Blog > How to Effectively Manage Short Payments: Strategies, Best Practices, and Solutions

How to Effectively Manage Short Payments: Strategies, Best Practices, and Solutions

Getting paid has always been a critical component for any company since incoming funds drive revenue and allow for acquiring and allocating resources to various high-priority operations that keep your business afloat.

When a buyer pays less than the billed amount, also known as a short payment, significant challenges can arise for businesses trying to maintain a healthy cash flow.

This article will explain short payments, their use cases, and how they can impact your bottom line to help your business effectively navigate and manage your finances.

What is a short payment?

A short payment is any payment that falls below the invoiced amount, meaning a customer pays less than the total amount owed. This can be due to payment disputes, incorrect billing, or deductions made by the payer.

For businesses, managing short payments is crucial for maintaining financial health and ensuring that short-term obligations and current liabilities are met adequately.

Businesses can better manage their financial stability by understanding the root causes of short payments. This involves reviewing common payment discrepancies, keeping accurate loan terms and credit limit records, and employing strategies to address unexpected expenses and improve merchant cash advances.

Now that you know what short payments are, it’s important to understand how they can impact your company.

The impact of short payments on cash flow

Short payments can significantly impact cash flow, hindering your company’s day-to-day operations and overall financial health.

When customers pay less than the invoiced amount, AR is reduced, and liquidity issues can arise. This reduction in cash inflow can force businesses to rely more on short-term

financing options, such as merchant cash advances or lines of credit, to maintain their daily operations.

Short payments can also impact the accounts receivable (AR) and accounts payable (AP) sections of balance sheets, influencing capital and financial statements.

The challenge of short payments is compounded when they become a recurring issue, as it can lead to a business making late payments for its short-term debts and obligations. These delays can impact a company’s credit rating, increasing the cost of future borrowings.

Companies must often adjust their balance sheets and consider revising customer credit terms to mitigate these challenges. Managing short payments effectively requires monitoring and timely action to ensure financial stability and continued liquidity.

To fully understand the impact of short payments, knowing how to write a short payment is crucial.

How do you write a short payment?

Writing a short payment involves communicating the discrepancy or reasoning for the partial or delayed payment. Here’s a list of the six steps to write a short payment:

- Begin with a formal greeting: Address the recipient professionally by name or business name.

- Reference invoice details: Specify the invoice number and the original payment amount.

- Explain the short payment: State the amount received versus the expected amount, and mention any potential reasons for the discrepancy, such as calculation errors or missing information.

- Request clarification or action: Politely ask for further explanation or corrective action.

- Propose the next steps: Suggest possible actions to resolve the issue, like reissuing an invoice or offering payment terms.

- Maintain a professional tone: Be professional and courteous to preserve the business relationship.

It’s also helpful to include your contact details so the recipient can follow up with you for more information or clarification regarding the short payment.

While not always ideal, there may be certain circumstances where short payments are necessary.

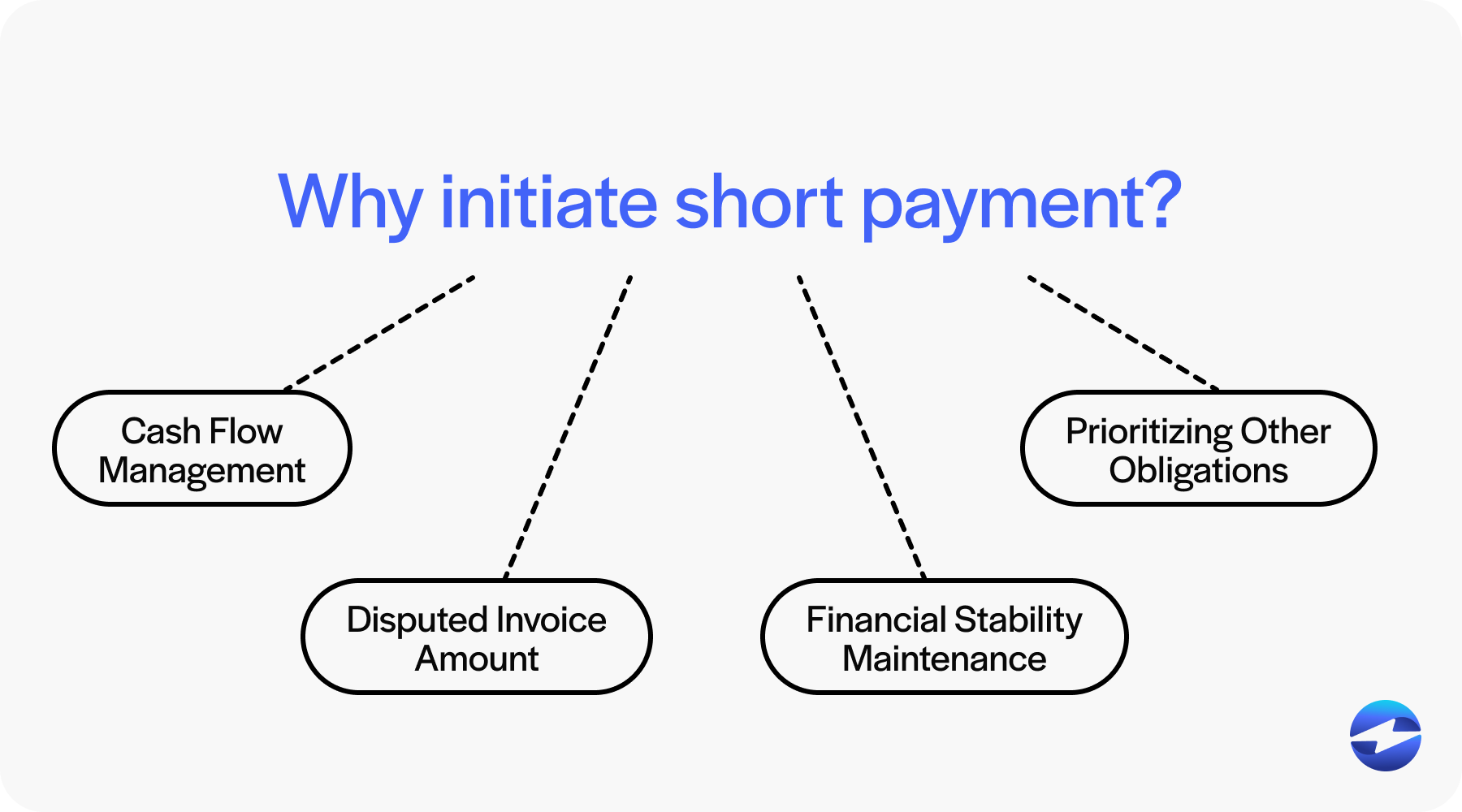

Why should businesses initiate short-paid invoices?

When a business faces unexpected expenses or temporary liquidity challenges, reducing the payment on an invoice can help prioritize essential payments and manage current liabilities effectively.

This approach can prevent late payments on more critical obligations, such as loan payments or payroll, ensuring seamless daily operations.

Four reasons businesses need to initiate a short payment include:

- Cash flow management: Short payments can help businesses manage cash flow by temporarily reducing outgoing payments, allowing them to allocate funds where they’re most needed.

- Disputed invoice amount: If there’s a discrepancy or disagreement over an invoice amount, short payments can serve as partial payments while the issue is being resolved.

- Financial stability maintenance: When facing tight cash reserves, short payments can help maintain stability by ensuring critical expenses are covered without fully depleting resources.

- Prioritizing other obligations: By short paying less urgent invoices, businesses can prioritize payments for essential obligations like payroll, rent, or loan repayments.

Short paying should be a temporary solution rather than a regular practice to ensure long-term financial stability and critical relationships with vendors.

How to address and resolve short payments

Short payments may be necessary if there’s a dispute over the invoice amount or disagreement on services rendered. Addressing such discrepancies promptly while maintaining partial payment demonstrates good faith and maintaining a working relationship with vendors.

However, businesses should communicate clearly with their teams and creditors to ensure understanding and avoid negative impacts on credit rating or favorable payment terms. Accurately documenting any alterations to financial statements and balance sheets

is crucial to providing a clear picture of short-term obligations and overall economic health.

It’s essential first to identify the reason behind a short payment, which can be due to disputes, miscalculations, or unfavorable payment terms.

Once the cause is identified, the next step is communicating with the customer to clarify any misunderstandings or rectifying errors. Suppose the cause is linked to disputes or dissatisfaction with goods or services. In that case, addressing these issues promptly can help restore the payment process.

Additionally, revisiting the terms and conditions of the credit or purchase agreement can offer insights for adjusting future transactions to avoid repeated short payments.

To manage short payments effectively, businesses should also consider enhancing their financial statements and incorporating stronger credit management practices, such as defining clearer loan terms and understanding short-term obligations and lines of credit.

Regular financial health analysis and setting clear expectations with clients can prevent future short payments and encourage more efficient routine operations.

Along with implementing the proper protocols to address and resolve short payments, businesses can follow several best practices when handling these transactions.

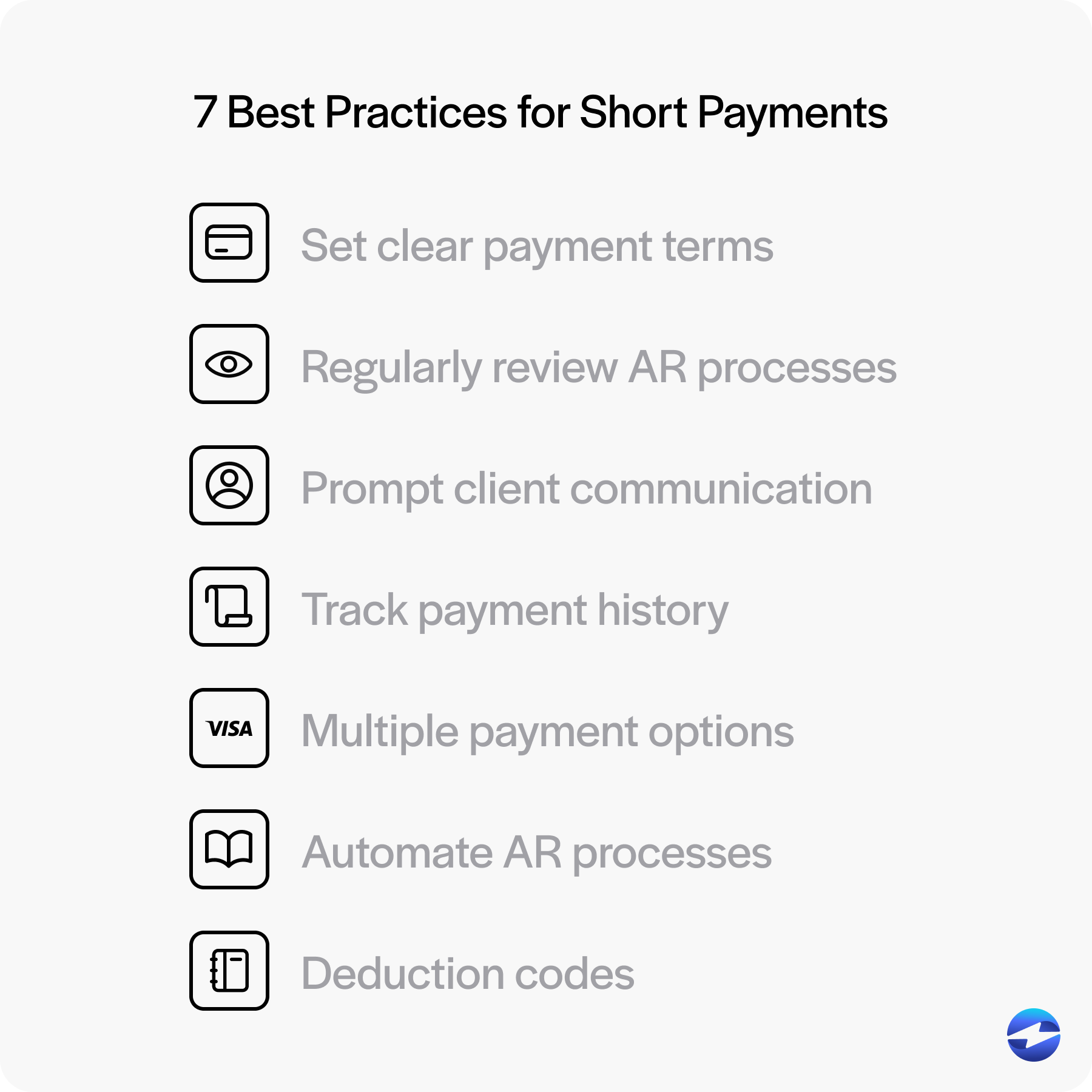

7 best practices for short payments

To properly manage short payments, your business must implement best practices that minimize their occurrence and impact.

Here are seven best practices to effectively mitigate and manage short payments:

- Set clear payment terms: Ensure agreements are clear and documented to prevent misunderstandings involving payment amounts and deadlines.

- Regularly review AR processes: Keep AR processes aligned with industry standards. One specific industry standard for managing short payments is the Uniform Retail Credit Classification and Account Management Policy, which provides guidelines for categorizing and handling partial payments in retail and commercial settings.

- Prompt client communication: Address short payments as soon as they arise and keep an open line of communication with customers.

- Track payment history: Monitor client interactions and payment trends to identify potential issues early on.

- Multiple payment options: Provide flexible payment options for clients to make convenient and timely payments, such as mobile payments, credit and debit cards, ACH, email pay, and more.

- Automate AR processes: Use digital tools that automate the AR process for better tracking and follow-up procedures.

- Deduction codes: Utilize deduction codes to efficiently track early payment discounts, promotions, and other valid reasons for short payments.

Businesses can pair these best practices with various software tools to enhance their short payments.

Tools and technologies for managing short payments

Your company can leverage robust software to navigate short payments, such as accounting, customer relations, automation, and analytics tools.

Accounting software is crucial for monitoring AR and generating accurate financial statements. Such software often includes features for tracking short-term debts and highlighting discrepancies in loan payments.

Customer relationship management (CRM) systems can also be integrated to manage client interactions and address causes of short payments more swiftly.

Lastly, automation software can send reminders for monthly payments and manage late payment notifications. Analytics tools will also provide valuable insights into financial health and suggest improvements in credit management practices. Managing short payments for your businessBy applying a proactive approach when managing short payments, your business can solidify more financial stability and strong client relationships.

Leveraging industry-standard tools and strategies enables smoother cash flow management and minimizes the impact of short payments on overall operations. This structured approach helps safeguard your financial health while ensuring consistent, positive client interactions.