Blog > How To Integrate a Payment Gateway into Sage Software

How To Integrate a Payment Gateway into Sage Software

Integrating a payment gateway into Sage accounting software provides numerous advantages for merchants, including streamlined payment processes, improved cash flow, and enhanced security.

Whether you use Sage 50, Sage 100, Sage Intacct, or another Sage product, syncing a payment gateway with any of these systems can transform how your business accepts and manages credit card and electronic payments.

This article will walk you through the integration process in Sage, from selecting the right payment gateway provider to enabling and testing your solution. These steps will help you optimize payment processing with fewer errors, faster collections, and secure transactions.

What is Sage software?

Sage software consists of a suite of business management tools designed to optimize financial operations, with popular accounting/enterprise resource planning (ERP) products like Sage 50 software, Sage 100 software, and more.

Sage accounting/ERP products and services help businesses manage accounting tasks such as accounts receivable (AR), cash flow, and financial reporting.

The Sage software can also sync with payment gateways to facilitate secure and quick payment processing for various industries and business sizes.

Why integrate a payment gateway into Sage?

Integrating a payment gateway into Sage software offers several business benefits, including better payment processing, cash flow, security, and more.

Here are five reasons to integrate a payment gateway into your Sage system:

- Streamlined payment processing: Integrated Sage systems can automate payment workflows, reducing manual data entry and minimizing the risk of human error. This improves operational efficiency and saves time.

- Enhanced cash flow management: Integrating a gateway into Sage enables real-time processing of credit and debit card payments, helping merchants collect outstanding invoices faster. This ensures a steady cash flow and supports better financial planning.

- Improved payment security: A reliable payment gateway provider ensures compliance with security standards such as Payment Card Industry (PCI) Compliance, safeguarding sensitive financial data and reducing fraud and data breach risks.

- Real-time financial insights: Seamless integration with up-to-date financial data can improve reporting accuracy and enhance decision-making. Automatic data syncing also reduces duplication and AR errors.

- Increased payment flexibility: Businesses can accept various payment methods, including credit, debit, and Automated Clearing House (ACH)/eCheck payments. This flexibility enhances customer satisfaction and can drive higher sales.

By integrating a payment gateway into Sage, your company can optimize financial operations and provide customers with a more secure, convenient payment experience.

How to integrate a payment gateway into Sage

The Sage integration process can vary depending on the chosen payment gateway provider, so it’s important to follow their instructions carefully.

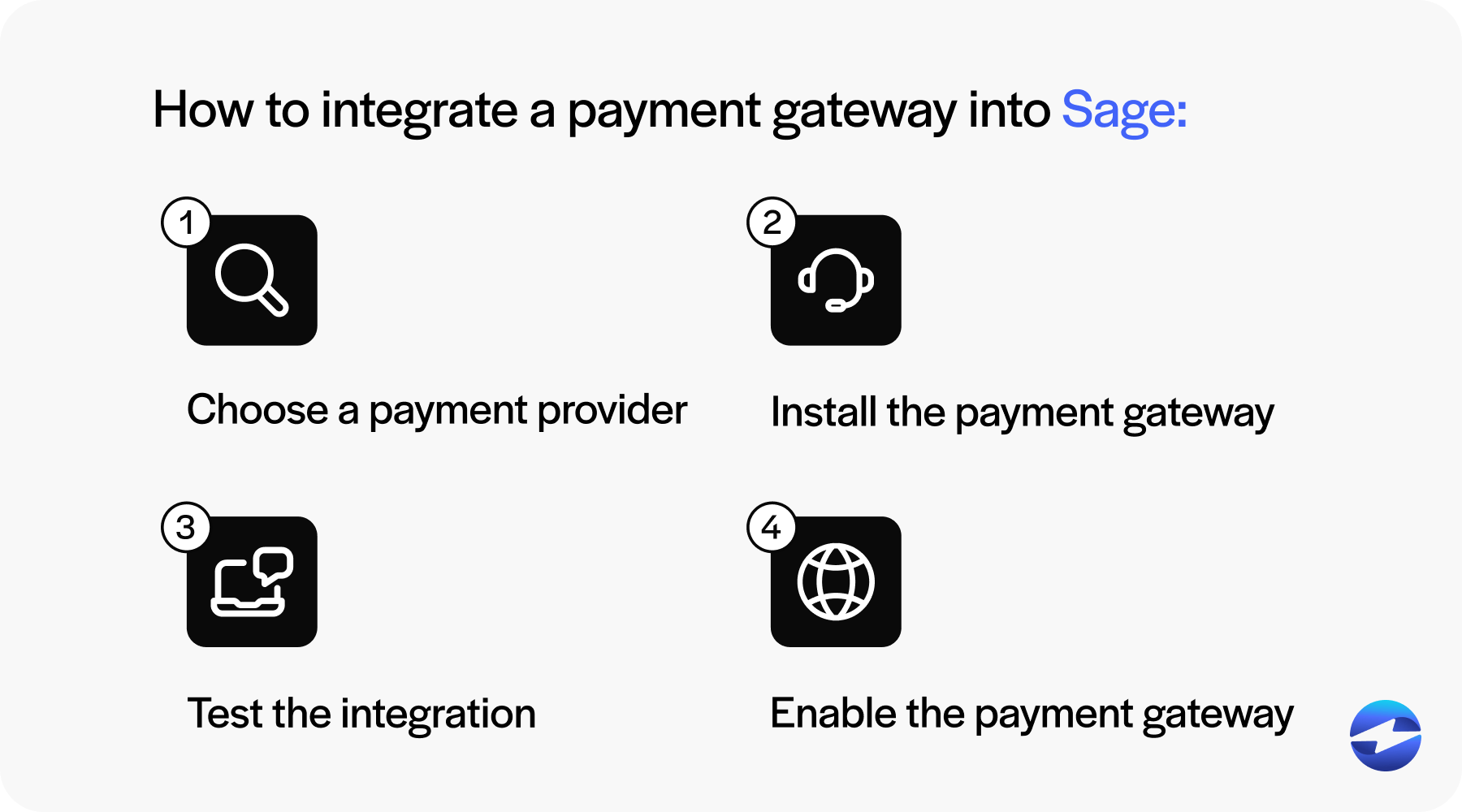

Integrating a payment gateway generally consists of 4 steps:

- Choose a payment gateway provider

- Install the payment gateway

- Test the integration

- Enable the payment gateway

1. Choose a payment gateway provider

Choosing a payment gateway provider that offers a seamless and compatible integration into your Sage software is essential.

Look for a Sage payment gateway that fits your business needs, offers good security, and supports a variety of payment methods. Consider payment processing costs and ensure the provider complies with industry standards like PCI Compliance.

Reviewing each provider’s functionality, payment collection tools, payment security, costs, and customer support will enable your business to make the best decision.

Once chosen, sign up with the provider and gather any necessary setup information. The payment gateway provider will also have you set up and link a merchant account.

2. Install the payment gateway

The next step is to install the payment gateway. This process may vary depending on the Sage version you’re using.

Your provider may ask you to download a package and run an installer or set up online credentials, so following their instructions is essential.

Many payment providers offer Sage-compatible plugins or extensions that can be downloaded and installed. If a direct plugin isn’t available, developers can integrate the gateway using Sage’s application programming interface (API). This requires configuring API keys and setting up payment processing rules.

Once installed, the gateway should appear as a payment option within Sage.

3. Test the integration

Testing your payment integration in Sage will allow your business to ensure its software operates efficiently with no errors before going live.

Here are a few methods for testing:

- Use a sandbox environment: Most payment providers offer a test mode (sandbox) that allows businesses to simulate transactions without processing actual payments.

- Check transaction processing: Send test payments to verify that transactions are successfully processed and recorded in Sage.

- Confirm data syncing: Ensure payments are correctly applied to invoices and reflected in financial reports.

After running these tests, you can address any issues by consulting with your payment provider’s support team or Sage documentation for troubleshooting. Once resolved, your payment gateway can go live in Sage.

4. Enable the payment gateway

Once testing is successful, you can switch your Sage payment gateway from the test environment to the live mode in your gateway settings, meaning payments will process in real-time, and funds will be deposited into your merchant account.

Next, configure the payment settings by defining accepted payment methods, processing fees, and invoice-matching rules to align with your business operations. To ensure a seamless adoption, train staff on how to process payments within Sage and equip them with troubleshooting knowledge for common issues.

Establishing a routine for monitoring transactions, reconciliations, and financial reports will also enable your business to maintain accuracy and sufficient payment security.

With the payment gateway now active and fully integrated into Sage, merchants can offer various payment options to give customers more flexibility, enhancing and improving financial management.

While all these steps are essential to successfully process payments in Sage 100, finding a payment gateway that fits your needs is imperative.

Choosing the right payment gateway for your Sage software

Selecting the most suitable payment gateway for Sage is crucial for ensuring seamless transactions, secure payments, and efficient financial management.

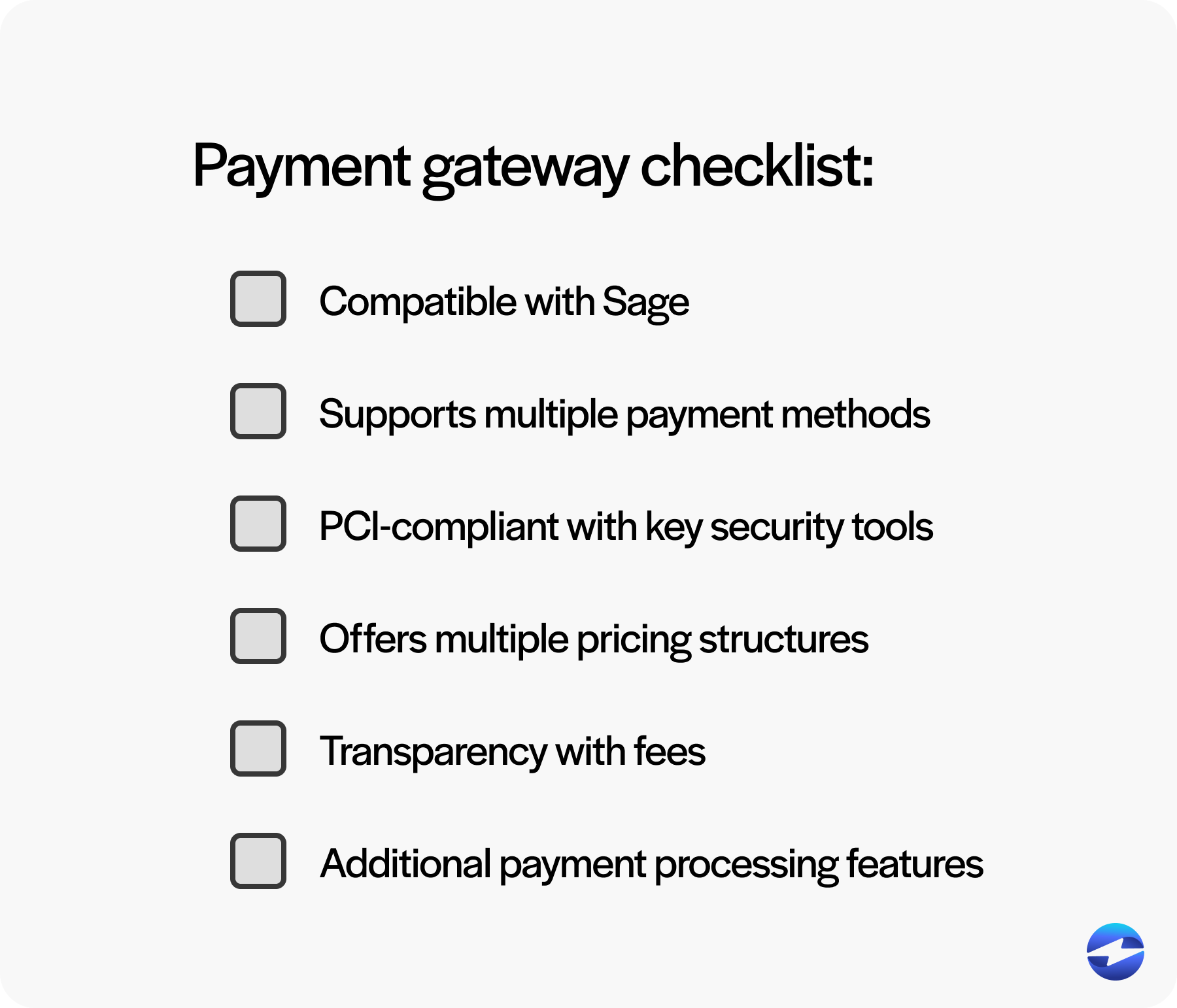

There are several factors to consider when choosing a gateway, such as compatibility, supported payment methods, security standards, cost and fees, and additional payment processing features.

Compatibility with Sage software

Not all payment gateways integrate seamlessly with Sage, so choosing one that’s fully compatible with your specific version is essential, whether it’s Sage 50, 100, Intacct, or another Sage product.

Look for providers that offer built-in integrations, Sage-certified plugins, or API support to ensure a hassle-free setup and data synchronization.

Supported payment methods

The Sage payment gateway of your choosing should support multiple payment methods to ensure it meets all your customers’ preferences.

Common options include credit and debit cards (Visa, Mastercard, American Express, etc.) and ACH/eChecks for direct bank transfers. Digital wallets (Apple Pay, PayPal, etc.) and recurring billing payment options have also gained popularity.

A gateway that offers multiple payment options can improve customer satisfaction and increase conversion rates.

Payment security standards

Since security is a top priority when handling payments, a PCI-compliant payment gateway that implements the necessary measures to protect sensitive customer data is essential.

Security features to look for include:

- Tokenization & encryption: Protects payment information from unauthorized access.

- Fraud prevention tools: Helps detect and prevent fraudulent transactions.

- Two-factor authentication (2FA): Adds an extra layer of security for account access.

Additional security like 3D Secure, off-site data storage, and customizable fraud modules will also be valuable tools to protect customer payments.

Cost and fees

A cost-effective payment gateway that provides reliable payment processing software for Sage while lowering processing costs can significantly benefit your revenue.

Payment gateway providers will often offer multiple pricing structures, including:

- Flat rate pricing: Merchants pay a fixed percentage of their overall processing volumes.

- Interchange plus pricing: Merchants pay the interchange rate set by card networks plus a fixed markup from the payment processor.

- Tiered pricing: Transactions are categorized into tiers (qualified, mid-qualified, and non-qualified) with varying rates.

- Subscription-based pricing: Merchants pay a monthly fee to access their payment processing software despite their transaction volumes.

Payment gateways typically charge fees per transaction, along with potential setup or monthly fees. Therefore, it’s essential to compare the following costs:

- Transaction fees: A percentage of each sale, usually between 2.5% and 3.5%

- Monthly fees: Some providers charge a flat monthly rate for their services

- Chargeback fees: Costs associated with disputed transactions

- Additional service fees: Additional fees can consist of cross-border transaction fees or premium support charges

Businesses should look for a payment gateway with transparent costs and pricing to avoid hidden fees.

A gateway that fits your budget while providing critical features needed for your payment processing operations in Sage is key to maximizing profits.

Additional payment processing features

Beyond basic payment processing, some Sage payment processing providers offer additional tools that can enhance your customer payments.

Sage integrations may include features like automated reconciliation to sync payments directly into Sage and reduce manual data entry, as well as custom reporting and analytics that deliver real-time financial insights. Sage integrations may also support mobile and remote payment processing.

Your payment processor may also provide additional features you can plug into Sage, such as recurring billing, email pay, online billing portals, mobile payments, and physical payment terminal options to simplify payment collections. They may also offer the ability to securely store customer cards to promote a more instant payment experience.

Selecting a gateway with the right features can improve operational efficiency and provide a better experience for your team and customers.

For the best payment processing experience, look for trusted payment processing solutions like EBizCharge.

EBizCharge: A comprehensive payment gateway for Sage

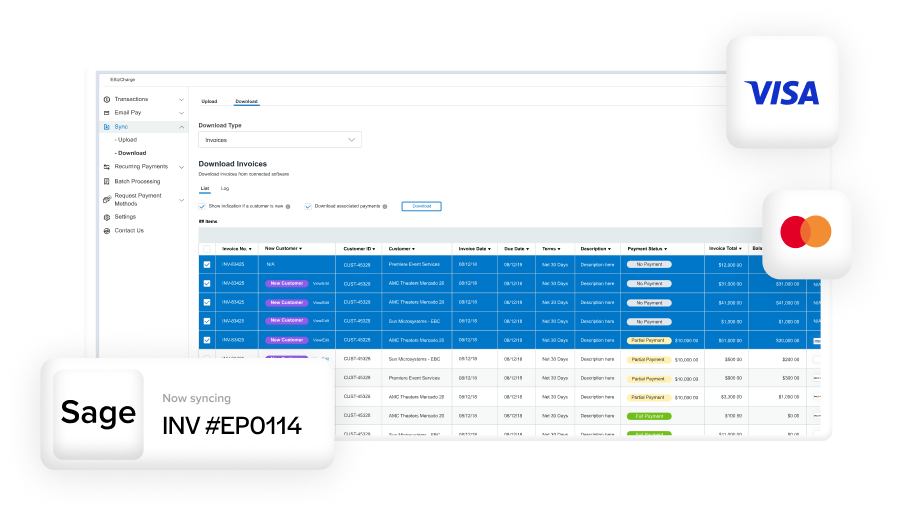

EBizCharge integrates effortlessly with Sage software, offering a robust suite of invoicing tools and features that simplify and secure payment processing operations and enhance efficiency.

With features like real-time insights into financial records and automated payment collections, merchants can leverage EBizCharge to manage outstanding invoices more effectively.

EBizCharge also supports numerous payment methods (credit, debit, and ACH/eChecks) and delivers robust payment collection tools like secure email payment links, recurring billing, auto and mobile pay, hosted checkouts, a branded customer payment portal, and more.

Moreover, EBizCharge secures cash flow by embedding advanced security standards and providing full PCI Compliance for its Sage payment processing solutions. It also enhances operational efficiency by eliminating manual data entry, minimizing the risk of human errors.

In addition to its powerful payment software and diverse payment tools, EBizCharge provides customized, transparent pricing to ensure the lowest payment processing costs, as well as complimentary support and surcharging options.

EBizCharge transforms payment processing in the Sage accounting software with comprehensive software that supports all business needs and boosts long-term financial health and revenue.