Blog > Complete Guide to SAP ECC: Which Modules Need Payment Integration?

Complete Guide to SAP ECC: Which Modules Need Payment Integration?

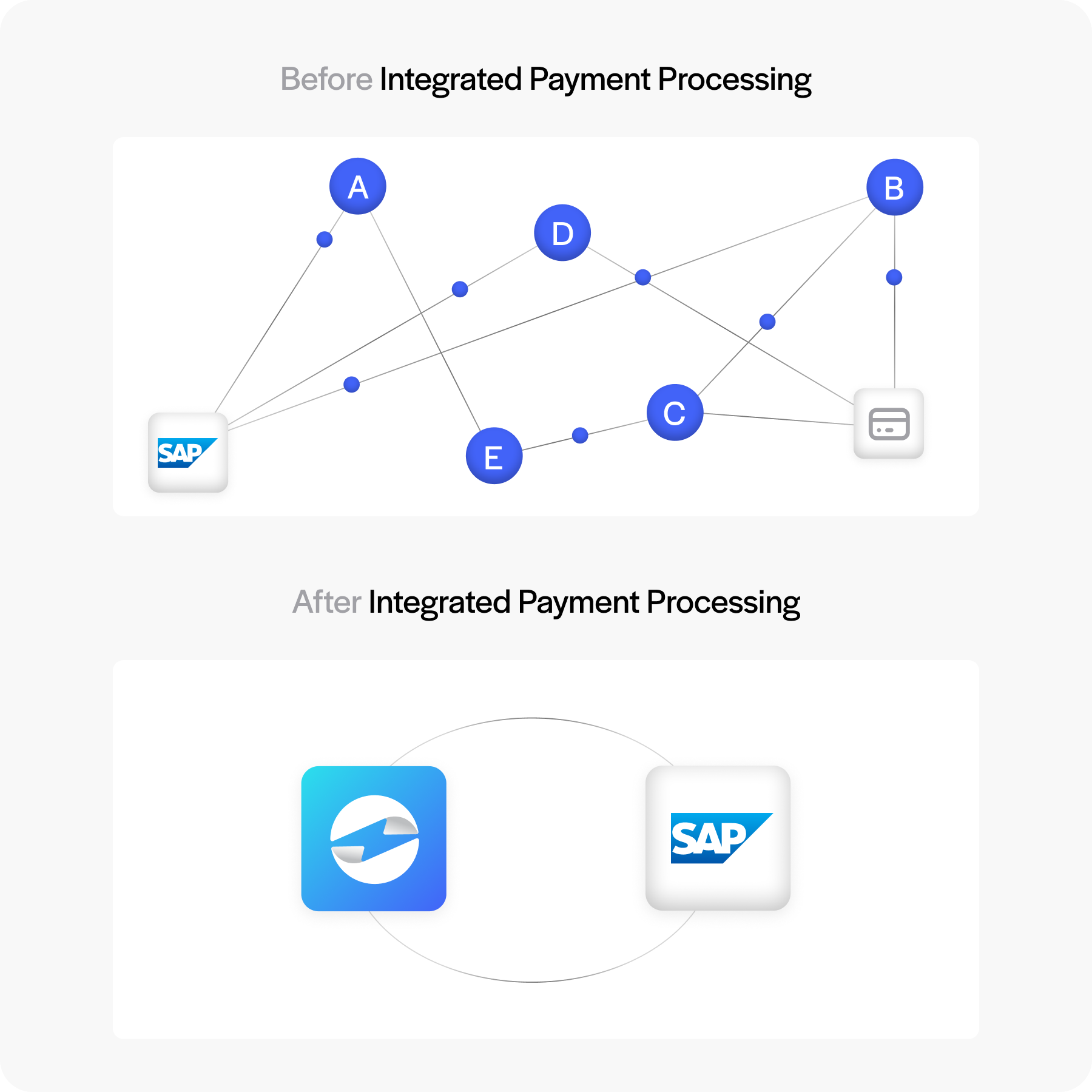

For years, SAP ECC has been the system of choice for enterprises looking to bring order and integration to complex operations. Its wide set of modules allowed businesses to connect finance, logistics, and human resources into one environment. But as business needs evolve, so does the need for smarter financial workflows—especially when it comes to payments. Integrating a solid payment processing solution into the right modules can mean faster cash flow, fewer errors, and a smoother experience for both employees and customers.

This guide takes a closer look at the key SAP ECC modules, how they work, and which ones benefit most from payment integration. By the end, you’ll have a clearer picture of where payments fit into your ERP strategy and why choosing the right payment processor matters.

Understanding SAP ECC Modules

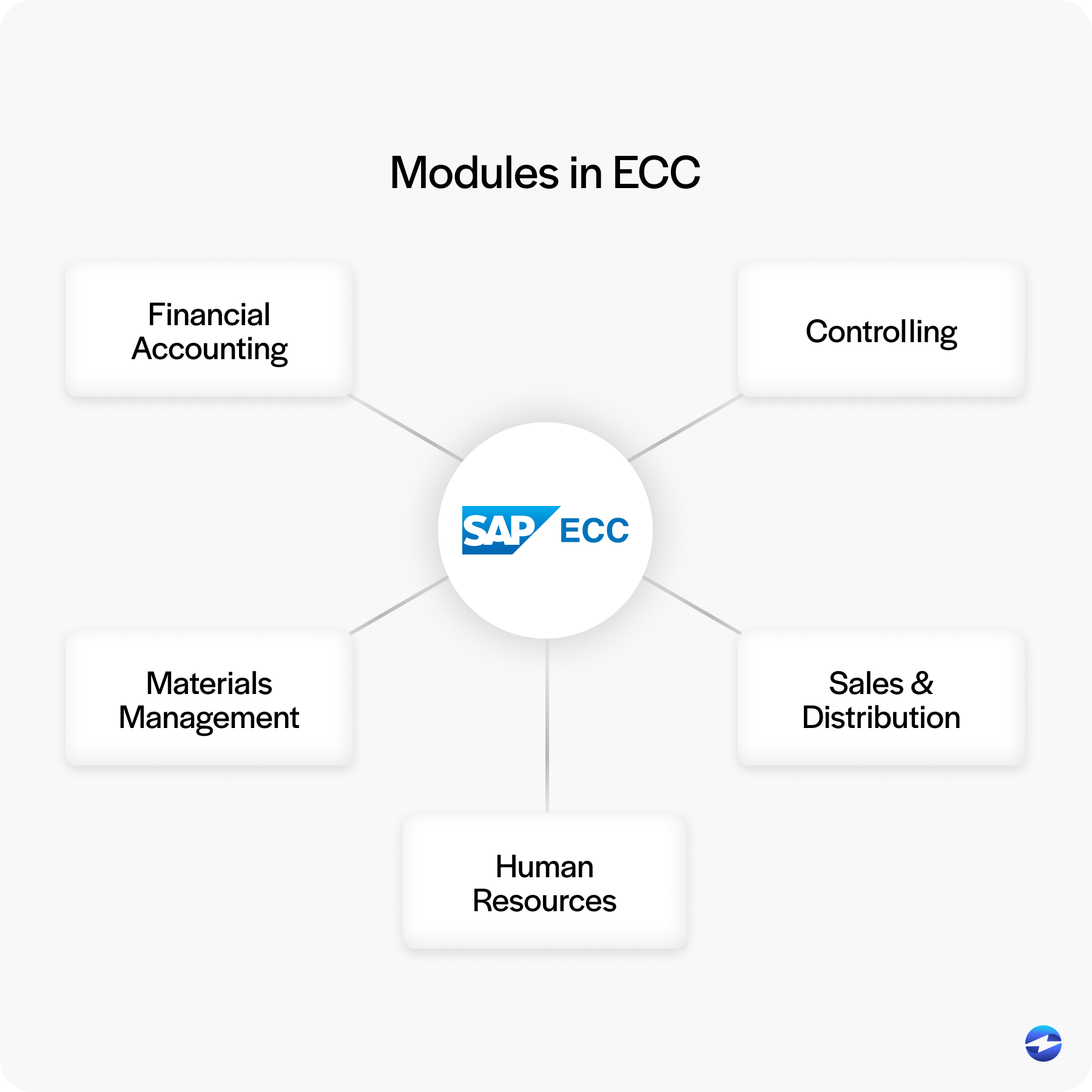

Think of SAP ECC modules as the building blocks of the SAP system. Each one handles a specific area of business—finance, controlling, materials management, sales, HR, and more. They’re designed to work together, creating a seamless flow of data across departments. For example, a sales order in the SD module can trigger updates in both finance and inventory management, giving everyone access to the same, consistent information.

This modular approach is one of the reasons SAP software became so popular. Instead of running disconnected systems for accounting, supply chain, and HR, businesses could finally operate from one integrated platform. But when it comes to payments, not every module carries the same weight, so integration needs to be targeted.

Core Financial Modules and Payment Integration

The FI (Financial Accounting) module is at the heart of most payment activity. It manages accounts receivable, accounts payable, and general ledger postings. Without FI, your SAP billing process wouldn’t connect to the rest of your financial data.

This is the most critical area to connect with a payment processor. By tying payments directly into SAP billing software, businesses can automatically post transactions, speed up reconciliation, and keep their books accurate in real time. It reduces manual entry, lowers the risk of errors, and frees up your finance team to focus on analysis instead of data entry. For most organizations, FI is the first place to start when considering a payment processing solution.

Sales and Distribution (SD) Module

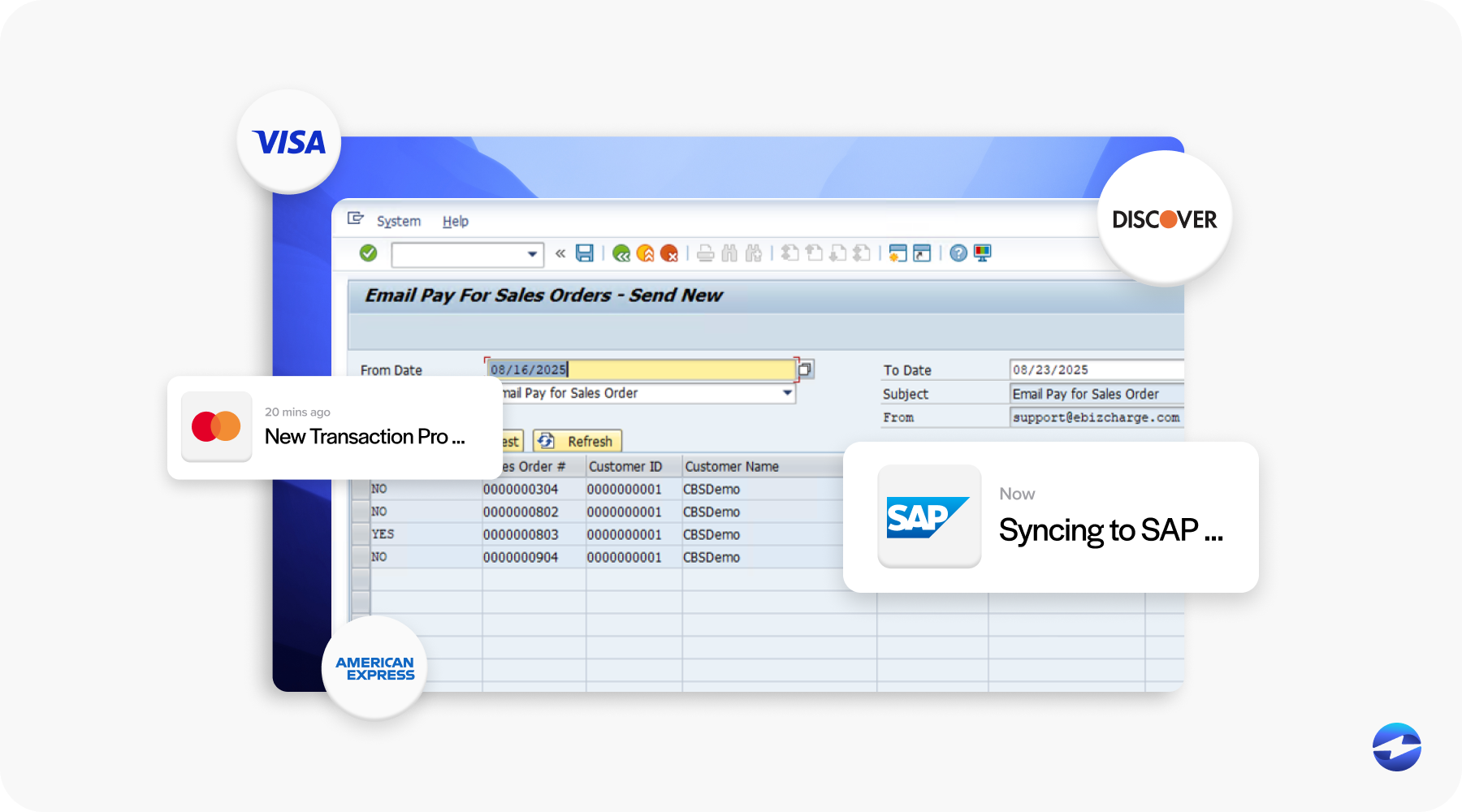

The SD module handles everything from customer orders to deliveries to invoicing. Because it sits so close to the customer experience, it’s also a prime candidate for payment integration. Linking SD with a payment processor ensures payments can be captured at the point of sale or alongside invoicing, making collections faster and more reliable.

For example, when a customer places an order, their credit card or ACH payment can be processed immediately and tied to the invoice within the SAP system. This not only improves cash flow but also creates a better experience for the customer, who can see their payments reflected instantly. In a world where speed matters, connecting payments to SD makes a noticeable difference.

Materials Management (MM) and Vendor Payments

MM focuses on procurement and vendor-related processes. While it’s not customer-facing, payments play a big role here too. Businesses rely on MM to manage supplier invoices and track what they owe vendors. Integrating MM with a third-party payment processor allows supplier payments to be processed more efficiently, cutting down on manual steps and ensuring vendors are paid on time.

This has ripple effects. Faster vendor payments strengthen supplier relationships, leading to better terms and smoother supply chains. For companies that handle a large volume of procurement, bringing a payment processing solution into MM is a practical way to reduce back-office workload.

Human Resources (HR) and Payroll Considerations

The HR module isn’t usually top of mind for payment integration, but it does intersect with payroll and reimbursements. Employees expect timely, accurate payments just as much as customers or suppliers. While not as central as FI or SD, HR workflows can benefit from a link to the right SAP solutions.

In practice, this could mean integrating payroll disbursements with finance so that employee payments are posted to the general ledger automatically. It’s a smaller piece of the puzzle, but in large organizations, even incremental efficiency gains add up.

Choosing the Right Payment Integration for ECC

Not every payment processing solution is built the same. When deciding how to integrate with SAP ECC, there are several factors to weigh:

- Security and compliance: Any payment processor you choose must support PCI compliance and strong encryption.

- Compatibility: The integration should work seamlessly with your existing SAP software without requiring heavy customization.

- Scalability: As your business grows, the solution should handle increased payment volumes without disruption.

- Third-party payment processors: Options like EBizCharge offer direct integration with ECC and can provide customer portals, advanced reporting, and lower transaction fees than traditional providers.

The right fit will depend on your business model, transaction volumes, and future goals, but getting this decision right will pay off in fewer headaches down the road.

Best Practices for Integrating Payments in ECC

Integration isn’t just about flipping a switch. To get the most out of your investment, consider these practices:

- Clean up your data first. Inconsistent records can create major issues once payments start flowing automatically.

- Test everything end-to-end. Run sample transactions to confirm that postings hit accounts receivable and the general ledger accurately.

- Train your team. Both finance and IT staff should understand not just how to use the system, but why the integration matters.

- Monitor and adjust. Collect feedback from employees and customers and use reporting tools to track performance.

By taking these steps, businesses ensure their SAP billing software and payment workflows work together smoothly, without surprises.

Why EBizCharge is a Strong Integration Choice for SAP ECC

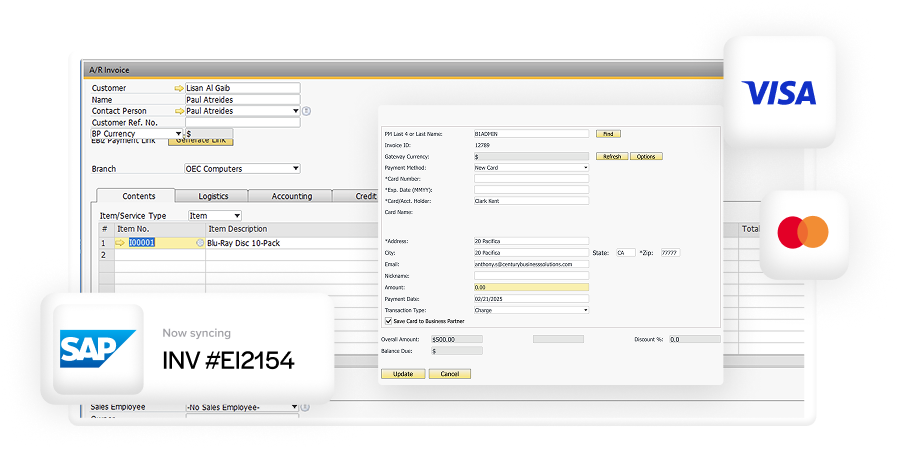

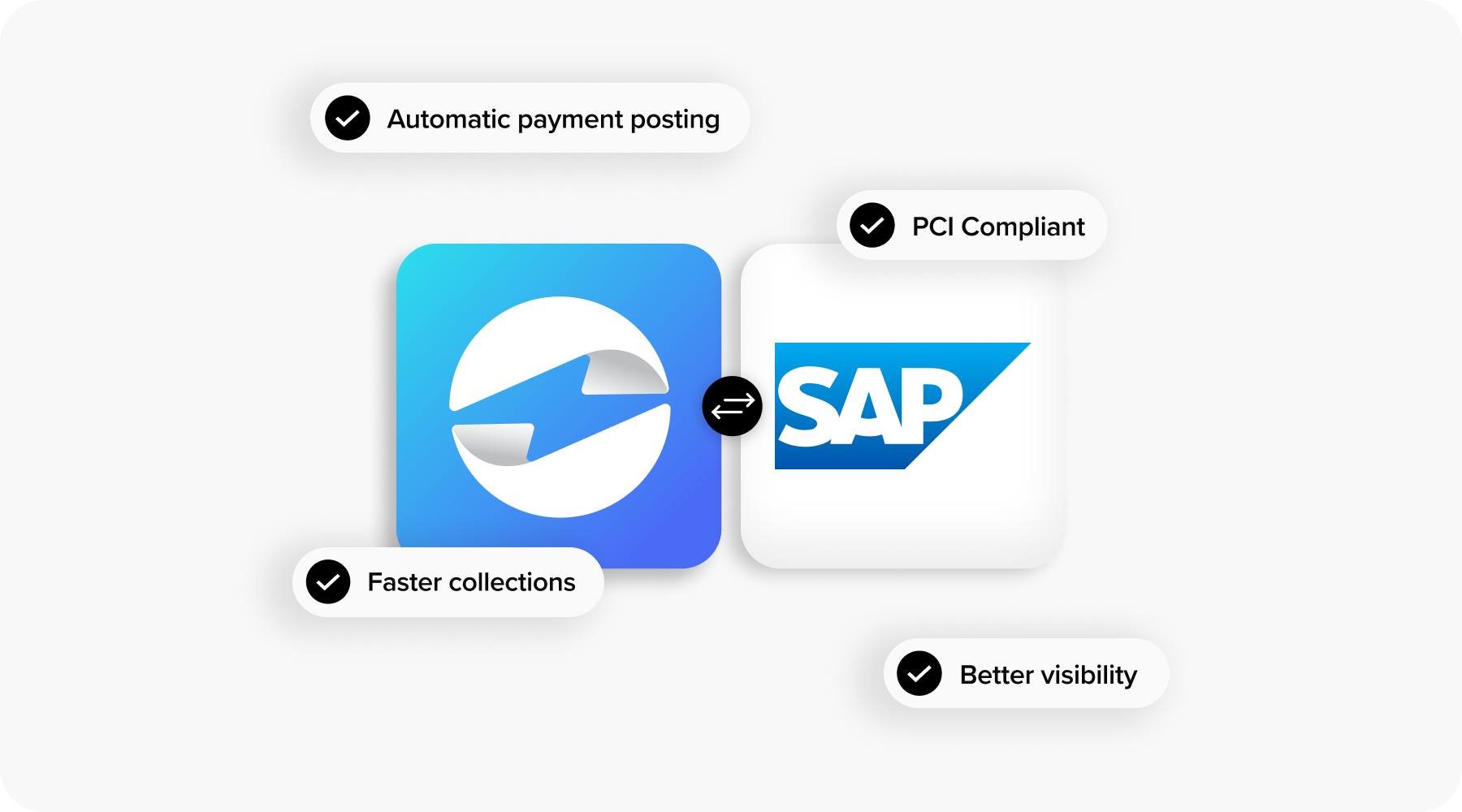

There are plenty of third-party payment processors out there, but EBizCharge stands out for businesses running SAP ECC. It integrates directly with the FI and SD modules, automating postings into accounts receivable and the general ledger. This saves time, reduces manual entry, and keeps records accurate.

EBizCharge also adds customer-facing features that ECC doesn’t natively offer, like secure online payment portals. Customers can pay invoices on their own schedule, and those payments flow straight into the SAP system. Built-in PCI-compliant security gives peace of mind, while advanced reporting tools help finance teams track trends and performance.

Most importantly, EBizCharge scales. As transaction volumes grow, it grows with you, making it a dependable, long-term choice. For businesses that want to modernize SAP billing while still using ECC, pairing with EBizCharge creates a smoother, more efficient way to handle payments.

- Understanding SAP ECC Modules

- Core Financial Modules and Payment Integration

- Sales and Distribution (SD) Module

- Materials Management (MM) and Vendor Payments

- Human Resources (HR) and Payroll Considerations

- Choosing the Right Payment Integration for ECC

- Best Practices for Integrating Payments in ECC

- Why EBizCharge is a Strong Integration Choice for SAP ECC