Blog > Billing in Sage Intacct: Complete Setup and Optimization Guide

Billing in Sage Intacct: Complete Setup and Optimization Guide

Billing is one of those business functions that can either keep everything moving smoothly or become the bottleneck that slows down cash flow. Many finance teams spend far too much time fixing errors, chasing unpaid invoices, or trying to reconcile payments between systems that don’t talk to each other. For mid-market and enterprise businesses, those inefficiencies add up fast.

That’s where billing in Sage Intacct makes a difference. As part of the Sage Intacct ERP, the billing module takes what is often a messy, manual process and organizes it into something repeatable, accurate, and easier to manage. When you set it up properly and pair it with the right payment processing solution, billing goes from a headache to a strength.

In this guide, we’ll walk through the essentials of Sage Intacct billing—how it works, how to set it up, and how to optimize it. We’ll also touch on how third-party integration with tools like EBizCharge can extend the power of Sage Intacct software and make the overall workflow smoother.

Understanding Billing in Sage Intacct

Sage Intacct is a cloud-based enterprise resource planning (ERP) platform built for businesses that need flexibility and robust financial management. Billing is just one part of the broader Sage Intacct ERP, but it’s central to how revenue flows through the system.

When billing lives inside your ERP, you eliminate the gaps that often appear when using separate systems. For example, if your invoices are managed in one application but revenue recognition happens elsewhere, you’re left juggling spreadsheets or manual uploads. Sage billing removes that friction by keeping everything connected.

The result? Cleaner records, faster invoicing, and fewer late nights trying to reconcile accounts at the end of the month.

Core Features of Sage Intacct Billing

Before diving into setup, it’s useful to understand the strengths of Sage Intacct’s billing module. These features make it more than just a way to send out invoices.

Automated Invoicing

With billing in Sage Intacct, you can automate recurring invoices for subscription-based customers or long-term contracts. Customizable templates allow you to create professional invoices that match your brand, complete with payment instructions. Automation means fewer missed bills and a more predictable cash flow.

Revenue Recognition

Compliance with standards like ASC 606 can be daunting. Sage Intacct links billing schedules directly to revenue recognition schedules, ensuring that your revenue is recognized correctly and consistently. This feature alone saves countless hours of manual work and reduces audit risks.

Multi-Entity and Multi-Currency Support

For businesses with subsidiaries or international operations, billing often becomes complex. Sage Intacct handles multi-entity structures and multiple currencies, making it easier to manage global operations from a single system. That way, everything stays consistent whether you’re billing a client in the U.S. or Europe.

Integration with Other Modules

One of the biggest advantages of Sage Intacct integration is that billing connects seamlessly with accounts receivable (AR), general ledger (GL), and order management. When an invoice is sent, the information updates across the system in real time. Finance teams gain a single source of truth, reducing errors and improving reporting accuracy.

Security and Audit Trail

Security isn’t something to overlook. Sage Intacct offers role-based permissions and detailed audit logs, helping you maintain accountability at every step. It also supports Payment Card Industry (PCI) compliance standards, which is critical for protecting sensitive payment data. With these safeguards in place, you’ll always know who created, approved, or modified an invoice, ensuring both compliance and peace of mind.

These core features give finance teams the structure and confidence to bill a ccurately, stay compliant, and scale their processes without unnecessary stress. Together, they form the foundation of a strong billing system inside Sage Intacct.

Setting Up Billing in Sage Intacct

Getting started with Sage Intacct software doesn’t have to be overwhelming. If you break the process into steps, you’ll have billing up and running with minimal friction.

Prerequisites

First, confirm that your version of Sage Intacct ERP includes the billing module and that your team has the right permissions to configure it. It also helps to map out your company’s billing workflows ahead of time so you know what processes need to be reflected in the system.

Configuring Billing Modules

Once prerequisites are in place, activate the billing module within Sage Intacct. This is where you define billing terms, customer profiles, and invoice rules. Taking the time to set this up correctly avoids problems down the line.

Creating Invoice Templates

Next, design professional invoice templates. Sage Intacct allows customization so you can add your logo, adjust layouts, and include clear payment instructions. Templates should make it easy for customers to understand what they owe and how to pay.

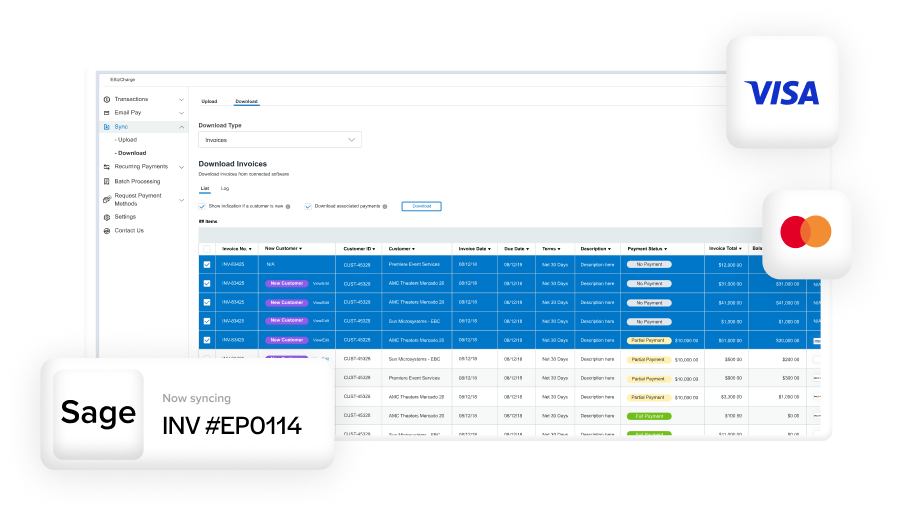

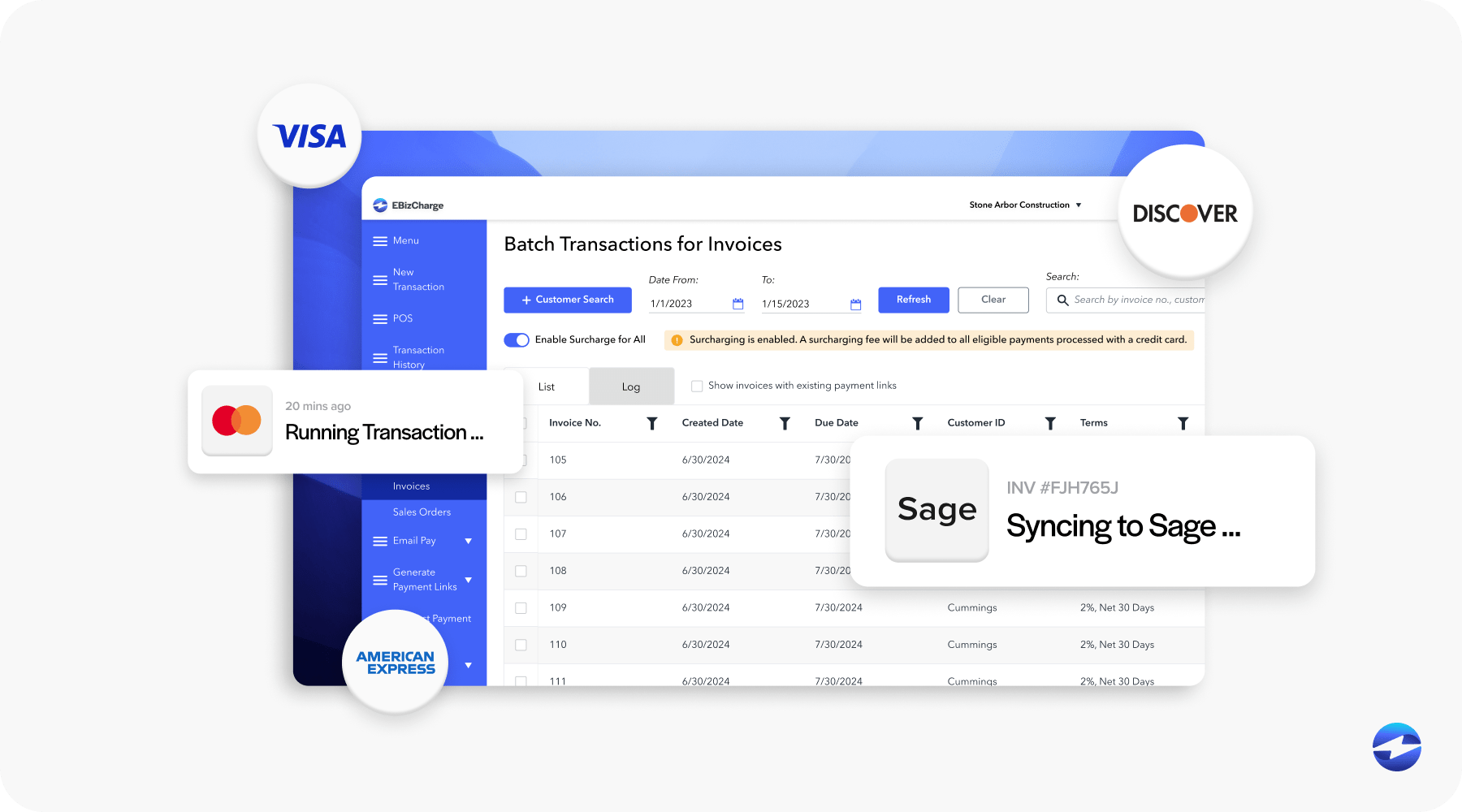

Connecting to a Payment Processor

Billing and payments go hand in hand. After setting up invoices, connect your Sage ERP to a payment processor. Sage’s native tools offer reliable payment options, but many businesses extend this functionality with third-party integration like EBizCharge. With EBizCharge, you get a more robust payment solution, including lower fees, faster processing times, and a customer portal for self-service.

Testing the Setup

Before rolling out to customers, run test invoices and process payments. This ensures your payment processing configuration works correctly and that invoices are posted properly in accounts receivable and the general ledger. A little testing upfront prevents bigger issues later.

By completing these setup steps carefully, you give your team a solid foundation to build on. The system is configured to match your workflows, payments are connected securely, and the groundwork is in place for smoother billing operations going forward.

Best Practices for Optimizing Sage Intacct Billing

Once your billing system is live, good habits make all the difference. Here are some best practices for Sage Intacct payment processing to keep billing efficient.

- Automate where possible. Use recurring invoices and automated reminders to reduce manual follow-ups.

- Keep records clean. Regularly audit customer data to prevent errors in billing.

- Review permissions. Make sure role-based access is up to date to protect sensitive financial data.

- Train your team. Billing touches multiple departments, so everyone needs a basic understanding of how billing in Sage Intacct works.

- Use reporting tools. Leverage Sage Intacct’s built-in analytics to monitor trends and find bottlenecks.

These habits ensure that your billing process remains accurate and scalable as your business grows.

Benefits of Integrating EBizCharge with Sage Intacct

While Sage Intacct billing is strong on its own, adding EBizCharge through third-party integration can elevate it further. Here’s why many finance teams choose to integrate.

- Seamless workflow: Payments post directly inside Sage Intacct without requiring staff to re-enter data.

- Lower costs: Many companies find that EBizCharge reduces transaction fees compared to standard options.

- Customer convenience: The customer payment portal gives clients a simple, secure way to pay, which often means faster collections.

- Better reporting: Payment details flow directly into Sage Intacct, improving reconciliation and month-end reporting.

Together, Sage Intacct and EBizCharge create a more complete payment processing solution. By combining billing, payments, and reporting, you cut down on busy work while giving customers a better payment experience.

Building a Stronger Billing System

Efficient billing keeps businesses financially healthy. With billing in Sage Intacct, you have the tools to automate invoices, comply with revenue standards, support multiple entities, and tie everything back into your ERP. When set up carefully, Sage Intacct billing turns what was once a tedious process into a reliable system that supports growth.

Add a strong payment solution like EBizCharge into the mix, and the benefits multiply. Payments become faster, data stays consistent, and finance teams get more time back for strategic work. For anyone responsible for managing cash flow, this combination of Sage Intacct integration and robust payment processing is a clear step toward efficiency and peace of mind.