Blog > How To Manage Short-Paid Invoices

How To Manage Short-Paid Invoices

Short-paid invoices are a common yet complex problem many businesses face that can impact cash flow and create administrative headaches.

From honest mistakes to deliberate disputes, the reasons behind short-paid invoices can vary. Understanding these reasons will help your business effectively address invoicing issues and prevent discrepancies with customers.

What are short-paid invoices?

Short-paid invoices, or short payments, refer to invoices that aren’t paid in full. This means a customer’s payment is less than the total invoiced amount stated on the invoice, and the business must follow up to collect the remaining balance owed.

The reasons for short payments can vary considerably. They may range from honest misunderstandings to deliberate attempts at manipulating payment terms. Understanding these elements is essential for a business owner or the receivable department to manage their cash flow effectively.

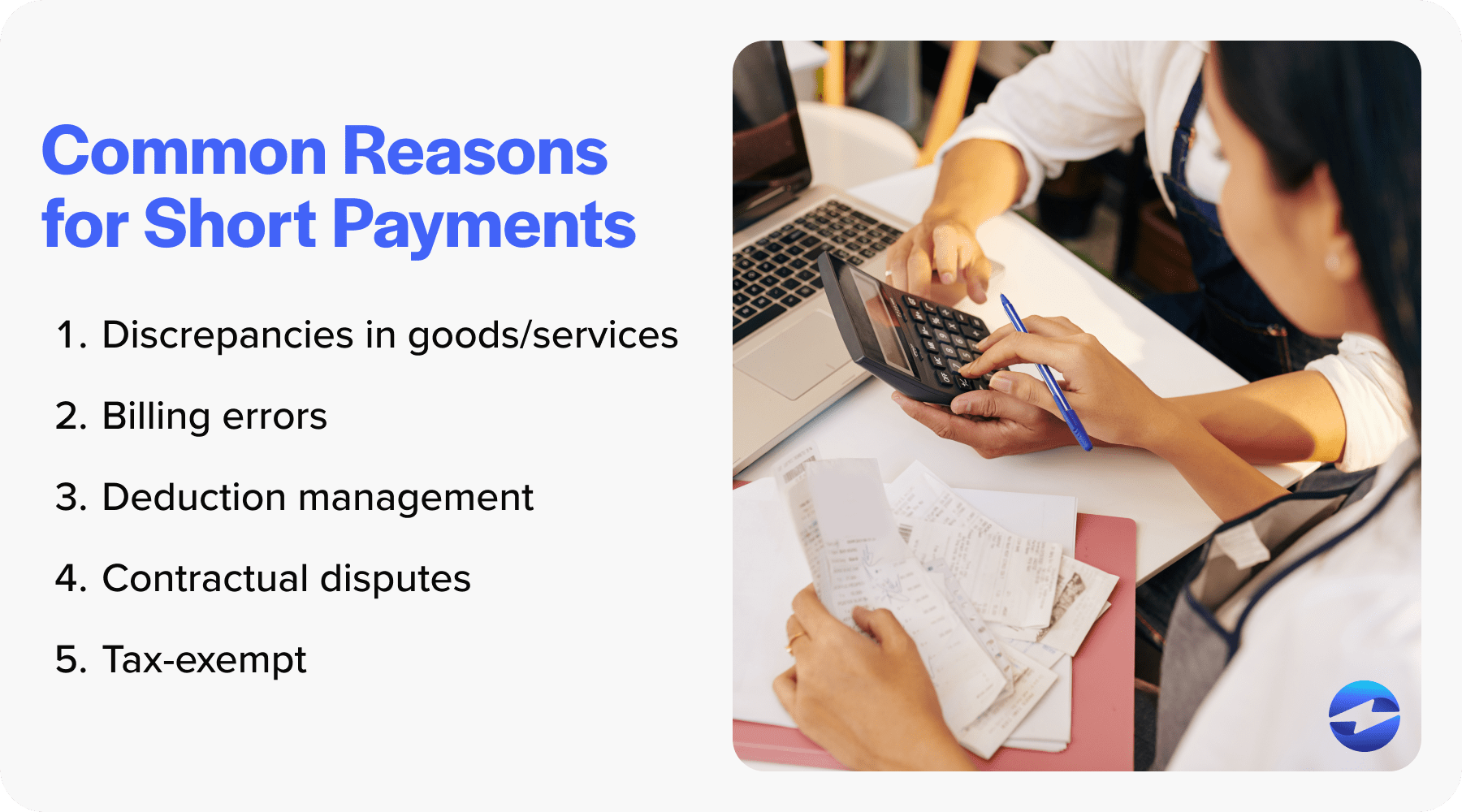

5 common reasons for short payments

Since there are several legitimate reasons why a customer may short pay an invoice, businesses should work to recognize and address these valid concerns promptly.

Here are five reasons for short payments to look out for:

- Discrepancies in goods or services: Customers may receive less than what was agreed upon or find the quality lacking, which may lead to a reduction in the payment until the issue is resolved.

- Billing errors: Inaccuracies such as overcharges, incorrect item counts, or mathematical mistakes can cause a customer to withhold part of the payment.

- Deduction management: When early payments or volume discounts are part of the agreement, customers may deduct these from the total invoiced amount.

- Contractual disputes: In some cases, a misunderstanding or disagreement about the contract terms may occur, leading to short payments while negotiations take place.

- Tax-exempt: Accounts receivable (AR) teams sometimes mistakenly apply sales tax to tax-exempt customers. When these customers receive invoices with sales tax included, they may make payments that exclude the tax amount, resulting in a short payment.

Conversely, there are also unjustified reasons to short pay an invoice. Some customers may deliberately withhold payments to improve their own cash flow or as a negotiation tactic.

Regardless of the reasons, short-paid invoices can have a negative effect on businesses.

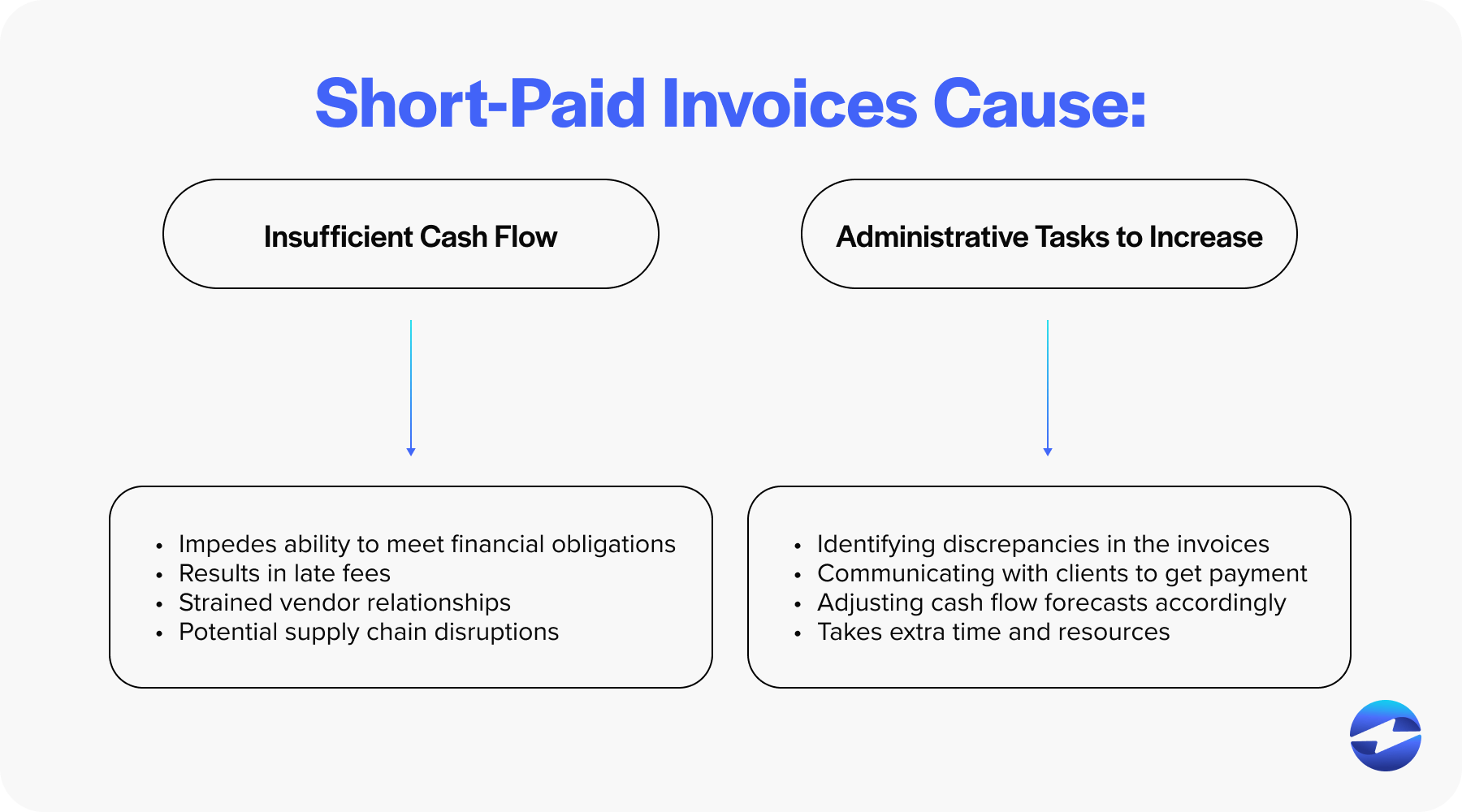

How do short payments affect businesses?

The repercussions of short-paid invoices can ripple throughout a company’s entire financial ecosystem.

First, short-paid invoices can lead to insufficient cash flow, which impedes the ability to meet immediate financial obligations, such as payroll, utility bills, and supplier payments. These invoices can result in late fees, strained vendor relationships, and potential disruptions in supply chains.

The administrative burden of reconciling short-paid invoices also adds another layer to the financial management processes. Accounting teams are tasked with identifying discrepancies, communicating with clients to rectify payment issues, and adjusting cash flow forecasts accordingly. This not only consumes valuable time and resources but also diverts attention away from more strategic initiatives aimed at driving business growth and innovation.

For these reasons, resolving disputes as quickly as possible is imperative.

Resolving disputes with dispute and deduction management

Managing short-paid invoices can be time-consuming and frustrating for businesses, so implementing a well-structured, proactive approach is essential.

With an organized and efficient dispute and deduction management strategy, your business can swiftly and amicably resolve short-paid invoice issues swiftly.

What is dispute and deduction management?

Dispute and deduction management is a specialized area within the receivable teams that focuses on proactively preventing and managing reasons for short-paid invoices.

Dispute and deduction management consists of policies and procedures designed to quickly identify, investigate, and resolve valid or invalid deductions that customers may take when making a payment.

Dispute and deduction management allows businesses to efficiently handle legitimate disputes while contesting an unjustified short pay, ensuring that only valid reasons are accepted.

Using this method, a company can protect its financial health by recovering rightfully owed funds, thereby minimizing the negative impact on its cash flow.

How to effectively resolve short-paid invoices

Businesses should adopt a clear strategy for resolving short-paid invoices to ensure effective customer communication and maintain good-standing customer relationships.

Here are seven steps to consider implementing in your short-paid invoice resolution strategy:

- Verification: Immediately verify the payment against the invoice to confirm whether it’s short paid.

- Customer notification: Promptly notify the customer about the discrepancy via electronic invoicing systems or email.

- Investigation: Determine the reason for the short payment. It could be an honest mistake, a customer cash flow issue, or a disagreement about the delivered goods or services.

- Evaluation: Consider the context and any previous customer history to evaluate the validity of the reason given.

- Resolution: For valid disputes, negotiate a mutually acceptable resolution, such as a payment plan or an adjustment to future payment terms. For invalid reasons, enforce the original payment terms and seek full payment.

- Documentation: Meticulously record details of the dispute and resolution process. An updated and accurate accounting record is essential for legal compliance, identifying patterns and trends, and providing evidence for ongoing dispute cases.

- Prevention: Review and refine payment processes to prevent recurring issues. Accurate and timely invoicing and upfront, transparent payment terms can reduce the incidence of short payments.

In addition to knowing how to deal with these invoices, incorporating best practices to minimize short-paid invoices is invaluable for any AR team.

Best practices for minimizing short-paid invoices

There are numerous reasons for short-paid invoices, such as billing errors or contractual disputes. Regardless of the reason, businesses should familiarize themselves with best practices to mitigate these invoices and avoid significant problems.

Here are a few best practices for minimizing short-paid invoices:

- Establish clear communication channels

- Document disputes and resolutions

- Leverage technological solution

Establish clear communication channels

Establishing clear communication channels is paramount in minimizing short-paid invoices.

Maintaining open lines of communication will enable businesses to clarify payment expectations and obligations to customers from the beginning. Prompt responses to inquiries or invoice issues are crucial in preventing payment delays.

Additionally, fostering strong customer relationships by demonstrating a willingness to listen and resolve concerns often leads to more consistent payments over time. It’s imperative to designate a dedicated contact point for billing inquiries and to ensure that staff are adequately trained to handle payment-related communications efficiently.

Businesses can also use collection email templates to provide a standardized format for communicating with clients regarding payment discrepancies and to include all necessary information, reducing the risk of misunderstandings. Pre-written templates can also save your staff time and resources needed to compose individualized messaging for each short-paid invoice situation.

Document disputes and resolutions

Monitoring and evaluating all invoices allows businesses to promptly identify discrepancies or errors in invoicing, such as incorrect pricing or missing items, which may lead to underpayments. You can address these issues by conducting thorough reviews before invoices are sent to customers, reducing the likelihood of short payments.

Tracking valid and invalid short payments provides valuable insights into their root causes, whether they stem from legitimate disputes or errors in invoicing. By distinguishing between valid and invalid short-paid invoices, businesses can effectively address underlying issues by resolving client disputes or improving internal invoicing processes to prevent future errors.

Leverage technological solutions

Leveraging technology solutions can significantly enhance the resolution of short-paid invoices. By automating detection processes, technology can instantly flag invoicing discrepancies for immediate attention, expediting the resolution of payment issues.

Automation reduces manual efforts involved in dispute resolution, resulting in faster fund recovery and streamlined processes. Automation also increases accuracy by minimizing human error that may lead to disputes or short payments in the first place.

Incorporating elements such as electronic invoicing, accounting software, and customer portals can revolutionize how AR teams manage their invoicing and disputes, leading to more timely payments and better-managed cash flow.

Minimize short-paid invoices with EBizCharge

To minimize the occurrence of short-paid invoices in your business, implementing a payment processing solution like EBizCharge can be a game-changer.

EBizCharge’s user-friendly payment processing system integrates seamlessly with various accounting software, ensuring accurate data entry and reducing human error. Its clear-cut electronic invoicing eliminates the pitfalls of manual invoicing and simplifies the payment procedure for customers, encouraging timely payments.