Blog > How to Optimize Your Invoicing and Billing Processes

How to Optimize Your Invoicing and Billing Processes

Billing and invoicing, while often used interchangeably, serve unique roles in financial transactions. Understanding these differences is essential for addressing common challenges, such as manual errors, delayed invoices, and poor payment tracking, as they can strain customer relationships, limit payment flexibility, and lead to compliance issues.

Thankfully, this article will guide you through best practices for streamlining invoicing and billing processes to transform financial management and operations.

Billing vs. invoicing

While billing and invoicing share a common goal of collecting payments for the various services and products your company provides, their approach and functions differ.

Recognizing the nuances between billing and invoicing can improve financial health, payment terms, and customer satisfaction.

What is billing?

Billing is the process of charging customers for provided services, products, and resources.

While billing can include one-time payments, it’s common for recurring expenses such as monthly memberships or subscriptions and usage-based services like utility bills.

The billing process is essential for businesses to ensure they get paid for their products and/or services. By implementing effective billing practices, your company can prevent late payments and improve cash flow.

What is invoicing?

Invoicing is the process of sending specific documentation to customers that typically includes a detailed account of goods or services rendered, payment terms, and an exact payment amount owed.

An invoice includes a comprehensive outline of what products or services were provided and specific transaction details, such as quantities, rates, and total costs.

While invoices can be used for recurring purchases, they’re also common for one-time, large purchases such as commercial sales, professional services, business-to-business (B2B) transactions, and more.

Creating invoices is an integral part of a company’s financial management since they serve as an official payment request and record of services or products delivered.

Invoicing and billing can come with some challenges, so businesses should address them promptly to find reliable solutions to combat them.

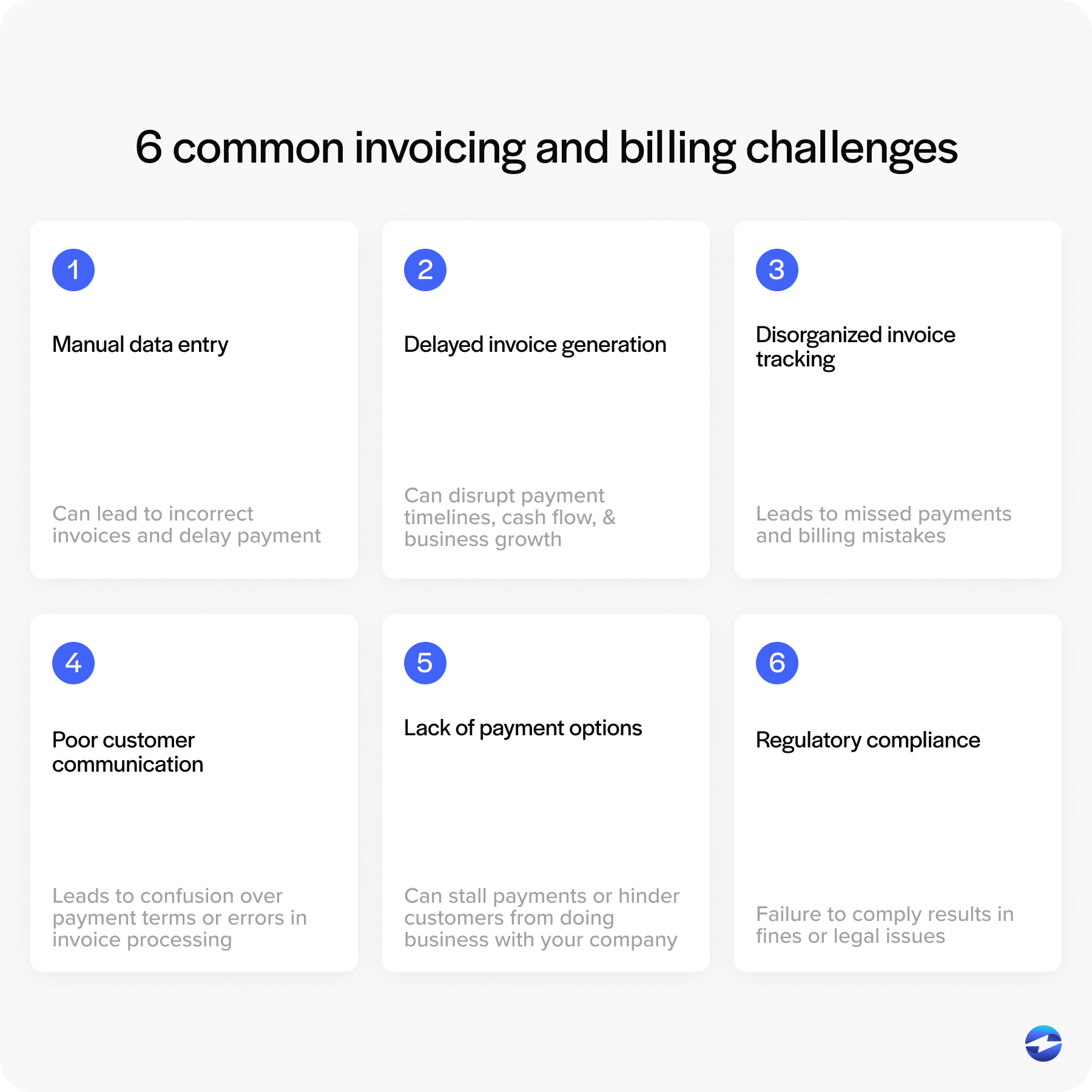

6 common challenges in invoicing and billing

Understanding various invoicing and billing challenges will allow your business to proactively mitigate these issues to maintain positive financial health and reputation.

Here are six common challenges of invoicing and billing:

- Manual data entry: Manual data entry can lead to incorrect invoices and delayed payments, decreasing cash flow and customer satisfaction. To avoid this, businesses can use automated accounting software to accelerate the invoicing process, mitigate and prevent human error, and improve accuracy.

- Delayed invoice generation: Delayed invoice generation is a frequent problem in billing processes, which can disrupt payment timelines, cash flow, and business growth. Many companies experience delays due to inefficient invoicing processes or lack of guidelines. Automated tools can help address this issue by sending prompt statements to streamline invoicing procedures and enhance transaction management.

- Disorganized invoice tracking: Disorganized tracking of sent or paid invoices can lead to missed payments and billing mistakes. Many businesses struggle with tracking invoices due to manual processes. Implementing an organized system, such as invoice templates or accounting software, can help. These tools provide clear records, making managing payments and accounting for all invoices easier.

- Poor customer communication: Poor communication can result in confusion over payment terms or errors in the invoicing process, as customers may not understand invoice details or face issues with payment methods. This leads to delays in payments and affects customer satisfaction. Effective communication of transaction information via precise invoices and routine follow-ups can enhance customer payment comprehension and ensure more seamless operations.

- Lack of payment options: Lack of flexible payment methods can be a significant barrier for customers who want access to multiple options and can lead to delayed payments or a loss in business. Expanding and catering to diverse customer preferences can improve the customer experience, streamline your billing process, and drive more cash flow. Providing various options, such as credit and debit cards, Automated Clearing House (ACH)/eChecks, digital wallets, and more, can encourage timely payments.

- Regulatory compliance: Invoicing and billing compliance means adhering to legal and financial regulations. These include regulations such as Payment Card Industry Data Security Standards (PCI-DSS), General Data Protection Regulation (GDPR), and local and industry-specific invoicing laws like the Health Insurance Portability and Accountability Act (HIPAA). Failure to comply can result in fines or legal issues. It’s essential to stay current with various regulatory authorities and industry standards to maintain accounting systems that align with these protocols and strengthen your overall financial health.

With these challenges in mind, merchants can implement strategic improvements and reliable payment tools to avoid discrepancies.

The following section will explore best practices for combatting these common issues.

7 best practices to streamline invoicing and billing operations

Incorporating best practices into your invoicing and billing processes is essential to ensuring on-time payments, positive cash flow, and long-term revenue.

Here are seven best practices to streamline your invoicing and billing:

- Standardized invoice templates

- Automation

- Digitized invoices

- Flexible payment options

- Business software integrations

- Payment portals

- Saved cards

1. Standardize invoice templates

Standardizing invoice templates is a simple yet effective way to improve invoicing, as consistent templates help eliminate confusion and reduce manual data entry errors.

A clear, uniform layout ensures that all necessary information, such as payment terms and due dates, is visible. This consistency aids in easier tracking and reconciliation. Customers receive invoices in a familiar format, which leads to quicker processing and reduces late payments.

Standard templates also facilitate easier integration with accounting software, further streamlining the billing process.

2. Automate where possible

Automating invoicing and billing processes can significantly enhance efficiency and accuracy.

By using accounting software, businesses can automate invoice generation, distribution, and reminders. Automation reduces the chances of human error and can handle complex configurations effortlessly. It also helps maintain timely payments by automatically notifying customers of upcoming due dates.

Automated systems save time that would otherwise be spent on manual processes, allowing businesses to focus on other high-priority tasks.

3. Digitize the process

Digitizing the invoice process involves moving away from paper and manual entries, which can improve accuracy and efficiency by eliminating time-consuming tasks and human error.

Merchants can use digital invoices to easily track payment statuses, reduce delays, and keep records safe. These invoices can be accessed anytime and anywhere, enhancing the ability to manage cash flow more effectively.

Digital invoicing can also lead to quicker updates and enhancements, giving businesses greater flexibility when responding to various situations.

4. Offer flexible payment options

Offering flexible payment options can significantly improve the customers’ invoicing and billing experience.

Providing a range of payment methods like credit and debit cards, ACH/eChecks, online payments, and more can promote more timely payments, enhance convenience, and increase customer satisfaction. Offering incentives like payment discounts for early settlements can also encourage quicker payments and improve cash flow.

Businesses that accommodate various payment preferences can minimize delays and boost their overall financial position.

5. Integrate with popular business software

Integrating invoicing and billing processes with popular business systems, such as accounting, enterprise resource planning (ERP), eCommerce, and customer relationship management (CRM) platforms, is crucial for operational efficiency.

Payment integrations can provide seamless data flow between systems, eliminating the need for duplicate data entry and significantly reducing the risk of manual errors. With real-time syncing, businesses can maintain accurate financial records, improve reporting accuracy, and gain insights into cash flow and outstanding balances.

With reliable accounting integrations, businesses can automatically reconcile payments, generate profit and loss reports, and manage taxes more accurately. CRM integrations enhance the customer experience by ensuring current payment history, preferences, and contact details — helping sales and support teams provide faster, more personalized service.

By integrating the invoice and billing process into existing business software, merchants can track invoices from creation to payment and optimize transactions while mitigating human error and late payments and strengthening customer trust.

6. Integrate a payment portal

Pairing payment portals with invoicing and billing systems enables customers to pay directly through a secure, user-friendly interface.

Customer payment portals can reduce the time and effort required for manual payment collections and provide more flexibility and convenience to the user experience.

Payment portals also support features like real-time payment confirmations and automated reminders, making the billing process more efficient for merchants and consumers.

7. Use saved cards

Allowing customers to save their preferred payment methods simplifies future transactions, especially for recurring billing or repeat purchases.

Saved cards reduce friction during checkout, increase the likelihood of on-time payments, and enhance the customer experience by eliminating the need to re-enter information. This convenience speeds up transactions and can generate more customer retention by making doing business with your company easier.

To streamline these operations further, you can work with a reliable payment processing solution with comprehensive tools and features that simplify the payment process.

Working with a payment processing solution

Working with a payment processing solution can significantly streamline your invoicing and billing processes.

A payment processor is a company or service that facilitates transactions between a business and its customers. It securely transmits payment information, authorizes transactions, and ensures funds are transferred from the customer’s account to the business’s bank account.

Payment processing solutions can automate repetitive tasks, enhance operational efficiency, and generate faster, on-time payments. Well-rounded providers will typically provide flexible payment methods, including credit, debit, ACH/eCheck, and other online payments, to cater to various customer preferences and reduce payment collection delays.

Compared to traditional methods that rely on manual input and limited payment capabilities, payment processing solutions offer automated data entry, reduced errors, robust payment collection tools, and a faster billing cycle.

For the best payment processing experience, merchants should look for trustworthy providers with comprehensive software, reliable support, transparent pricing, and features that transform customer payments.

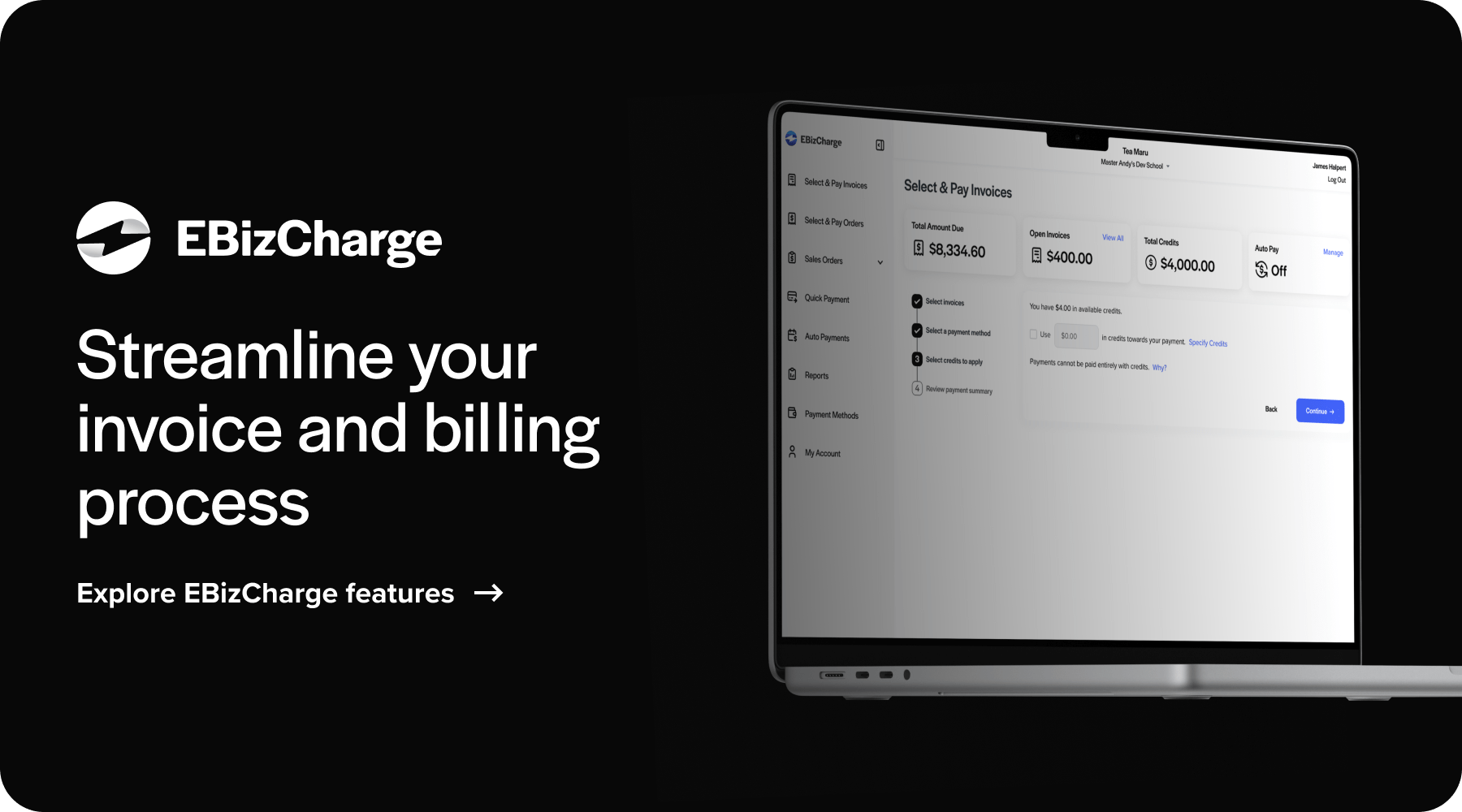

How EBizCharge streamlines invoicing and billing operations

EBizCharge provides top-rated payment processing software that streamlines invoicing and billing processes.

The EBizCharge platform consists of over 100 payment integrations into top accounting, ERP, CRM, and eCommerce systems to automate key workflows, minimize data entry burdens, and ensure greater accuracy across financial operations. Streamlining these processes supports smoother day-to-day operations and strengthens overall cash flow control.

EBizCharge’s key features include automated invoice processing to minimize payment delays through seamless, real-time handling of invoices and support for multiple payment methods. It also offers tools like recurring billing, secure email payment links, customer payment portals, and auto and mobile payment options, accelerating customer invoice access for faster payments.

The comprehensive EBizCharge solution also offers detailed reporting tools with valuable financial insights to support informed decision-making.

Additionally, EBizCharge is PCI-compliant and validated, meaning a Secure Software Assessor has assessed the software to validate its adherence to PCI Standards. This level of compliance ensures secure payment processing to safeguard sensitive customer data and maintain trust.

Thanks to its unmatched software and impressive payment collection tools, EBizCharge optimizes the invoicing and billing process and eliminates administrative burdens, thus empowering businesses to focus more on long-term growth initiatives and success.