Blog > 8 Essentials You Should Include on an Invoice

8 Essentials You Should Include on an Invoice

Late payments can wreak havoc on cash flow, hindering growth and causing undue stress between companies and customers. To alleviate this stress, businesses can optimize invoices for more seamless transactions, client trust, and timely remittance.

A well-crafted, detailed invoicing system is critical to your success and overall customer experience. Thankfully, this article will teach you what to include on an invoice to streamline the invoicing process and get paid faster.

What is a business invoice?

At its core, an invoice is a formal document that serves as an official request for payment between the seller and buyer.

An invoice is more than just a financial request. It’s a structured communication outlining the products or services provided, associated costs, and precise payment terms. As a vendor or supplier, sending an invoice is the final touch that signifies your work is complete, or the requested products or outcomes have been delivered.

Before the invoice is submitted, the customer should know the exact or estimated cost at the start of the business relationship. This initial agreement is typically signed as a contract or purchase order. In some cases, the exact cost won’t be known until the work is completed.

For example, a business might hire an accountant to process its annual tax filing. The accountant quotes an hourly rate and time estimate to complete the work. The invoice should be within a reasonable range of the initial estimate. Ultimately, the invoice is part of the official legal paper trail that can help a company collect payment if a customer refuses to pay.

Now that you know what an invoice is, the next section will explain what to include in an invoice.

What should be included on an invoice?

Creating invoices for businesses from scratch can be tedious, so modern technology like accounting software can provide ready-to-use templates to streamline this process.

Imagine being a dedicated small business owner using a professionally designed template to generate an invoice for a new client. Once the template is set up, you only need to update the pertinent details, such as the date and amount due.

In addition to listing charges for goods and services, invoices should provide clarity, foster trust, and ensure seamless transactions.

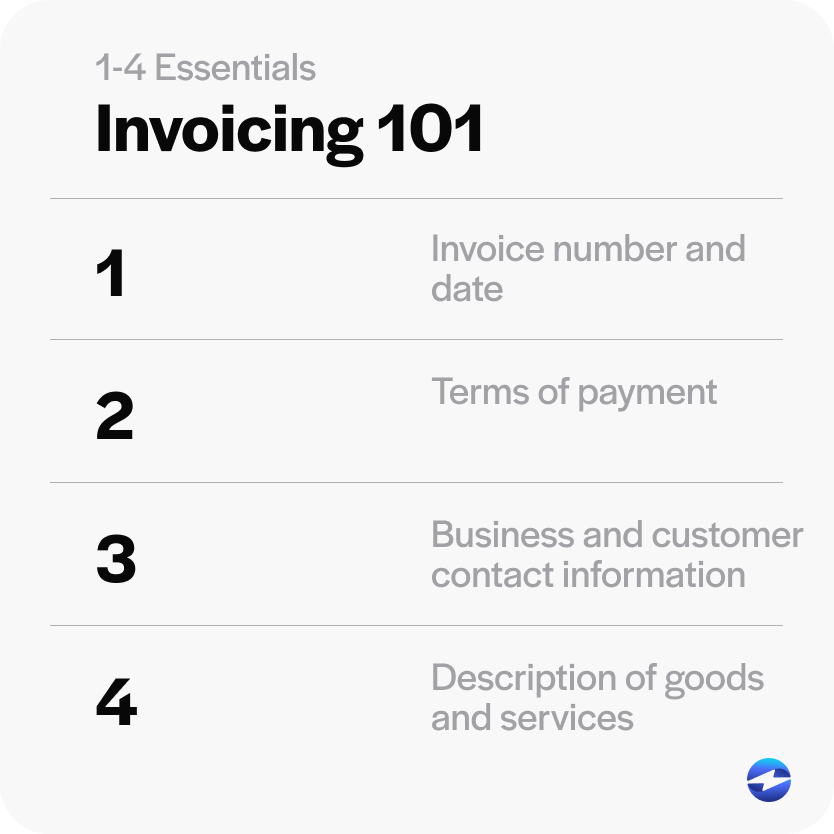

Here are eight essential parts of an invoice that you should include on your invoice template:

- Invoice number and date

- Terms of payment

- Business and customer contact information

- Description of goods and services

- Quantity and price

- Subtotal, deductions, taxes, and total due

- Payment instructions

- Notes and additional information

1. Invoice number and date

Each invoice you generate should include a unique identifying number, known as an invoice number. This number will streamline communication with your customer and help you track each transaction to completion. Most accounting software allows businesses to select the starting number for this invoice sequence.

It’s common for invoice numbers to be in an ascending numerical sequence (i.e. Invoice #101 or Invoice #102). However, new businesses may want to avoid starting with a low number (i.e. Invoice #00001) since low numbers may indicate that your company hasn’t been in business for long or you may be inexperienced.

Starting with a higher, random number (i.e. Invoice #12675) will make your company look more established. In addition to the invoice number, you should also include an invoice date so both parties can keep track of payment deadlines and history.

2. Terms of payment

Setting clear expectations from the start is important to prevent any misunderstandings or disputes. For this reason, you should always list clear payment terms on the invoice.

Terms of payment are often shown as Net 15 or Net 30, meaning payment is due within 15 or 30 days. Consider offering early payment discounts to incentivize prompt remittance and detail any consequences for late payments to encourage adherence to deadlines.

While generous payment terms can attract new clients, they may lead to delayed payments. Therefore, striking the perfect balance between client convenience and timely payments is a challenge businesses must address.

3. Business and customer contact information

The invoice header should prominently display your business’s contact details, including name, logo, address, phone number, and email address. This provides a professional look and gives customers access to the information they need to contact you.

Similarly, you should include the customer’s contact information to ensure the invoice reaches the intended recipient and provide any reference numbers for the purchase order or quote.

4. Description of goods and services

The invoice should provide a detailed breakdown of the bill for services rendered. It’s important to be specific and concise, using clear language your client can easily understand.

A well-defined description leaves no room for confusion and helps the client confirm the invoice is accurate.

5. Quantity and price

Quantity and price are essential components of an invoice, meaning each product or service should be itemized and include its corresponding quantity and unit price.

This breakdown showcases transparency in pricing, giving clients a clear view of the costs associated with each line item. Transparent pricing on the invoice is essential to avoiding unnecessary questions or confusion that could delay payment.

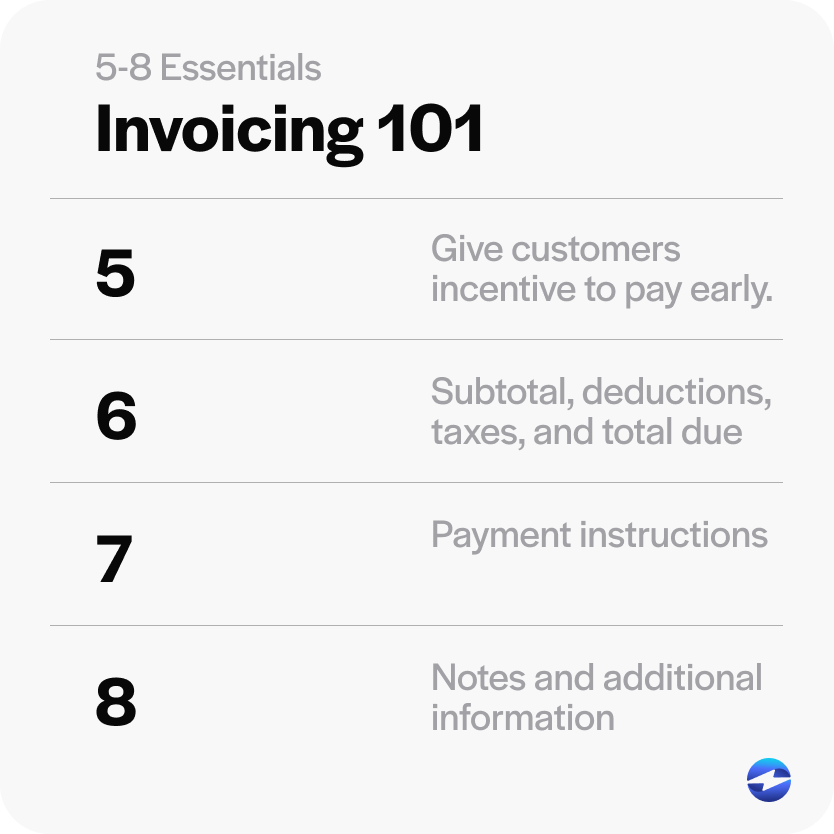

6. Subtotal, deductions, taxes, and total due

At the bottom of the itemization section, calculate the subtotal by adding up the costs of all line items before any deductions or taxes. Deductions, like discounts or credits, should be clearly labeled to avoid ambiguity.

If there are any applicable taxes, they should be accurately calculated and displayed. Lastly, the total amount due should be the most prominently displayed figure on the invoice, providing a quick reference point for the client’s payment.

7. Payment instructions

While each company has specific processes for receiving payment from their customers, these instructions should be as clear and straightforward as possible to reduce payment barriers and improve your cash flow.

Whether you request payment via check, credit card, ACH, or wire transfer, it’s crucial to provide thorough instructions for the customer.

In today’s digital age, you may even offer an option to make a digital payment through an online tool. If so, be sure to provide a link or QR code on the invoice.

8. Notes and additional information

Finally, personalize your invoice by including a brief note of gratitude or acknowledgment. Even a simple “Thank you for your business” adds a human touch that reinforces your relationship with the client and reminds them of your commitment to exceptional service.

If applicable, you can also provide additional invoicing information, such as the contact information for their dedicated accounts receivable representative (which may vary from the primary company information listed at the top of the invoice).

Setting up these invoice items will initially take a little bit of time. However, if done right, this small investment will help you avoid the many headaches associated with invoicing delays and making those dreaded collection calls.

5 benefits of invoicing customers

While the primary purpose of invoices is to collect payment from customers, invoices and the invoicing process can produce several benefits for both the buyer and seller.

A well-crafted invoice can generate trust, streamline business processes, minimize the number of accounting resources required, and protect both parties from regulatory and legal issues.

Here are five benefits of invoicing your customers:

- Efficient processing

- Compliance with regulatory standards and record-keeping

- Budget management

- Enhanced transparency

- Greater customer satisfaction

Efficient processing

Depending on the size and type of the company, businesses can generate hundreds, if not thousands, of invoices monthly. Keeping your books organized with high volumes can be challenging, even for the most experienced accounting professionals.

Thankfully, maintaining an efficient and well-organized invoicing system can streamline this payment process and allow your business to swiftly review, approve, and receive payments without unnecessary bottlenecks.

Compliance with regulatory standards and record-keeping

The Internal Revenue Service (IRS) and other regulatory bodies enforce strict requirements for businesses to keep detailed and accurate records, especially concerning their financials.

Proper invoicing can significantly reduce stressful predicaments such as audits or financial penalties that can hurt the company’s bottom line.

Budget management

Financial planning is one of the most critical business activities that company leaders must manage. Poor financial projections can lead to long-term repercussions, such as operational disruptions and bankruptcy.

Maintaining organized invoicing information allows buyers and sellers to proactively manage their budgets by showing what upcoming payments and approximately what cash flow they can expect within a certain period.

Enhanced transparency

Implementing clear invoicing procedures and straightforward invoice templates will enhance buyer and seller transparency and build more trust — a cornerstone of any successful business relationship.

An efficient invoicing process that provides customers with a clear understanding of what products and services they’re receiving and being charged for can lead to more significant sales, long-term revenue, and return customers in the future.

Greater customer satisfaction

An invoice is likely one of your final interactions with each customer. For many businesses, customer service ends once their service or product is delivered.

Your goal should be to make invoicing as pleasant as possible to ensure customers’ last interaction with your company is positive. A high-quality invoicing process reduces the likelihood of misunderstandings, disputes, and overall dissatisfaction, which can leave a bad taste in the customer’s mouth and a negative online review.

Finally, a top-rated payment platform like EBizCharge will further streamline and simplify your invoicing process to create a more user-friendly customer experience and long-term revenue.

Businesses can create a clear and complete invoice process to yield more long-term success

Knowing what needs to be on an invoice is essential for businesses to enhance their payment collection process and generate more success in the future. Still, invoicing should be viewed as more than a transaction.

As you refine your invoicing approach, remember that every figure, word, and detail speaks volumes about your business, and invoices are no exception. By harnessing the power of templates, including crucial information, and comprehending the diverse benefits of invoicing, your company can get paid faster and cultivate enduring client relationships.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.