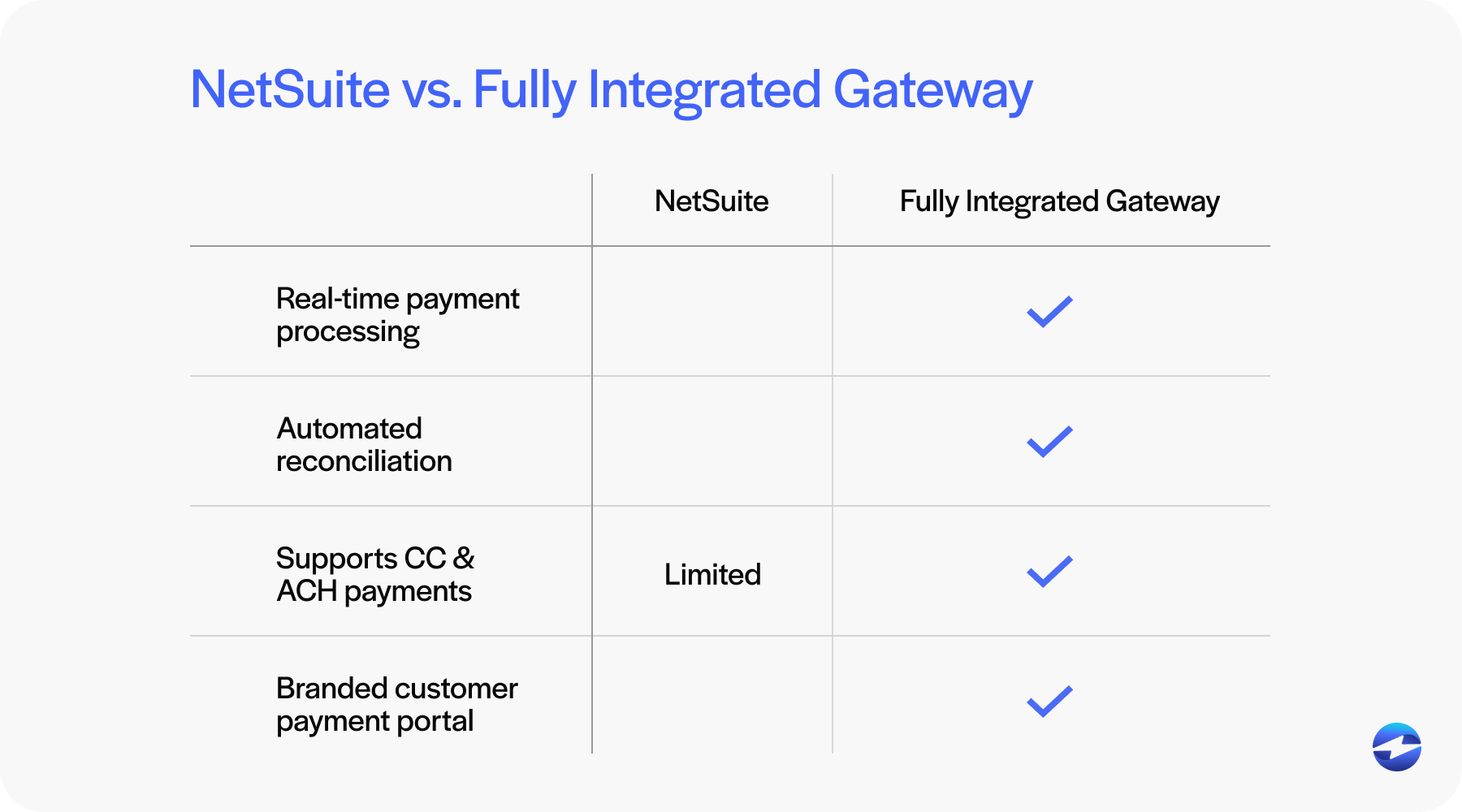

There are two ways to approach this: use NetSuite’s native capabilities or bring in a third-party integration. Each has pros and cons. Native solutions might offer quick setup but limited features. A third-party NetSuite payment gateway integrator, on the other hand, gives you more flexibility and tools tailored to your business.

A solid payment gateway management strategy in NetSuite includes more than just processing payments—it ensures your data is secure, your transactions are logged correctly, and everything reconciles without manual effort.

Why Gateway Management Matters for NetSuite Users

When payment systems don’t talk to each other, everything slows down. You end up reconciling spreadsheets manually, tracking down errors that shouldn’t have happened, or wondering why a customer payment didn’t post to their invoice.

This kind of fragmentation between billing, payments, and financial reporting is all too common. It’s frustrating and risky. You might have to chase down missing payments, fix compliance issues, or handle duplicate data.

With good payment gateway management in NetSuite, you get one system that pulls everything together. Transactions post automatically. Reports reflect real-time data. And your finance and operations teams stop wasting time fixing what shouldn’t be broken.

Evaluating Your Current Setup

Before you change anything, take stock of what you’ve already got. Are you using more than one payment gateway? Are your payments syncing with invoices and customer accounts? Are there gaps your team is constantly patching up?

Talk to the people doing the work every day. Finance will know where reconciliations get messy. Customer service can tell you if payments show up late. IT might be struggling with support tickets from failed integrations.

This step gives you the insight to identify what’s working and what needs improvement—and it lays the groundwork for choosing a better-fit solution.

Choosing the Right Payment Gateway for NetSuite

Now comes the part that really matters: picking the right tool.

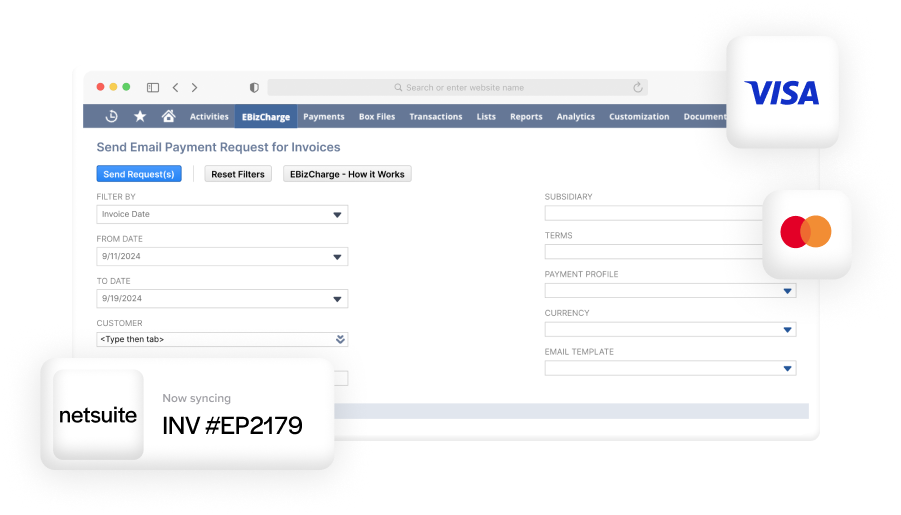

Look for a solution that offers a true NetSuite integration—not a workaround, but something that lives within the platform and plays well with your existing workflows. A good NetSuite payment gateway integrator will provide secure, payment card industry (PCI)-compliant infrastructure, while also offering features like tokenization, customer portals, and credit card and ACH support.

It’s not just about accepting payments. It’s about how those payments interact with your invoices, customer records, and reports. That’s where a payment processing solution like EBizCharge shines—by giving you a real-time, native experience that reduces the need for manual work and connects all the dots.

Integration Strategy: Best Practices

Once you’ve selected a payment gateway, a smooth integration strategy is key.

Start with a clear plan. Map out what the integration should look like. Set timelines. Choose a sandbox environment for testing so you don’t disrupt your live system.

Next, get roles and permissions right. Make sure users have secure access and can only see or do what they’re supposed to.

Automate what you can—things like invoice matching, payment posting, and error handling. Good payment processing is invisible. When it works, no one notices. That’s the goal.

And always sync your payment data with the rest of NetSuite: invoices, customer records, and general ledger accounts. This is where true payment gateway management in NetSuite pays off.

Benefits of Streamlined Payment Gateway Management

When everything is working together, reconciliation becomes a background task, not a monthly nightmare. Payments come in quicker, and they’re tied directly to the right accounts and records. Your teams have better visibility and fewer errors to clean up.

You also gain confidence in your compliance posture. With the right payment processor and integrated payment gateway setup, you can support PCI standards and avoid risky shortcuts.

Ultimately, you save time, reduce headaches, and build a smoother payment experience for your customers.

Simplifying Your NetSuite Payments Strategy with EBizCharge

EBizCharge offers a seamless NetSuite integration that simplifies payment gateway management from end to end. It embeds directly into NetSuite, allowing merchants to manage their entire payment processing workflow without leaving the ERP environment. That means no more juggling external systems or patching together third-party tools that weren’t built with your business in mind.

With EBizCharge, payments are automatically applied to invoices, reconciliations are simplified, and data stays in sync in real time. Merchants gain tools like customer-facing payment portals, tokenization for secure storage, and full support for credit card and ACH payments – all within a fully integrated payment gateway.

By managing your NetSuite payment gateway through EBizCharge, you reduce complexity, eliminate manual entry, and give your team more time to focus on what matters most: serving customers and driving growth.

- Understanding NetSuite Payment Gateway Architecture

- Why Gateway Management Matters for NetSuite Users

- Evaluating Your Current Setup

- Choosing the Right Payment Gateway for NetSuite

- Integration Strategy: Best Practices

- Benefits of Streamlined Payment Gateway Management

- Simplifying Your NetSuite Payments Strategy with EBizCharge