Blog > How to Set Up and Use a Virtual Terminal in Sage ERP

How to Set Up and Use a Virtual Terminal in Sage ERP

Processing payments within your ERP system should be simple, not a source of friction. If you’re using Sage ERP (whether Sage 100, Sage 300, or another version), the Sage virtual terminal offers a flexible, secure way to handle credit card and automated clearing house (ACH) payments without leaving your system. But setting it up can feel intimidating if you’ve never worked with integrated payment tools before.

This guide walks you through the entire process—from setup to everyday use—so you can take full advantage of the Sage payment virtual terminal. Whether you’re a controller, part of the AR team, or a business owner managing invoices yourself, this article is written with you in mind.

What Is a Virtual Terminal in Sage ERP?

Think of a virtual terminal as your payment processing hub that lives right in your web browser. Instead of needing a physical card reader or terminal sitting on your desk, you can manually key in and process payments entirely online. When this capability is built into Sage ERP, it means you’re handling payments without ever leaving your accounting system.

Your Sage virtual terminal can handle different payment methods: credit cards, ACH transfers, and more. What makes this particularly useful is that these payments link directly to the right customer accounts and invoices, so your records stay organized and accurate automatically.

Sure, convenience is nice, but the real value goes deeper than that. You’re eliminating the need to enter the same information twice, your reconciliation process becomes much faster, and your team can stay focused on one system instead of constantly switching between different tools and platforms.

What You’ll Need Before You Start

Before you jump into the setup, make sure you’ve got a few things in place:

1. A Compatible Sage ERP System

This guide applies to Sage 100, Sage 300, and other ERP systems that support integrated payments. You’ll want to confirm you’re on a version that allows Sage integration with payment processors.

2. Admin-Level Permissions

Whoever sets up the virtual terminal will need admin rights within Sage ERP. This includes access to module configuration, user permissions, and integrations.

3. A Payment Gateway Integration

To process payments through Sage’s virtual terminal, you’ll need to connect to a payment processor. EBizCharge is one of the most common options because it integrates directly with Sage and is designed specifically for ERP use cases.

Once that connection is live, the Sage payment virtual terminal becomes available for use within your accounting screens.

Step-by-Step: Setting Up the Virtual Terminal

Now it’s time to walk through how to set up the virtual terminal Sage features so it works seamlessly with your ERP environment. This process doesn’t require advanced tech skills, but it helps to go step by step.

Step 1: Log In to Sage ERP

Start by opening Sage ERP and signing in with an account that has administrative privileges. If you’re doing this for the first time, or if your Sage environment includes custom settings or workflows, it’s a good idea to run through the process in a test or sandbox environment first. This lets you experiment safely and avoid surprises in your live stream.

Step 2: Locate the Payment Module

Inside Sage, find the module that handles payments. This section may go by different names depending on your configuration. You might see labels like “Accounts Receivable,” “Payment Processing”, or even a module named after your integrated gateway, such as “EBizCharge.” Whichever label it uses, you’re looking for where customer payments are processed.

Step 3: Enable and Configure Virtual Terminal Settings

Once you’re in the right area, look for the virtual terminal settings. Enable the feature, then move on to customizing a few defaults that will help you tailor the system to your needs.

- What types of payments you’ll accept (credit cards, ACH, etc.)

- Your preferred currency and how funds should be settled.

- Whether you want transactions to post in real time or be batched for later approval.

These choices may vary based on how your team handles billing and reconciliation, so don’t be afraid to tweak them as you go.

Step 4: Set Permissions for Your Team

Next, decide who on your team should have access to the Sage virtual terminal. It’s important to be selective here – only give access to those who need it for their role. For example, someone in accounts receivable (AR) might need full access to process and apply payments, while others might only need view-only access for reports. This step is just as much about security as it is about functionality.

Step 5: Connect to Your Payment Gateway

Finally, it’s time to connect Sage to your payment processor. If you’re using EBizCharge, you’ll follow their instructions to enter gateway credentials, configure application programming interface (API) access, and complete the connection between Sage and the gateway.

Once the integration is in place, don’t skip the final step: run a test transaction. This helps confirm that everything – from authentication to transaction posting – is working smoothly. If the test processes correctly, you’re ready to go live and start using the Sage payment virtual terminal in your day-to-day operations.

How to Use the Virtual Terminal

With everything configured, you can start using the terminal for real transactions.

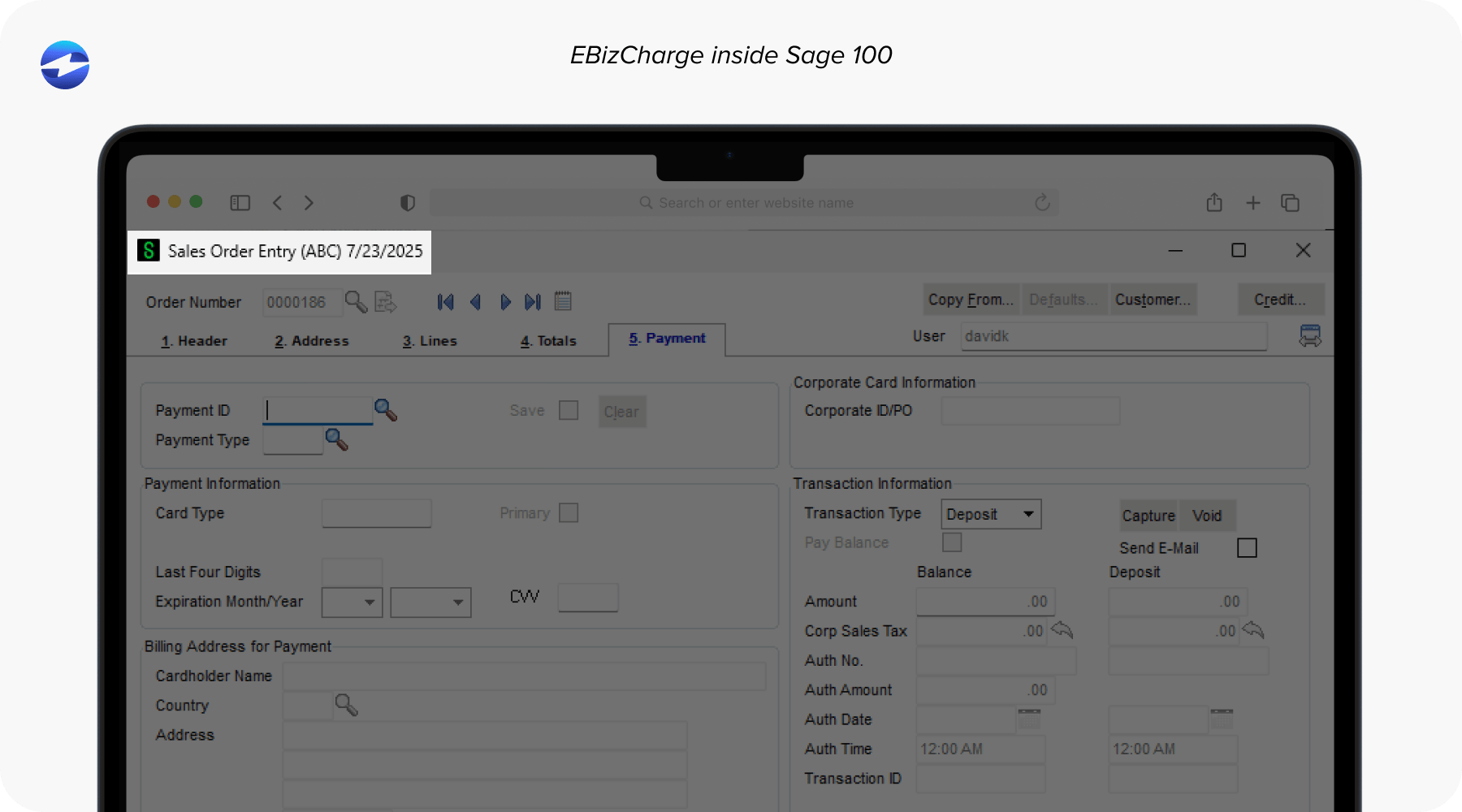

Processing a Payment

To process a payment:

- Open the customer record or invoice you want to apply a payment to.

- Click the option to accept payment (look for “Pay Now,” “Accept Payment,” or a virtual terminal button).

- Enter the payment details manually—this could be a credit card number or bank routing and account info.

- Submit the transaction.

The Sage payment virtual terminal will automatically record the payment, update the customer’s balance, and—if configured—send a receipt.

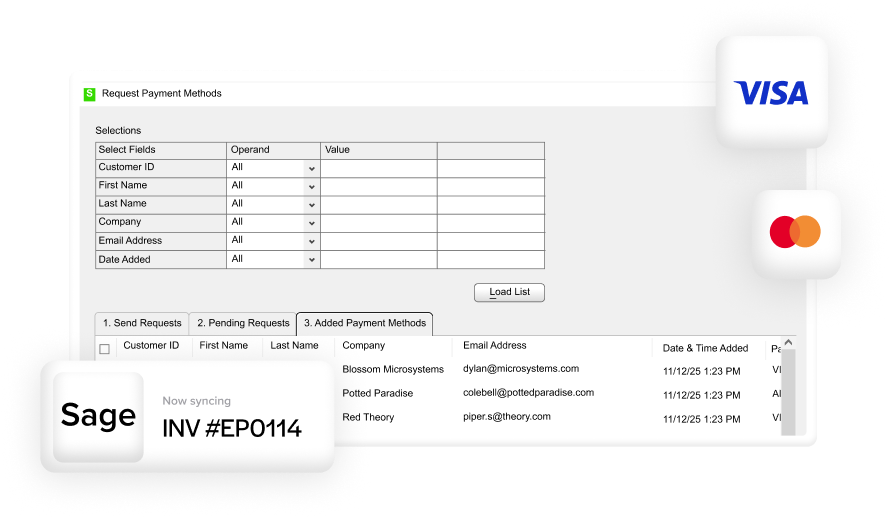

Saving Customer Payment Methods

You can securely store payment methods using tokenization, which means the full card or bank info isn’t actually stored in your system. This makes future payments easier and faster, especially for recurring customers.

If you’re using a payment processing solution like EBizCharge, you can even schedule recurring billing directly within Sage.

Managing Transactions

You’ll also have access to transaction logs, reporting, and refund tools through your virtual terminal. These tools help with:

- Reconciliation

- Refunds or voids

- Chargeback management

All of this lives inside Sage or the connected gateway, so you don’t need to bounce between platforms.

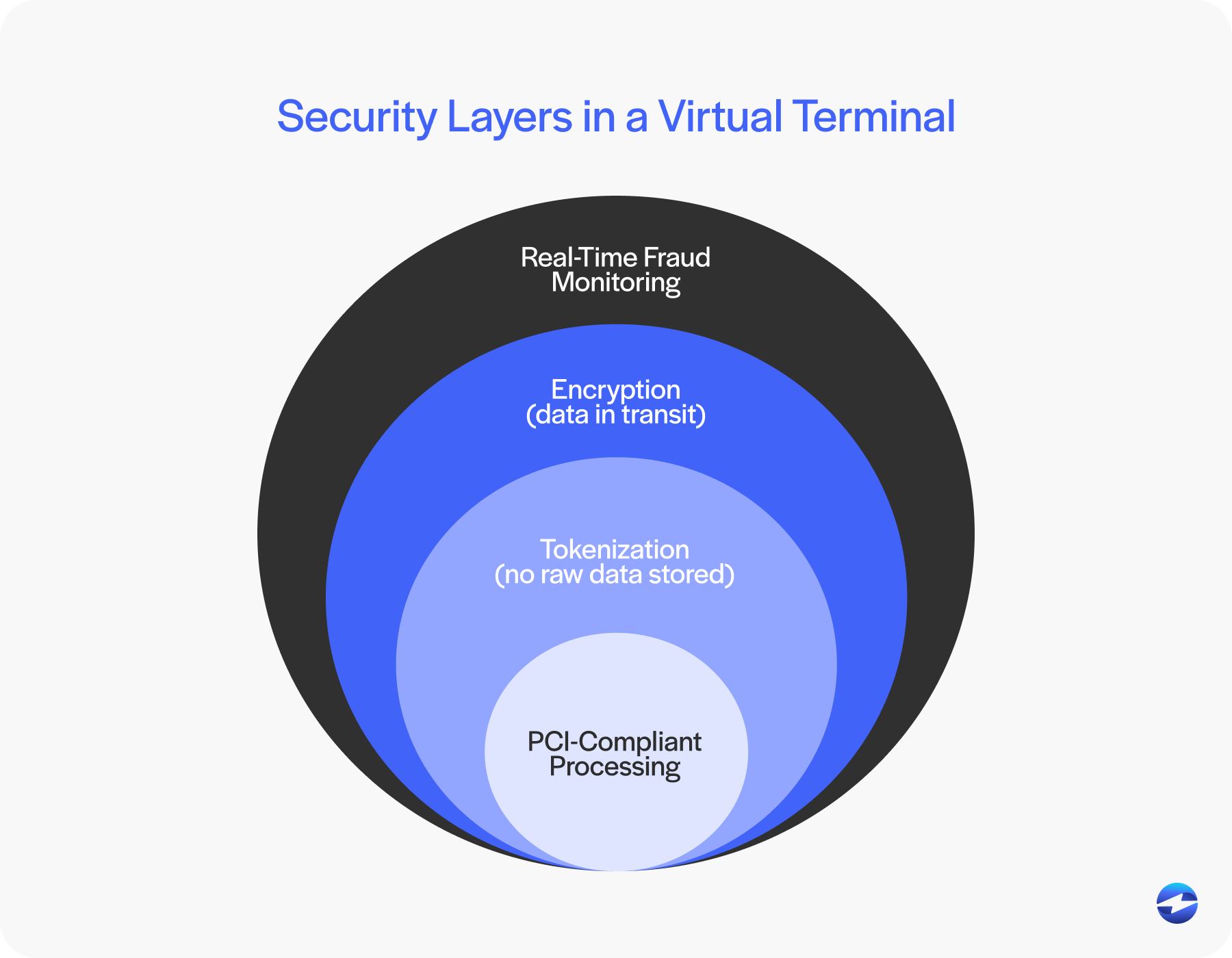

Security and Compliance

Handling payments means handling sensitive data, and compliance isn’t optional, especially when working within an ERP system that manages large volumes of customer and financial information. Even one security lapse could create a ripple effect that compromises data, disrupts cash flow, or leads to costly non-compliance penalties.

The Sage virtual terminal is designed to meet Payment Card Industry PCI compliance standards, particularly when used alongside a validated payment processor. But it’s not enough to enable the feature and forget about it. To maintain a secure environment, teams need to follow key best practices:

- Limiting access to payment functionality only to staff who need it.

- Using tokenization to prevent the system from storing raw credit card or banking data.

- Keeping both your Sage ERP system and connected payment gateway regularly updated with the latest patches and security enhancements.

Compliance isn’t just about satisfying regulations; it also protects your reputation and builds customer trust. If you’re using a third-party payment solution, ensure they include features like encryption, IP filtering, and real-time fraud monitoring. EBizCharge, for example, integrates these protections into every transaction and provides audit trails that support internal and external compliance checks.

Security should be woven into your day-to-day payment workflows, not treated as an afterthought. A secure Sage payment virtual terminal setup helps ensure your payment environment is efficient and responsibly managed.

Troubleshooting and Support

No system is perfect, and even with a well-executed setup, issues can crop up. Whether you’re experiencing minor glitches or more persistent disruptions, it’s helpful to know what to check first before calling in support.

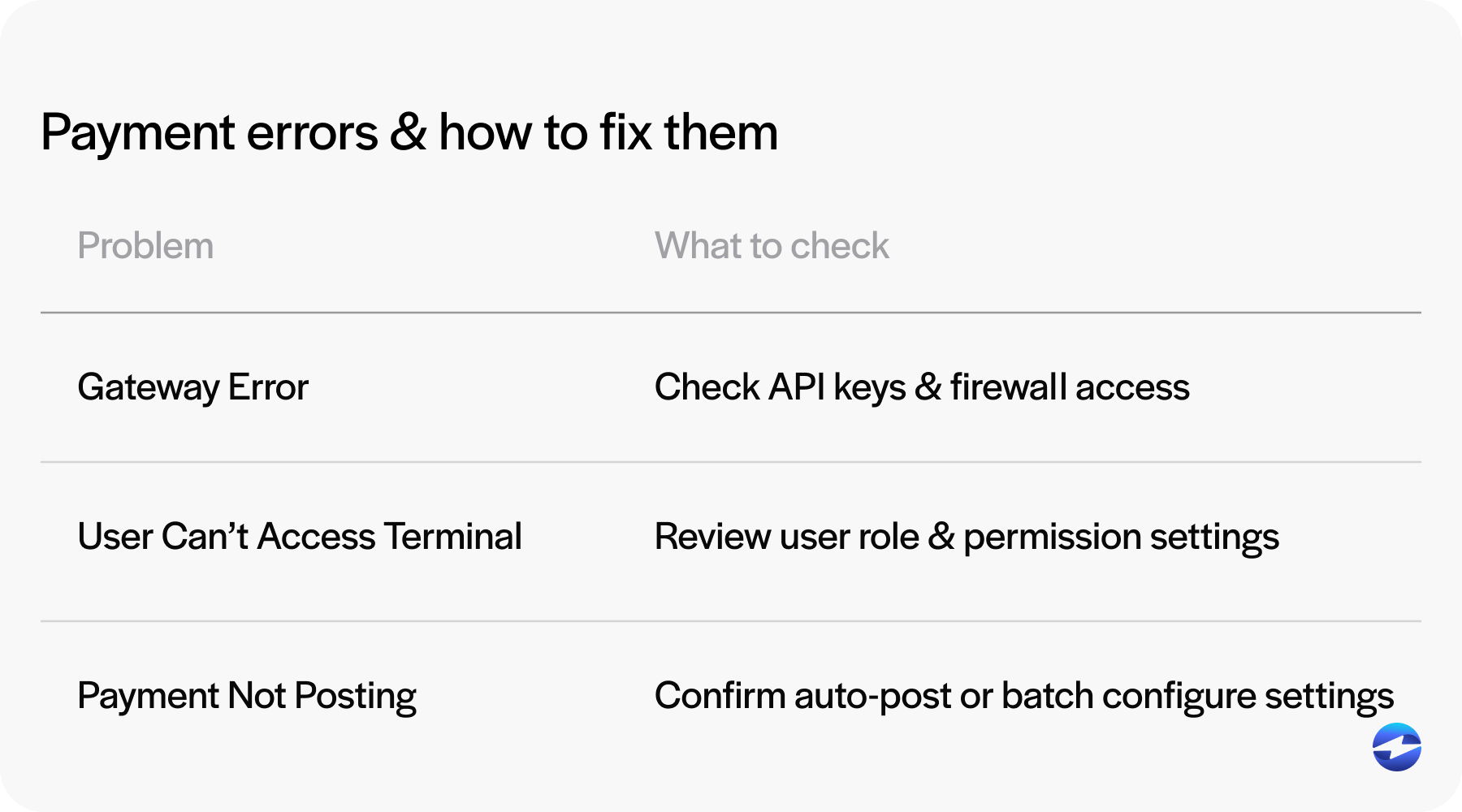

Here are a few common trouble spots, along with guidance on how to resolve them:

Payment Gateway Errors

If Sage isn’t communicating with your gateway, it could be an authentication issue. Start by double-checking your gateway credentials, including API keys, usernames, and passwords. Confirm that the API permissions are correctly set on both the Sage and gateway ends. A mismatch in your security keys or expired credentials is one of the most common causes of this problem.

Also consider whether your firewall or network settings might be blocking access to the gateway endpoint. If you’re working in a test environment, make sure you’re using test credentials that are isolated from your live production data.

User Permission Problems

If a user doesn’t see the virtual terminal or can’t access payment functions, review their Sage role settings. Even if the module is enabled, individual user roles may need specific permissions activated for tasks like entering payments, issuing refunds, or viewing reports. It’s a good idea to document permission configurations during setup to avoid confusion down the line.

Payments Not Posting Correctly

Sometimes payments are processed but don’t reflect correctly in the customer account or against invoices. This usually stems from posting configuration issues. In Sage ERP, it’s possible to process a transaction without it being finalized – especially if your settings require manual batch confirmation. Check whether the system is set to auto-post, or if there’s an intermediate approval or batching setup that’s being missed.

Look at your Sage transaction logs or audit trails to identify any disconnects. If you’re using a payment solution with its own dashboard, verify that the transaction completed successfully on that end too.

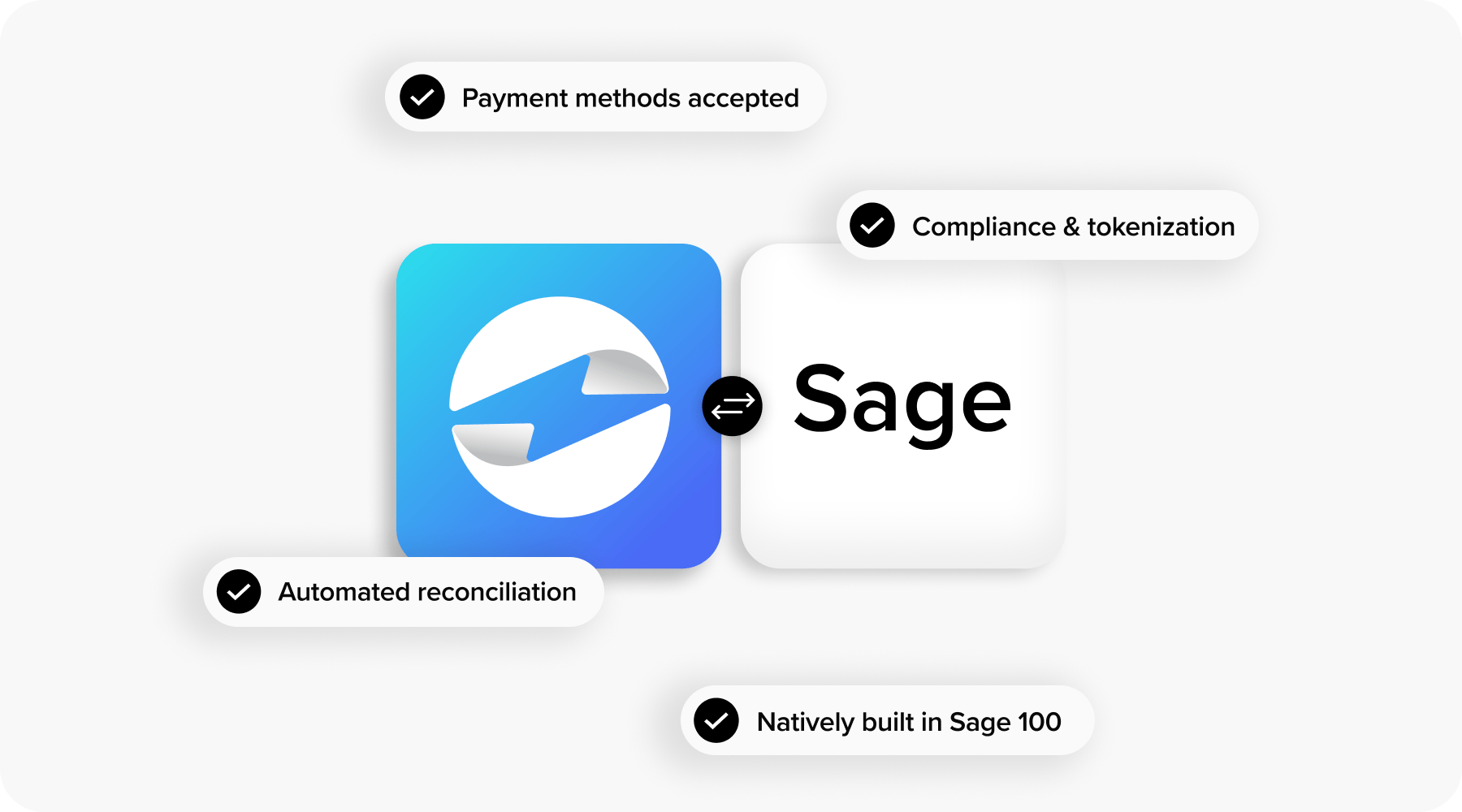

EBizCharge’s Seamless Sage Virtual Terminal

Setting up and using the Sage virtual terminal isn’t just about streamlining payment entry – it’s about equipping your team with a reliable, secure, and integrated payment experience that works the way you do.

EBizCharge offers a seamless virtual terminal that’s built specifically for Sage ERP users. Because the integration runs natively inside your Sage environment, you don’t have to leave the system or deal with clunky third-party workflows. Everything – from entering payments to applying them to invoices – happens right where your AR team is already working.

This centralization eliminates the need to re-enter data, reduces manual errors, and helps your team reconcile payments faster. It’s a major upgrade for teams handling high invoice volumes or managing complex billing cycles.

With support for credit cards, ACH, saved payment methods, and real-time transaction syncing, the EBizCharge virtual terminal transforms Sage ERP into a full-featured payment hub. Whether you’re processing one-off payments or recurring Sage billing, the experience is smooth, secure, and scalable.

If you’re still using disconnected payment tools or relying on outside platforms, it’s worth exploring what a purpose-built payment processing solution like EBizCharge can do.

Need help connecting your Sage ERP system to a trusted payment processor?

Explore integration options, talk to your accounting software partner, or reach out to your payment solution provider for guidance. Getting the Sage payment virtual terminal up and running could be one of the smoothest upgrades you make this year.